Quantum Capital fossil fuels linked to $2.4B in health costs

September 3, 2025

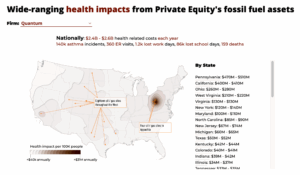

Quantum Capital’s 11.6k+ fossil fuel assets responsible for at least $2.4 billion in public health costs annually

Texas-based energy specialist private equity firm Quantum Capital’s extensive fossil fuel portfolio of upstream oil and gas assets is responsible for billions in human health-related costs in the U.S. annually, according to Private Equity, Public Harm, a new analysis by the Private Equity Climate Risks consortium. The public health-related costs associated with Quantum’s U.S. assets are staggering, primarily due to its vast collection of over 11.6 thousand oil and gas wells spread across the country. The firm’s investments have direct impacts on human health, causing asthma, hay fever, and even premature deaths.

Quantum has spent at least $18.7 billion over the past decade acquiring these harmful assets in the U.S. and abroad. With plans for a new oil and gas-focused fund on the horizon, Private Equity Stakeholder Project (PESP) has been raising the alarm on Quantum’s expanding oil and gas portfolio and its associated environmental and human health harms to investors. PESP urges investors to refuse further financial commitments to Quantum Capital until the firm transitions its portfolio to clean alternatives.

Quantum Backs Over 11,600 Fossil Fuel Assets Globally

Quantum Capital has amassed an extensive portfolio of fossil fuel assets across the globe. The firm’s portfolio includes at least 21 energy companies, the vast majority of which are upstream oil and gas extraction. Through many of its U.S. upstream portfolio companies, Quantum backs at least 11,500 producing oil and gas wells across the country. The firm backs seven offshore deepwater drilling rigs in the U.S. and overseas through its portfolio companies Trident Energy and HEQ Deepwater, and the recently acquiredCogentrix Energy operates 12 gas-fired power plants in the U.S. Quantum has spent at least $18.7 billion since 2014 acquiring these dirty assets, and announced plans to seek funds to continue this oil and gas expansion.

Explore the full Quantum Fossil Fuel Asset Map here.

Of the 11,500+ oil and gas producing wells operated by Quantum-backed companies, most are concentrated in Colorado, California, and West Virginia. QB Energy operates the most wells overall, 4,497, with 4,191 in Colorado. Sentinel Peak Resources operates 3,326 throughout Central and Southern California, and Anerto Resources operates 1,370 wells in West Virginia.

The 2024 Private Equity Climate Risks Scorecard found that Quantum’s upstream operations fuel climate chaos as they were responsible for over 152 million metric tons of CO2e, which is equivalent to the emissions of 36 coal-fired power plants.

Quantum-backed Oil and Gas Assets Add $2.4B – $2.6B to Human Health-Related Costs Each Year

In addition to the staggering environmental impacts of Quantum’s oil and gas extraction assets, the new report by Private Equity Climate Risks: Private Equity, Public Harm, found that Quantum Capital’s investments in upstream gas extraction facilities resulted in an estimated $2.4 to $2.6 billion in health-related costs in the U.S. each year, ranking the second highest health-costs in the analysis of 20 private equity firms.

The report details the human health impacts caused by emitted air pollutants such as SO2, NOX, PM2.5, and VOCs from private equity-backed coal-fired power plants, liquid natural gas (LNG) export terminals, and oil and gas extraction facilities in the U.S. These types of air pollutants affect human health at the most personal level– causing increased cases of asthma and asthma symptoms, hay fever, emergency room visits, loss of work and school days, as well as premature death. And while the human suffering behind these conditions is significant enough, quantifying the economic toll of these conditions through medical treatment, lost productivity, and even lost lives, helps provide clarity of the economic cost to society of continued investment in these types of assets.

See the chart of Quantum’s U.S. human health impacts here.

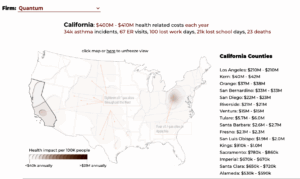

A snapshot from the Private Equity, Public Harm data dashboard shows the states with the highest human health-related costs from Quantum’s oil and gas extraction operations are Pennsylvania ($407 -$510 million), California ($400-$410 million), and Ohio ($260 -$280 million).

The data dashboard reveals health costs down to the county level. The most impacted counties in California by Quantum’s oil and gas wells are Los Angeles, Kern, and Orange.

PESP Urges U.S. Public Pension Funds To No Longer Invest in Quantum and Its Expanding Fossil Fuel Portfolio

Since Quantum announced fundraising for its next oil and gas-focused fund, Quantum Energy Partners IX, the Private Equity Stakeholder Project (PESP) has been delivering public comments to pensions currently invested with Quantum to raise the alarm about the firm’s expanding fossil fuel portfolio. PESP has been highlighting the associated financial costs and negative human health and environmental impacts of Quantum’s energy holdings and urging investors to decline further investments with the firm.

PESP delivered public comments at board meetings for several of Quantum’s limited partners, all U.S. public pension funds, between May and June 2025.

PESP gave in-person public comments at three California public pension funds board meetings in June: Alameda County Employees’ Retirement Association (ACERA) and

Sacramento County Employees’ Retirement System (SCERS) on June 18th, and Orange County Employees’ Retirement System (OCERS) on June 21st.

View the full video of PESP Investor Engagement Director, Alyssa Giachino, at the June 18th ACERA board meeting here.

The California pension funds with commitments to Quantum are in a unique position as their financial commitments to the firm help to finance the 3,000+ producing oil and gas wells in Central and Southern California, which directly impact Californians, and likely their own pensioners, to the tune of $400M-$410 million in human health-related costs each year.

PESP also submitted written public comments to the Oregon Public Employees Retirement System (OPERS) on May 27th. Between 2022 and 2023, OPERS committed $440 million to Quantum through four separate commitments to Quantum funds. Quantum’s continued appetite for fossil fuel investments creates challenges to implement Oregon’s Net Zero Plan, which aims to achieve net zero emission by 2050 across the entire pension fund portfolio.

On June 10th PESP also submitted a written comment to the State of Wisconsin Investment Board (SWIB), which has committed $67.8 million to Quantum Energy Partners Funds VII and VIII.

As Quantum’s Fossil Fuel Portfolio Expands, Financial Risks Increase

As Quantum launches its new oil and gas-focused fund and continues to pick up unwanted fossil fuel assets from public oil majors and other private equity firms, the financial risks for Quantum investors increase. The private equity industry is showing signs of decline, seeing the worst quarter for private equity deal volume since Q2 2020, and with trends worsening for private equity exits, Quantum is charting a risky course by continuing to be the private equity fossil fuel investor of last resort. The investors, including public employees counting on their pensions, will be the ones paying the price if Quantum continues to sink money into risky fossil fuel investments.

Quantum should cease further investments in dirty oil and gas assets that not only harm the environment and fuel climate chaos, but also directly harm human health. Quantum should end the dirty offloading cycle and retire its fossil fuel assets, and undergo a clean and just transition of its energy portfolio.