Behind the Headlines, BC Partners’ Recent Funds Lag Peers

December 7, 2020

Private equity firm BC Partners has drawn a lot of media attention recently.

In October, BC Partners faced a rebuke from lenders and was unable to refinance retailer PetSmart, pulling the plug on its $4.6 billion bond and loan offering after lenders balked.[i]

Since September, BC Partners has backed an increasingly bitter hostile takeover attempt by portfolio company GardaWorld of security giant G4S.[ii] Last week, BC Partners and GardaWorld raised their bid for G4S by 23%.[iii] GardaWorld’s chief executive last year described the company’s goal as “world domination.”[iv]

Yet behind the drama and headlines, some of BC Partners’ recent funds have underperformed peers.

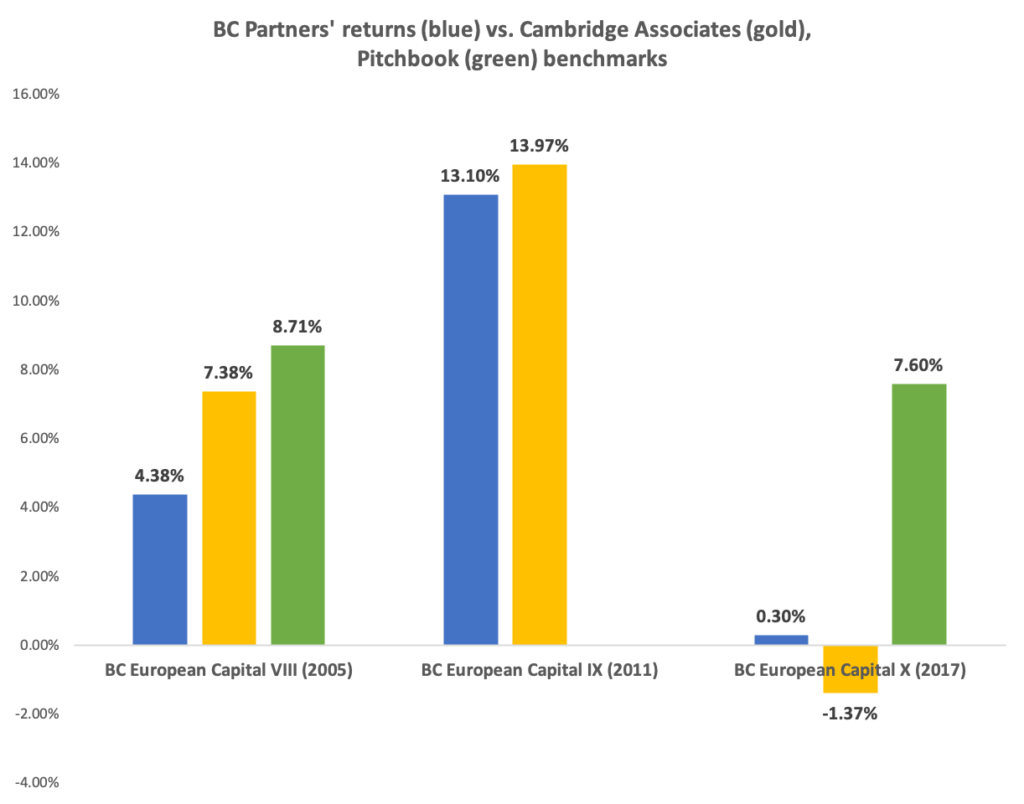

| Fund | Vintage Year | Multiple (TVPI) | IRR | At | Pitchbook IRR Benchmark | Pitchbook Quartile | Cambridge Assoc IRR Benchmark | Cambridge Assoc IRR Quartile | Cambridge Assoc TVPI Benchmark | Cambridge Assoc TVPI Quartile |

| BC European Capital X | 2017 | 1.00x | 0.30% | 1Q20 | 7.60% | 4th | -1.37% | 2nd | 0.99x | 2nd |

| BC European Capital IX | 2011 | 1.6x | 13.10% | 2Q20 | N/A | N/A | 13.97% | 3rd | 1.69x | 3rd |

| BC European Capital VIII | 2005 | 1.2x | 4.38% | 2Q20 | 8.71% | 4th | 7.38% | 3rd | 1.51x | 4th |

BC Partners’ 2005 flagship fund BC European Capital VIII had generated a 4.38% annualized return (IRR) and 1.2x multiple (TVPI) as of mid-year 2020, based on a report by an investor.[v] Based on Cambridge Associates’ benchmark, BC European Capital VIII ranked in the 3rd quartile in terms of IRR and the 4th quartile in terms of multiple.[vi] Data provider Pitchbook ranked BC European Capital VIII in the 4th quartile.[vii]

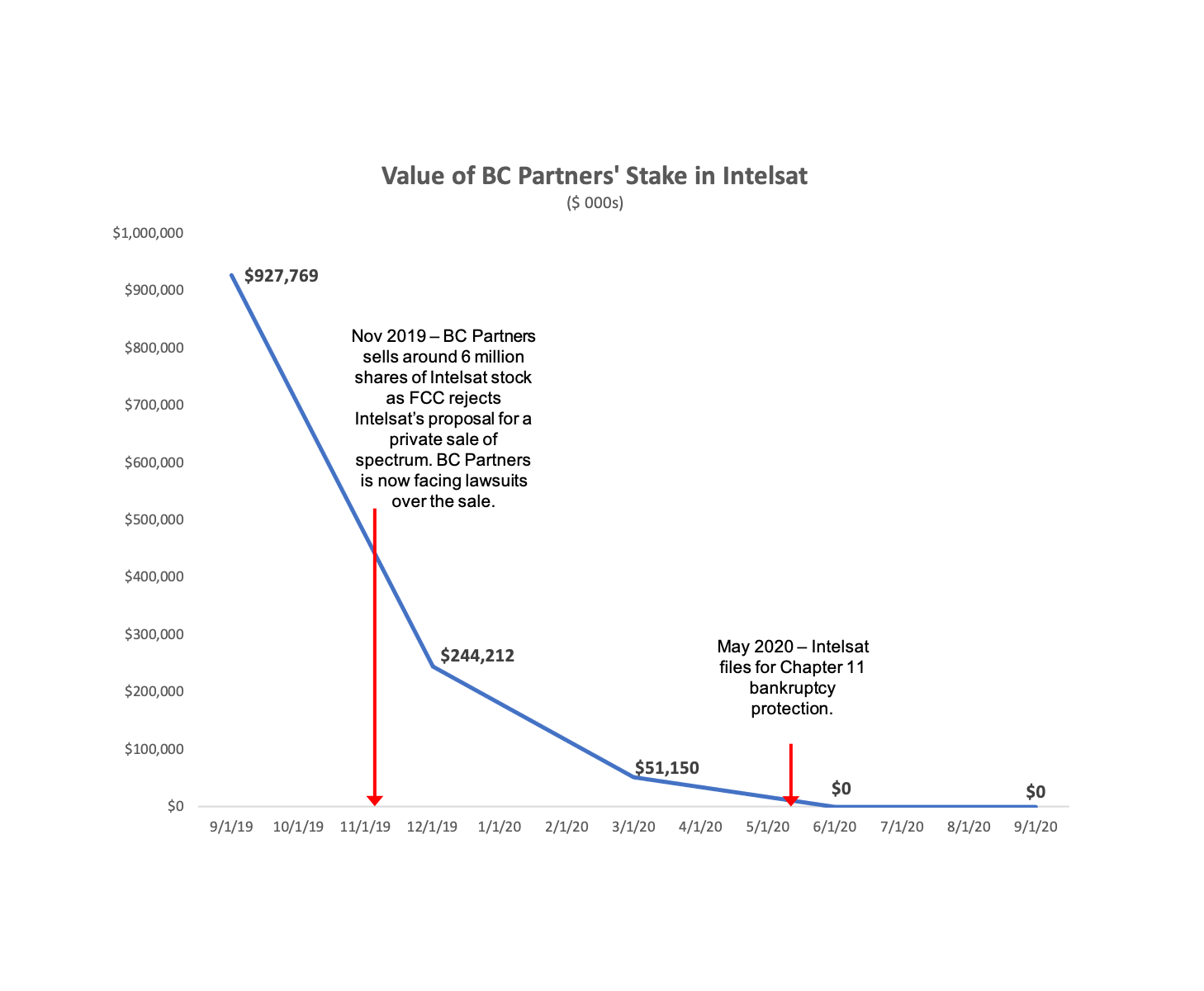

For example, BC European Capital VIII-owned satellite operator Intelsat filed for bankruptcy in May (see below).

The performance of BC Partners’ 2011-vintage BC European Capital IX, was stronger, generating a 13.10% IRR and a 1.6x multiple as of June 30.[viii] Yet the fund still underperformed peers, ranking in the 3rd quartile in terms of both IRR and multiple based on Cambridge Associates’ benchmark[ix] (Pitchbook did not provide a benchmark or quartile ranking for BC European Capital XI).

Investment consultant Stepstone Group reported that as of March 31, 2020, BC European Capital IX’s performance was performing only slightly (0.2%) better than a public market equivalent benchmark – meaning investors could have fared nearly as well by investing in publicly-traded stocks.[x]

BC Partners’ most recent flagship fund, 2017-vintage BC European Capital X, is newer and was not fully invested as of mid 2020.[xi] As of March 30, BC European Capital X had generated a 1.0x multiple and a 0.30% IRR, placing it in 2nd quartile based on Cambridge Associates’ benchmark.[xii] Pitchbook ranked BC European Capital X in the 4th quartile.[xiii]

Intelsat crashes to earth again, and BC Partners now faces lawsuits

BC Partners’ European Capital VIII has struggled in part because of investments like its buyout of satellite operator Intelsat.

BC Partners and Silver Lake Partners acquired Intelsat in 2008 in a $16.8 billion leveraged buyout. The transaction was financed with $15.3B of debt and $1.5B of equity.[xiv]

BC Partners Chairman Raymond Svider and Partner Justin Bateman have been on Intelsat’s board since 2008.[xv]

In the years following the deal, Intelsat’s revenue growth slowed and sales ultimately began to shrink, according to data compiled by Bloomberg.[xvi]

BC Partners and Silver Lake took Intelsat public through an IPO in April 2013 with its stock pricing below the offering range.[xvii] Prior to the IPO, BC Partners and Silver Lake collected around $200 million in transaction and monitoring fees from Intelsat, including a $60 million acquisition fee when they first acquired the firm.[xviii]

By February 2016 Intelsat’s stock had lost more than 90% of its value.[xix] As of mid 2016, Silver Lake Partners had marked its investment in Intelsat down by 90%, reporting that the investment had generated a -21% annualized return.[xx]

In 2018 Intelsat saw its share price buoyed by the prospect of the company being able to sell spectrum for use in the 5G buildout. Intelsat proposed distributing its spectrum holdings via a private sale.[xxi]

Intelsat’s bonds and shares plummeted in November 2019, though, after the US Federal Communications Commission (FCC) rejected the company’s proposal in favor of a public auction run by agency staff.[xxii]

Intelsat filed for bankruptcy protection in May 2020, wiping out BC Partners’ stake.[xxiii]

BC Partners and Silver Lake are now facing lawsuits by a number of Intelsat shareholders over their sale of millions of shares of Intelsat stock in late 2019 as the FCC rejected the company’s plan for a private sale of spectrum.[xxiv]

During the 4th quarter of 2019, BC Partners sold nearly 6 million shares of Intelsat stock.[xxv]

BC Partners Chairman Raymond Svider and Partner Justin Batemen are defendants in the lawsuits.[xxvi]

[i]“BC Partners Faces Lender Rebuke After Burning PetSmart Creditors,” Bloomberg, Nov 2, 2020.

[ii]“Why the world’s biggest security company is under attack,” Financial Times, Nov 24, 2020.

[iii]“GardaWorld raises bid for G4S in bitter takeover battle,” Financial Times, Dec 2, 2020.

[iv]“BC Partners Nears Deal to Buy Security-Services Company Garda World,” Wall Street Journal, Jul 23, 2019.

[v]Washington State Investment Board Performance Summary by Strategy, As of June 30, 2020.

[vi] Based on pooled return benchmark for 2005 funds of 7.38%, TVPI benchmark of 1.51x, Cambridge Associates Private Equity Index and Benchmark Statistics, Jun 30, 2020.

[vii] Pitchbook.com, accessed Dec 5, 2020.

[viii]Washington State Investment Board Performance Summary by Strategy, As of June 30, 2020.

[ix] Based on pooled return benchmark for 2011 funds of 13.97%, TVPI benchmark of 1.69x, Cambridge Associates Private Equity Index and Benchmark Statistics, Jun 30, 2020.

[x]StepStone Group report to the New York City Employees’ Retirement System, Private Equity Portfolio as of March 30, 2020.

[xi] Pitchbook.com, accessed Dec 5, 2020.

[xii] Based on pooled return benchmark for 2017 funds of -1.37%, TVPI benchmark of 0.99x, Cambridge Associates Private Equity Index and Benchmark Statistics, Mar 31, 2020.

[xiii] Pitchbook.com, accessed Dec 5, 2020.

[xiv] Silver Lake Partners quarterly report, June 30, 2016.

[xv]Intelsat Global Holdings S.A. SEC Form F-1, May 18, 2012.

[xvi]“An $8.7 Billion Burden Casts Doubt Over BC Partners Newest Fund,” Bloomberg, May 1, 2019.

[xvii]“Intelsat IPO Gets $347.8 Million as Stock Priced Below Range,” Bloomberg, April 13, 2020.

[xviii] 2010: $24.7 million, 2011: $24.9 million, 2012: $25.1 million, 2013: $64.2 million, 2008 acquisition fee: $60 million, Intelsat form 20-F, Feb 20, 2014. Intelsat form 424B4, Apr 18, 2013.

[xix]https://www.morningstar.com/stocks/pinx/inteq/quote, accessed Dec 5, 2020.

[xx] Silver Lake Partners quarterly report, June 30, 2016.

[xxi]“Intelsat Files for Bankruptcy Ahead of Spectrum Auction,” Wall Street Journal, May 14, 2020.

[xxii]“Intelsat Files for Bankruptcy Ahead of Spectrum Auction,” Wall Street Journal, May 14, 2020.

[xxiii]“Intelsat Files for Bankruptcy Ahead of Spectrum Auction,” Wall Street Journal, May 14, 2020.BC Partners SEC Forms 13F-HR for 2Q20.

[xxiv]FNY Partners Fund LP et al. v. BC Partners, US District Court for the Northern District of California, 3:20-cv-3741; Hill v. Silver Lake Group et al. US District Court for the Northern District of California, 4:20-cv-02341-JSW

[xxv] BC Partners SEC Forms 13F-HR for 3Q19, 4Q19.

[xxvi]FNY Partners Fund LP et al. v. BC Partners, US District Court for the Northern District of California, 3:20-cv-3741; Hill v. Silver Lake Group et al. US District Court for the Northern District of California, 4:20-cv-02341-JSW