BlackRock-GIP merger and ALLETE deal raise concerns from MN AG

BlackRock proposed merger with Global Infrastructure Partners and pending ALLETE acquisition prompts concerns from Minnesota attorney general and advocates

August 27, 2024

BlackRock, the world’s largest asset manager, with $10 trillion in assets under management, announced its plans to acquire private equity firm Global Infrastructure Partners (GIP) in January of this year. The $12.5 billion deal would be BlackRock’s largest acquisition in 15 years.

This deal would add over $100 billion of infrastructure assets to Blackrock’s private markets portfolio, more than doubling its existing portfolio. BlackRock’s CEO, Larry Fink, made clear that the GIP acquisition is designed to grow his company’s private infrastructure business substantially: “We are in the early part of this infrastructure revolution. We wanted to have the scale, we wanted to have the operational expertise of GIP marrying that expertise with BlackRock’s global relationships with companies and governments . . . This will be one of the fastest-growing areas of our industry over the next 10 years.” This acquisition fundamentally transforms BlackRock from the world’s largest passive investor into an entity with active control over significant power market assets, threatening competition, rates and regulation. GIP’s proposed acquisition of midwestern utility ALLETE is an example of just that.

Acquisition of ALLETE sparks questions from Attorney General, complicating merger

On May 6th, 2024 GIP announced its plan to acquire ALLETE, a holding company that controls Minnesota Power and Superior Water, Light and Power Company—two public utilities with more than 165,000 captive customers in Minnesota and Wisconsin, respectively, in a take-private deal. BlackRock already controls 13.55% of Allete’s voting shares. In addition, BlackRock controls 9.9% and 9.1%, respectively, of Cleveland Cliffs and US Steel—two industrial taconite facility customers of ALLETE representing 70% of Minnesota Power’s entire industrial demand. BlackRock’s control of 13.1% of Allete’s voting shares and nearly 10% of two of ALLETE’s largest customers raises concerns about horizontal competition and conflict of interest.

GIP’s acquisition of ALLETE will need to be approved by FERC as well as public utility regulators in Minnesota and Wisconsin. ALLETE filed petitions to approve the acquisition on July 19th at the Minnesota Public Utilities Commission (MNPUC) and the Public Service Commission of Wisconsin (PSCW). The Citizens Utility Board of Minnesota (CUB) submitted a comment stating, “CUB is also concerned about the inherent conflict of interest that arises between ratepayers wanting to pay as little as possible for safe and reliable electric service and private equity investors wanting to maximize their return on investment.” In addition, Attorney General Keith Ellison filed a comment recommending the case be sent to an evidentiary hearing to determine whether the proposed transaction is in the public interest, stating:

This proposed transaction implicates many of the same concerns as past mergers the Commission has considered, as well as additional concerns that the Commission has not yet faced. If the transaction is consummated, ALLETE and Minnesota Power will become subsidiaries of Global and Canada Pension. Global is itself set to be acquired by BlackRock, one of the world’s largest asset managers. All of these entities have numerous other investments in energy and nonenergy industries, presenting opportunities for cross-subsidization and self-dealing that could harm Minnesota Power’s ratepayers and the public interest more broadly. Moreover, the investment goals and strategies of the new owners likely differ from those of ALLETE’s current owners. The fact that Global and Canada Pension are willing to pay a 19 to 22 percent premium above ALLETE’s market price suggests that they see significant value in controlling ALLETE’s management and investment strategy. The buyers will be expecting to recover their initial investment along with significant returns. And they presumably expect to recover much of that investment and return from Minnesota Power, ALLETE’s largest division and a source of captive ratepayer revenue.Additional concerns arise from the loss of transparency and changed dynamics due to taking ALLETE private. While Minnesota Power is agreeing to provide some information voluntarily, it is unclear whether this voluntary cooperation will be as enforceable as those disclosure obligations that are required by the federal government and stock exchanges for publicly traded companies. Minnesota Power will also go from being the largest component of ALLETE’s operations to a minor part of the vast investment portfolios of Global and Canadian Pension—as well as potentially BlackRock. The decreased relevance of Minnesota Power may have negative implications for its ratepayers, Minnesota, and the public interest.

Attorney General Ellison’s comment points to a potential lack of ratepayer benefits, loss of transparency, and significant benefits to executives and shareholders as reasoning to refer the petition to a contested-case proceeding, which could delay the ALLETE transaction by several months.

This recommendation from the Attorney General comes as the Special Mandatory Redemption End Date for BlackRock approaches in early 2025 with potential financial consequences if the GIP acquisition does not close prior. The SEC filing states:https://www.sec.gov/Archives/edgar/data/1364742/000119312524061922/d767409d424b5.htm#supptoc767409_6

However, if (i) the GIP Transaction is not consummated on or before the later of (x) January 12, 2025 and (y) the date that is five business days after any later date to which the “Termination Date” may be extended in the Transaction Agreement (as defined herein) (including any extension mutually agreed upon by the parties to the Transaction Agreement) (the “Special Mandatory Redemption End Date”) or (ii) BlackRock Funding notifies the trustee under the indenture that BlackRock will not pursue consummation of the GIP Transaction, BlackRock Funding will be required to redeem all outstanding 2029 notes and 2034 notes (the “Special Mandatory Redemption”), at a special mandatory redemption price equal to 101% of the aggregate principal amount of the applicable series of notes, plus accrued and unpaid interest, if any, to, but excluding, the Special Mandatory Redemption Date (as defined herein).

A question of “active” vs “passive” management: Blackrock’s “blanket authorization” called into question

As the proposed merger includes changing ownership of publicly regulated utilities, Blackrock and GIP also need approval from the Federal Energy Regulatory Commission (FERC). FERC is responsible for determining whether the merger is consistent with the public interest, examining a merger’s effect on competition, rates and regulation, and the potential for cross-subsidization.

Complicating matters is Blackrock’s blanket authorization. Issued in 2010 and renewed until 2025, this authorization from FERC allows BlackRock to own up to 20 percent of voting securities of U.S. traded utilities without the need for a case-specific approval as long as the company does not have control over the day-to-day operations of the utility. In the 2022 re-authorization application BlackRock states “neither BlackRock nor any of its investment management subsidiaries directly owns any physical electric utility assets in the U.S., is in an energy-related business, or is a “public utility” or an “electric utility company” under the FPA.” Although BlackRock asserts it has held active or controlling interests in FERC jurisdictional entities previously, BlackRock’s GIP purchase fundamentally transforms BlackRock’s business model from that of a passive asset manager to an active one. Indeed, during its January 2024 earnings call, BlackRock CFO Martin Small used the word “transformational” eight times to describe its GIP acquisition:

“First of all, this is unassailably a transaction that we consider transformational. Most definitely, our clients feel it’s transformational. The volume of emails I can see on [BlackRock CEO] Larry’s screen suggests to me that it’s transformational. And it’s what we’ve talked about, it’s transformational transactions. It’s transformational in terms of the capabilities that BlackRock has and can offer to clients, and it’s transformational in terms of the financial and earnings impact to the firm. So, those two axes are how we’ve always measured transformational: in terms of our capabilities and in terms of the financial impact. And on both fronts, this is definitely a transformational transaction.”

BlackRock’s proposed acquisition of GIP significantly expands BlackRock’s direct control over utilities, such as ALLETE, materially shifting BlackRock’s management orientation from a passive investment manager to an active owner of energy infrastructure.

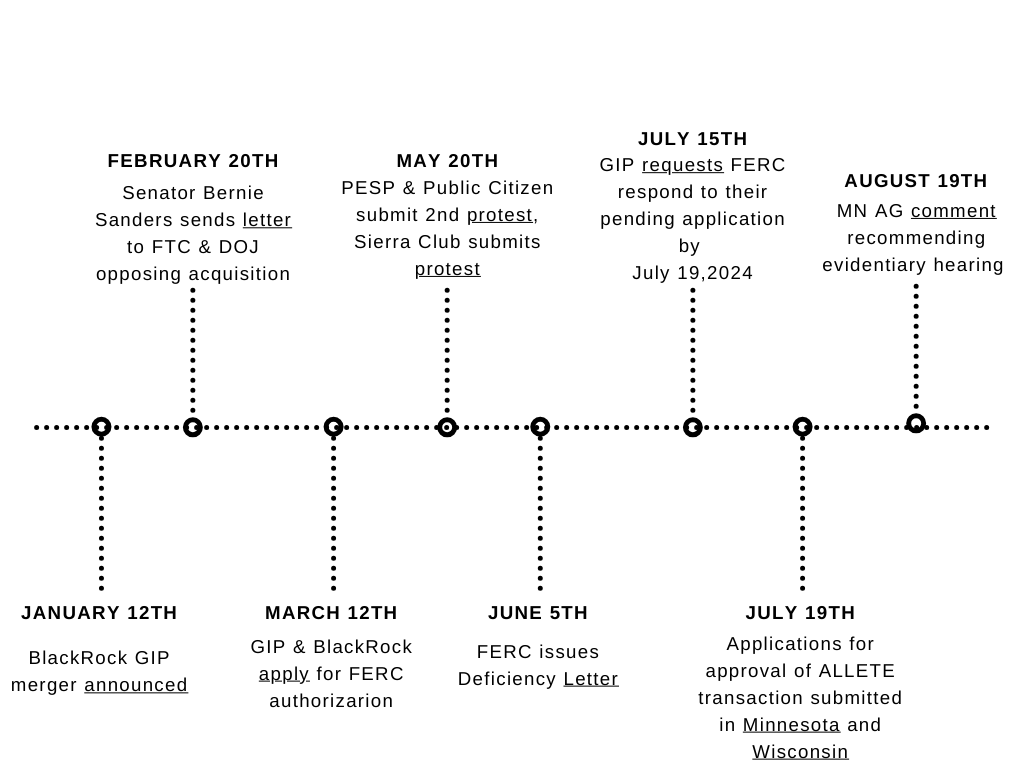

BlackRock and GIP filed the initial application seeking FERC authorization for the merger in March. The application omits dozens of utilities where BlackRock holds shares as part of its blanket authorization, masking potential conflicts of interest, including the ALLETE transaction. In June, FERC outlined seven key areas in which BlackRock and GIP’s application was deficient. BlackRock and GIP have since responded to these issues in order, and FERC must now evaluate whether the proposed merger can continue. GIP and BlackRock requested FERC respond to their application by the end of July but FERC has yet to make a ruling. In addition, a separate comment period for the ALLETE transaction is open until September 17, 2024. A timeline of events over the past eight months can be seen below.

Timeline of events in GIP/BlackRock merger. Regulatory proceedings at federal and state agencies are pending.

Privatization and consolidation create risks for regulators and the public

Private equity’s growing influence over public utilities and infrastructure should be of concern to regulators and the public. The private equity playbook employs aggressive financial tactics that can undermine the financial stability of portfolio companies. Private equity firms’ use of leveraged buyouts to load acquisition targets with significant debt often leaves the newly acquired portfolio company financially strained and vulnerable to bankruptcy. Private equity ownership and management of energy assets have already allegedly caused spills, leaks, explosions, and air pollution, and several private equity-owned power plants have been subject to regulatory actions as a result of their cost-cutting efforts and subsequent non-compliance with environmental regulations.

In the case of ALLETE, captive ratepayer revenue will be footing the bill for much of the returns to the private equity firm while those same customers may face rising monthly power bills, cutbacks on utility maintenance, and a lack of transparency, and other risks that historically come with private equity takeovers.The historic size of this proposed BlackRock/GIP deal, the scale of control that the merger would give to BlackRock, and the critical nature of the public services provided by utilities in the portfolio companies should give regulators pause.

Advocacy organizations, including PESP as well as Public Citizen[1] and Sierra Club have raised issues of potential adverse impacts of the merger on competition, rates and regulation with FERC. Senator Bernie Sanders sent a letter to the FTC and DOJ calling the regulators to block the deal for being in violation of the Clayton Act, which states investors cannot have stake in companies where “the effect of such an acquisition may be to substantially lessen competition, or to tend to create a monopoly.”[2] PESP echoed these concerns in a separate letter also sent to FTC and the DOJ, stating, “the merger appears to be in violation of the Clayton Antitrust Act, creates several conflicts of interest, and threatens to raise costs for countless Americans”.

FERC and other regulatory agencies should closely examine how this acquisition will impact ratepayers and energy markets. FERC should head the call of the Minnesota Attorney General and hold an evidentiary hearing, where the Commission can explore remedies to BlackRock’s conflict of interest and potential impacts on rates and competition including the divestiture of BlackRock’s management of passive utility holdings from its active utility holdings. BlackRock and GIP limited partners should be aware of the potential implications this merger has on investments and what it means for the long-term health of their infrastructure portfolios.

Resources

[1] PESP and Public Citizen have submitted three joint protests which can be found here, here and here.

[2] Clayton Act of 1914, U.S. Code 15 (2018), § 18.