Blackstone must retire the nation’s deadliest coal plant

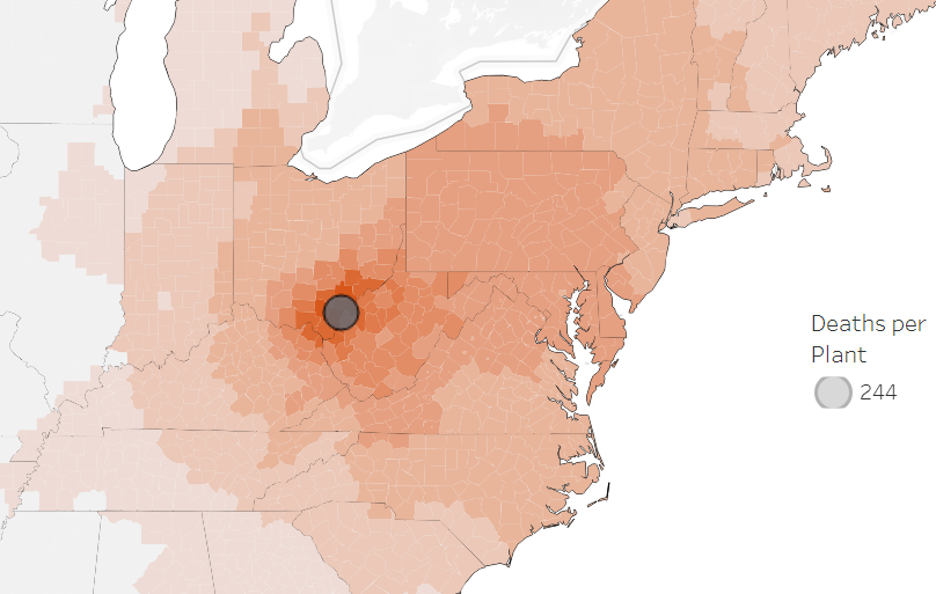

The world’s largest private equity firm owns one of the US’s largest and dirtiest coal plants, General J Gavin Coal Plant in Ohio. Since Blackstone acquired Gavin in 2016 from the utility AEP, it has spewed over 106 million metric tons of CO2 into the atmosphere.[1] The plume of toxins emitted by the plant have major public health impacts because it is upwind of major metropolitan areas across the eastern seaboard. Sierra Club modeling found Gavin to be the nation’s deadliest coal plant, causing an estimated 244 premature deaths each year from particulate emissions.

Figure: Blackstone’s Gavin Plant mortality data

Coal demand is declining. Why doesn’t Blackstone have a plan for closure?

The private equity owned General J Gavin Coal Plant in Ohio is an outlier among other similar coal plants slated for closure. The Gavin Coal plant turns 50 this year, and now operates on borrowed time. The average age for retirement of coal-fired generating units has been 50 years since 2000. Experts broadly agree that as coal-fired power plants age, operation and maintenance expenses increase while performance decreases. Blackstone has yet to announce a planned closure for this plant. With the passage of the Inflation Reduction Act, Blackstone has the opportunity to do right by its employees, and local communities through planned closures that facilitate a just transition.

In fact, Blackstone is retiring other coal plants in its portfolio. In 2022, Blackstone acquired a 20% stake in NIPSCO. Announcing the deal, NIPSCO said it “has been executing on one of the fastest transitions from coal-fired electricity in the U.S. utilities sector, targeting 0% coal-fired generation mix by 2028.”

In an earnings call, Blackstone executive Jon Gray mentioned “a couple of billion dollars we invested to help them facilitate the energy transition.” Yet, Blackstone has not made a similar announcement for retiring Gavin.

Coal market decline

Demand for coal powered electricity is falling. Analysts at IEEFA found that coal did not reach more than 20 percent of market share in 2023. The amount of coal used each day fell precipitously; in 2008 the US used 2.8 million tons a day and in 2023 the US used 1.1 million tons– a 62 percent drop in coal usage. By 2026, the United States is on track to close half of its coal generation capacity, which peaked in 2011. Much of the decrease in coal usage is tied to low gas prices and increases in utility-scale solar generation. In response to decreased demand for coal, coal plant owners have decreased their output. Power generation at both utility and privately owned plants has fallen every month in 2023 compared to the same months in 2022. Not only that, S&P Global Market Intelligence predicts that the Inflation Reduction Act will accelerate coal plant closure.

Unplanned closures devastate local economies

Private equity owners are largely shielded from public pressure and regulatory oversight, creating conditions in which they aren’t accountable for the impacts of their decisions on communities. This played out at the Homer City Power Plant in Pennsylvania, which was established in 1969. After more than a decade of uncertainty in which the plant faced two bankruptcies and management warned that two of its three units may close, the owners gave only a 90 day notice of plant closure in April of 2023.

The private equity owners of the Homer City Power Plant miscalculated coal demand. From 2010-2016 the capacity factor at the plant averaged 56.9 percent but by 2022, the capacity factor averaged 19.7 percent. When asked about the plant closure, the Homer City Generation CEO Michael Wexler stated, “the low price of natural gas, a dramatic spike in the cost of its ongoing coal supply, unseasonably warm winters and increasingly stringent environmental regulations” were key factors in the plant closure. This miscalculation by the private equity owners resulted in 129 employees of the Homer City Power Plant being laid off with only 90 days notice. In response to this closure local labor leaders raised concerns about the economic impact of this closure on the families of previous employees, the local tax base and revenue for schools.

Planning for closure: Current opportunities for private equity

Much like the Homer City Power Plant, the Gavin Coal Plant is aging, facing decreasing demand for coal and increased regulatory pressure. For example, in November 2022, the US EPA issued a final decision denying Gavin’s request to extend the deadline for complying with regulations for coal ash storage. While the owners of the Gavin Coal Plant have sued the EPA challenging this decision, according to research conducted by EarthJustice there are approximately 59,300,000 cubic yards of coal ash and water at the Gavin Coal Plant coal ash ponds.

There are billions of dollars available through the Inflation Reduction Act that help facilitate the closure of dirty fossil fuel assets such as the Gavin Coal Plant. Accessing these loans require owners to retire dirty infrastructure, reuse their facility for clean energy projects, and create a community benefits plan for local residents and disadvantaged communities. However, this funding is on a first-come-first-serve basis and will run out by 2026.

Decreased coal demand constitutes a potential financial risk for investors in aging plants. This risk can be managed through planned retirements that utilize federal programs like IRA funding in order to support transitioning assets from brown to green. Limited Partners must urge Blackstone to commit to an orderly retirement for the Gavin coal plant that transitions away from fossil fuels and reduces adverse economic impacts on local communities.

More on Blackstone’s energy portfolio

Source: Private Equity Energy Tracker

Key research on Blackstone’s energy portfolio

- Private Equity Climate Risks Scorecard

- Private Equity Profits from Disaster

- Private Equity’s Dirty Dozen

- Private Equity Propels the Climate Crisis

[1] Per EPA data from 2016-2023 Gavin has emitted 116,899,257 short tons of CO2, or 106,051,006 metric tons, https://campd.epa.gov/data/custom-data-download