Private Equity Healthcare Acquisitions – November 2021

December 6, 2021

In light of the growing investor interest in health care and the risks associated with private equity ownership of health care companies, the Private Equity Stakeholder Project will be tracking private equity-backed health care acquisitions. Below is a list of private equity health care buyouts and add-on acquisitions completed or announced during November 2021. We will continue to track acquisitions on a monthly basis.

See October 2021 acquisitions here.

Athenahealth – Hellman & Friedman and Bain Capital

In a $17 billion deal, private equity firms Hellman & Friedman (H&F) and Bain Capital announced they will acquire healthcare software company Athenahealth. It is one of the largest healthcare buyouts of the year.[1]

Athenahealth is owned by private equity firm Veritas Capital and hedge fund Elliott Investment, which took the company private for $5.7 billion in 2018.[2]

This is the second major healthcare buyout for H&F this year, which also participated in the $34 billion buyout of Medline Industries this summer. The Medline buyout is largest deal of its kind since the 2008 financial crisis and includes almost $15 billion in debt.[3]

Athenahealth’s software includes tools for electronic health records (EHR) and medical billing and collections, also known as revenue cycle management (RCM). RCM companies specialize in the collection of medical debt, a service that cash-strapped hospitals pay to outsource.[4] Athenahealth currently partners with more than 140,000 hospitals and ambulatory care providers in every US state.[5]

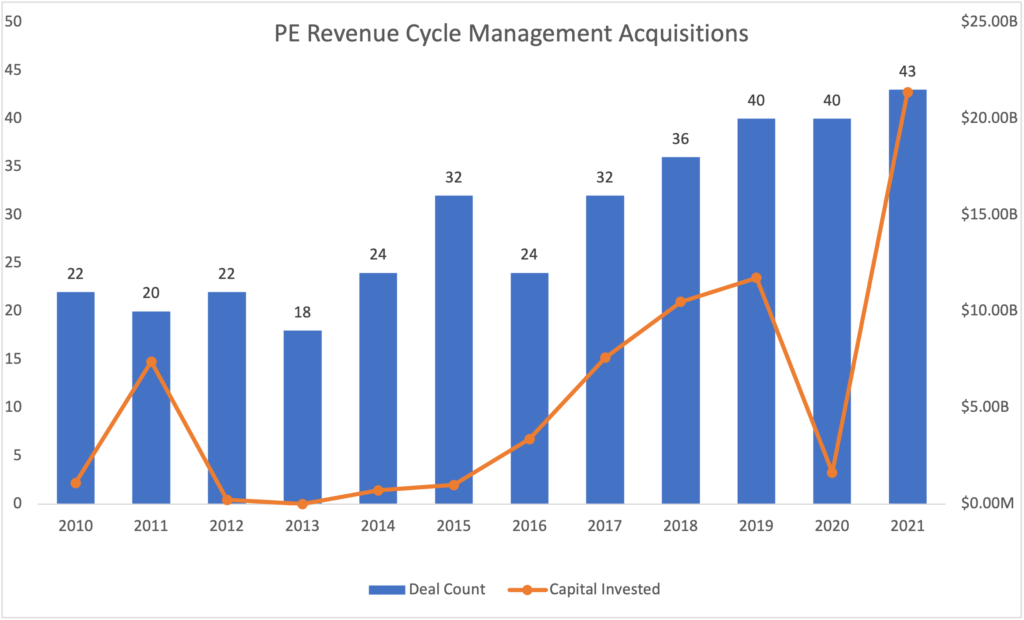

Private equity firms are increasingly investing in RCM companies; in 2021, there were at least 43 private equity acquisitions of companies that do revenue cycle management valued at $21.4 billion. This compares to 2011, when there were 20 deals valued at $7.4 billion.[6]

Source: Pitchbook, Inc.

While abuses pervade the medical debt collection industry, private equity firms’ ownership of RCM companies raises particular concern. Earlier this year, an analysis by PESP of Consumer Financial Protection Bureau (CFPB) data found that private equity-owned RCM companies face high numbers of debt-related consumer complaints, particularly related to attempts to collect a debt that is not owed, either because it had already been paid, was the wrong amount, or targeted the wrong individual.

See: How Private Equity Profits from Aggressive Medical Debt Collection

Innovacare – Bain Capital

Bain Capital will acquire Innovacare, a physician practice management group with 30 medical clinics across Florida.[7]

Bain’s acquisition of the company is part of a wave of private equity investment in management service organizations (MSO), where private-equity-owned MSOs take over the business functions of physicians’ practices. This often includes management, billing, staffing, credentialing, accounting, and other services. Private equity firms typically acquire or create a platform company, which then makes add-on acquisitions of smaller providers with the goal of expanding regionally and beyond. Physician specialty groups, such as dermatology, orthopedics, and anesthesia, in particular have seen substantial private equity investment.[8]

Bain Capital has a checkered history of healthcare company ownership. For example, Bain used to own pediatric home health company Aveanna Healthcare with private equity firm J. H. Whitney. A 2019 investigation by Bloomberg News found that Avenna was cited for numerous safety violations while under Bain and Whitney’s ownership, with at least seven children dying under its care in just one year. Aveanna employees interviewed by Bloomberg said that company pressure to make a profit jeopardized the quality of care. Employee bonuses at Aveanna were overwhelmingly (90%) tied to earnings growth, patient care hours provided and cash collection, while patient satisfaction and clinical outcomes together counted for just 10%.[9]

Bain also owned CRC Group, a behavioral healthcare company that ran addiction treatment and “troubled teen” programs across the US. Under Bain’s ownership CRC and its subsidiary, Aspen Education Group, faced allegations of widespread abuse and neglect at its facilities.

Private Equity Buyouts

| Company | Type | PE Firm |

| Inovalon Holdings | Health tech | 22C Capital, Insight Partners, Nordic Capital |

| Ro Health | Staffing | Achieve Partners |

| Iodine Software | Health tech | Advent International |

| Leinco Technologies | Biopharmaceuticals | Ampersand Capital Partners |

| Avera eCare | Telehealth | Aquiline Capital Partners |

| Cube Biotech | Biopharmaceuticals | ArchiMed |

| M2 Orthopedics | Practice management | Archimedes Health Investors, Heritage Medical Systems, The Firmament Group |

| Alvogen Group | Pharmaceuticals | Aztiq Pharma Partners, Innobic |

| InnovaCare Health | Practice management | Bain Capital |

| Athenahealth | Revenue cycle management | Bain Capital, Government of Singapore Investment Corporation (GIC), Hellman & Friedman |

| VorroHealth | Health tech | Basis Vectors |

| MJH Life Sciences | Healthcare consulting | BDT Capital Partners |

| CIVCO Radiotherapy | Medical devices | Blue Wolf Capital Partners |

| Nevada Behavioral Health Systems | Behavioral health | BPEA Private Equity |

| VorroHealth | Vitamin supplements | Butterfly Equity |

| EMS Management and Consultants | Revenue cycle management | BV Investment Partners |

| Infusion for Health | Infusion therapy | Cimarron Healthcare Capital, Oak HC/FT |

| BioAgilytix Labs | Medical supplies | Cinven |

| Perkins Biomedical Services | Medical devices | Copley Equity Partners |

| Leiters Health | Medical supplies | Frazier Healthcare Partners, H.I.G. Capital, Intermountain Ventures, Kaiser Permanente Ventures, Mayo Clinic, Novant Health, Rex Health Ventures, Spectrum Health Ventures, SV Health Investors, University of North Carolina Health Care System, Welsh, Carson, Anderson & Stowe |

| Pacific Fertility Centers | Fertility services | Gelman Brothers |

| Genesis Research | Pharma consulting | GHO Capital |

| Rectangle Health | Revenue cycle management | GI Partners |

| U.S. Medical Management | Home health and hospice | HLM Venture Partners, Oak HC/FT, Rubicon Founders, Valtruis |

| American Health Staffing | Staffing | Littlejohn & Co. |

| Kaleo | Pharmaceuticals | Marathon Asset Management |

| ImagineSoftware | Revenue cycle management | Marlin Equity Partners |

| Lighthouse Lab Services | Practice management | Martis Capital, NaviMed Capital |

| Calcium | Healthcae marketing | NexPhase Capital |

| U.S. Oral Surgery Management | Oral surgery | Oak Hill Capital |

| Summit Behavioral Healthcare | Behavioral health | Patient Square Capital |

| US Health Partners | Practice management | Silversmith Capital Partners |

| Executive Home Care Franchising | Home care | The Riverside Company |

| BioCareSD | Biopharmaceuticals | Vistria Group |

| Stateserv Medical | Medical devices | WindRose Health Investors |

Private Equity Add-On Acquisitions

| Company | Type | PE Firm | Add-on Platform |

| North Suburban Vision Consultants | Eye care | ACE & Company, Golub Capital BDC, J.P. Morgan), Riata Capital Group, Unusual Ventures | AEG Vision |

| Guidemark Health | Healthcare consulting | Arsenal Capital Partners | Pharma Value Demonstration |

| Archerhealthcare | Healthcare marketing | Audax Group, Odyssey Investment Partners | TrialCard |

| Basic Laboratory | Laboratory services | Aurora Capital Group, The Cambria Group | Pace Analytical Services |

| Medbio | Healthcare supplies | Berwind | Caplugs |

| Abingdon Hearing Care | Hearing care | Beverly Capital, Northstar Capital, Thompson Street Capital Partners | Alpaca Audiology |

| Hughes Family Hearing Aid Center | Hearing care | Beverly Capital, Northstar Capital, Thompson Street Capital Partners | Alpaca Audiology |

| iMedRIS | Health tech | Bratenahl Capital Partners, Primus Capital, Quad Partners | Cayuse |

| Jmi Laboratories | Pharmaceuticals | Bridgepoint Advisers, Temasek Holdings | Element Materials Technology |

| Worcester Physical Therapy Services | Physical therapy | Calera Capital | Bay State Physical Therapy |

| Suburban Otolaryngology | Hearing care | Candescent Partners, Harvey & Company | ENT Partners |

| Digital Artefacts | Health tech | CGI Partners, McKesson Ventures, NovaQuest Capital Management | Clinical Ink |

| Omni IPA Medical Group | Managed care | Chicago Pacific Founders, Leavitt Equity Partners | P3 Health Partners |

| Albany Physical Therapy (United States) | Physical therapy | Churchill Asset Management, Gryphon Investors | Physical Rehabilitation Network |

| HealthCare Support | Staffing | Cornell Capital, Trilantic North America | Ingenovis Health |

| Preventimed | Practice management | Crestline Investors | Genuine Health Group |

| SuitX | Medical devices | EQT | Ottobock |

| Schedule360 | Health tech | Francisco Partners, ICONIQ Capital | QGenda |

| Health Fidelity | Health tech | Francisco Partners, TA Associates Management | Edifecs |

| Frontida Biopharm | Biopharmaceuticals | Frazier Healthcare Partners, Thomas H. Lee Partners | Adare Pharma Solutions |

| ProComp Software | Health tech | GPB Capital | Cantata Health |

| Advanced Physical Therapy And Sports Medicine | Physical therapy | Great Point Partners | Spine & Sport Physical Therapy (San Diego) |

| USOC Medical | Healthcare devices | Insight Equity | CSAT Solutions |

| Colorado Springs Urological Associates | Urology | Lee Equity Partners | Solaris Health |

| Michigan Institute of Urology | Urology | Lee Equity Partners | Solaris Health |

| Healthcare Real Estate Capital | Healthcare consulting | Madison Dearborn Partners | Kaufman, Hall and Associates |

| Dr. Profet Health & Wellness Center | Pimary care | MBF Healthcare Partners | Palm Medical Centers |

| Fields Healthcare Research | Patient data collection | Mubadala Investment Company, Thoma Bravo | Medallia |

| Cincinnati Eye Institute | Eye care | Partners Group | Eyecare Partners |

| The Eye Institute of West Florida | Eye care | Partners Group | |

| Silver Linings Hospice Care | Hospice | Pharos Capital Group | Charter Health Care Group |

| CareSignal | Healthcare devices | Primus Capital | Lightbeam Health Solutions |

| Change & Innovation Agency | Health tech | Realization Capital Partners | GetInsured |

| Envigorate Healthcare Solutions | Healthcare cost management | Renovus Capital Partners | Futura Mobility |

| Arcadia Hospice of SEPA | Hospice | Revelstoke Capital Partners | The Care Team |

| Rural Solutions | Practice management | Revelstoke Capital Partners, WP Global Partners | Fast Pace Health Urgent Care |

| Adelson Eye & Laser Center | Eye care | Ridgemont Equity Partners | Sunvera Group |

| Endoscopy Development Company | Medical devices | RoundTable Healthcare Partners | American Optics |

| Mountain Empire Eye Physicians | Eye care | Sheridan Capital Partners | Atlantic Vision Partners |

| Center for Allergy & Asthma Care | ENT serrvices | Shore Capital Partners | Southern Ear, Nose, Throat and Allergy Partners |

| Scott & Christie Eyecare Associates | Eye care | Shore Capital Partners | EyeSouth Partners |

| Lacrimedics | Medical devices | Shore Capital Partners | Innovia Medical |

| Appco Pharma | Pharmaceuticals | The Carlyle Group | Viyash Pharmaceuticals |

| Medical Machining Specialsts | Medical devices | The Jordan Company | Arch Global Precision |

| MUSE Microscopy | Medical devices | Visionary Private Equity Group | Predictive Health Diagnostics |

| Retina Associates of Utah | Eye care | Webster Equity Partners | Retina Consultants of America |

| Interim HealthCare (Treasure Coast Franchise) | Home health and hospice | Wellspring Capital Management | Interim HealthCare |

| The Columbus Organization | Laboratory services | Welsh, Carson, Anderson & Stowe | CareSource Management Services |

(Image from https://selectinsuregroup.com/health-insurance/)

[1]https://www.nytimes.com/2021/11/22/business/athenahealth-hellman-friedman-bain-capital.html

[2]https://www.cnbc.com/2021/11/20/bain-capital-hellman-are-reportedly-near-an-athenahealth-buyout-deal.html

[3]https://www.ft.com/content/5c1e4817-0a42-4de5-a281-baad2149a40f

[4]https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3593887 pg. 78.

[5]https://www.healthcareitnews.com/news/athenahealth-bought-private-equity-firms-hellman-friedman-bain-capital

[6] Pitchbook, accessed December 2, 2021.

[7]https://innovacarehealth.com/about/

[8]https://www.modernhealthcare.com/physicians/specialty-physician-groups-attracting-private-equity-investment

[9]https://www.bloomberg.com/news/features/2019-10-22/death-and-deals-sick-children-suffer-private-equity-profits