Private Equity Health Care Acquisitions – December 2021

January 12, 2022

In light of the growing investor interest in health care and the risks associated with private equity ownership of health care companies, the Private Equity Stakeholder Project will be tracking private equity-backed health care acquisitions. Below is a list of private equity health care buyouts and add-on acquisitions completed or announced during December 2021. We will continue to track acquisitions on a monthly basis.

See November 2021 acquisitions here.

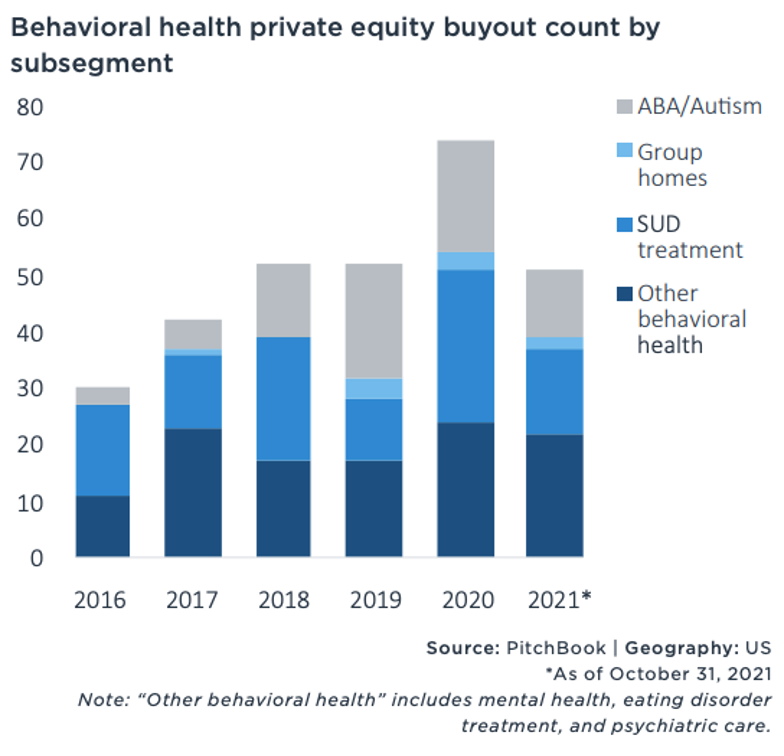

Behavioral health remains a popular investment target for private equity investors, with at least 10 deals in December. This is part of a growing trend of private equity in the space, which includes mental health, addiction treatment, and autism services. According to data provider Pitchbook, “No other major healthcare provider space has seen such explosive growth in the past five or so years.”[1]

Investment in behavioral health is expected to continue growing in 2022. “In mental health, an explosion of platform activity since 2020 foretells accelerated consolidation in the years to come,” writes Pitchbook. “…By contrast, [Substance Use Disorder] treatment, the oldest behavioral health segment, should see another wave of private equity investment start as platforms that last transacted in 2015 through 2018 return to the market, and may begin to enter the early stages of platform consolidation in the coming years.”[2]

December’s private equity behavioral health deals include American Securities’ acquisition of FullBloom (fka Catapult Learning[3]), an educational services platform that provides academic intervention, special education programs, and behavioral health services for K-12 students. FullBloom operates in 41 states and Washington, DC, and has at least 7,800 employees, making this one of the largest behavioral health transactions of the year.[4]

American Securities has come under fire for its ownership of prison telephone and communications provider Global Tel Link (GTL), which has faced scrutiny for exorbitant phone and video-calling rates, flaunting legal protections, allegedly conspiring to bribe government officials.[5]

December Behavioral Health Acquisitions

| Company | Type | PE Firm(s) | Platform Acquirer | Locations |

| FullBloom | Youth behavioral health, autism services, academic intervention, teletherapy | American Securities | n/a | 41 states and Washington, DC |

| Granite Recovery Centers | Addiction treatment | Webster Equity Partners | BayMark Health Services | NH |

| Riverwood Group | Addiction treatment | Webster Equity Partners | BayMark Health Services | AR, FL, IL, IN, KS, NE, SD |

| Community Medical Services | Addiction treatment, teletherapy | FFL Partners, Two Sigma Investments | n/a | AK, AZ, CO, IN, MI MN, MT, ND, OH, TX, WI |

| ABA Tools | Autism services software | Insight Partners | CentralReach | |

| Atlanta Addiction Recovery Center | Addiction treatment | Nautic Partners | Pyramid Healthcare | CT, GA, NC, NJ |

| The Bluff | Addiction treatment | Nautic Partners | Pyramid Healthcare | CT, GA, NC, NJ |

| South Sound Behavior Therapy | Autism services | New MainStream Capital | Center for Social Dynamics | CA, CO, OR, WA |

| Right Path Addiction Treatment Centers | Addiction treatment | Shore Capital Partners | BrightView | VA, OH, KY, DE |

| PresenceLearning | School-based behavioral health, teletherapy | Spectrum Equity, The Rise Fund | n/a |

BayMark Health Services, which is owned by private equity firm Webster Equity Partners,[6] acquired Riverwood Group and Granite Recovery Centers. Riverwood Group is a medication assisted treatment (MAT) provider operating in Arkansas, Florida, Illinois, Indiana, Kansas, Nebraska and South Dakota.[7] Granite Recovery Centers is a New Hampshire-based addiction treatment provider.[8]

BayMark is the largest provider of Opioid Use Disorder (OUD) services in North America, with more than 300 addiction treatment facilities in 35 states and three Canadian provinces.[9] Webster Equity created BayMark as a platform company in 2015 by buying and merging BAART Programs and MedMark Services, and has since made numerous acquisitions of smaller regional addiction treatment providers.[10]

The outsized returns targeted by private equity investors over relatively short periods of time pose risks to quality of care at private-equity-owned behavioral health providers. Risks may include inadequate staffing or reliance on untrained and unlicensed staff, pressure on providers to provide unnecessary and costly services, or abuse of federal funding programs at the expense of patient care.[11]

See our report: Understaffed, Unlicensed, and Untrained: Behavioral Health Under Private Equity

December Private Equity Buyouts

| Company | Type | PE Firm |

| FullBloom | Behavioral health | American Securities |

| Community Medical Services | Behavioral health | FFL Partners, Two Sigma Investments |

| PresenceLearning | Behavioral health, telehealth | Spectrum Equity, The Rise Fund |

| BioAgilytix Labs | Biopharmaceuticals | Cinven, Cobepa, Caledonia Private Capital |

| TTG Imaging Solutions | Diagnostic imaging | Sentinel Capital Partners |

| Allergy Partners | ENT services | WayPoint Capital Partners |

| Client Network Services | Health tech | The Carlyle Group |

| PracticeTek Solutions | Healthare investing | Lightyear Capital, Audax Group and Greater Sum Ventures |

| WillowWood Global | Medical devices | Blue Sea Capital |

| Seqens | Pharmaceuticals | SK Capital Partners, Ardian, Mérieux Equity Partners, Bpifrance, Eximium, Caisse des Dépôts Group |

| Alliance Physical Therapy Partners | Physical therapy | Beecken Petty O’Keefe & Company |

| Office Ally | Practice management services | Francisco Partner |

| EMS Management and Consultants | Revenue cycle management | BV Investment Partners |

| South Bay Partners | Senior housing | Harbert Management |

| UrgentMED | Urgent care | Quilvest Private Equity |

December Add-On Acquisitions

| Company | Type | PE Firm | Platform Company |

| Secure Exchange Solutions | Health tech | ABRY Partners, Riverside Credit Solutions, Silversmith Capital Partners, SV Health Investors | Centauri Health Solutions |

| Masy Bioservices | Biopharmaceuticals | Ampersand Capital Partners, Ares Capital Corporation BDC, Madison Dearborn Partners | Alcami |

| Ascential Care | Managed care organization | Ares Management, Auburn Hill Capital, BDT Capital Partners, Blackstone, Blackstone Credit, Harvest Partners, MidCap Financial, Partners Group | Acrisure |

| Cyan Health | Healthcare consulting | Arsenal Capital Partners | Pharma Value Demonstration |

| OmniSYS | Health tech | Avista Capital Partners, Constitution Capital Partners | XIFIN |

| Pivot Health Solutions | Physical therapy | BDT Capital Partners | Athletico Physical Therapy |

| Wellframe | Health tech | Blackstone | HealthEdge |

| Exemplar Research | Clinical trials | Centre Partners | The IMA Group |

| Bonney Lake Physical Therapy & Hand Rehab | Physical therapy | Churchill Asset Management, Gryphon Investors | Physical Rehabilitation Network |

| Lyophilization Services of New England | Pharmaceuticals | Churchill Asset Management, Kohlberg & Company, Mubadala Development Company | PCI Pharma Services |

| Workwell Occupational Medicine | Occupational health | Clearview Capital | MBI Industrial Medicine |

| HealthCare Support | Staffing | Cornell Capital, Trilantic North America | Ingenovis Health |

| Omeros (Omidria Franchise) | Medical supplies | CVC Capital Partners | Rayner Group |

| Homestead Hospice | Hospice | Dorilton Capital | Traditions Health |

| Andrews Sports Medicine & Orthopaedic Center | Orthopaedics | FFL Partners, Thurston Group | Mississippi Sports Medicine and Orthopaedic Center |

| Moberly Family Dentistry | Dental | Five Points Capital, Thurston Group | Gen4 Dental Partners |

| Health Fidelity | Health tech | Francisco Partners, TA Associates Management | Edifecs |

| Digestive Care Physicians | Gastroenterology | Frazier Healthcare Partners | United Digestive |

| Gastroenterology Associates of Southwest Florida | Gastroenterology | Frazier Healthcare Partners | United Digestive |

| Frontida Biopharm | Biopharmaceuticals | Frazier Healthcare Partners, Thomas H. Lee Partners | Adare Pharma Solutions |

| CueSquared | Health tech | Frontier Growth | AccessOne |

| Remarkable Health | Health tech | GI Partners, TA Associates Management | Netsmart Technologies |

| Loving Hands Hospice | Hospice | Granite Growth Health Partners, Health Velocity Capital, Petra Capital Partners | Three Oaks Hospice |

| Select Home Health Services | Home health | Grant Avenue Capital | Valeo Home Healthcare |

| Medicom Health Interactive | Health tech | H.I.G. Capital | Eruptr |

| ABA Tools | Behavioral health | Insight Partners | CentralReach |

| Protein Metrics | Health tech | Insight Partners | GraphPad Software |

| InSync Healthcare Solutions | Health tech | Martis Capital, Warburg Pincus | Qualifacts Systems |

| Beaver Dam Eye Care | Eye care | Monarch Alternative Capital | Shopko Eyecare Center |

| Atlanta Addiction Recovery Center | Behavioral health | Nautic Partners | Pyramid Healthcare |

| The Bluff | Behavioral health | Nautic Partners | Pyramid Healthcare |

| South Sound Behavior Therapy | Behavioral health | New MainStream Capital | Center for Social Dynamics |

| Dr. Pimple Popper | Dermatology | OMERS Private Equity, Penfund | Forefront Dermatology |

| HomeCare Connect | Home health | OMERS Private Equity, Summit Partners | Paradigm Outcomes |

| Beacon Dental Health | Dental | Regal Healthcare Capital Partners, The Jordan Company | Dental365 |

| Roller Weight Loss & Advanced Surgery | Surgery centers | Sentinel Capital Partners | SSJA Bariatric Management |

| Becker Eye Care Center | Eye care | Sheridan Capital Partners | Atlantic Vision Partners |

| MidAtlantic Eye Care | Eye care | Sheridan Capital Partners | Atlantic Vision Partners |

| Right Path Addiction Treatment Centers | Behavioral health | Shore Capital Partners | BrightView |

| Dyad Labs | Laboratory services | Sofina | Merieux Nutrisciences |

| Bridget Burris DDS | Dental | Surge Private Equity | Access Dental Management |

| The RND Group | Health tech | Sverica Capital Management | Gener8 |

| Discover Vision Centers | Eye care | The Firmament Group | Vision Integrated Partners |

| In Vitro ADMET Laboratories | Fertility | Water Street Healthcare Partners | Discovery Life Sciences |

| Granite Recovery Centers | Behavioral health | Webster Equity Partners | BayMark Health Services |

| Riverwood Group | Behavioral health | Webster Equity Partners | BayMark Health Services |

| ORM Fertility | Fertility | Webster Equity Partners | Pinnacle Fertility |

| Interim HealthCare of Sacramento Hospice | Home health, hospice | Wellspring Capital Management | Interim HealthCare |

[1]https://files.pitchbook.com/website/files/pdf/PitchBook_Analyst_Note_Established_Private_Equity_Healthcare_Provider_Plays.pdf#page=1 pg. 10.

[2]https://files.pitchbook.com/website/files/pdf/PitchBook_Analyst_Note_Established_Private_Equity_Healthcare_Provider_Plays.pdf#page=1 pg. 13.

[3]https://fullbloom.org/2020/01/20/catapult-learning-unveils-new-parent-company-brand-fullbloom/

[4]https://www.american-securities.com/en/companies/fullbloom

[5]https://pestakeholder.org/report/american-securities-big-bet-on-prison-phone-calls/

[6]https://websterequitypartners.com/portfolio/baymark/

[7]https://www.prweb.com/releases/baymark_acquires_riverwood_group_llc_opioid_treatment_programs/prweb18411131.htm

[8]https://www.eagletribune.com/news/granite-recovery-centers-acquired-by-national-provider/article_2f14c638-6a74-11ec-8981-bbe8fa6ef173.html

[9]https://www.prweb.com/releases/baymark_acquires_riverwood_group_llc_opioid_treatment_programs/prweb18411131.htm

[10]https://webcache.googleusercontent.com/search?q=cache:EkDVvmi9T_sJ:https://www.pehub.com/webster-shelves-baymark-auction-eyes-further-growth/+&cd=3&hl=en&ct=clnk&gl=us

[11]https://pestakeholder.org/wp-content/uploads/2020/09/PESP-behavioral-health-9-2020.pdf