Private Equity-Backed Companies Dominate 2020 Oil and Gas Bankruptcies

January 28, 2021

Private equity-backed companies comprised the majority of oil and gas producer bankruptcies in 2020. Of the companies that filed for bankruptcy last year, 57 percent are backed by private equity firms, or 26 of the 46 filings.[1]

The high number of oil and gas producer bankruptcies last year, as tracked by Haynes and Boone, made clear the risks of fossil fuel exploration and production as the pandemic impacted both demand and pricing.

Notably, 2020 saw an increase in bankruptcies with debt loads greater than $1 billion, with an unusually high number relative to the prior six years. More than two thirds (71%) of 2020’s multibillion-dollar bankruptcies were backed by private equity.

Private-equity backed oil companies such as Ultra Petroleum (backed by Fir Tree Capital Management), Chesapeake Energy (Carlyle Group was a major investor), and Unit Corporation (backed by Partners Group) each held more than $5 billion in aggregate debt. Ultra is particularly remarkable as it filed for bankruptcy twice in five years.

Even before oil prices collapsed into negative territory in the spring of 2020, private equity firms were having difficulty selling off their oil and gas producer holdings. Haynes and Boone partner Buddy Clark questioned private equity firms’ approach: “The investment model for private equity was to find the right people, invest money, have them drill one or two wells and then flip it,” Clark said in January 2020. “The question is, will that model ever come back?”

Given the growing trend to wean the world from fossil fuel-burning vehicles and the unlikely scenario of a return to pre-pandemic oil demand level, investments in oil and gas producers require in-depth assessment of long-term risks, particularly if they are backed by private equity.

Oil and gas companies that filed for bankruptcy last year were substantially more indebted than those filing in prior years. The aggregate debt of oil and gas bankruptcies in 2020 rivaled the record from 2016, even though there were fewer filings last year.

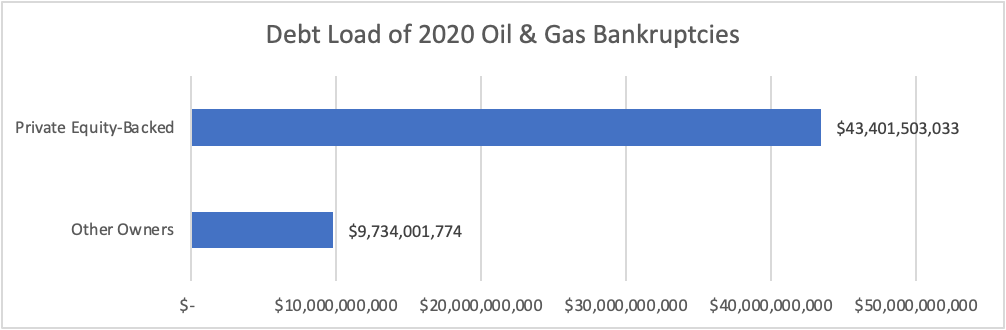

Private equity’s extensive use of debt to fund oil and gas acquisitions exposed investors to greater risk. The combined debt of the 46 oil producers that filed for bankruptcy through December 2020, was around $53 billion. Private equity-backed oil producers accounted for over 82 percent of that debt, owing a combined $43 billion. The average debt held by bankrupt private equity-backed crude producers was more than three times that of their non-private equity-backed peers.

| Type of Producer | Average Aggregate Debt |

| Private Equity-Backed | $1,669,288,578 |

| Other Owners | $486,700,089 |

Source: Various; Haynes and Boone, LLP Oil Patch Bankruptcy Monitor, December 31, 2020

The table below shows an updated list of some of the private equity-backed oil and gas companies that filed for bankruptcy last year with debt loads exceeding $100 million.

| Filing Date | Debtor | Private Equity Owners | Total Secured and Unsecured Debt |

| 1/27/2020 | SOUTHLAND ROYALTY COMPANY | EnCap Investments; MorningStar Partners | $625,047,200 |

| 3/23/2020 | SHERIDAN HOLDING COMPANY I | Warburg Pincus | $618,485,147 |

| 5/14/2020 | ULTRA PETROLEUM CORP. | Fir Tree Capital Management LP; Disciplined Growth Investors Inc | $5,556,148,072 |

| 5/15/2020 | GAVILAN RESOURCES | Blackstone; Mesquite Energy | $1,120,804,265 |

| 5/22/2020 | UNIT CORPORATION | OPTrust and Partners Group | $4,808,182,228 |

| 5/31/2020 | TEMPLAR ENERGY | Bain Capital; Ares Management; Paulson & Co | $465,700,000 |

| 6/14/2020 | EXTRACTION OIL & GAS | Yorktown Partners; Luminus Management | $2,522,573,161 |

| 6/17/2020 | CHISHOLM OIL AND GAS | Ares Management, Apollo Global Management | $560,003,485 |

| 6/25/2020 | SABLE PERMIAN RESOURCES | Energy and Minerals Group; OnyxPoint Global Management, Pantheon International | $1,434,296,685 |

| 6/28/2020 | CHESAPEAKE ENERGY CORPORATION | Carlyle Group | $11,800,000,000 |

| 6/28/2020 | LILIS ENERGY | Varde Partners | $579,876,334 |

| 7/15/2020 | CALIFORNIA RESOURCES CORPORATION | Ares Management | $6,285,823,505 |

| 7/16/2020 | BRUIN E&P PARTNERS | ArcLight Capital Partners | $1,077,000,000 |

| 7/26/2020 | ROSEHILL RESOURCES | EIG Global Energy Partners | $362,700,000 |

| 7/30/2020 | DENBURY RESOURCES | GoldenTree Asset Management LP; Fidelity | $2,500,000,000 |

| 8/3/2020 | FIELDWOOD ENERGY | Riverstone Energy; Canada Pension Plan Investments; ACE & Company | $1,959,200,000 |

| 8/16/2020 | CHAPARRAL ENERGY | Bayou City Energy | $487,500,000 |

| 9/2/2020 | URSA PICEANCE HOLDINGS | Denham Capital | $303,205,987 |

Source Haynes and Boone, LLP Oil Patch Bankruptcy Monitor, December 31, 2020

[1] Haynes and Boone’s data is reported through December 31, 2020