Biden’s LNG pause may not lessen financial risk of Rio Grande LNG terminal

April 11, 2024

Uncertainty around global demand for liquified natural gas (LNG), otherwise known as methane gas, and overinvestment in export infrastructure should raise questions about massive proposed projects like Global Infrastructure Partners’ (GIP) Rio Grande LNG Terminal.

There is increased uncertainty for proposed LNG terminals, and analysts predict there will be a glut of LNG and a risk of stranded assets for investors, even though the Rio Grande LNG terminal is not directly affected by the recent pause in approvals of LNG terminal applications. In January 2024, President Biden announced a pause on the approval of new Department of Energy (DOE) export permits for Liquified Natural Gas (LNG) terminals to evaluate the public interest impacts.

Pension funds and other institutional investors are exposed to the Rio Grande LNG terminal project through their investments in GIP Fund V. GIP has at least a 46 percent stake in the Rio Grande LNG terminal via a $3.5 Billion investment. GIP’s investment in the project came on the heels of a series of setbacks for Rio Grande LNG.

Future LNG demand Is not guaranteed

The intergovernmental International Energy Agency found LNG trade demand declines after 2030 in two of its three models, indicating uncertainty in investors’ ability to recoup investments in LNG. IEA found that “the sharp decrease in natural gas demand globally means that the majority of projects currently under construction are no longer necessary” (page 46).

After 2030, demand grows moderately under the conservative STEPS model but falls in the APS and NZE scenarios. With decreases in demand after 2030 in the APS and NZE scenarios, capacity utilization of terminals currently under construction also falls.

| IEA Policy Scenario | Description | 2030 LNG Demand |

| STEPS | Stated Policy Scenario (STEPS) provides an outlook based on current policies. | Demand peaks before 2030 and there is relatively stable demand between 2030 and 2050. |

| APS | The Announced Pledges Scenario (APS) provides an outlook based on countries achieving any announced Net Zero or Carbon Neutral pledges either by 2030 or longer term. | 2030 gas demand is 10% lower than 2022 gas demand. |

| NZE | The Net Zero Emissions by 2050 (NZE) Scenario is based on the global energy sector reaching net zero emissions by 2050. | 2030 gas demand is 20% lower than 2022 levels. |

The IEA reports that there may be an oversupply of LNG as demand declines and countries turn to renewable energy sources. European LNG demand is predicted to decline, and current LNG export capacity is enough to meet future demand.

Increased investments in renewable energy among developing nations in Asia further call into question assertions of long-term LNG demand. The IEA wrote (pg. 30), “Increasingly cost-competitive low-emissions options for power generation and heating – alongside increased climate ambitions among many emerging markets and developing economies in Asia – raise major questions about the long-term outlook for natural gas demand.”

Additionally, the US’s largest LNG customers, Japan and South Korea, indicate that they will dramatically reduce demand. IEEFA predicts Japan could cut LNG demand by one-third by 2030 and South Korea’s LNG demand could fall by 20 percent by 2036, calling into question the necessity of projects that are slated to come online during or after this demand decrease.

Southeast Asian and Chinese demand for LNG is also not guaranteed. In South and Southeast Asia, financing for LNG infrastructure has yet to materialize and these projects take a notoriously long time to complete. For example, Vietnam completed its first LNG terminal in 2023, but the country’s first LNG power-plant has yet to secure off-take agreements and may be delayed until 2027. China’s policies seek to limit dependence on foreign gas, and the country’s most recent 5-year plan names coal as its source of energy stability and security, not LNG.

LNG prices and risk of stranded assets

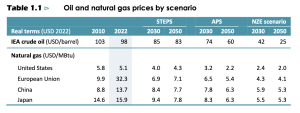

According to the IEA, in every scenario natural gas prices fall by 2030 compared to 2022 prices.

| STEPS | APS | NZE Scenario | |||||||

Real Terms (USD 2022) | 2010 | 2022 | 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | |

IEA Crude Oil (USD/barrel) | 103 | 98 | 85 | 83 | 74 | 60 | 42 | 25 | |

Natural Gas (USD/MBtu) | |||||||||

| United States | 5.8 | 5.1 | 4 | 4.3 | 3.2 | 2.2 | 2.4 | 2 | |

| European Union | 9.9 | 32.3 | 6.9 | 7.1 | 6.5 | 5.4 | 4.3 | 4.1 | |

| China | 8.8 | 13.7 | 8.4 | 7.7 | 7.8 | 6.3 | 5.9 | 5.3 | |

| Japan | 14.6 | 15.9 | 9.4 | 7.8 | 8.3 | 6.3 | 5.5 | 5.3 | |

(Table from IEA Report “The Oil and Gas Industries in Net Zero Transitions” Page 33)

Investors would struggle to recoup investments if governments reach their stated emissions reduction goals or pass additional emissions reduction policies. Under the NZE scenario, “sponsors of around 70% of LNG export projects currently under construction would struggle to recover their invested capital.” In the APS scenario, “40% of what is currently under construction – that would not fully recover their invested capital” (p 47).

In fact there is a greater risk of over-investment in LNG than underinvestment. The IEA reports:

“The fears espoused by some large resource holders and certain oil and gas companies that the world is underinvesting in oil and gas supply are no longer based on the latest technology and market trends. Indeed, the amount of investment expected in 2023 is significantly higher than what is needed in the APS and almost double NZE Scenario levels in 2030. This implies that the oil and gas industry does not expect there to be any significant near-term reduction in demand and, when it comes to the overall adequacy of current spending trends, the risks are currently weighted more towards overinvestment in oil and gas than the opposite” (p 67).

Rio Grande LNG off-take agreement risks

The financial viability of LNG terminals is, in part, based on securing off-take agreements. An off-take agreement is made with a company or end-user who makes a commitment to buy LNG from the terminal for a set period of time. Rio Grande LNG has off-take agreements for phase I of the project, but for a majority of those agreements there is no end-user. Eight out of nine off-take agreements are Free-On-Board (FOB) contracts, meaning that the buyer arranges shipping and the end-user of the LNG is not defined.

The ability of these traders to find end-users is dependent on the price and demand of LNG. Yet, price decreases in all policy scenarios by 2030 and demand decreases in two out of three scenarios.[1] Additionally, the Rio Grande LNG terminal wouldn’t be completed until 2027, leaving only three years before demand plateaus or decreases under two of the three IEA scenarios.

GIP must limit risk for investors

In addition to the social, ecological and environmental risks associated with the Rio Grande LNG Terminal project, there are still financial risks. Global LNG prices and demand may decrease leaving investors on the hook for stranded assets and the environmental damage caused by investments in fossil fuel infrastructure.

Limited partner investors in Rio Grande LNG and other LNG infrastructure should take steps to investigate their financial risk and comply with community demands while aligning investments with the Paris Agreement 1.5 degree warming goals.

Table 3: Sources on Delivery Type of Rio Grande LNG Off-Take Agreements

[1] According to the IEA, price decreases in all policy scenarios due to two possible factors: decreased demand and increased supply, “For example, moves on the part of producer economies with the lowest production costs to gain market share even as demand declines would likely lead to lower prices, at least for an initial period (see Section 1.6). Lower prices could also occur in the case of overinvestment in oil and gas supply. In this case, projects would face even larger commercial risks, producer economies would face further headwinds, and it would risk pushing the 1.5 °C goal out of reach.” p. 33 of The Oil and Gas Industries in Net Zero Transitions