Critical questions about private equity’s big bet on data centers

March 17, 2025

As power demand forecasts surge, partially driven by a frenzy around artificial intelligence and the technology’s data centers projections, private equity firms are poised to be a key part of the developments, with several large deals already announced by firms including Global Infrastructure Partners (GIP)/BlackRock, KKR, Energy Capital Partners/Bridgepoint, Brookfield, and others.

Questions remain over the long-term profitability, feasibility, and broad impacts of data centers, with recent news of Microsoft canceling multiple data center leases and the dramatic DeepSeek market disruption earlier in 2025. It is critical that private equity investors and regulators consider the many variables and potential liabilities that could materialize in the rushed buildout of energy intensive data centers.

How is private equity showing up in the data center space?

Blackstone is one of the clearest examples of how private equity firms have been and could continue to invest in multiple facets of the data center sector. In addition to investing in the actual centers and operating companies, Blackstone is also investing in power generation needed to run the data centers, as well as companies that make the computer components and software needed for technologies such as AI.

Data Center Operators

In 2021, Blackstone purchased QTS Realty Trust, a data center operator, for $6.7 billion. In 2023, Blackstone entered into a $7 billion joint venture with Digital Realty, another data center operator. In 2024, Blackstone agreed to a $16.1 billion purchase of AirTrunk, also a data center operator.

Data Center Software and Hardware

On the components side of things, Blackstone has backed CoreWeave in multiple deals. CoreWeave is an owner of the specialized computer chips currently needed for AI technology and is using Blackstone’s investment to purchase more of these chips from Nvidia, the main company impacted by DeepSeek’s market disruption in early 2025. In January of 2025, Blackstone also announced a $300 million investment in DDN, a company on the computer software side of AI in addition to physical components.

Data Center Power Generation

In January of 2025, Blackstone entered into an agreement to purchase The Potomac Energy Center, a 774 MW gas plant in Virginia that was built specifically for data centers needs in 2017. In a statement announcing the agreement, Blackstone stated: “This investment underscores Blackstone’s commitment to investing in the electric infrastructure required to power AI innovation.” According to research done for the Private Equity Climate Risks 2024 Scorecard, Blackstone is currently responsible for 34.4 million metric tons of carbon dioxide emissions from fossil fuel companies in its energy portfolio. This emissions figure only includes upstream operations, liquefied natural gas terminals, and coal power plants, as of June 2024. The firm’s stated goal of continued investment in energy infrastructure for data centers could greatly increase those emissions.

Energy Capital Partners/Bridgepoint

Blackstone is currently in the process of selling one of its fossil fuel assets, the 50 year old Gavin coal plant, to another private equity firm, Energy Capital Partners, a unit of UK-based Bridgepoint. Energy Capital Partners also recently announced a new $50 billion “strategic partnership” with private equity firm KKR focused on data centers and power generation. In a statement, KKR stated that “the collaboration aims to accelerate the development of data center and power generation and transmission infrastructure for the rapid expansion of artificial intelligence (AI) and cloud computing globally.” Energy Capital Partners has stated that its proposed acquisition of the Gavin coal plant is “entirely unrelated” to its data center partnership with KKR.

GIP/BlackRock

In September 2024, GIP/BlackRock announced a partnership with Microsoft and MGX called the Global AI Infrastructure Partnership. In a statement, GIP/BlackRock stated that the partnership will “make investments in new and expanded data centers to meet growing demand for computing power, as well as energy infrastructure to create new sources of power for these facilities. These infrastructure investments will be chiefly in the United States fueling AI innovation and economic growth, and the remainder will be invested in U.S. partner countries.”

How much energy is really needed for AI? DeepSeek shows investors that we may not know that answer yet.

While some forecasts show a greater need for additional power generation in order to keep up with proposed data centers, the exact power generation needs are still in question. Some of the initial demand forecasts may be too high, which could lead to investment in stranded power generation assets that are ultimately not needed for the grid. Compounding the problem, many power utilities are “flying blind” on accurate power needs, due to the practice of data center developers applying for interconnection in multiple utility service areas at the same time in search of the “best deal” as reported in a multi part series reporting on data centers. Former Federal Energy Regulatory Commissioner (FERC) Allison Clements characterized the current problem as “phantom load” in a recent oped, stating:

Whether it shows up as several different load interconnection requests for one viable project or a single request for a half-baked opportunity, the result is a significant amount of “phantom” load that not only inflates demand projections across the country but also introduces material uncertainty and inefficiency into individual utilities’ load interconnection processes.

A recent report by the Bipartisan Policy Center and Koomey Analytics outlines some of this uncertainty around data centers specifically. The conclusion of the report states:

It is incumbent on utilities, regulators, policymakers, and investors to investigate claims of rapid new electricity demand growth and to ensure that expectations are based on the latest and most accurate data and models. Although data centers’ electricity use appears to be growing again, exactly how that growth will play out in coming years is deeply uncertain, both because growth in the use of AI is uncertain and because progress in efficiency is uncertain.

Chinese AI company DeepSeek is a great example of this uncertainty that both investors and regulators must contend with. On January 20, 2025, DeepSeek made headlines by releasing an open source AI model that was significantly more energy efficient than its competitors while still appearing to beat industry standards for math and reasoning benchmarks, as reported by Wired. Following this release, American AI components company Nvidia “lost $589 billion in market capitalisation (or 17% of its value) setting the record for the greatest one-day value loss of any company in history, as reported by Reuters Institute. Nvidia dropped even further the following week. The stock has slightly improved since then, though as of February 27, it was still well below its peak from earlier in January.

Nvidia matters in the data center and AI conversation because DeepSeek competitors such as OpenAI, the American company behind ChatGTP, use a business model based on scaling the numbers of Nvidia computer chips used and “training” them for longer periods of time, using a high amount of resources, including energy, to do so. According to AI reporter Karen Hao, DeepSeek’s announcement and model release showed the world that AI could be possible using significantly less resources, 1/50th the current standard in the case of DeepSeek’s model.

As AI models are developed, the technology is also expected to “learn” how to be more energy efficient, ultimately using less resources.

Despite uncertainties around accurate power demand, rush to meet tech company demands is increasing emissions

Tech corporations such as Microsoft and Google have made carbon emissions reductions commitments, while still blazing ahead in data center development and subsequently increasing emissions. According to Microsoft’s 2024 Environmental Sustainability report, scope 3 emissions have increased 30.9% since 2020 in part due to the company’s data centers (page 11). Microsoft states a company goal to reduce scope three emissions by “more than half from a 2020 baseline by 2030” according to the same report.

Google reported a 13% increase in GHG emissions in just one year (2023) and a staggering 48% increase since 2019 “primarily driven by increased data center energy consumption and supply chain emissions” in its 2024 environmental report (page 7) Google further stated that: “As we further integrate AI into our products, reducing emissions may be challenging due to increasing energy demands from the greater intensity of AI compute, and the emissions associated with the expected increases in our technical infrastructure” investment” (page 31). Google also states a company goal to “Reduce 50% of our combined Scope 1, (market-based), and 3 absolute emissions (compared to our 2019 base year) by 2030” in the same report.

Other negative impacts on communities

Identifying which customers bear the financial burden of building out the infrastructure to support data centers and the projected power needs is another pending question. Utility commissions in Ohio and Indiana have already begun dealing with some of these questions. In Ohio, a proposed settlement in an ongoing tariff proceeding for American Electric Power (AEP) would “require large new data center customers to pay for a minimum of 85% of the energy they say they need each month – even if they use less – to cover the cost of infrastructure needed to bring electricity to those facilities.” The utility commission in Indiana approved a similar agreement in AEP’s service territory earlier this year, requiring “new large load customers, including data centers, to make long-term financial commitments proportional to their size to ensure the costs to serve these customers are reasonably recovered from the customer, and not passed on to existing customers.”

However, even with these settlements, it is likely that utility customers around the country could still experience higher power bills due to data center buildouts. Customers and utilities in the PJM Interconnection, a Mid Atlantic regional grid, are currently experiencing this price increase in a dramatic way, following historically high prices in last summer’s capacity power auction. The price for wholesale power supply in the auction jumped over 800 percent from previous prices. Brian Tierney, utility company FirstEnergy president and CEO, stated that customers can expect increases to “monthly residential bills by 11% to 19% beginning in June” of 2025 because of the auction prices. People’s Counsel David Lapp of Maryland, one of the states that purchases power from PJM, stated that the 2025 PJM auction results could be even worse, with customers “looking at increases of as much as $40 to $50 a month,” as reported by the Washington Post.

Considered the data center capital of the world with over 300 data centers either in operation or proposed, Virginia is another state at the center of this issue, with multiple legislative bills on the topic introduced in the 2025 state legislative session. As seen in other regulatory forums, the arguments and proposed policies center on issues of increased costs to utility customers, in addition to water usage and environmental impact.

Opportunity to invest in clean energy transition

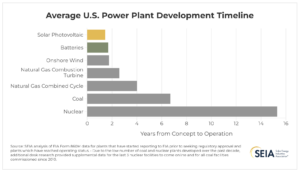

According to Energy Information Administration (EIA) data as shown in the chart below from the Solar Energy Industries Association, solar and storage (batteries) is currently the fastest way to build new power generation, in addition to being the least expensive in many applications. Natural gas combustion turbine plants come in third place after solar, batteries, and wind, but face additional challenges of cost and inefficiencies, supply chain delays, and the need to be built near pipeline infrastructure. NextEra, a large utility company, recently announced plans to build more gas generation for data centers, however, in the company’s fourth quarter 2024 earnings call in January, CEO John Ketchum explained that the long development timeline of the gas plants meant that the generation would not be available before 2030. Ketchum also explained that solar and onshore wind are still faster and cheaper to build than new natural gas and remain critical to hyperscaler companies with immediate energy needs. NextEra currently has a goal of achieving carbon free operations by 2045. It is unclear how new gas generation coming online in 2030 fits into that plan.

Investors and regulators should ask questions

As private equity looks for investment opportunities in the data center space and AI trend, many unknowns remain. From questions about the accuracy around emissions-heavy power generation projections, changes in technology and efficiency, to upcoming regulatory and legislative hurdles, and potential for dramatic financial impacts on utility consumers, alongside potential environmental impacts, data centers could be risky investments. Regulators and investors should ask private equity firms making large bets on data center and related power infrastructure to provide clarity around the soundness of these investments and potential impacts. In cases where investments are being made in power generation, investors should ask if the quickest and lowest cost option of solar, batteries, and offshore shore wind is being considered instead of prolonging the life of polluting fossil fuel assets or building new, expensive, polluting, supply chain-challenged gas powered plants.