Disaster recovery industry dominated by private equity

While profiting from dangerous fossil fuel emissions, private equity increasingly profits from climate disaster cleanup – since September 2023, private equity firms have acquired a stake in at least 49 more disaster restoration companies.

November 21, 2024

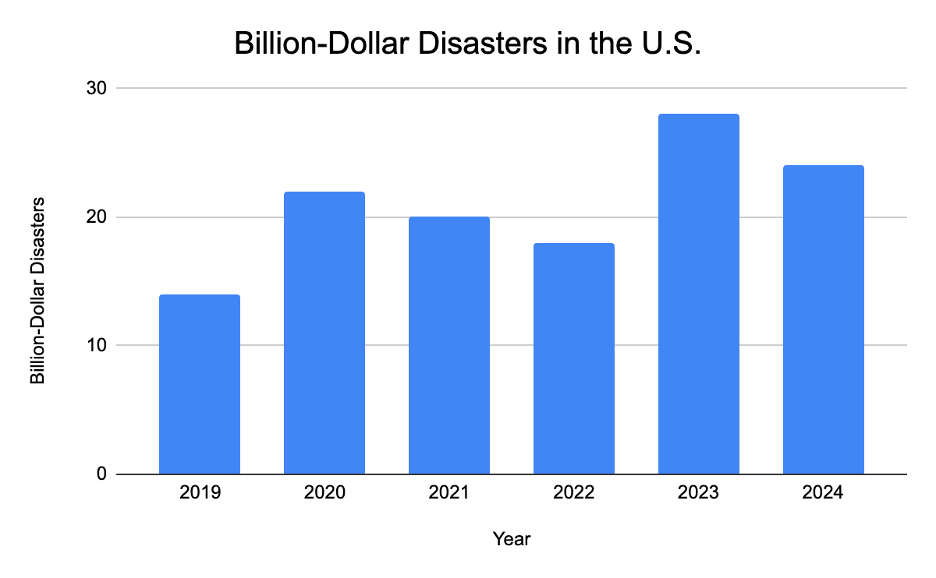

In September 2023, Hurricane Helene tore through the southeast United States, becoming the third deadliest storm in the United States after Hurricanes Katrina and Maria. Communities in and around Asheville, North Carolina, home to the National Oceanic and Atmospheric Administration’s (NOAA) National Centers for Environmental Information, bore the brunt of the storm, despite previously being considered a climate safe haven. One study estimated that Hurricane Helene could incur $250 billion in damages – more than any other hurricane on NOAA’s list of billion-dollar events (the next largest is 2005’s Hurricane Katrina, which caused $200 billion in damages). According to NOAA, there were 28 billion-dollar events in 2023, breaking the 2020 record of 22 billion-dollar climate disasters.

Private equity firms want a cut of the billion-dollar profits that come with each disaster. Last year, PESP released a report detailing private equity investments in climate disaster through both fossil fuels and disaster restoration. The 2024 Private Equity Climate Risks Scorecard studied 21 private equity firms that manage $6 trillion worth of companies, and found that two-thirds of the energy companies in their portfolios are responsible for 1.17 billion metric tons CO2 equivalent of emissions a year through investments in upstream oil and gas, liquefied natural gas (LNG) terminals, and coal-fired power plants. While profiting from dangerous emissions, private equity increasingly profits from climate disaster cleanup – since the release of last year’s report in September, private equity firms have acquired a stake in at least 49 more disaster restoration companies.[1]

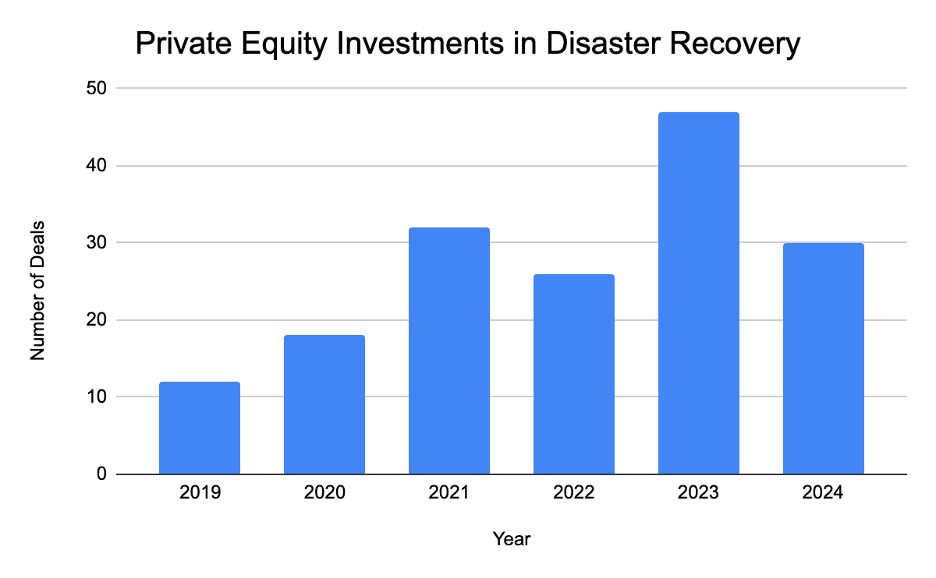

The trend of private equity investment generally follows the increase in billion-dollar events. NOAA analyst Tom Ross believes that while climate change has accelerated climate catastrophe, there is also simply more to destroy: “If a storm hiccups, it gets a billion dollars’ worth of damage now, whereas 20 years ago, it took a lot more than a hiccup to do it.”

Following a then-record number of billion-dollar events in 2020 and low interest rates spurred by the COVID-19 pandemic, private equity investments in the disaster recovery sector soared, increasing 77% from 2020 to 2021. While activity in the industry slowed slightly in 2022, investments peaked again in 2023 and are on pace to surpass 2021 levels for this year.

Despite sustained interest in disaster recovery over the past several years, the industry remains highly fragmented, leaving private equity firms with plenty of acquisition opportunities. TSG Consumer’s ATI Restoration acquired 15 companies from November 2020 to April 2024, while AEA Investors’ Blackmon Mooring has acquired 11 companies since March 2020.[2] Blusky, owned by Partners Group and Kohlberg and Company, acquired ten smaller businesses in just two years from December 2021 to December 2023.

Cotton Commercial, headquartered in Texas and owned by Sun Capital Partners since 2020, is open about its desire to take over more of the industry. In January, Cotton expanded to a new region through acquiring 24 Restore, “formerly New England’s largest locally owned full-service disaster restoration company.” The acquisition continues “the company’s global strategic plan aiming to meet the increasing demand for commercial restoration services across North America and globally.” The Sun Capital Partners website lists Cotton as “actively seeking add-on acquisitions.”

Trivest Partners, which claims to be the oldest private equity firm in the southeast United States, is one of the private equity firms investing heavily in the disaster restoration sector. The firm “focuses exclusively on founder and family-owned businesses,” making the fragmented recovery industry the perfect fit. Since February 2020, the company has invested in 14 restoration companies, placing most of them under a platform company named HighGround. This practice of rapidly acquiring smaller local companies and unifying them through a national brand is common practice for private equity firms operating in this space. Alpine Investors created Guardian Restoration Partners in April 2024 by combining three home restoration companies: DryLux Restoration (Arizona), Dry Kings (California), and Midwest Restoration (Wisconsin). By October, Guardian had acquired three additional companies in Virginia, Idaho, and Pennsylvania.

As shown in last year’s report, those working in the industry face a number of challenges. Workers leave their homes for weeks and months at a time to rebuild communities, often spending long days and nights cleaning up disasters, forced to live together in poor housing. Many of these employers refuse to pay living wages and offer few to no benefits. They often send workers into dangerous, toxic messes with insufficient training, inadequate protective gear and poor staffing levels and then refuse to pay workers what was promised. Structures like franchises, subcontractors, and temporary positions make it hard for workers to hold the employers accountable for wage theft, health and safety issues, and other concerns.

Private equity firms are also invested in staffing agencies that connect workers to restoration companies. Great Range Capital, a private equity firm based in Kansas, owns One Source Staffing and Labor (formerly Labor Source). The firm also owns Repairs Unlimited and Atlas Restoration Specialists, two restoration companies in the region. By owning both the restoration company and the staffing agency, it becomes possible for Great Range Capital to profit multiple times from the same project. Workers hired for jobs in Minnesota and Illinois filed a lawsuit against Labor Source and BluSky alleging missing wages and lack of overtime pay, violations of federal and state Fair Labor Standards Acts.34 The docket shows that settlement proceedings began in September 2022 and the parties reached agreement as to a portion of the case.

As climate change accelerates and impacts more communities around the world, the need for skilled labor in the disaster restoration industry grows. While investment in the sector is necessary, private equity firms seeking high returns for themselves have come to dominate the disaster recovery sector, reducing workplace standards, overcharging communities and exploiting disasters to extract fees and profits without regard to the workers and communities harmed by their practices.

[1] Data taken from Pitchbook and company press releases.

[2] Pitchbook. “AEA Investors.” https://my.pitchbook.com/profile/10017-10/investor/profile