Carlyle’s shareholders and fossil fuel investments

March 12, 2024

In a recent blog post by Reclaim Finance, the organization brought attention to the environmental impact of one of the largest private equity firms globally, The Carlyle Group. Highlighting the research conducted by the Private Equity Climate Risks data consortium, Reclaim Finance illuminated Carlyle’s significant influence, often escaping public scrutiny.

Reclaim Finance January 2024: Shareholders turn a blind eye to Carlyle’s fossil fuel investments

Massive Fossil Fuel Investments

Reclaim Finance’s analysis, based on research by the Private Equity Climate Risks project, revealed that Carlyle’s investment strategy heavily favors fossil fuels over renewable energy. As of April 2023, for every dollar Carlyle had allocated to renewable energy, Carlyle had invested 16 dollars in fossil fuels, a stark contrast to the trajectory needed to limit global warming to 1.5°C overall. Carlyle’s fossil fuel investments extend globally, with Carlyle’s significant ownership stakes in companies engaged in upstream, midstream, and downstream fossil fuel assets.

One notable example is Neptune Energy, co-founded by Carlyle in 2015, which has expanded its oil and gas exploration and production despite the imperative to phase out fossil fuels (Carlyle sold its stake in Neptune Energy in January 2024).

Reclaim Finance wrote:

The exploration and production company that was co-founded by Carlyle in 2015 and its management team consists of former employees of fossil fuel companies such as Shell, Chevron, and BP³. Neptune Energy has grown in part by buying fossil assets from companies that are decarbonizing their portfolios, such as ENGIE, and continuing to operate them⁴.

Currently, Neptune Energy plans to continue expanding its upstream oil and gas assets, although halting investment in new oil and gas production projects is a critical first step to meeting the 1.5°C imperatives. Indeed, it has 114,1 millions of barrels of oil equivalent (mmboe) of short-term expansion plans and significant operations in the Arctic, including licenses in the Barents Sea, an endangered region with abundant Arctic wildlife⁵.

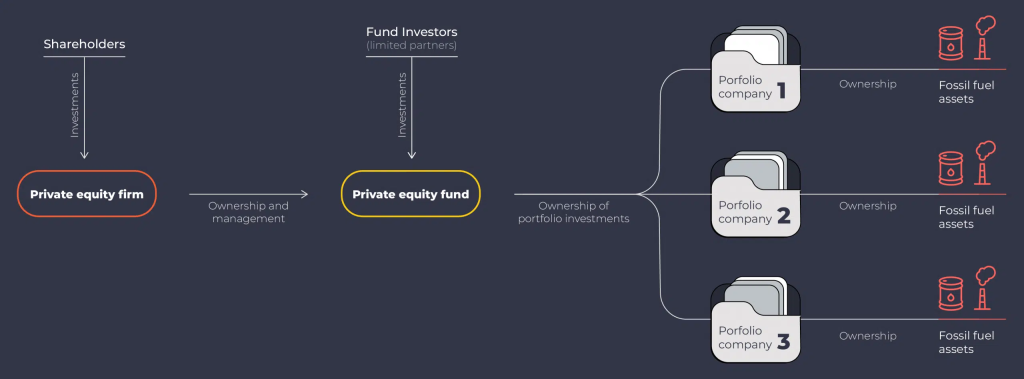

Simplified illustration of how private equity works, using the fossil fuel sector as an example (from Reclaim Finance)

Shareholder Complicity

Despite Carlyle’s portrayal of commitment to net-zero greenhouse gas emissions by 2050, Reclaim Finance identifies that the firm’s shareholders, including major institutional investors like BlackRock and JPMorgan Asset Management, have failed to hold the firm accountable. At Carlyle’s recent Annual General Meeting, shareholders overwhelmingly supported the re-election of board members.

Call for Action

Reclaim Finance urges Carlyle shareholders to reassess their approach and demand accountability from the firm. Specifically, Reclaim Finance recommended shareholders push for Carlyle to disclose all portfolio emissions and fossil fuel investments and to adopt a climate strategy aligned with a 1.5°C pathway. Reclaim Finance noted that Carlyle should adopt sectoral policies restricting fossil fuel assets and halting expansion in existing portfolio companies:

Carlyle shareholders must change their approach before the next annual meeting in 2024 to hold directors accountable for the firm’s failure to disclose all portfolio emissions (scope 1, 2, and 3) and fossil fuel companies; and most important, for its failure to develop a climate strategy consistent with a 1.5°C pathway. To align with a 1.5°C pathway, Carlyle must urgently adopt public sectoral policies that include, at a minimum, the restriction of all fossil fuels assets in all new funds and an end to fossil fuel expansion in companies already in the portfolio.

In conjunction with Private Equity Climate Risks research, Reclaim Finance highlights the significant role private equity firms like Carlyle play in perpetuating climate change through investments in fossil fuels. The organization underscores the importance of shareholder activism in driving meaningful change towards a more sustainable future. Investors in Carlyle’s funds should press for the firm to disclose climate impacts, halt new investments in fossil fuels, and transition existing investments.

The Private Equity Climate Risks project is a collaborative effort investigating private equity’s impact on the climate crisis by Americans for Financial Reform Education Fund (AFREF), Global Energy Monitor (GEM), and the Private Equity Stakeholder Project (PESP). Read more at: www.peclimaterisks.org.

- “Neptune Energy awarded new licences in Norway,” Media release, Jan 16, 2024, https://www.neptuneenergy.com/media/press-releases/year/2024/neptune-energy-awarded-new-licences-norway.

- “Neptune Energy completes Eni and Vår Energi transactions,” Media release, Jan 16, 2024, https://www.neptuneenergy.com/media/press-releases/year/2024/neptune-energy-completes-eni-and-var-energi-transactions.

- Currently, 49% of Neptune Energy is owned by China Investment Corporation, 30.6% by The Carlyle Group and 20.4% by CVC Capital Partners. Neptune Energy, About us, accessed in November 2023.

- Neptune Energy, Neptune Energy completes the acquisition of ENGIE E&P International SA, February, 2018, accessed in November 2023 and ENGIE, ENGIE enters into exclusive negotiations for the sale of its 70% interest in Exploration & Production International, May 2017, accessed in November 2023.

- Urgewald, Global Oil and Gas Exit List 2023, Neptune Energy, Operations and Urgewald, Reputational risk projects: Wisting Oil Field and Barents Sea.