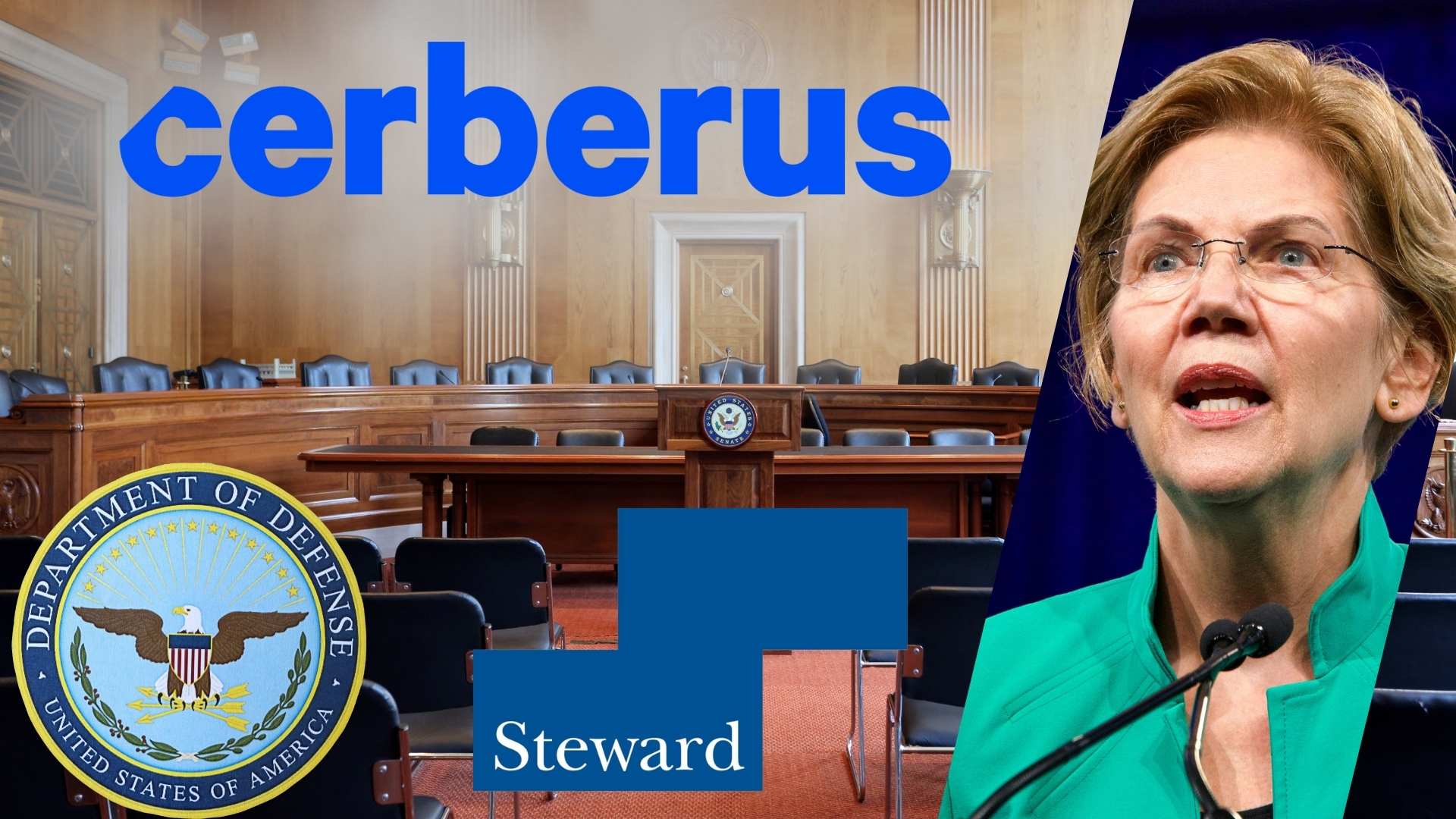

Warren statement on DOD nominee Stephen Feinberg of Cerberus Capital

February 26, 2025

Senator Elizabeth Warren questioned Stephen Feinberg, CEO of private equity firm Cerberus Capital Management and nominee for Deputy Secretary of Defense, about his role in the financial decline of Steward Health Care during a Senate Armed Services Committee hearing. Warren pointed to Cerberus’s management of Steward Health Care, which saw the firm extract over $700 million while leaving the hospital system burdened with debt.

The private equity firm owned Steward, a 31-hospital system operating in 10 states, from 2010 to 2020. On May 6, 2024, Steward, employing nearly 30,000 workers, and serving over 2 million patients annually, filed for Chapter 11 bankruptcy. Cerberus had made its money and ran, while Steward spiraled into financial distress. Feinberg defended Cerberus’s involvement, arguing the hospitals were stable when the firm exited in 2020, but Warren challenged that claim, citing financial struggles and staffing shortages that occurred under his leadership.

During the exchange, Warren referenced research from the Private Equity Stakeholder Project, which reported that many Steward hospitals were already financially strained before Cerberus’s departure. She also highlighted that Feinberg profited significantly while nurses at Steward facilities saw only modest pay increases and staffing concerns escalated. When pressed on the number of “unsafe staffing” complaints filed during Cerberus’s ownership, Feinberg was unable to provide a response. The hearing underscored broader concerns about private equity’s influence on critical industries like healthcare and the potential implications of Feinberg’s leadership at the Department of Defense.

PESP had previously shared concerns of Cerberus’s Feinberg being nominated to a high ranking DOD position. Feinberg’s selection as a leader in the Department of Defense is troubling given that the military contractor DynCorp, which Cerberus owned from 2010 to 2020, paid millions of dollars to settle multiple suits alleging that it defrauded the U.S. government during the time that Cerberus owned it. During the period that Cerberus owned government contractor Dyncorp (2010-2020) the company paid at least $9 million to resolve multiple lawsuits by the U.S. Department of Justice alleging that DynCorp had defrauded the U.S. Government.

Dyncorp is far from the only controversy Feinberg’s Cerberus has faced in recent years. Additionally, Cerberus’ proposed merger of grocery chain Albertsons with Kroger could push up grocery prices for Americans. Cerberus has already received a $4 billion payout related to the merger, which the Federal Trade Commission (FTC) is currently suing to block.

In the 2023 PESP Private Equity Labor Scorecard, Cerberus received the second-worst score and an F grade. Cerberus-owned companies represented the most significant mass layoffs of all the private equity firms in the report, with 13.04 layoffs per every 1,000 employees. Cerberus-owned companies also had the highest number of reported 1,146 serious OSHA violations, with 0.29 serious violations per every 1,000 employees.