Oregon pension shows climate progress, private markets drive emissions

February 11, 2026

Oregon pension makes progress on climate, private markets’ carbon footprint dominates emissions

The Oregon State Treasury, led by Treasurer Elizabeth Steiner, recently published a progress report of the Net Zero Plan unveiled in 2024 by the previous treasurer. This report is the first progress update since the passage of the Climate Resilience Investment Act (CRIA) in 2025, which directs the Oregon State Treasurer (OST) to reduce the carbon footprint of the Oregon Public Employees Retirement Fund (OPERF) consistent with fiduciary duty to retirees.

Treasurer Steiner’s leadership and publicly available analysis are important to begin tackling what has been called OPERF’s “big bet on private equity.” Changing the tide on an investment strategy that has led to significantly higher private markets exposure than the average public pension fund is no easy task, especially given OPERF’s fossil fuel-heavy Real Assets Portfolio. There is a lot of work to do to hold the private funds industry accountable for its part in advancing the climate crisis. Oregon fiduciaries working to meet their net zero targets are providing a glimpse into the work ahead of them in this progress report.

Without adequate disclosures, private markets progress is unclear

The report provides a lookback at OPERF’s portfolio Scope 1 and 2 emissions and models the carbon intensity of OPERF’S investments from 2022 and 2023. The report also provides an update on climate-positive investments as well as manager engagement. One of the main findings of the report is that the emissions intensity decreased by more than 50% over the study period with the private equity portfolio being among the least carbon-intensive.

Looking more closely, this reduction in private equity emissions intensity is based on a model using similar types of companies that are publicly traded to estimate the emissions contributions of OIC’s private equity portfolio. This type of comparison is often inaccurate since private market valuations are more subjective, emissions are undisclosed, and public markets have outperformed private equity over the past several years.

This analysis demonstrates how the opacity of the private equity industry limits what data is available to limited partners and the public. If private equity firms disclosed portfolio holdings and emissions, there would be a much clearer picture of how much climate-related financial risk OPERF beneficiaries are exposed to, and insight into where the industry needs to shift to align its investment practices with Oregon legislation.

The Oregon Treasury acknowledges that its data for private markets is imperfect (on page 31), and correctly notes that many peer funds exclude private markets from emissions reporting due to data challenges. OST’s commitment to continuing to include and improve emissions metrics for private markets is a valuable contribution to understanding the impacts and bringing private markets into alignment with policy goals.

Private markets have largest carbon footprint

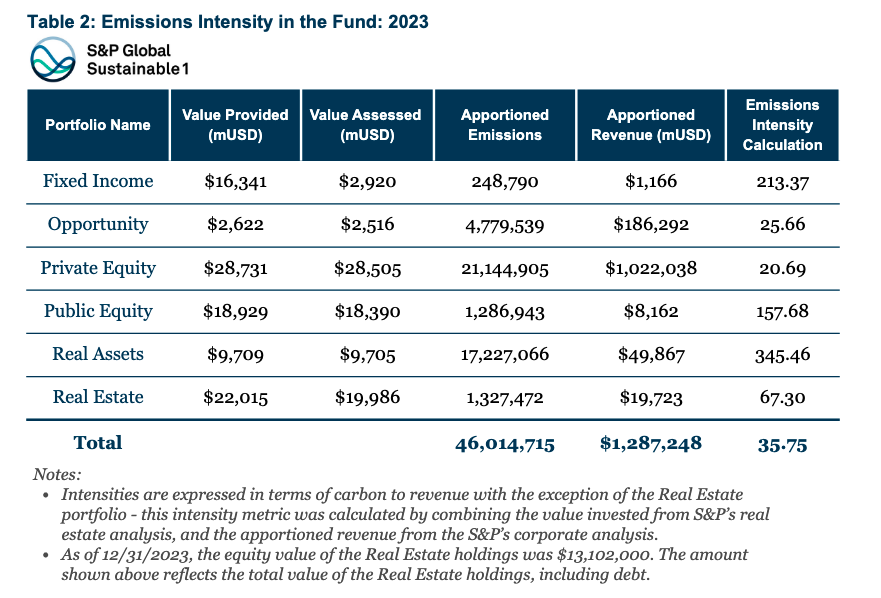

The report’s emissions modeling for 2023, as seen in Table 2 below, had the highest apportioned emissions attributed to private equity and real assets – over 80% of the total.

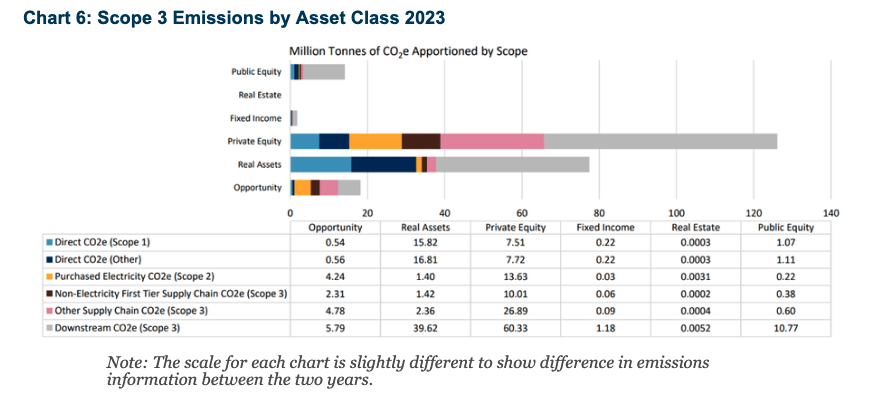

The more detailed modeling of direct and indirect emissions for 2023, shown in Chart 6 below, illustrates that by far the largest sources of CO2e for Scopes 1, 2 and 3 were attributed to Private Equity and Real Assets, dwarfing every other asset class combined in each category of emissions.

Progress on climate-positive investments

The report indicates steady progress towards increasing climate-positive holdings within OPERF’s Real Assets portfolio, with 2024 surpassing 20% of the portfolio being exposed to climate-positive holdings, which the report describes as “renewable generation, EV charging,

battery materials and carbon credits, otherwise called “energy transition infrastructure Investments.”

Without more transparency into what private equity firms are buying and selling, there is no way to delineate which of these holdings are false solutions that prolong the use of fossil fuels or delay true climate action versus industries that actively contribute to an energy transition.

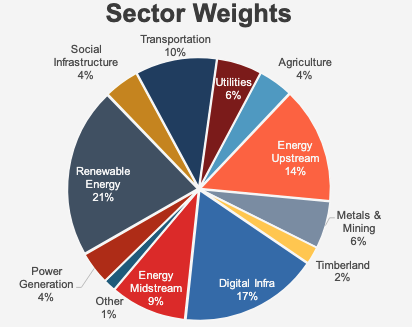

Moving the Real Assets class away from fossil fuel investments is certainly the right direction to mitigate climate-related financial risks in OPERF private markets. As of Sept 30, 2024, the portfolio had substantial exposure to fossil fuels in energy upstream, midstream, and power generation sectors, a combined 27% of the asset class.

Oregon fiduciaries should engage managers with a known track record of fossil fuel investments to ensure they are using OPERF dollars to shift their portfolios to rapidly decarbonize and mitigate climate-related risks. As of September 2025 OPERF’s Real Asset portfolio has exposure to the following private equity asset managers that received failing grades on the 2024 Private Equity Climate Risks Scorecard report: Brookfield Asset Management, NGP Capital Management, EnCap, and Quantum Energy.

Oregon is working within the opaque private equity industry

The work that lies ahead involves moving private equity firms to reduce real-world carbon emissions and reposition the portfolio for a low-carbon energy economy. Part of this is understanding what the emissions from private equity-backed companies are, and pressing them for credible commitments to redesign their investment strategies away from fossil fuels. The lack of disclosures from the private equity industry creates real roadblocks for limited partners looking to mitigate climate-related financial risk and specifically for Oregon fiduciaries working to comply with the CRIA legislation.

OST and its consultants have provided valuable insights into how well their investment portfolios are doing to meet net zero goals, despite private markets disclosure limitations, and have an important baseline to track, compare, and guide future investment decisions.