Carlyle’s Net Zero Announcement Masks Significant, Ongoing Fossil Fuel Investments

February 26, 2022

The Carlyle Group announced on February 1st that the firm has set a net zero by 2050 goal while also setting “near-term climate goals” in order to carry out immediate action on reductions to emissions.

The announcement lacks in specifics and did not commit to transparency around Carlyle’s fossil fuel holdings or emissions. Carlyle “conspicuously” failed to sign onto a pledge by global financial institutions to eliminate CO2 emissions a few months prior at COP26.

Carlyle has among the largest fossil fuel portfolios compared to other large private equity buyout firms, according to PESP’s October analysis, with at least 68 fossil fuel companies. With this announcement, Carlyle appears to be seeking to position itself as a leader among its peers with a “call to accelerate the transition to a net zero economy” and Kewsong Lee, Carlyle’s Chief Executive Officer, said in the press release,“Investors need to be at the vanguard of helping companies decarbonize across all sectors of the economy.”

But it is hard to see how Carlyle leads if it continues to expand its already substantial fossil fuel exposure. Carlyle’s annual report filed February 10th with the SEC said “funds focused on investing in carbon-based energy (“Carbon Energy Funds”) remain a significant part of our business (8% of total AUM).”

The annual filing went on to discuss Carlyle’s plans to continue investing in fossil fuel assets:

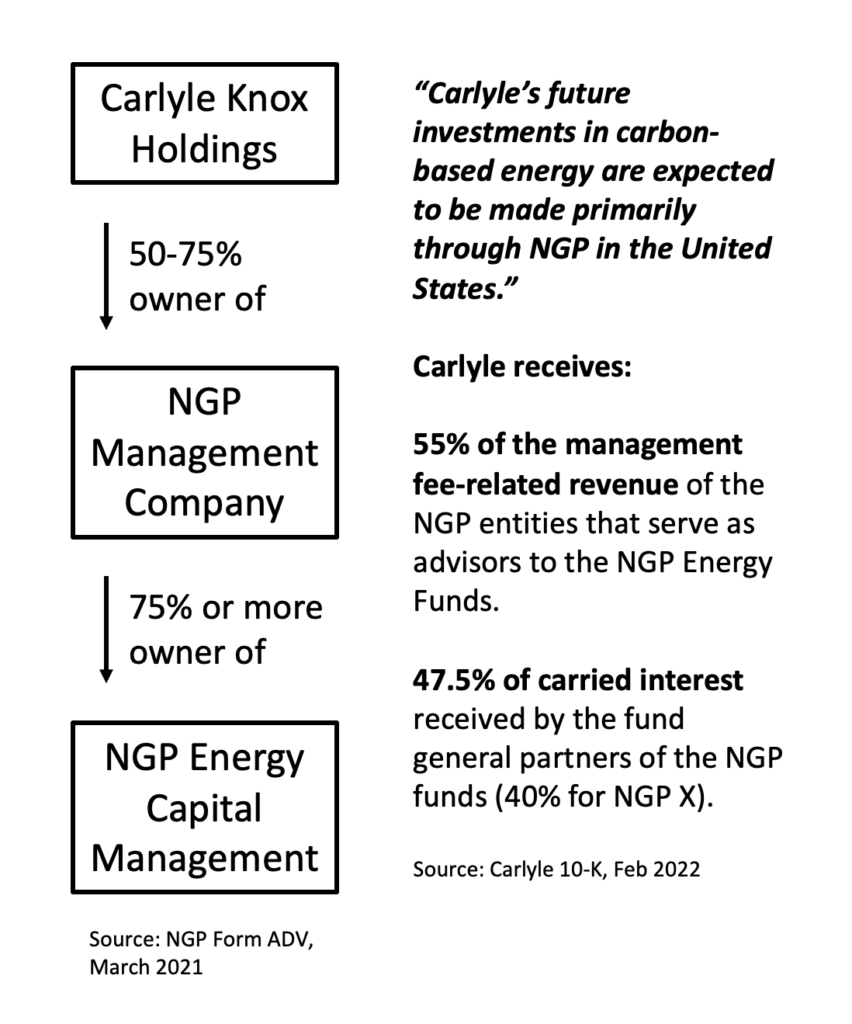

“Carlyle’s future investments in carbon-based energy are expected to be made primarily through NGP in the United States and Carlyle International Energy Partners outside the United States.” Carlyle has a significant ownership stake in NGP (see graphic below), for which over 80 percent of its energy investments are in oil and gas.

Although Carlyle’s net zero announcement stated that “75% of Carlyle’s portfolio companies’ Scopes 1 and 2 emissions will be covered by Paris-aligned climate goals by 2025,” it did not specify which companies the 75% covers and which are in the remaining 25%. The announcement did not define what it means by “Paris-aligned.” It also omits scope 3 emissions, the indirect emissions which, according to the US Environmental Protection Agency, “often represent the majority of an organization’s total GHG emissions” and which the Center for American Progress says are a hidden risk for investors.

In a recent Op-ed, Carlyle CEO Lee suggested that Carlyle intends to continue investing in fossil fuel assets while setting near term goals for energy companies and working on the energy transition.

It appears these pledges are not applicable to NGP’s investments. For example, although Carlyle has done “bottom up carbon footprinting” of its majority-owned portfolio companies and publishes a report under the 2020 Taskforce on Climate-related Financial Disclosure Framework (TCFD), it states that NGP is not included in the scope of the reporting framework. Even for Carlyle’s carbon footprinting, the firm has not made public disclosures of the emissions.

Carlyle’s 2021 TCFD report highlights investments in renewable energy, touting a total of $930MN as of Q3 2021. No comparable data for the company’s fossil fuel investments is included, but the vast majority of Carlyle’s energy investments are in oil and gas. The report also states that 100 percent of the carbon footprinting data for majority-owned portfolio companies has been completed, though the data is not disclosed.

Also omitted entirely from the 2021 TCDF report and the net zero announcement are the indirect scope 3 emissions. Indirect scope 3 emissions account for about 88 percent of total emissions; failure to account for them is an insufficient analysis of climate impacts.

Aside from the omissions in Carlyle’s net-zero announcement and the exclusion of NGP in the TCDF reporting, more broadly, net-zero by 2050 is not adequate.[1] Former chair of the Intergovernmental Panel on Climate Change (IPCC) recently stated that net-zero “helps perpetuate a belief in technological salvation and diminishes the sense of urgency surrounding the need to curb emissions now.” According to the IPCC, every scenario required to avoid some of the most devastating aspects of climate change, requires negative emissions.

Furthermore, a recent analysis by Columbia Center on Sustainable Investment found that two-thirds of companies spanning seven industries, which are responsible for 64 percent of global emissions, rely on offsets as the primary source of emission reductions. Plans to offset carbon emissions from continued operations and expansion of fossil fuel assets is increasingly problematic as it is an unregulated and voluntary market.[2] Additionally, growing evidence shows that carbon credits have not offset the amount of pollution they’re supposed to.[3]

The Sierra Club, Greenpeace and around two dozen environmental justice organizations joined the Private Equity Stakeholder Project to send a letter in April 2021 to Carlyle and thirteen other major private equity firms calling for public disclosure of direct and indirect emissions resulting from investments in oil and gas assets, and calling for a transition plan away from fossil fuel investments.

Shortly following reporting that Apollo will not be investing in fossil fuels through the firm’s 2022 buyout fund earlier this month, PESP sent letters to Carlyle and several other large buyout and infrastructure managers asking whether they would follow Apollo’s lead and commit to not invest their flagship funds in fossil fuel-linked assets.

Recent Carlyle Fossil Fuel Acquisitions

| Year Acquired | Company Name | Energy Type |

| 2021 | Varo Energy | Downstream |

| 2020 | Occidental Petroleum’s Colombia Operations | Upstream |

| 2020 | Panda Liberty Power Project | Downstream |

| 2020 | Panda Patriot | Downstream |

| 2019 | Compañía Española de Petróleos | Upstream, Midstream, Downstream |

| 2019 | Boru Energy | Upstream |

| 2019 | Crimson Midstream | Midstream |

| 2018 | Diamondback Energy and Carlyle (Joint Venture) | Upstream |

| 2018 | Lone Star Ports | Downstream |

| 2018 | Neptune Energy | Upstream |

| 2018 | Revere Power | Downstream |

| 2017 | Assala Energy | Upstream |

| 2017 | Black Stone Minerals | Upstream |

| 2017 | COG Energy | Upstream |

| 2017 | Cogentrix Energy Power | Downstream |

| 2017 | EOG Resources (Oil and Gas Assets in Oklahoma) | Upstream |

Recent NGP Fossil Fuel Acquisitions

| Year Acquired | Company Name | Energy Type |

| 2021 | Mesa Minerals Partners II | Upstream |

| 2020 | AVAD Energy Partners II | Upstream |

| 2020 | Eagle Mountain Energy Partners | Upstream |

| 2020 | Elk Range Royalties | Upstream |

| 2019 | Wing Resources | Upstream |

| 2018 | Black Mountain Sand | Upstream; Midstream |

| 2018 | Iron Horse Midstream | Midstream |

| 2018 | Mettle Midstream Partners | Midstream |

| 2018 | Rebellion Energy | Upstream |

| 2018 | Trilogy Midstream | Midstream |

| 2017 | Camino | Upstream |

| 2017 | Hibernia Energy | Upstream |

| 2017 | Infinity Natural Resources | Upstream |

| 2017 | Mallard Exploration | Upstream |

| 2017 | Outrigger Energy | Midstream |

| 2017 | Titus Oil & Gas | Upstream |

[1]https://www.brookings.edu/blog/planetpolicy/2021/10/25/net-zero-carbon-pledges-have-good-intentions-but-they-are-not-enough/; https://www.sierraclub.org/sierra/problem-net-zero-cop26-climate-talks; https://www.theguardian.com/commentisfree/2021/sep/28/net-zero-is-not-the-real-issue-we-need-to-focus-on-our-carbon-budget; https://www.eenews.net/articles/dangerous-trap-how-the-world-adopted-net-zero/

[2] Carlyle used carbon offsets to claim its carbon neutral status in 2018 for its operations across 30+ global offices: https://www.carlyle.com/sites/default/files/documents/CarbonNeutrality-Jan2019.pdf

[3]https://www.ft.com/content/cfaa16bf-ce5d-4543-ac9c-9d9234e10e9d; https://www.greenpeace.org/international/story/50689/carbon-offsets-net-zero-greenwashing-scam/; https://www.wired.com/story/do-carbon-offsets-really-work-it-depends-on-the-details/; https://features.propublica.org/brazil-carbon-offsets/inconvenient-truth-carbon-credits-dont-work-deforestation-redd-acre-cambodia/