Endeavour Capital Performance Lags Peers

September 17, 2018

Endeavour Capital is a Portland, Oregon-based private equity manager with investments focused on the Western US.

Endeavour Capital is a Portland, Oregon-based private equity manager with investments focused on the Western US.

While some of Endeavour Capital’s early funds were strong performers, the private equity firm has struggled to keep up with peers as it has raised larger funds in recent years.

Key points:

As of the end of the fourth quarter 2017, Endeavour Capital’s most recent funds – Endeavour Capital Fund V (2008), Endeavour Capital Fund VI (2011) and Fund VII (2014) all ranked in the 3rd or 4th quartiles relative to peers.

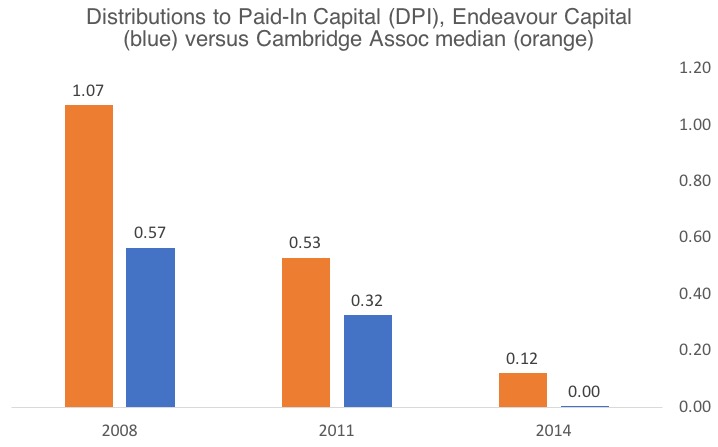

Endeavour Capital has been slower to return capital to investors than peers. As of the first quarter 2018, Endeavour Capital’s Fund V (2018), Fund VI (2011), and Fund VII (2014) all lagged the Cambridge Associates median in terms of Distributions to Paid-in Capital (DPI).

The concentration of Endeavour Capital Funds V, VI and VII’s value in current portfolio companies means that the funds’ returns are more dependent on Endeavour’s own valuations of its portfolio companies – and its ability to exit those companies at prices in line with or above those valuations.

A review of a number of Endeavour Capital portfolio companies suggests investors may have reason for concern:

- Aladdin Bail Bonds/ Seaview Insurance (Endeavour Capital Fund VI) has seen the annual value of premiums it writes drop by 26% since 2017. Aladdin’s largest market, California, recently adopted legislation banning for-profit bail.

- ZOOM+Care’s (Endeavour Capital Fund VI) affiliated Zoom Health Plan was taken into receivership by Oregon insurance regulators in 2017. In late 2017, Endeavour filed suit against Zoom, noting “Since March of 2017, (Zoom Management) has faced repeated cash shortfalls, rendering it time and time again without sufficient funds to satisfy Zoom+Care’s financial obligations and placing (Zoom Management) on the brink of insolvency.”