Financial risks of the Gavin Coal Plant for institutional investors

July 22, 2024

The Gavin Coal Plant (Gavin) is a 50-year-old 2,600 MW coal-fired power plant in Cheshire, OH,[1] originally developed and constructed by American Electric Power (AEP), an electric utility currently spanning 11 states[2]. Gavin is infamous for a 2002 controversy where AEP paid $20 million to buy the town of Cheshire, paying the majority of its few hundred residents to relocate after the EPA ruled the plant in violation of the Clean Air Act and citizen-led environmental lawsuits were underway over the community impacts of the chronic pollution exposure.[3] In 2017, Lightstone Generation (Lightstone) a joint venture between private equity firms Blackstone and ArcLight Capital Partners, purchased Gavin.[4] As a result, numerous public pension funds invested with Blackstone and ArcLight are currently invested in the coal plant.[5]

As Gavin continues to age, investors are increasingly exposed to numerous financial risks including regulated environmental cleanup, changing market conditions, high debt burden, and fund underperformance. Gavin exemplifies the broader trends of the declining coal industry in the U.S. and should be decommissioned before financial risks materialize. Pension funds should evaluate their current risk exposure to the plant and ask Blackstone about their plans to retire Gavin.

Regulatory Risks from Coal Ash

Gavin has a history of not only harmful air pollution but of water pollution through the company’s handling of hazardous coal ash waste.[6] Coal ash is a byproduct of coal combustion that is composed of contaminants such as mercury, cadmium, and arsenic which can pollute the waterways it comes into contact with. Long-term exposure to coal ash has also been shown to cause cancer, according to data from the EPA and CDC. [7],[8] Improper storage of Gavin’s waste could lead to contamination of groundwater and potentially the Ohio River, which is a drinking water source for millions of people.[9]

After a 2015 EPA ruling, the operators of Gavin began to close one of their coal ash storage ponds and requested an extension for the second storage pond after the 2021 deadline.[10] The EPA denied the extension request because the plant was not in compliance with existing coal ash regulations due to improper closure of the first pond, and inadequate groundwater contamination monitoring for both ponds.[11] Instead of following the agency’s order to stop dumping coal ash, Gavin joined a lawsuit against the EPA in 2022.[12] The U.S. Court of Appeals affirmed the EPA ruling in June 2024, blocking the attempts to get out of the coal ash clean-up requirement.[13] The ruling confirms that sites must stop coal ash from being in contact with groundwater and that there will be no future contact.[14] According to EPA estimates, given this ruling, Gavin is currently on the hook for $40 million in capital costs and $2.5 million a year to stop dumping leachate and an additional $7 million in capital costs and $500,000 a year to fix their dumping of bottom ash wastewater.[15]

Changing Market Conditions

The Gavin coal plant is a merchant power plant in the PJM Interconnection (PJM). PJM is an organization that coordinates the movement of wholesale electricity across 13 eastern states, managing the grid infrastructure to create reliable and secure electricity access.[16] As a merchant generator, the Gavin plant is an independent power or non-utility producer, meaning that there are no long-term power purchase agreements to cover their operations.[17] Instead, the plant sells on the spot market and in PJM’s capacity market.[18] The capacity market ensures there is enough generating capacity available to meet future demand, providing payments to generators in exchange for their commitment to be available during specified periods when there may not be enough electricity on the grid to meet demand.[19] The spot market is an on-demand market where prices are updated every 5 minutes based on real-time grid conditions.[20] The total revenue from generation on the spot market and capacity payments must cover operating costs at merchant power generators.

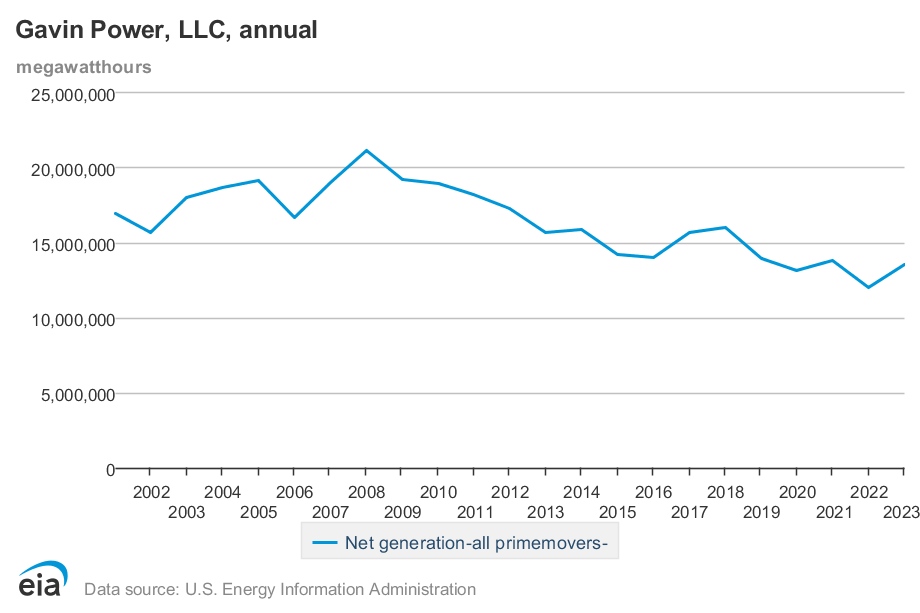

For Gavin, both revenue sources have been on the decline. According to U.S. Energy Information Administration data, the annual net generation of Gavin peaked in 2008 with 2022 having the lowest production since 2001.[21]

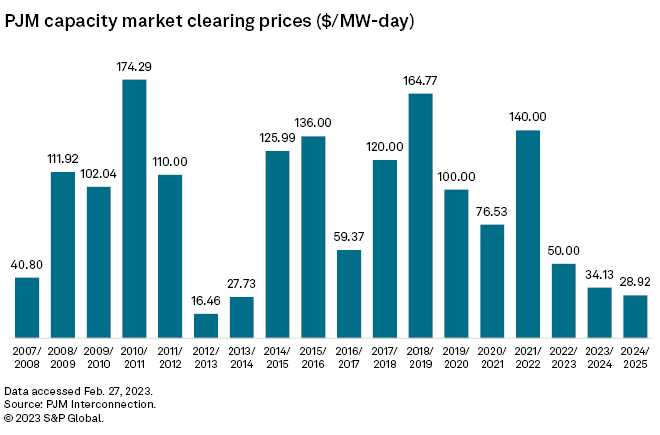

Capacity prices have also been on the decline for the PJM market. The 2024/2025 Delivery Year price was set at $28.92 MW-day for much of the PJM area.[22] This is the 3rd consecutive drop in prices and an overall drop from $164.77 in the 2018/2019 delivery year, see below.[23] Lightstone relies on capacity payments for approximately 40-50% of its cashflow.[24]

High Debt Burden and Fund Underperformance

Gavin’s operator, Lightstone, carries a high debt burden which will need to be paid back to lenders in 2027.[25] Blackstone and ArcLight took out $2.1 billion in debt financing for the purchase of the power generators from AEP in 2018.[26] After 18 months of ownership, the firms went back to its debt lenders to finance the $375 million dividend recapitalization they used to pay themselves back for the acquisition, according to Reuters.[27] Although Lightstone was able to refinance its debt in 2022, S&P estimates the company will have over $1 billion outstanding on its Term B loan at maturity.[28] This high debt burden in addition to declining revenue from sales and capacity payments creates questions about the future viability of the plant.

In addition to debt burden, two of the three private equity funds, ArcLight Energy Partners Fund VI (ArcLight VI) and Blackstone Capital Partners VI (Blackstone VII), used to create Lightstone Generation have underperformed, landing in the 4th quartile in Q1 of 2024, compared to their peers, according to Pitchbook. Both these funds’ IRRs also underperformed relative to their benchmarks in the same quarter. Blackstone VII has an IRR of 13% compared to a benchmark of 17.25% and ArcLight VI’s IRR is 3.18% compared to a benchmark of 10%.[29] Although these funds contain other investments outside of Gavin, looking at overall fund performance relative to peer funds gives investors a window into investment health especially without more publicly available, robust metrics on specific fund investments, due to the lack of public disclosures for the private equity industry.

Coal Industry on the Decline for Investors

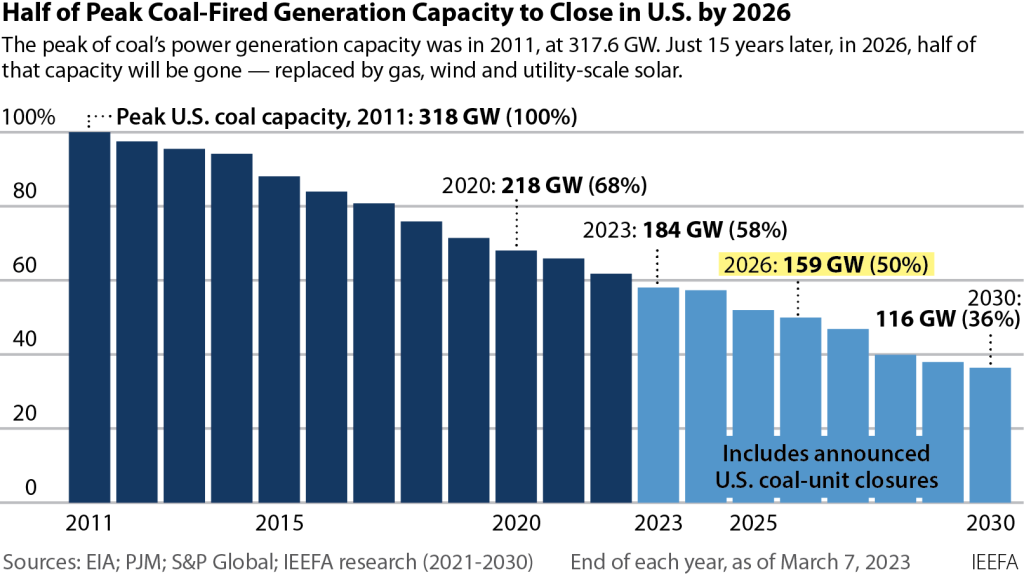

Coal prices and demand fluctuate regularly, based on seasonal weather, new regulations, availability of natural gas, new renewable energy technologies, and geopolitical events. However, even with expected fluctuations, the long-term demand for coal is expected to consistently decline until at least 2026, according to the International Energy Agency (IEA).[30] IEEFA research found half of the peak coal-fired generation in the US will close by 2026, with 17 GW of coal generation retirements announced for 2025 already, see below.[31] Coal companies also face a high risk of bankruptcy. From 2012 to 2022 at least 60 US coal companies filed for bankruptcy.[32]

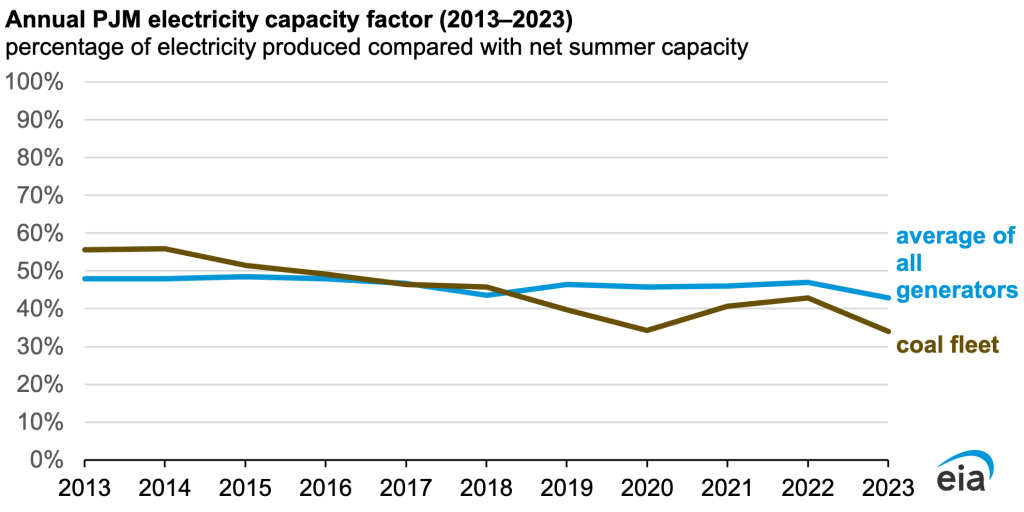

S&P’s Industry Credit Outlook for 2024 echoes these findings for the PJM market specifically, citing declining capacity prices and policy-related retirements as drivers for continuing coal retirements in the region. They forecast at least 24 GW of policy-related retirements in 2024.[33] These factors and other economic drivers are seeing the use of coal-fired generation in the PJM market falling over the last decade with coal comprising 14% of PJM’s generation in 2023, down from 44% in 2013, see below.[34],[35]

Institutional investors are already beginning to move their investment portfolios away from coal. The New York City Employees’ Retirement System is reducing exposure from publicly traded companies that derive at least 50% of their revenue from thermal coal production, mining, and/or processing.[36] Similarly, the New York State Teachers’ Retirement System announced it is divesting from public equities that derive more than 10% of their revenue from thermal coal in 2021.[37] Finally, the New York State Pension Fund has divested at least $40 million from 22 coal companies.[38]

Lawmakers also are seeing the value in safeguarding pensions from climate-related financial risks. This year the Oregon legislature passed HB 4083, the Clean Oregon Assets Legislation Act (COAL Act).[39] The bill directs the Oregon Public Employees Retirement System to divest about $1 billion in coal mining and energy companies.[40]

It’s Time to Retire Gavin Responsibly – And it’s possible

Earlier this year, a different private equity-owned coal plant, Merrimack, announced its retirement.[41] Owned by Atlas Holdings, Merrimack was primarily surviving based on capacity market payments, similar to Gavin.[42] Ultimately, that revenue was not enough to sustain Merrimack. According to IEEFA, Merrimack’s parent company Granite Shore, was unsuccessful in the last two capacity-market auctions, which covered power from June 2026 through May 2028. The decision to retire Merrimack is being coupled with new investments in renewables, according to Granite Shore.[43] Granite Shore Power said it plans to build “renewable energy parks” and battery storage infrastructure at the former site, adding reliability to the power grid and supplying carbon-neutral power for generations to come.[44]

Investors in Gavin should take note of this proactive example and be aware of the community risks that come along with the current Gavin plan of inaction. In Pennsylvania, for example, the Homer City Generating Station gave only a 90 days notice that they would be closing the doors on the state’s largest and last coal-fired power plant, leaving more than 120 workers in the lurch.[45] Plagued by financial woes, including a 2017 bankruptcy that paved the way for private equity investors to snatch up the plant, the Homer City plant fought to stay afloat but with competition from cheaper natural gas and reduced maintenance resources the coal plant couldn’t make ends meet.[46] Now, in addition to local job losses, the small town of Homer City has to deal with an immediate loss of $750,000 in annual property taxes and environmental pollution caused from decades of housing the coal industry.[47] Redevelopment efforts have been proposed but not officially announced since the site closed last year.[48]

The Gavin coal plant sits at a crossroads. The plant owners can ignore numerous financial risks including regulated environmental cleanup, changing market conditions, high debt burden, and fund underperformance and roll the dice in an attempt to squeeze the last remaining dollars from the plant while Gavin remains operational. Or the plant’s owners can be proactive and set up the site to serve local communities, investors, and the climate for generations to come by converting the plant to a source of renewable energy. Limited partners invested in the plant should evaluate the risks of continuing their investment in Gavin and ask Blackstone what their plans are to safely retire the Gavin Coal Plant.

Resources

[1]Global Energy Monitor. 2024. “Gavin Power Plant – Global Energy Monitor.” July 8, 2024. https://www.gem.wiki/Gavin_Power_Plant.

[2]Global Energy Monitor. 2021. “American Electric Power – Global Energy Monitor.” July 14, 2021. https://www.gem.wiki/American_Electric_Power.

[3]Martin, Richard. 2014. “For $20 Million, a Coal Utility Bought an Ohio Town and a Clear Conscience.” The Atlantic, October 30, 2014. https://www.theatlantic.com/business/archive/2014/10/for-20-million-a-coal-utility-bought-an-ohio-town-and-a-clear-conscience/381499/.

[4]PR Newswire. 2017. “AEP Completes Sale of Four Competitive Power Plants,” January 30, 2017. https://www.prnewswire.com/news-releases/aep-completes-sale-of-four-competitive-power-plants-300398721.html.

[5]Wamsted, Dennis, Seth Feaster, Tom Sanzillo. 2021. “Pension Funds Investing Indirectly in Ohio’s Gavin Coal Plant Are at Risk as Financial, Environmental Disadvantages Mount.” Institute for Energy Economics and Financial Analysis https://ieefa.org/sites/default/files/2022-04/Pension-Funds-Investing-Indirectly-in-Ohios-Gavin-Coal-Plant-Are-at-Risk-as-Disadvantages-Mount_October-2021.pdf.

[6]Ohio Capital Journal. 2022. “Ohio’s Largest Coal Plant to Change Coal Ash Handling After U.S. EPA Denial.” December 6, 2022. https://ohiocapitaljournal.com/2022/12/06/ohios-largest-coal-plant-to-change-coal-ash-handling-after-u-s-epa-denial/.

[7]“Coal Ash Basics | US EPA.” 2024. US EPA. April 18, 2024. https://www.epa.gov/coalash/coal-ash-basics#:~:text=Coal%20ash%20contains%20contaminants%20like,drinking%20water%2C%20and%20the%20air.

[8]“Coal Ash.” n.d. https://www.atsdr.cdc.gov/substances/coalAsh.html.

[9]Kowalski, Kathiann M., and Kathiann M. Kowalski. 2022. “Ohio’s Largest Coal Plant to Change Coal Ash Handling After U.S. EPA Denial.” Energy News Network. December 2, 2022. https://energynews.us/2022/12/02/ohios-largest-coal-plant-to-change-coal-ash-handling-after-u-s-epa-denial/.

[10]Courthouse News Service. 2024. “Power plants fight federal coal ash storage rules at DC Circuit,” March 7, 2024. https://www.courthousenews.com/power-plants-fight-federal-coal-ash-storage-rules-at-dc-circuit/.

[11]“EPA Takes Final Action to Protect Groundwater From Coal Ash Contamination at Ohio Facility | US EPA.” 2022. US EPA. November 18, 2022. https://www.epa.gov/newsreleases/epa-takes-final-action-protect-groundwater-coal-ash-contamination-ohio-facility.

[12]Courthouse News Service.

[13]Earthjustice. 2024. “Federal Court Blocks Attempt by Coal Power Plants to Evade Cleaning up Coal Ash Contaminating Water – Earthjustice.” July 8, 2024. https://earthjustice.org/press/2024/federal-court-blocks-attempt-by-coal-power-plants-to-evade-cleaning-up-coal-ash-contaminating-water.

[14] McGrath, Kathryn. 2024. “Federal Court Blocks Attempt by Coal Power Plants to Evade Cleaning up Coal Ash Contaminating Water – Earthjustice.” Press release. Earthjustice. June 28, 2024. Accessed July 18, 2024. https://earthjustice.org/press/2024/federal-court-blocks-attempt-by-coal-power-plants-to-evade-cleaning-up-coal-ash-contaminating-water.

[15] Generating Unit-level Costs and Loadings Estimates by Regulatory Option for the 2024 Final Rule – DCN SE11756. 2024. Environmental Protection Agency. May 8, 2024. https://www.regulations.gov/document/EPA-HQ-OW-2009-0819-10336

[16]“PJM – About PJM.” n.d. https://www.pjm.com/about-pjm.

[17]Clark, Kevin. 1998. “Merchant Power.” Power Engineering. April 1, 1998. https://www.power-eng.com/coal/merchant-power/#gref.

[18]Wamsted et al. 2021

[19]“PJM Learning Center – Capacity Market (RPM).” n.d. https://learn.pjm.com/three-priorities/buying-and-selling-energy/capacity-markets.aspx.

[20]Ibid

[21]“Electricity Data Browser.” n.d. Energy Information Administration. Accessed July 15, 2024. https://www.eia.gov/electricity/data/browser/#/plant/8102?freq=A&ctype=linechart<ype=pin&pin=&maptype=0&linechart=ELEC.PLANT.GEN.8102-ALL-ALL.A&columnchart=ELEC.PLANT.GEN.8102-ALL-ALL.A.

[22]“PJM Capacity Auction Procures Adequate Resources.” 2023. Press release. February 27, 2023. Accessed July 15, 2024. https://www.pjm.com/-/media/about-pjm/newsroom/2023-releases/20230227-pjm-capacity-auction-procures-adequate-resources.ashx#:~:text=Overall%20Results,billion%20from%20the%20previous%20auction.

[23]Hale, Zach. 2023. “PJM Reports 3rd Consecutive Decline in Power Capacity Prices.” S&P Global, February 27, 2023. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/pjm-reports-3rd-consecutive-decline-in-power-capacity-prices-74512109.

[24]Wamsted et al. 2021

[25]S&P Global. 2022. “Lightstone HoldCo LLC Outlook Revised to Stable From Negative on Maturity Extension; ‘B-’ Rating Affirmed,” November 3, 2022. https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/2911741.

[26]McLaughlin, Tim. 2021. “How Private Equity Squeezes Cash From the Dying U.S. Coal Industry.” Reuters, March 2, 2021. https://www.reuters.com/article/world/how-private-equity-squeezes-cash-from-the-dying-us-coal-industry-idUSKBN2AU1YS/.

[27] Ibid

[28]“Lightstone Holdco LLC Outlook Revised To Positive On Higher Debt Paydown; Rating Affirmed.” 2024. S&P Global. February 9, 2024. https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3123775.

[29] Pitchbook, accessed July 15, 2024.

[30]“Global Coal Demand Expected to Decline in Coming Years – News – IEA.” 2023. IEA. December 15, 2023. https://www.iea.org/news/global-coal-demand-expected-to-decline-in-coming-years.

[31] “U.S. on Track to Close Half of Coal Capacity by 2026 | IEEFA.” n.d. https://ieefa.org/resources/us-track-close-half-coal-capacity-2026.

[32]Pham, Ken Ward Jr.Alex Mierjeski, Scott. 2023. “How Bankruptcy Helps the Coal Industry Avoid Environmental Liability.” ProPublica, April 26, 2023. https://www.propublica.org/article/west-virginia-coal-blackjewel-bankruptcy-pollution.

[33]“North America Merchant Power.” 2024. S&P Global Industry Credit Outlook 2024. Accessed July 15, 2024. https://www.spglobal.com/_assets/documents/ratings/research/101591878.pdf.

[34]Annual Electric Generator Report and Power Plant Operations Report. 2024. U.S. Energy Information Administration, June 12, 2024. https://www.eia.gov/electricity/data/eia860/

[35] “PJM Has Been Dispatching Coal-fired Generators Less Than Other Generators.” 2024. US Energy Information Administration. June 17, 2024. https://www.eia.gov/todayinenergy/detail.php?id=62343.

[36]“NYCERS Annual Climate Report 2023.” 2023. https://business.cch.com/BFLD/NYCERS-2023-Annual-Climate-Report-04042024.pdf.

[37]“NYSTRS Freezes Investments in Top 20 Oil, Gas and Coal Companies, Representing $1 Billion in Holdings; Divests From Thermal Coal.” 2021. Press release. December 28, 2021. https://www.nystrs.org/NYSTRS/media/PDF/About%20Us/Press%20Releases/2021/NYSTRSClimateAction_12-28-21.pdf.

[38]Gardner, Timothy, and Sohini Podder. 2020. “New York State Pension Fund Sets 2040 Goal of Net Zero Carbon Emissions.” Reuters, December 20, 2020. https://www.reuters.com/article/new-york-state-pension-fund-energy/new-york-state-pension-fund-sets-2040-goa%20l-of-net-zero-carbon-emissions-idUSKBN28J223/.

[39]“HB 4083 Enrolled.” n.d. Oregon Legislative Information. https://olis.oregonlegislature.gov/liz/2024R1/Measures/Overview/HB4083.

[40]Baumhardt, Alex. 2024. “Legislature Passes Bill to Rid Oregon’s Public Employee Retirement System of Coal Investments • Oregon Capital Chronicle.” Oregon Capital Chronicle. March 6, 2024. https://oregoncapitalchronicle.com/briefs/legislature-passes-bill-to-rid-oregons-public-employee-retirement-system-of-coal-investments/.

[41]WBUR. 2024. “New England’s Last Coal Plants Will Close by 2028 | WBUR News.” WBUR.Org, March 28, 2024. https://www.wbur.org/news/2024/03/28/new-hampshire-coal-plant-merrimack-station-close.

[42]“Closure of Last New England Coal Plant Marks Significant Energy Transition Milestone | IEEFA.” n.d. https://ieefa.org/resources/closure-last-new-england-coal-plant-marks-significant-energy-transition-milestone.

[43]Wolfe, Sean. 2024. “New England’s Last Coal Plants to Voluntarily Shut Down.” POWER Engineering. March 28, 2024. Accessed July 16, 2024. https://www.power-eng.com/coal/new-englands-last-coal-plants-to-voluntarily-shut-down/#gref.

[44]“Agreement Between Granite Shore Power and EPA Paves Way for Battery, Solar, and Other Clean Energy Facilities.” 2024. Granite Shore Power. June 22, 2024. Accessed July 16, 2024. https://graniteshorepower.com/blog/transition-to-renewable-energy-parks.

[45]Carleton, Audrey. 2024. “Private Equity Kept Aging Pennsylvania Coal Plant Open, Then Closed It With No Plan for Workers and Community.” Capital & Main, February 13, 2024. https://capitalandmain.com/private-equity-kept-aging-pennsylvania-coal-plant-open-then-closed-it-with-no-plan-for-workers-and-community.

[46]Frazier, Reid. 2024. “A Western Pa. Town Navigates an Uncertain Future After Its Coal Plant Closes.” The Allegheny Front. July 15, 2024. https://www.alleghenyfront.org/a-western-pa-town-navigates-an-uncertain-future-after-its-coal-plant-closes/.

[47] Ibid

[48]Cloonan, Patrick. 2024. “Interagency Working Group Forum Explores Post-power Plant Future of Indiana County.” Indiana Gazette, June 13, 2024. https://www.indianagazette.com/news/interagency-working-group-forum-explores-post-power-plant-future-of-indiana-county/article_f928dc52-2903-11ef-81c4-4b43df101b7c.html.