Blackstone sees dramatic decline in buyout fundraising, increased attention to child labor charges

April 24, 2023

Private equity and real estate giant the Blackstone Group launched fundraising a year ago for Blackstone Capital Partners IX, its next flagship buyout fund, seeking to raise as much as $30 billion.[1]

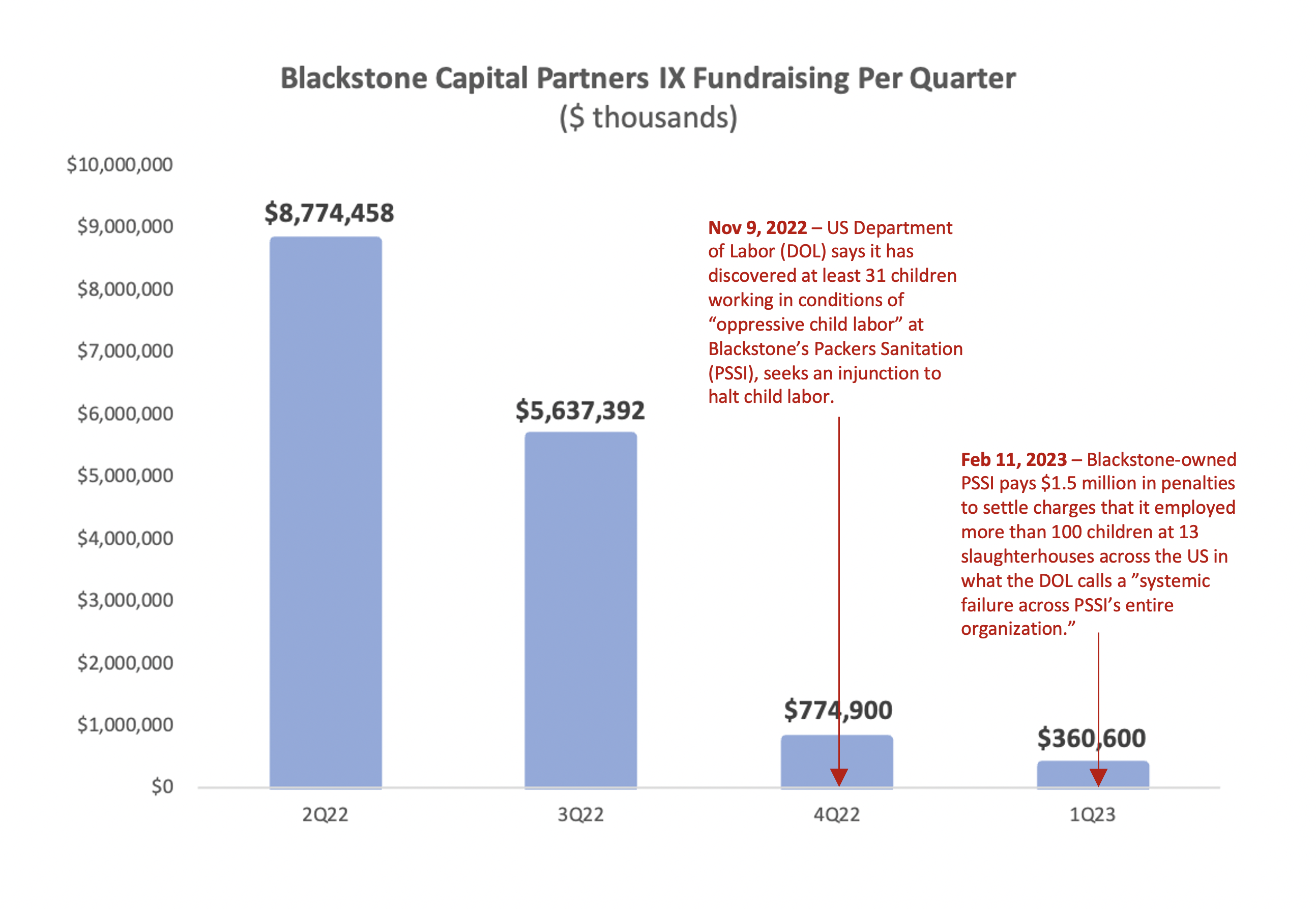

Yet Blackstone’s most recent quarterly earnings released last week revealed the fund raised just $360.6 million during the first quarter of 2023 and $1.14 billion over the six months through March 2023, a 92% decline from the fund’s first six months of fundraising.[2]

While private equity firms have faced a broad slowdown in fundraising in recent months, the dramatic drop in Blackstone Capital Partners IX fundraising also comes at a time when Blackstone has faced scrutiny from investors over child labor at portfolio company PSSI.

The US Department of Labor (DOL) in November 2022 sought an injunction against Blackstone-owned slaughterhouse cleaning company Packers Sanitation Services Inc. (PSSI) to stop the company from illegally employing dozens of children in hazardous occupations on overnight shifts in conditions of “oppressive child labor.” When Blackstone-owned Packers ultimately settled the charges and paid a $1.5 million fine in February 2023, the DOL noted, “These findings represent a systemic failure across PSSI’s entire organization to ensure that children were not working in violation of the law.” Several Blackstone executives serve or recently served on PSSI’s board.[3]

Blackstone has lowered expectations for the new fund, reporting in January that the firm would, “raise roughly a similar amount as the prior fund.” The predecessor fund (BCP VIII) closed in 2019 with $25.6 billion.

Yet even that could take time. If Blackstone Capital Partners IX continues fundraising at the same pace it did during the first quarter of 2023 (i.e. $360.6 million per quarter), it will take the fund until 2030 to match its predecessor.[4]

Meanwhile, Blackstone has continued to face scrutiny from some of its largest investors.

In a March 2023 letter to Blackstone about PSSI, New York State Comptroller Thomas DiNapoli, sole trustee of the $240 billion New York State Common Retirement Fund, called the alleged child labor “abhorrent” and asked “how PSSI plans to eliminate illegal child labor practices.”

“How are we going to align with our partners, our fund managers around private equity, because we all heard the sad story about children…being used to clean slaughterhouses at night,” asked California Public Employees’ Retirement System (CalPERS) board member Ramón Rubalcava during a March investment committee meeting.

California State Teachers Retirement System (CalSTRS) Investment Committee Chair William Prezant said at a March investment meeting that fund staff “is pursuing this issue vigorously.”

While New York Common, CalPERS, and CalSTRS committed a combined total of more than $1.5 billion to Blackstone’s last buyout fund,[5] none of the three appears to have committed to Blackstone Capital Partners IX thus far, based on publicly available information.[6]

A list of Blackstone Capital Partners VIII or VII investors that do not appear to have committed to Blackstone Capital Partners IX is below.

Investors’ overallocation to private equity and concerns about child labor may not be the only reasons for investors to hold off on committing to Blackstone Capital Partners IX.

Blackstone’s last three flagship buyout funds – Blackstone Capital Partners VIII, VII, and VI – have all underperformed peers, ranking in the third and fourth quartile according to data provider Pitchbook:

| Name | Fund Size | Vintage | IRR | IRR Quartile | TVPI | DPI | RVPI |

| Blackstone Capital Partners VIII | $26.00B | 2020 | 16.22% | 3 (Lower-Mid) | 1.19x | 0.07x | 1.15x |

| Blackstone Capital Partners VII | $18.86B | 2016 | 13.57% | 4 (Bottom) | 1.51x | 0.54x | 1.03x |

| Blackstone Capital Partners VI | $15.20B | 2011 | 12.61% | 3 (Lower-Mid) | 1.80x | 1.42x | 0.38x |

(Source: Pitchbook, accessed April 22, 2023)

Given a crowded fundraising market, charges of “oppressive child labor” at Blackstone portfolio company Packers Sanitation, and poor performance relative to peers, investors may choose to skip Blackstone Capital Partners IX.

** After publication of this blog post, Blackstone’s Managing Director of Global Public Affairs contacted PESP to state that the BCP IX’s negative fundraising trends “reflect broader industry factors.” Blackstone further asserted that “the fundraising for BCP Capital Partners IX during the 60-day period after the November 9, 2022 announced injunction [against PSSI] – with significant associated press — was multiples more than the 60-day period prior to November 9, 2022.” Because Blackstone does not publish data on fundraising trends on 60-day intervals, PESP is unable to corroborate Blackstone’s assertion.

Blackstone Capital Partners VIII or VII investors that do not appear to have committed to Blackstone Capital Partners IX so far (based on publicly available information):

1199SEIU Health Care Employees Pension Fund

Alaska Permanent Fund

American Electric Power System Retirement Plan

American Federation of Musicians and Employers’ Pension Fund And Subsidiary

Arizona State Retirement System

Boston City Retirement System

BP Master Trust For Employee Pension Plans

Brighthouse Life Insurance Company

California Public Employees’ Retirement System

California State Teachers’ Retirement System

Colorado Public Employees’ Retirement Association

Dakota Cement Trust Fund

Danica Pension

Employees’ Retirement System of the State of Hawaii

Essex County Council Pension Fund

Exelon Corporation Pension Fund

Farmers Insurance Group of Companies

Florida State Board of Administration

Fubon Life Insurance

Houston Firefighters’ Relief and Retirement Fund

Houston Police Officers’ Pension System

IAM National Pension Fund

Illinois State Board of Investment

Ilmarinen Mutual Pension Insurance Company

Keva

Lexington Insurance Company

Liberty Mutual Retirement Benefit Plan

Los Angeles County Employees’ Retirement Association

Maine Public Employees’ Retirement System

Maryland State Retirement and Pension System

Massachusetts Pension Reserves Investment Trust

MetLife

Michigan Department of Treasury

National Grid Pension Plan

New Jersey State Investment Council

New York City Public Pension Funds

New York State Common Retirement Fund

Niagara Mohawk Pension Plan

Ohio Police & Fire Pension Fund

Oregon Public Employees Retirement System

Oregon State Treasury

Pennsylvania State Employees’ Retirement System

Rasmuson Foundation

Raytheon Technologies Corp Ret Plan

Retirement Plan of Carilion Clinic

San Diego County Employees Retirement Association

San Francisco Employees’ Retirement System

Santa Barbara County Employees’ Retirement System

Screen Actors Guild – Producers Pension Plan

Shell Pension Plan

Sound Retirement Trust

South Dakota Investment Council

State of Wisconsin Investment Board

State Teachers’ Retirement System of Ohio

Teacher Retirement System of Texas

Teachers Retirement System of the State of Illinois

Texas Permanent School Fund

Textron Master Trust

The Travelers Pension Plan

Transamerica Pension Plan

United Food & Commercial Workers International Union – Industry Pension Fund

Varma Mutual Pension Insurance Company

Washington State Investment Board

(Note: This list of investors in Blackstone Capital Partners VII and/or VIII is drawn from Pitchbook. We then searched investors’ websites for references to “Blackstone Capital Partners IX” to determine whether any were invested in the new buyout fund.)

[1] “Blackstone Is Coming Up Short in Its Push for a Record $30 Billion Buyout Fund,” Bloomberg, Jan 27, 2023. https://www.bloomberg.com/news/articles/2023-01-27/blackstone-coming-up-short-in-its-push-for-a-record-buyout-fund

[2] Based on BCP IX committed capital of $8,774,458,000 at 6/30/22, $14,411,850,000 at 9/30/22, $15,186,750,000 at 12/31/22, and $15,547,350 at 3/31/23.

[3] Blackstone Senior Managing Directors Peter Wallace, David Kestnbaum, and Vikram Suresh and Blackstone Operating Partner Jeffrey Overly serve or recently served on Packers Sanitation’s board.

[4] $10.1 billion / $360.6 million = 28 quarters or 7 years

[5] CalSTRS: $750 million commitment to Blackstone Capital Partners VIII, https://www.calstrs.com/files/dde3f45f7/PrivateEquityPerformance-06302022.pdf NY Common: $500 million, https://www.osc.state.ny.us/files/retirement/resources/pdf/asset-listing-2022.pdf, CalPERS: $262.5 million, https://www.calpers.ca.gov/page/investments/about-investment-office/investment-organization/pep-fund-performance.

[6] CalSTRS Semi-Annual Private Equity Performance Review, Mar 2, 2023. https://calstrs-pensionx-web.specialdistrict.org/files/3c09f7555/INV032%7E3.PDF NY Common Monthly Disclosure of Investments & Transactions, accessed Apr 22, 2023. https://www.osc.state.ny.us/common-retirement-fund/resources/financial-reporting-and-asset-allocation CalPERS Private Equity Program Fund Performance Review, accessed Apr 22, 2023. https://www.calpers.ca.gov/page/investments/about-investment-office/investment-organization/pep-fund-performance