Apollo Global Management Completes Merger of Kindred Healthcare and LifePoint Health, Shifts Some Hospitals to New Company

January 31, 2022

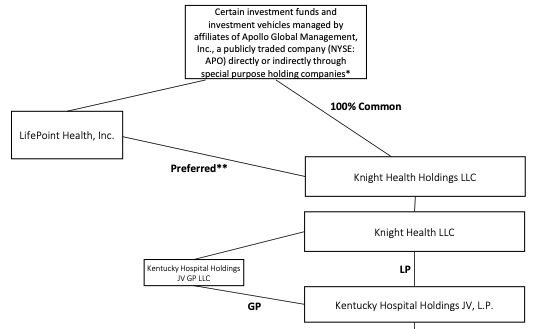

Private equity firm Apollo Global Managementin late December completed its acquisition of acute care hospital chain Kindred Healthcare and merged it with rural hospital chain LifePoint Health. As part of the transaction, LifePoint has shifted some of the acquired facilities and some its existing hospitals into a new company called ScionHealth, which appears to also be controlled by Apollo.

Apollo’s merger of LifePoint and Kindred and creation of ScionHealth merits scrutiny. Although LifePoint received $1.6 billion in federal CARES Act stimulus grants and loans, LifePoint’s 2020 financial statements show that the company slashed salary and benefits costs, and reducing charity care.[1] Rather, it spent hundreds of millions of dollars to buy a competitor even as a growing number of its hospitals reached capacity during the Omicron surge.[2]

See our September 2021 report: Private Equity Firms Reap Payouts After Hospital Chain Received $1.6 Billion in CARES Act Support

Apollo’s acquisition of LifePoint and Kindred is part of a growing of consolidation of healthcare providers in recent years, driven in part by private equity.[3]

Private equity investment in healthcare companies can carry substantial risk to patients and healthcare workers.[4] The high returns typically targeted by private equity investors over short time horizons may incentivize cost-cutting and risky behavioral that harm patient care, including using high financial leverage, reducing staff, and pushing costly procedures.[5]

The New LifePoint and ScionHealth

LifePoint, which generates around $9 billion in annual revenue, will take on Kindred’s rehabilitation and behavioral health businesses as well as its acute rehabilitation units, outpatient centers and post-acute facilities. Following the Kindred acquisition and spinoff of ScionHealth, LifePoint has around 65 community hospitals, 30 behavioral health and rehab hospitals and an additional 15 in the works, 170 outpatient and post-acute facilities and 50,000 employees. LifePoint had 84 hospitals, 85 post-acute and outpatient facilities and 48,000 employees prior to the deal.[6]

ScionHealth will consist of 79 hospital campuses in 25 states, including Kindred’s 61 long-term acute care hospitals and 18 of LifePoint’s community hospitals and associated health systems.[7]

To support the acquisition of the Kindred hospitals, LifePoint made a $350 million preferred equity contribution to ScionHealth, in addition to ScionHealth raising $550 million in debt.[8]

In other words, Apollo shifted $350 million in cash off of LifePoint’s balance sheet and added $550 million in debt to ScionHealth to fund a $900 million payout to private equity firms TPG Capital and WCAS and Canadian pension fund PSP, the owners of Kindred Healthcare, even as multiple LifePoint and ScionHealth hospitals reached capacity.[9]

LifePoint hospitals at capacity as of late December:[10]

- Clark Memorial Health, Jeffersonville, IN (93 of 96 inpatient beds occupied, 13 of 13 ICU beds occupied)

- Raleigh General Hospital, Beckley, WV (175 of 175 inpatient beds occupied, 24 of 24 ICU beds occupied)

ScionHealth hospitals at or near capacity as of late December:[11]

- Clinton Memorial Hospital (35 of 44 inpatient beds occupied, 7 of 6 ICU beds occupied)[12]

- Kindred Hospital Baldwin Park (72 of 77 inpatient beds occupied, 7.5 of 8 ICU beds occupied)[13]

- Kindred Hospital Los Angeles (67.8 of 72.8 inpatient beds occupied, 5 of 5 ICU beds occupied)[14]

The acquisition comes after LifePoint received $1.6 billion in CARES Act grants and loans.[15]

Furthermore, in April 2021 Apollo sold LifePoint from one of its private equity funds (Apollo Investment Fund VIII) to another fund managed by Apollo (Apollo Investment Fund IX), making a $1.6 billion profit from the transaction. This transaction likely generated hundreds of millions of dollars in carried interest for the private equity firm and its executives.[16]

LifePoint slashed benefits and charity care after receiving CARES money

Aided by the federal support, LifePoint generated $1.14 billion in EBITDA and $304 million in net income in 2020 despite the pandemic. LifePoint ended 2020 with over $2.6 billion in cash, despite receiving CARES Act money intended to be invested in operations that year.[17] Moody’s reported that LifePoint still had $1.8 billion in cash on its balance sheet as of September 30, 2021.[18]

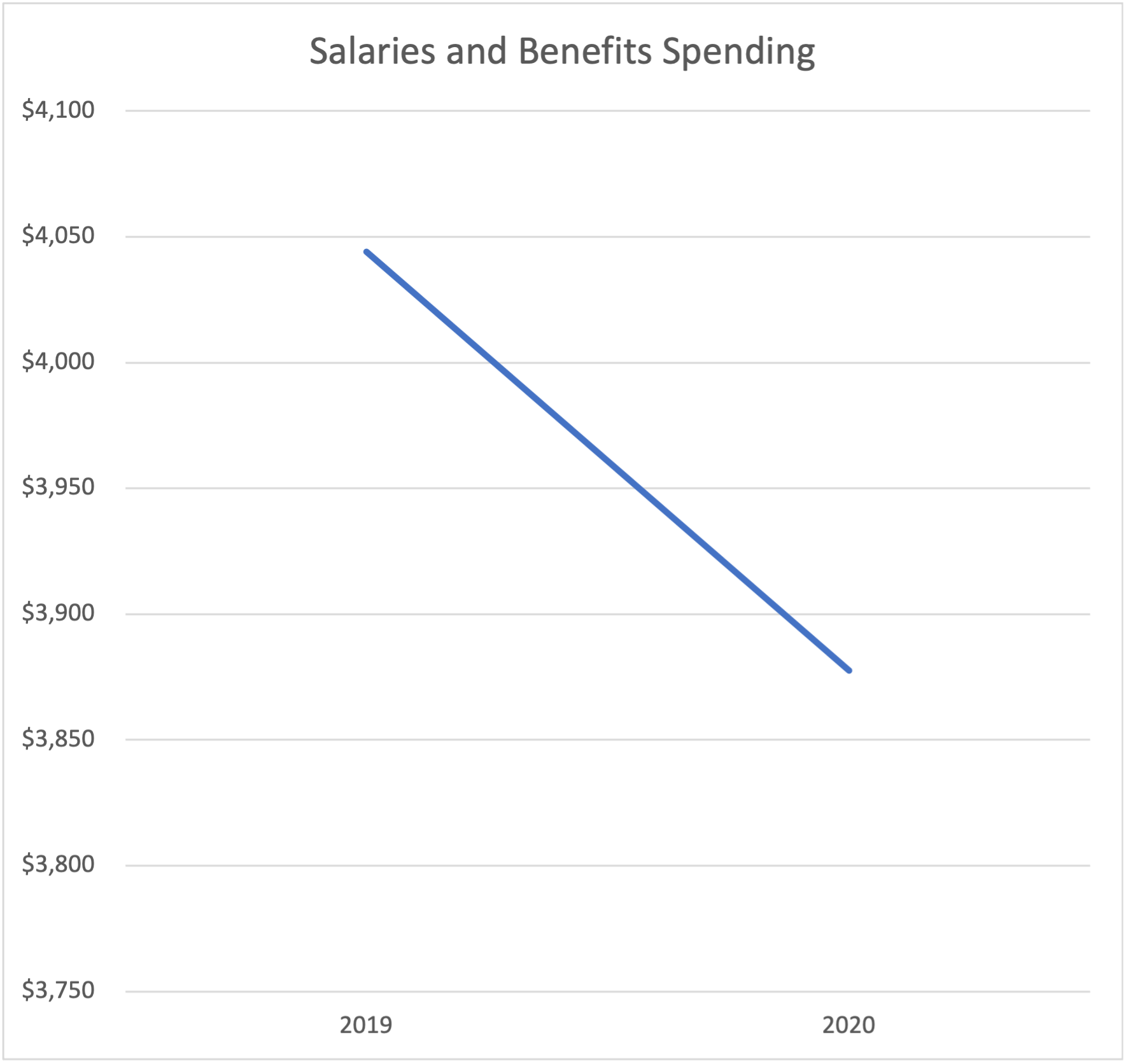

Indeed, despite the pandemic, LifePoint cut operating costs substantially in 2020, slashing salary and benefit costs by $166 million versus the prior year. LifePoint cut supply costs by $54 million in 2020 versus the prior year.[19] LifePoint also cut the charity care it provided by 21% ($7.3 million) in 2020.[20]

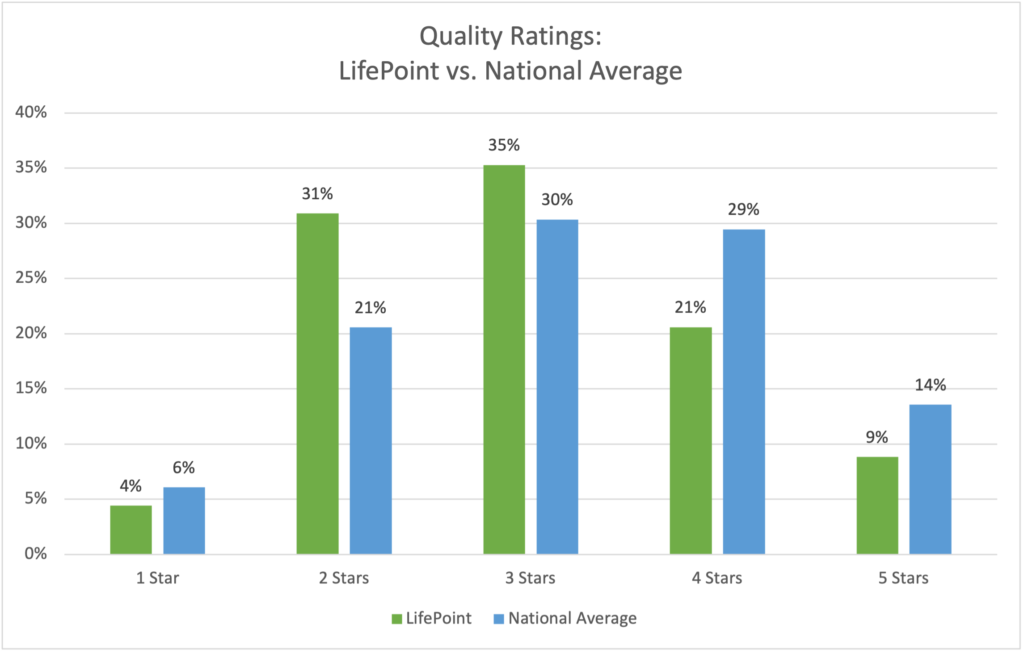

Our September 2021 report found that LifePoint’s hospitals lagged the national average in terms of Centers for Medicare and Medicaid Services quality (i.e. star) ratings.[21]

LifePoint hospitals faced scrutiny for cutting costs at the expense of patient care in several states including Idaho, Washington, and Wyoming. For example, in 2020 the Wall Street Journal reported on how in Wyoming LifePoint chipped away at staffing and services at its hospital in working-class Riverton until most services were transferred to another LifePoint hospital in Lander, 30 miles away. Riverton residents reported that the consolidation severely reduced access to medical services and the transfer led to increased utilization of air ambulances, from 155 in 2014 to 937 in 2019.[22]

[1]LifePoint 2020 financial statement.

[2]“ScionHealth completes $450M term loan wide of talk; terms,” S&P, Dec 20, 2021.

[3] Anaeze C. Offodile II, Marcelo Cerullo, Mohini Bindal, Jose Alejandro Rauh-Hain, and Vivian Ho, “Private Equity Investments In Health Care: An Overview Of Hospital And Health System Leveraged Buyouts, 2003–17,” Health Affairs, May 2021. https://www.healthaffairs.org/doi/10.1377/hlthaff.2020.01535

[4] Atul Gupta, Sabrina T. Howell, Constantine Yannelis & Abhinav Gupta, “Does Private Equity Investment in Healthcare Benefit Patients? Evidence from Nursing Homes,” NBER, February 2021. https://www.nber.org/papers/w28474

[5] Appelbaum, Eileen and Batt, Rosemary, Private Equity Buyouts in Healthcare: Who Wins, Who Loses? (March 15, 2020). Institute for New Economic Thinking Working Paper Series No. 118 https://doi.org/10.36687/inetwp118

[6]“LifePoint Health and Kindred Healthcare close deal, form new company,” Modern Healthcare, Dec 23, 2021.

[7]“ScionHealth completes $450M term loan wide of talk; terms,” S&P, Dec 20, 2021.

[8]“ScionHealth completes $450M term loan wide of talk; terms,” S&P, Dec 20, 2021.

[9]“ScionHealth completes $450M term loan wide of talk; terms,” S&P, Dec 20, 2021.https://protect-public.hhs.gov/pages/hospital-utilization, accessed Dec 29, 2021.

[10]https://protect-public.hhs.gov/pages/hospital-utilization, accessed Dec 29, 2021.

[11]https://protect-public.hhs.gov/pages/hospital-utilization, accessed Dec 29, 2021.

[12]https://protect-public.hhs.gov/pages/hospital-utilization, accessed Dec 29, 2021.

[13]https://data.statesmanjournal.com/covid-19-hospital-capacity/facility/kindred-hospital-baldwin-park/052045/ accessed December 29, 2021.

[14]https://data.desertsun.com/covid-19-hospital-capacity/facility/kindred-hospital-los-angeles/052032/

[15]LifePoint 2020 financial statement. Pg. 61.

[16]https://pestakeholder.org/wp-content/uploads/2021/09/Apollo_Kindred_Lifepoint_PESP_September-2021.pdf

[17]LifePoint 2020 financial statement. Pg. 71-73.

[18]https://www.moodys.com/research/Moodys-confirms-LifePoint-Healths-ratings-outlook-positive–PR_458482

[19]LifePoint 2020 financial statement. Pg. 70.

[20]LifePoint 2020 financial statement. Pg. 100 (F-9).

[21]https://pestakeholder.org/wp-content/uploads/2021/09/Apollo_Kindred_Lifepoint_PESP_September-2021.pdf

[22] Brian Spegele, “A City’s Only Hospital Cut Services. How Locals Fought Back,” Wall Street Journal, April 11, 2021. https://www.wsj.com/articles/a-citys-only-hospital-cut-services-how-locals-fought-back-11618133400