Ohio Capital Journal : Watchdog raises alarm about politically connected Ohio coal plant

August 26, 2024

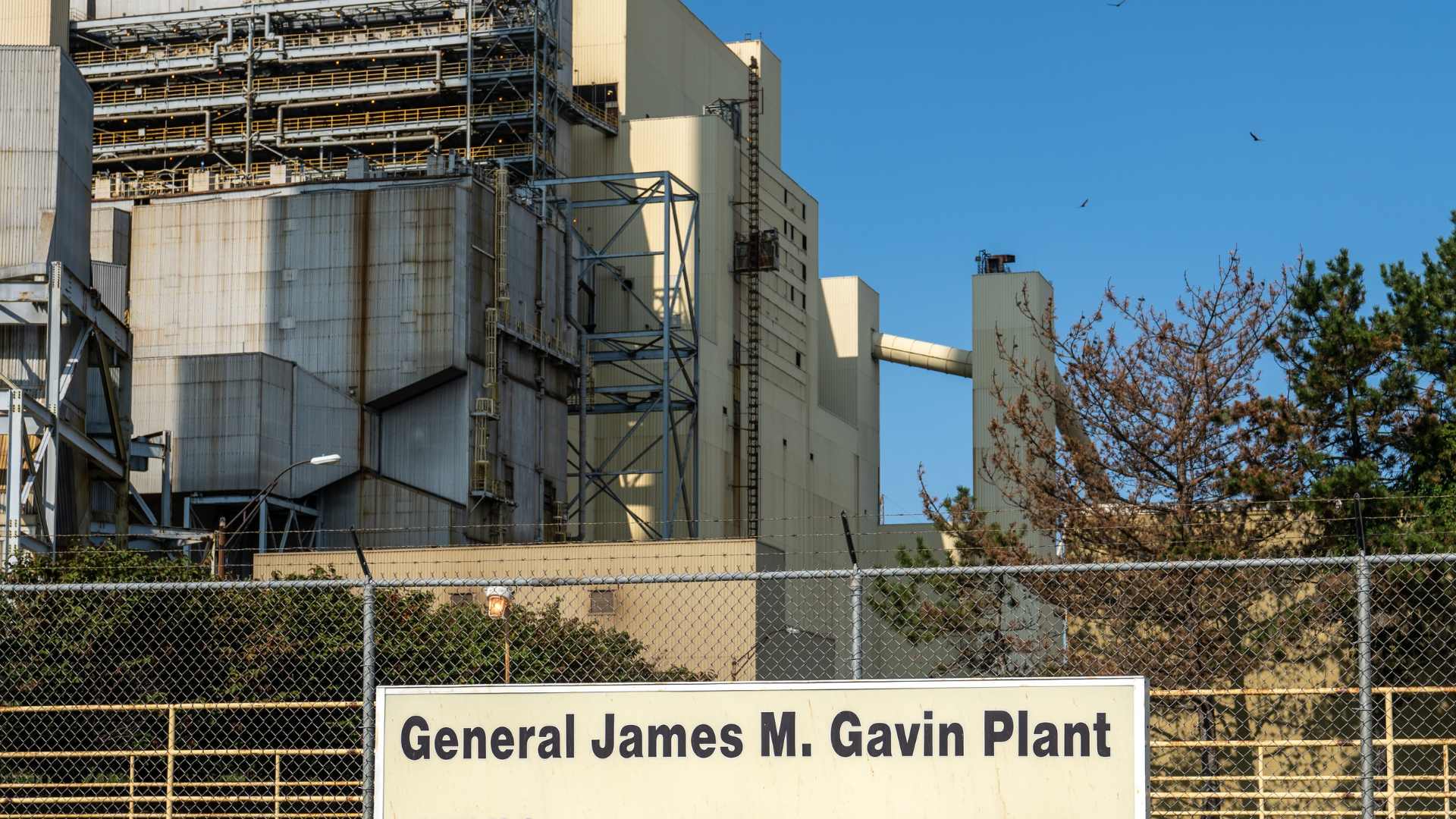

The Gavin coal plant along the Ohio River, owned by the politically-connected private equity firm Blackstone, is losing money and poses significant environmental liabilities. The plant, owned by Blackstone and ArcLight Capital Partners, is considered the deadliest coal plant in the U.S. due to the large amount of soot it releases, causing an estimated 244 premature deaths annually. The plant also faces issues with coal ash management, requiring over $40 million to comply with environmental regulations.

Ohio Capital Journal August 23, 2024: Watchdog raises alarm about politically connected Ohio coal plant

Critics are concerned that the plant’s private equity owners, who have close ties to political figures like Donald Trump and J.D. Vance, might evade responsibility for cleanup costs. This situation echoes previous instances where Ohio taxpayers were left subsidizing unprofitable, polluting plants due to political reasons.

Despite claims from Blackstone that they have invested heavily in making the plant environmentally friendly, there is skepticism over whether they will address the full extent of the environmental hazards, especially as market trends make coal increasingly uncompetitive.

Private Equity Stakeholder Project research was highlighted in the OCJ story. As Gavin continues to age, investors are increasingly exposed to numerous financial risks including regulated environmental cleanup, changing market conditions, high debt burden, and fund underperformance. Gavin exemplifies the broader trends of the declining coal industry in the U.S. and PESP argues it should be decommissioned before financial risks materialize. PESP also recommends that pension funds should evaluate their current risk exposure to the plant and ask Blackstone about their plans to retire Gavin.

“There’s a private-equity playbook here, with the firm putting a relatively small amount of capital into these projects, making sure they get theirs, and not really worrying about the repercussions of these assets and what they will cost in public dollars at the end of the life of the plant,” PESP researcher Nichole Heil told the OCJ. “We’ve seen private equity walk away either through a sale or a bankruptcy and not be liable for the environmental cleanup.”