Private equity lags stocks for retail investors

January 27, 2026

Private equity funds for retail investors dramatically underperformed stocks in 2025 despite charging much higher fees

Private equity seeking DOL safe harbor against 401K lawsuits over fees, performance

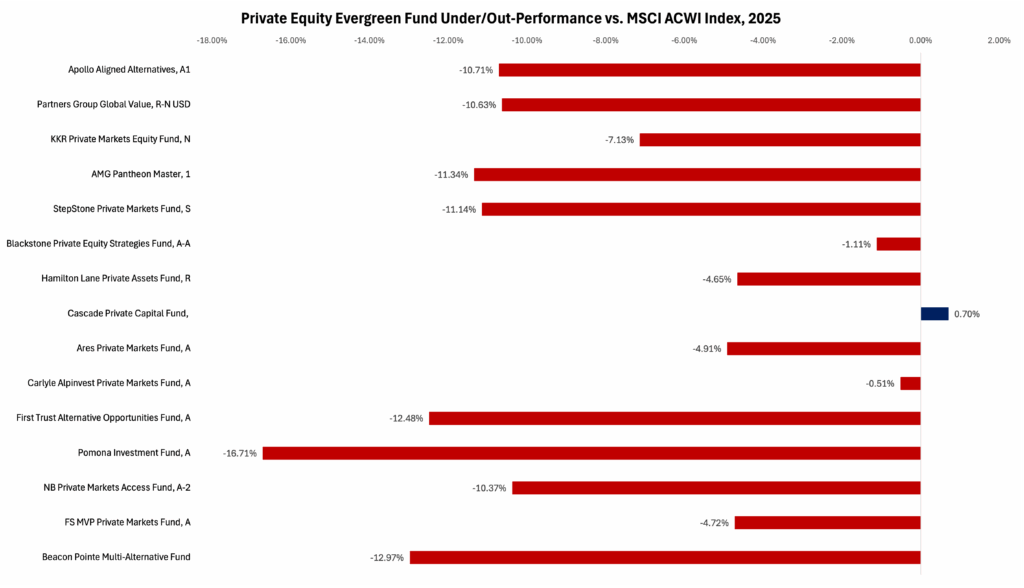

As the private equity industry is asking the Trump Administration to provide it access to Americans’ 401K retirement savings and a regulatory safe harbor against 401K lawsuits by retirement savers, a review of the top private equity evergreen funds – the vehicles aimed at retail investors including those saving for retirement – shows that the largest private equity-focused evergreen funds dramatically underperformed publicly-listed stock indexes last year (2025) despite charging much higher fees than public equity (stock) index funds.

The fifteen large private equity-focused evergreen funds (see below table), including some managed by private equity giants Apollo,Blackstone, KKR, Carlyle Group, and Ares Management, generated a median return of 11.20% last year, about half the 22.34% return generated by the MSCI ACWI Index, and significantly less than the S&P 500 Index, which returned 17.43% in 2025.

*Private equity evergreen fund returns were compared to 2025 MSCI ACWI index net return of 22.34%, except for funds where return data was only available through November 2025, which were compared to the MSCI ACWI index LTM net return as of 11/30/2025 of 18.21%.

Private equity evergreen funds’ underperformance was not just limited to 2025. The private equity evergreen funds generated a median annualized return of 11.24% over the last three years (2023-2025), just half the return of the S&P 500 index (22.48%) and slightly more than half the return of the MSCI ACWI index (20.65%) over the same period.

Private equity’s underperformance compared to stocks is not limited to evergreen funds. State Street’s private equity index delivered a 7.08% return in 2024, compared with a 25.02% total return for the S&P 500 index. As of the end of 2024, S&P 500 index outperformed private equity on a one, three, five and 10-year basis.[1]

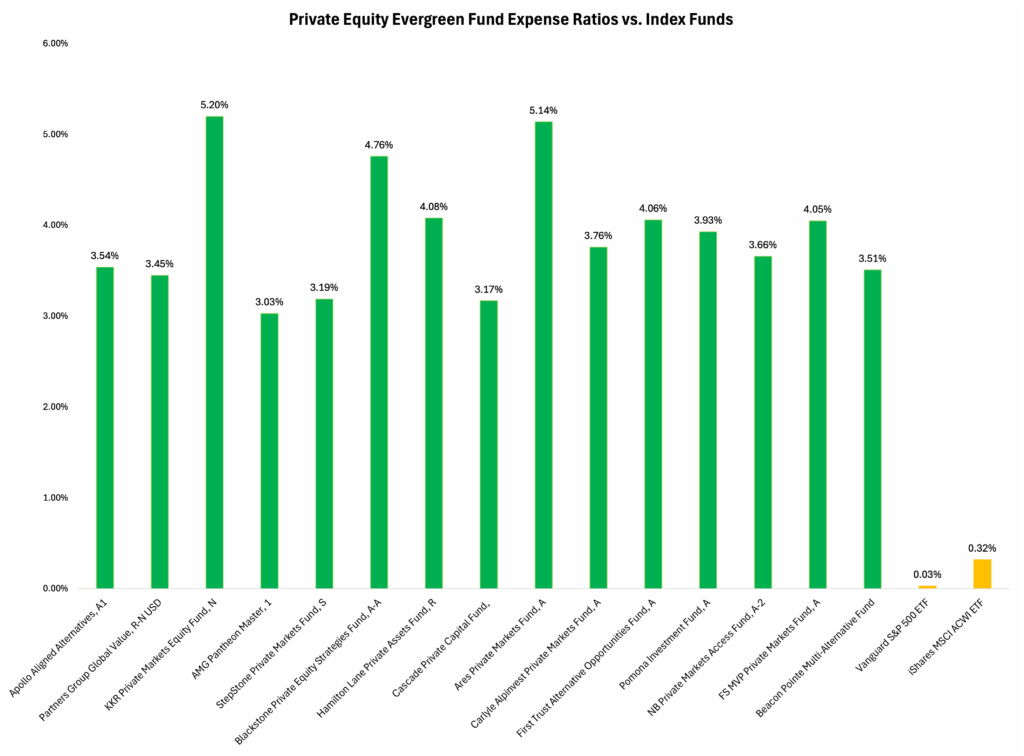

Despite underperformance, private equity evergreen funds charge extremely high fees

While significantly underperforming public equity indexes, these private equity evergreen funds also charge investors extremely high fees. The median expense ratio for the fifteen private equity evergreen funds reviewed is 3.76%, not including sales charges. By comparison, the Vanguard S&P 500 ETF, which tracks the S&P 500 index and outperformed nearly all the evergreen private equity funds reviewed, charges a total expense ratio of 0.03%, less than 1% of the median expense ratio charged by the private equity evergreen funds.

For example, the Pomona Investment Fund (class A), which provides retail investor access to private equity, generated a net return of just 5.63% in 2025, yet charges investors an expense ratio of 3.93%. Private equity giant Apollo’s $25 billion Apollo Aligned Alternatives fund (class A1) generated a 7.5% return last year, yet estimates total costs to investors of 3.54% per year.

Despite poor returns in recent years, combined with high fees and illiquidity that some expertsconsider unsuitable for 401Ks,[2] the private equity industry is pushing for the US Department of Labor (DOL) to give the industry a legal safe harbor that would limit the ability of consumers to sue if private equity managers or 401K managers or providers make recommendations that are contrary to their fiduciary duty to retirement savers.[3] Following the August 7 Executive Order, the DOL quickly rescinded prior guidance that cautioned against offering private equity to 401K retirement savers.[4]

In addition to charging expense ratios ranging from 3.19% to 5.2%, some of these funds also allow sales charges as high as an additional 5% to compensate brokers responsible for selling the investments in the funds. These sales charges can substantially reduce the returns that retail investors receive. For example, Ares Management’s Ares Private Markets Fund (class A) generated a 13.3% net return last year after taking out the fund’s 5.14% expense ratio. Yet with the sales charge of up to 3.5% included, the 2025 net return for Ares Private Markets Fund (class A) drops to 9.33%.[5]

Private equity chases retirement savers as institutional investors exit

Private equity firms are focusing on investments by 401K retirement savers and other retail investors not because private equity is a better investment, but because private equity is struggling to fundraise from its traditional base of institutional investors.

Global private equity fundraising fell 11.0% in 2025,[6] making last year the fourth year in a row that private equity fundraising has declined.[7] Based on data from S&P, global private equity fundraising fell to its lowest level in a decade last year.[8]

The Financial Times reported last March that “Private equity assets under management fell last year for the first time in decades as investors confronting a $3tn backlog of ageing and unsold deals pulled back from committing new funds to the sector.”

Private equity industry publication Private Equity International (PEI) reported recently that one quarter of institutional investors in private equity reduced their allocations last year, with public pension funds the most active in reducing their exposure. Nearly one-third of public pension funds reduced their exposure to private equity last year, PEI reported.[9]

Among the public asset owners that have stepped back from private equity are state retirement systems in Ohio, Maine, Nevada, Washington, Oregon, Texas and Alaska, while the state’s sovereign wealth fund, the Alaska Permanent Fund, is preparing to scale down.

The $85 billion Alaska Permanent Fund’s (APFC) current allocation to private equity is 18%, but staff have recommended a reduction to 15% for the board to review in early 2026, with investment staff suggesting private equity’s “golden era” is in the rearview mirror.

On average, US public pensions allocate 14% to private equity, reflecting the shift toward alternatives over the past 15 years – which are higher risk, high fee and illiquid. But private equity’s rapid growth paired with deteriorating economics have led to a logjam of zombie companies and mountains of undeployed capital, called dry powder, leading the AFPC staff to quip, “there is no investment idea so good that it cannot be ruined by too much capital.”

Staff for AFPC presented the board with declining return expectations for private equity in October, noting a performance peak in 2021 with 5-year annualized returns dropping and expected to “trend even lower towards around 6%” in 2026, per analysis from Callan and Cambridge Associates.

“If the expected future returns are not adequately higher for private equity, the rationale for taking on higher risks (illiquid, levered, idiosyncratic, high fees) may have eroded,” AFPC staff’s presentation said.

| Recent Private Equity Allocation Cuts | |||

| Asset Owner | AUM (billions) | PE Reduction | Revised PE Allocation Target |

| Alaska Permanent Fund* | $85 | -3% | 15% |

| Maine Public Employees Retirement System | $21 | -2.5% | 10% |

| Washington State Investment Board | $230 | -2% | 23% |

| Alaska Retirement Management Board | $36 | -2% | 12% |

| Texas Teachers Retirement System | $225 | -2% | 12% |

| Ohio Public Employees Retirement System | $110 | -1% | 14% |

| Nevada Public Employees Retirement System | $70 | -1% | 5% |

| US Public Pension Average | 14% | ||

| *proposed | |||

Oregon’s $100 billion state pension has been paring down its private equity portfolio. Consultant Meketa has noted private equity is dragging down the OPERF’s overall fund returns, noting that the “Private Equity (-1.5%) overweight and underperformance was the largest detractor from third quarter (2025) benchmark relative returns.” Treasurer Elizabeth Steiner has announced she is working with investment staff to continue paring down to reach the current 20 percent target, and indicated she’s open to adjusting the target further.

The $110 billion Ohio Public Employees Retirement System voted in November to trim private equity by 1 point to a 14 percent target, “expressing concerns over lack of opportunities in the asset class, along with liquidity risk,” per Buyouts. There are “significantly fewer opportunities for finding value in the private equity market,” according to Meketa per Buyouts.

The $70 billion Nevada Public Employees Retirement System reduced its target private equity allocation by 1 point to 5 percent, Private Equity International reported in September. NVPRS already has a much lower allocation to private markets allocation target at 15 percent, half the average size for public pensions.

Alaska’s $36 billion Retirement Management Board also approved a cut to its private equity allocation to 12 percent from 14 percent at its December meeting, citing “lower than expected” distributions and a need for liquidity, Buyouts reported.

Maine PERS, with $21 billion AUM, voted to adopt a staff recommendation for a 2.5 percent reduction at the November board meeting which cut private equity to a 10 percent allocation, following a 2022 reduction from 15 percent.

Texas Teachers Retirement System, currently with $225 billion in assets, was one of the early funds to make a significant reduction in its private equity target, dropping it by 2 points to 12 percent in 2024 in light of the asset class’s “dwindling returns,” Bloomberg reported.

Resources

[1] “Private market funds lag US stocks over short and long term,” Financial Times, June 10, 2025.

[2] “401(k)s Not the Place for Private Equity, Says Johns Hopkins Study,” PlanAdviser, Mar 20, 2025. “Private Equity Does Not Belong in 401(k) Plans,” Center for Retirement Research at Boston College, July 20, 2021.

[3] “Private Equity Firms Celebrate Trump’s Executive Order Giving Them The Keys To Retirement,” Forbes, Aug 8, 2025.

[4] “DOL Rescinds Guidance Cautioning Against Private Equity in 401(k)s,” Plan Sponsor Council of America, Aug 12, 2025.

[5] Ares Private Markets Fund Performance, https://www.areswms.com/solutions/apmf/performance, accessed Jan 24, 2026.

[6] “Private equity fundraising totals continue to decline in 2025,” S&P, Jan 9, 2026.

[7]“Global private equity fundraising sinks for 3rd straight year,” S&P, Jan 16, 2025.

[8] Based on $490.81 billion fundraising total for 2024, greater than $500 billion fundraising totals for 2015-2024. “Private equity fundraising totals continue to decline in 2025,” S&P, Jan 9, 2026. “Global private equity fundraising sinks for 3rd straight year,” S&P, Jan 16, 2025.

[9] “A quarter of institutional LPs cut PE allocations in 2025,” Private Equity International, Jan 19, 2026.