OilPrice.com : Private Equity To Revive Asian M&A With A Focus On Oil And Gas

June 30, 2023

According to a new OilPrice.com story, mergers and acquisitions (M&A) in Asia have experienced a significant decline this year, with total M&A value dropping by 41% year on year to $362 billion, the lowest level since 2013. Geopolitical uncertainties have caused Chinese outbound investment to shift away from North America, Western Europe, and Australia, redirecting their focus towards Southeast Asia and other emerging markets.

OilPrice.com June 21, 2023: Private Equity To Revive Asian M&A With A Focus On Oil And Gas

This shift, along with the overall turmoil, has also affected investments into China, resulting in a 35% year-on-year drop in deals involving Chinese companies, reaching $125.4 billion. On the other hand, private equity transactions are likely to give a significant boost to Asian mergers and acquisitions.

Private equity-backed deals in Asia reached $53 billion in the first half of the year, marking a 37% decline compared to the previous year. However, it is expected that private equity activity will gradually increase in the coming months, as Asian private equity firms currently hold a record-high of $417 billion in dry powder, indicating potential future investment.

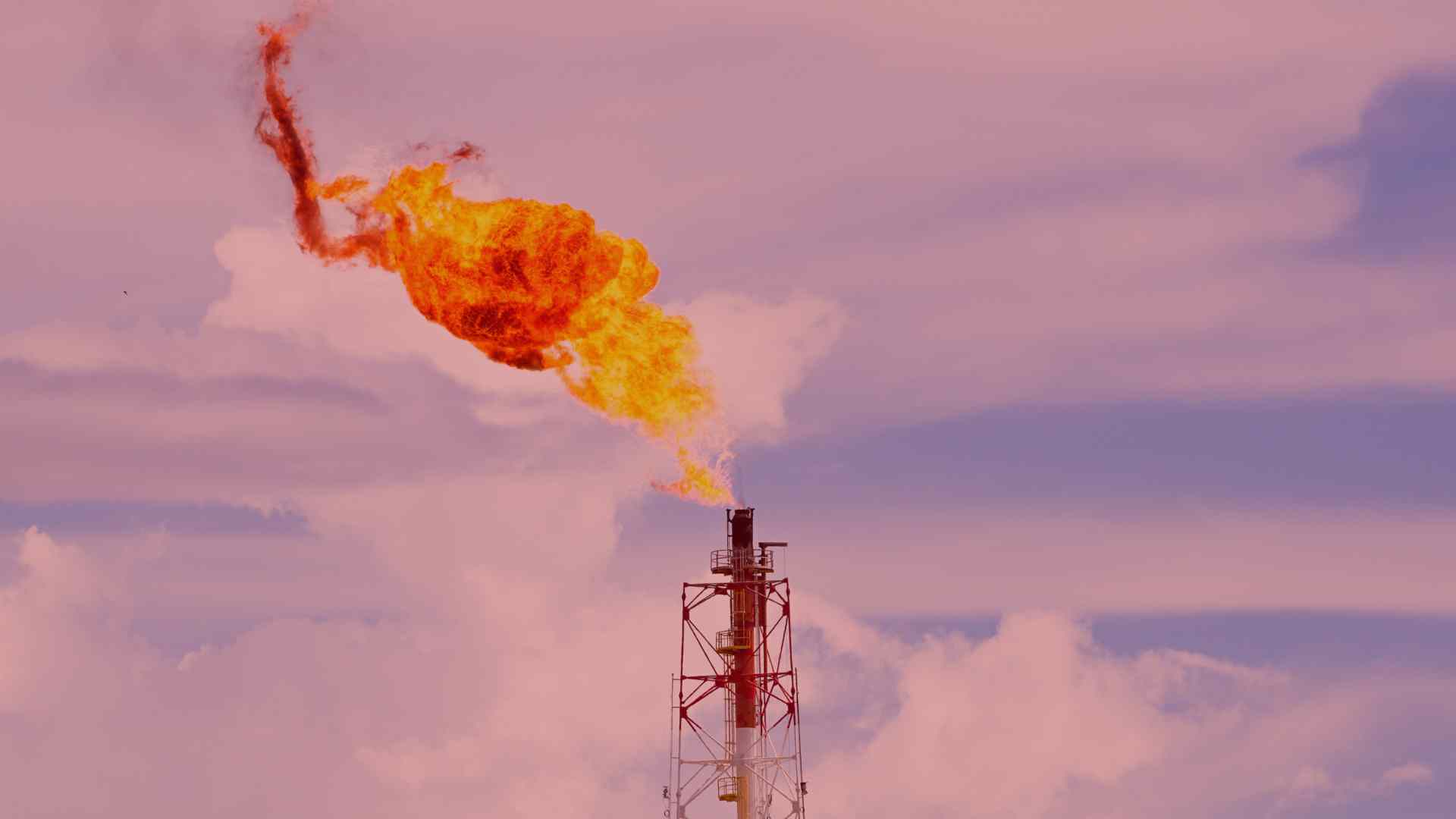

As traditional banks reduce their financing to fossil fuels, private equity is becoming a prominent source of funding in the oil and gas markets. OilPrice pointed to the Private Equity Climate Risks Scorecard which showed that the eight largest buyout firms have put nearly as much money into coal, oil, and gas as world’s largest banks.

These eight PE firms—Apollo Global Management, Blackstone Group, Brookfield Asset Management, Carlyle Group, KKR, and Warburg Pincus—oversee $216 billion worth of fossil-fuel assets, which is similar to the amount of money that big banks put into fossil fuels last year in 2021. Additionally, the largest private equity funds have 80% of their energy investments in fossil fuels.

One of the worst PE firms on climate was The Carlyle Group, who received an F grade on the scorecard. Carlyle has $373 billion in assets under management, and has been quietly scooping up fossil fuel assets over the past decade, in contravention of its stated climate goals. Its billions of dollars of investment in fossil fuel assets produced an estimated 277 million metric tons of CO2 emissions over just ten years, as much as the “carbon bomb” that Alaska’s Willow arctic drilling project is set to emit in its entire lifetime.

“These polluting assets are shifting from the public markets, where there is greater amount of regulatory and public scrutiny, into the shadows of our financial industry, where private equity usually operates,” said Riddhi Mehta-Neugebauer, Climate Research Director at PESP.