New climate risk guidelines released to aid institutional investors

June 7, 2023

Along with new reports on the climate risks private equity firms pose with their fossil fuels investments, PESP strives to be a resource to institutional investors whose capital is used to fund these energy acquisitions. The Private Equity Climate Risks Scorecard from 2022 offered details on eight of the largest private equity firms in the world and their collective holdings of around $216 billion in energy and fossil fuels–similar to the sum of all financing by the world’s top five banks to the fossil fuel industry last year.

Private equity’s capital that funds these fossil fuel investments comes from endowments, wealthy people and especially pension funds for public employees such as teachers, nurses, and firefighters. One of the worst PE firms on climate was The Carlyle Group, who receives large amounts of capital from multiple state pension funds, received an ‘F’ grade on the aforementioned scorecard. A report released in April found that Carlyle’s billions of dollars of investment in fossil fuel assets produced an estimated 277 million metric tons of CO2 emissions over a decade, as much as the “carbon bomb” that Alaska’s Willow arctic drilling project is set to emit in its entire lifetime.

“The capital Carlyle has used to bloat their massive fossil fuel portfolio has come off the backs of public employee pension funds, university endowments, and other institutional investors,” said Amanda Mendoza, climate researcher at the Private Equity Stakeholder Project. “This report serves as a resource for pension funds and investors who are already working to decarbonize and de-risk their investments. Even investors actively seeking to address these risks in their public market portfolios may already have exposure to dirty assets.”

The report included a guide for institutional investors to help them navigate the significant climate risks through private equity’s investments in fossil fuels. To safeguard investments and contribute to a sustainable future, the report recommended the following steps:

- Demand Transparency: Request private equity managers to align their portfolios with science-based targets, keeping within a 1.5 degree Celsius warming pathway. Ask for full disclosure of fossil fuel holdings, emissions (Scopes 1, 2, and 3), energy transition plans, and climate lobbying efforts.

- Evaluate Transition Strategies: Assess how well private equity firms are adapting their portfolios and energy strategies for the clean energy transition. This information will help you make informed decisions about your investments.

- Prioritize Climate & Environmental Justice: Ensure private equity firms integrate climate and environmental justice considerations, accounting for the communities and workforces impacted by the climate crisis in their investment strategies.

- Reallocate Capital: Shift capital investments toward private equity firms credibly transitioning away from fossil fuels and providing transparency about their holdings, emissions, and impacts.

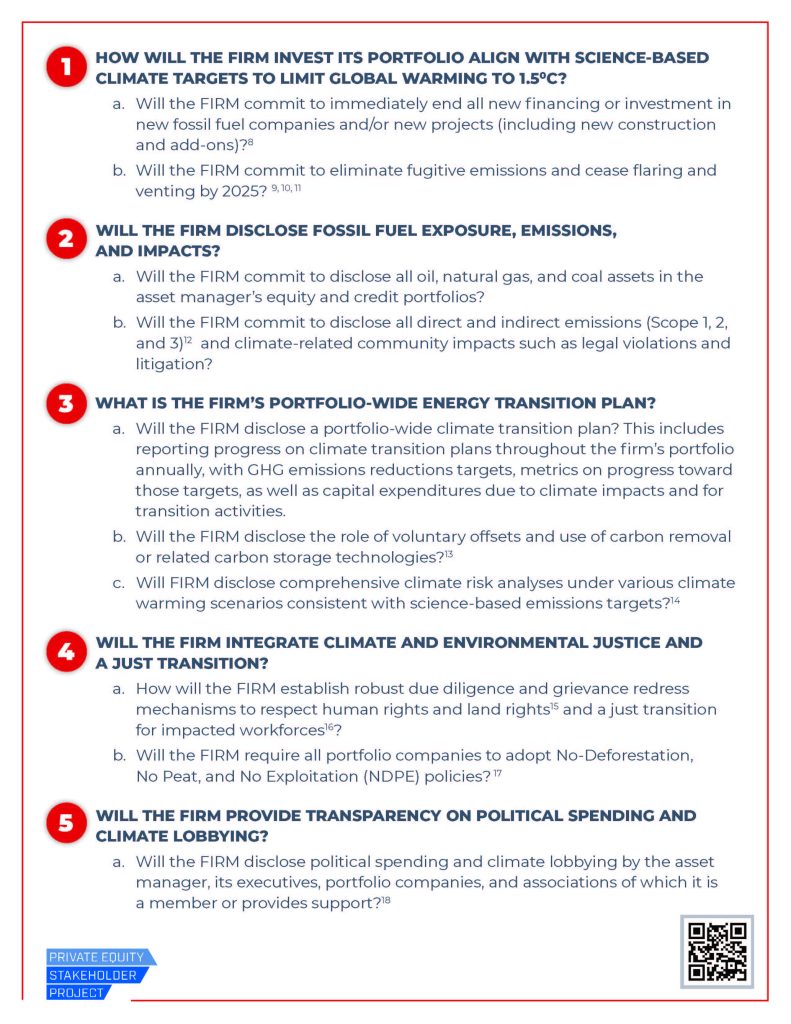

Additionally, PESP developed a new aid for institutional investors concerned about their capital titled “Climate Risk and Energy Transition Questions for General Partners.” The questions posed in the guide are geared to help investors assess how private equity firms are adapting their portfolios for the energy transition.

Helpful questions that general partners can ask the PE firms that hold their capital are:

- How will the firm invest its portfolio to align with science-based climate targets to limit mean global warming to 1.5 degrees C?

- Will the firm disclose fossil fuel exposure, emission, and impacts?

- What is the firm’s portfolio-wide energy transition plan?

- Will the firm integrate climate and environmental justice and a just transition?

- Will the firm provide transparency and political spending and climate lobbying?

Because of the lack of regulation of private markets, many blind spots arise around the hazards these firms pose to investors. Private equity firms have created large climate risks for the investors providing their capital, especially as these firms act as fiduciaries of public sector workers’ retirement savings. As societal sentiment grows in support of a clean energy economy, the environmental risks of doubling down on dirty energy assets are becoming clear. PESP hopes that this guide can be a significant resource for all institutional investors across the globe that are seeking to mitigate climate and transition risk in their portfolios.

Find the new guide for investors HERE.