New Study Finds that Private Equity Ownership of Nursing Homes Substantially Increased Mortality, Decreased Patient Well-Being

March 2, 2021

A new academic study has found that private equity ownership of nursing homes has disquieting impacts on operations and patient care, including increasing the mortality of Medicare patients by 10%.

Drawing from data reported by the Centers for Medicare and Medicaid Services, the analysis looks at US nursing homes between 2005 and 2017.

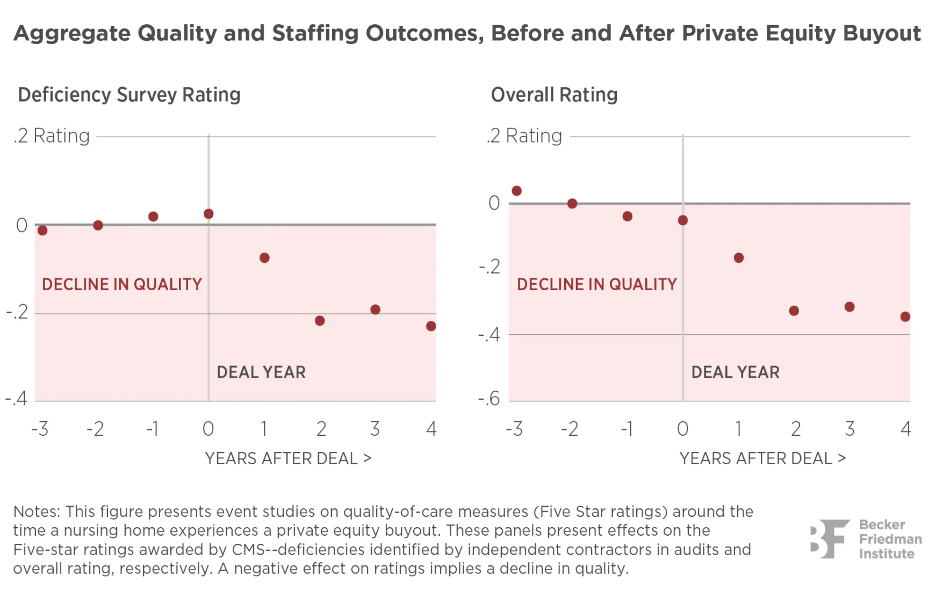

In addition to higher mortality, the report finds declines in other measures of patient wellbeing and the operational changes that help explain those effects, including declines in nursing staff and compliance with standards.

The report also asks how private equity firms make money off of nursing homes, given low profit margins in the industry cited at just 1-2%: “Using CMS cost reports, we find that there is no effect of buyouts on net income, raising the question of how PE firms create value.”[1]

The authors observe a link between shifts in operating costs toward non-patient care items to three key elements of the private equity playbook: monitoring fees, selling real estate to generate cash, and taking on debt. “We find that all three types of expenditures increase after buyouts, with interest payments rising by over 300%,” the authors write. “These results, along with the decline in nurse availability, suggest a systematic shift in operating costs away from patient care.”[2]

“As the strategies for returning profit to the investors are implemented, such as selling the real estate and thus requiring the operator to take on lease payments, the cash on hand turns negative. This could make the nursing home less well-equipped to manage sudden shocks such as, for example, needing to buy personal protective equipment following an infectious disease breakout.”[3]

The study, “Does Private Equity Investment in Healthcare Benefit Patients? Evidence from Nursing Homes,” was published in National Bureau of Economic Research (NBER) on February 13.

Key findings from the study are summarized below:

- Private equity ownership increases the short-term mortality of Medicare patients by 10%, implying 20,150 lives lost due to private equity ownership between 2005 and 2017. 20,150 Medicare lives lost implies a mortality cost of about $21 billion in 2016 dollars. This is about twice the total payments made by Medicare to private equity-owned facilities during the sample period, about $9 billion.

- Taxpayer spending over a short-term Medicare patient stay at a private equity-owned nursing home increases by 11%.

- Average staffing decreases at private equity-owned nursing homes. After a private equity buyout, the number of hours provided by frontline nursing assistants decreases on average by 3% and overall staffing declines by 1.4%. The vast majority of time spent by frontline nursing assistants is used provide mobility assistance, personal interaction, and cleaning to minimize infection risk and ensure sanitary conditions.

- After a private equity firm buyout, patient mobility declines and pain intensity increases.

- Going to a private equity-owned nursing home increases the probability of taking antipsychotic medications – discouraged in the elderly due to their association with greater mortality – by 50%. Elevated antipsychotic use could also be partly explained as a substitution response to lower nurse availability.

- After a private equity buyout: management fees increase by 7.7%, lease payments increase by 75%, and interest payments increase by about 325%. Cash on hand decreases by about 38%.

[1] Atul Gupta, Sabrina T. Howell, Constantine Yannelis, Abhinav Gupta, “Does Private Equity Investment in Healthcare Benefit Patients? Evidence from Nursing Homes.” Pg. 4

[2] Ibid, pg. 4.

[3] Ibid, pg. 34.