Financial Times : Buyout firm Carlyle to build Mediterranean oil and gas group

July 18, 2024

The Carlyle Group plans to establish an oil and gas company in the Mediterranean after acquiring projects in Italy, Egypt, and Croatia from Energean for up to $945 million. The new venture, chaired by former BP CEO Tony Hayward, will focus on offshore gas production for Europe and North Africa. Carlyle aims to boost production from 34,000 to 50,000 barrels of oil equivalent per day and may pursue further acquisitions.

Financial Times June 20, 2024: Buyout firm Carlyle to build Mediterranean oil and gas group

This acquisition follows Carlyle’s previous strategy of buying and selling fossil fuel energy assets, despite other firms retreating from such investments. Energean will use the sale proceeds to fund developments in Israel, Morocco, and Greece, repay a bond, and issue a special dividend.

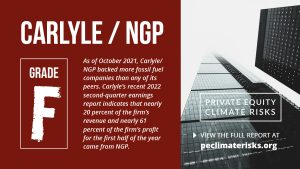

According to research by the Private Equity Climate Risks project, Carlyle’s investment strategy heavily favors fossil fuels over renewable energy. As of April 2023, for every dollar Carlyle had allocated to renewable energy, Carlyle had invested 16 dollars in fossil fuels, a stark contrast to the trajectory needed to limit global warming to 1.5°C overall. Carlyle’s fossil fuel investments extend globally, with Carlyle’s significant ownership stakes in companies engaged in upstream, midstream, and downstream fossil fuel assets.

The firm’s fossil fuel investments were also highlighted by The New York Times in October 2021 citing PESP’s report, Private Equity Propels the Climate Crisis. Carlyle ranked last among its peers on the 2022 Private Equity Climate Risks Scorecard earning an “F”, which was profiled in The Guardian.