Fortress Investment Group – OneMain Financial, ZestFinance, Cash Converters

December 11, 2017

From report “Private equity piles into payday lending and other subprime consumer lending”

(Written jointly by Private Equity Stakeholder Project and Americans for Financial Reform)

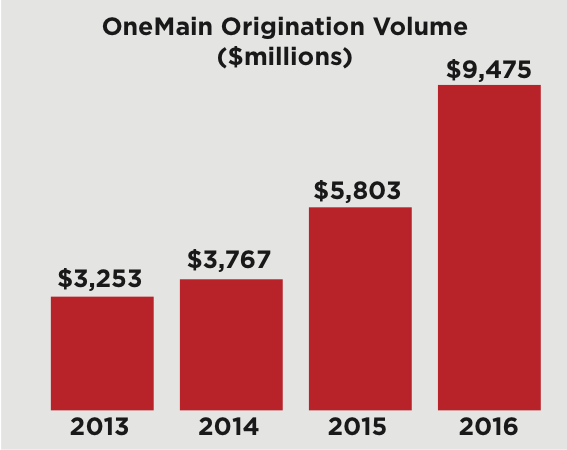

New York-based Fortress Investment Group is the majority owner of installment lender OneMain Financial. Fortress acquired installment lender Springleaf Financial from AIG in 2010 and in 2015 combined it with Citigroup’s OneMain, over the objection of consumer advocates[i], to create the largest subprime consumer lender in the United States, with 1,700 branches in 44 states.[ii] In 2016, OneMain generated $9.4 billion in loan volume. Driven by acquisitions, OneMain’s origination volume has grown dramatically in the past few years.[iii]

Wes Edens, founding principal and Co-Chairman of Fortress, has served on OneMain Holdings’ board since 2010 and has chaired the board since 2011.[iv]. Edens, along with Fortress executives Pete Briger and Randy Nardone recently made a combined $1.39 billion from the sale of Fortress to Japan’s SoftBank Group.[v]

While OneMain generally offers lower interest rates on its loans than payday lenders, the firm also sells ancillary products such as insurance that can significantly increase costs for borrowers. Although the company describes its life insurance and other policies as voluntary, which enables the lender to claim that the costs can be excluded from APR calculations, some policies are opened without customers’ approving them at the time, the New York Times reported in July 2016.[vi] The insurance OneMain sells to customers is provided by a wholly owned subsidiary of the company.[vii]

OneMain reportedly caps its loans at 36% interest.[viii] Yet additional fees and charges can increase the true interest that a borrower pays. In Missouri, for example, OneMain reports that its maximum interest rate on personal loans is 36%. Yet the firm also adds a “prepaid finance charge of the lesser of 5% of principal amount or $75 per loan.”[ix] In addition to increasing the cost of the loan for the borrower, such fees can incentivize refinancing. In early 2015, OneMain reported that 59% of the loans it had made in the prior year were renewals.[x] In addition, a growing percentage of OneMain’s loans are secured by borrowers’ cars, thus putting a significant asset at risk in the case of default.[xi]

OneMain (and before that Springleaf) has significantly increased its capacity to lend by packaging loans it makes into securities that it sells to investors. Following the firms’ acquisitions by Fortress, they have issued more than $6.6 billion of these securities.[xii]

Springleaf/OneMain has also been aggressive in persuading state lawmakers to relax restrictions on consumer lenders.[xiii] In 2016, OneMain pressed for legislative changes in about eight states, the New York Times reported in September. Since 2012, when its lobbying campaign began in earnest, OneMain has helped enact legislative changes in at least 10 states.[xiv]

ZestFinance/ Spotloan

In addition to its investments in Springleaf and OneMain, Fortress in 2015 provided $150 million in debt financing for a startup online lender, ZestFinance.[xv] Harnessing big data to aid lending decisions, the firm lends money at rates as high as an annual 390 percent, the Washington Post reported in 2014.ZestFinance has also utilized a relationship with a Native American tribe to circumvent state payday lending and usury laws, making loans through a website called Spotloan. Spotloan is owned by the Turtle Mountain

From www.spotloan.com, accessed Aug 3, 2017

band of the Chippewa Indian tribe of North Dakota, which asserts it isn’t subject to state laws.[xvi] Spotloan has drawn action by multiple state regulators.[xvii] In August 2016, for example, the Illinois Department of Financial and Professional Regulation ordered Bluechip Financial/ Spotloan to cease and desist from making or collecting on loans in Illinois because the firm did not have a license.[xviii]

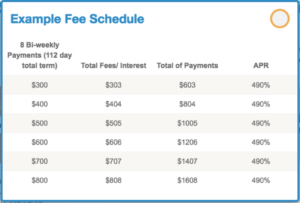

An example fee schedule on Spotloan’s website advertises loans with APRs of 490%.[xix]

Cash Converters

In 2016 Fortress also funded Australia’s largest payday lender, Cash Converters, after Australian bank Westpac decided to stop funding businesses that provide payday loans. The AUS$100 million facility from Fortress is substantially larger than the banking facility Cash Converters had previously had with Westpac. Cash Converters Managing Director Peter Cumins said terms and conditions of the Fortress Investment Group facility were “more aligned to the business strategy of the company than our previous supplier”.[xx]

Just months prior, in June 2015, Cash Converters agreed to pay an AUS$23 million settlement to resolve a class action lawsuit covering 37,500 borrowers. Attorneys for the plaintiffs argued that Cash Converters had imposed hefty fees in violation of New South Wales’ interest rate cap.[xxi]

One of the complainants, Julie Gray, said she found herself in “spiralling debt” after taking out a series of $600 loans. She said she believed the company preyed on vulnerable people.

“You go in and you get one loan, and then different things pop up – you might need new tyres for the car or a washing machine, medicines,” she said.

“You go back and you get another one [and] by the time you pay it off, especially being on a disability pension, you’re just chasing nothing.”

In April 2016, borrowers in Queensland also filed a class action lawsuit against Cash Converters, seeking AUS$17 million.[xxii]

The Australian Securities and Investments Commission (ASIC) in 2015 put the payday lending industry on notice to lift standards after it found many payday firms were falling short of regulatory requirements.[xxiii]

Security National Automotive Acceptance CFPB order

Fortress Investment Group also owns mortgage lender Nationstar[xxiv] and subprime auto lender Security National Automotive Acceptance Corp.[xxv] In 2015, the Consumer Financial Protection Bureau ordered Security National Automotive Acceptance, which specializes in loans to active-duty US servicemembers and veterans, to pay $3.28 million for using illegal debt collection practices. When consumers defaulted on their loans, the CFPB alleged, “SNAAC used aggressive collection tactics that took advantage of servicemembers’ special obligations to remain current on debts.”[xxvi]

[i]United States et al. v. Springleaf Holdings, Inc., et al.; Public Comment and Response on Proposed Final Judgment, Mar 21, 2016.

[ii]OneMain Holdings prospectus, May 25, 2017. OneMain Holdings Form 10Q, 1Q17.

[iii]OneMain Holdings Form 10-K, Feb 21, 2017.

[iv]OneMain Holdings Form 10-K, Feb 21, 2017.

[v]“Fortress Executives to Cash In $1.39 Billion From SoftBank Sale,” Bloomberg, Feb 15, 2017.

[vi]“How Private Equity Found Power and Profit in State Capitols,” New York Times, Jul 15, 2016.

[vii]OneMain Holdings Form 10-K, Feb 21, 2017.

[viii]“Subprime Lender, Busy at State Level, Avoids Federal Scrutiny,” New York Times, Sept 6, 2016.

[ix]OneMain Missouri maximum rate schedule, www.onemainfinancial.com, accessed Aug 3, 2017.

[x]OneMain Financial Holdings Form S-1/A, Feb 11, 2015.

[xi] 43% of OneMain’s loans were secured as of the end of 2016 vs. 27% at the end of 2015. OneMain Holdings Form 10-K, Feb 21, 2017.

[xii]https://finsight.com/sponsor/47, https://finsight.com/sponsor/219, accessed Sept 22, 2017.

[xiii]“How Private Equity Found Power and Profit in State Capitols,” New York Times, Jul 15, 2016.

[xiv] “Subprime Lender, Busy at State Level, Avoids Federal Scrutiny,” New York Times, Sept 6, 2016.

[xv]“ZestFinance Secures $150 Million in Funding From Fortress,” Media Release, Oct 6, 2015.

[xvi]“ZestFinance issues small, high-rate loans, uses big data to weed out deadbeats,” Washington Post, Oct 11, 2014.

[xvii]Cease and Desist Order, Illinois Department of Financial and Professional Regulation, Aug 9, 2016.

[xviii]Cease and Desist Order, Illinois Department of Financial and Professional Regulation, Aug 9, 2016.

[xix]www.spotloan.com/#, accessed Aug 3, 2017.

[xx]“Cash Converters turns to Fortress,” The Australian, Feb 10, 2016.

[xxi]“Cash Converters to refund thousands of people for charging up to 633 per cent interest on loans,” http://www.abc.net.au, Jun 18, 2015.

[xxii]“Cash Converters faces $17 million Queensland class action lawsuit,” Sydney Morning Herald, Apr 27, 2017.

[xxiii]“Cash Converters turns to Fortress,” The Australian, Feb 10, 2016.

[xxiv]Nationstar SEC Form DEF 14A, Apr 14, 2017.

[xxv] Presale report, SNACC Auto Receivables Trust 2014-1, S&P, Mar 31, 2014.

[xxvi]“CFPB Orders Servicemember Auto Loan Company to Pay $3.28 Million for Illegal Debt Collection Tactics,” Media Release, Oct 28, 2015.