It should come as no surprise that KKR-owned Envision Healthcare has finally declared bankruptcy

June 6, 2023

On May 15, 2023, KKR-owned Envision Healthcare filed for Chapter 11 bankruptcy.[1]

Looking at the Chief Transformation Officer’s declaration filed concurrently with Envision’s bankruptcy petition, one might think that Envision was an underdog up against the Goliathan COVID-19 pandemic, big bad UnitedHealthcare, and the “flawed” implementation of the No Surprises Act.[2]

But for anyone who has been following the Envision bankruptcy saga, it’s easy to see Envision’s real challenges: the unwieldy amount of debt saddled onto it by its private equity owner, and the bipartisan No Surprises Act that put the nail in the coffin of its surprise billing business strategy.[3]

In other words, Envision’s bankruptcy was of its own and KKR’s making.

It began with KKR’s $9.9 billion leveraged buyout of Envision in 2018, [4] which Reuters reported was one of the largest buyouts since the financial crisis.[5] KKR used approximately $7 billion in debt for the acquisition—about 70.7% of the overall deal.[6] This debt was not taken on by KKR, but rather loaded onto Envision.[7]

Using high amounts of leverage to acquire companies can be a major risk if market conditions suddenly change and a company must meet its debt service obligations amidst falling revenues.

Indeed, the billions in debt would become a major liability for Envision as the regulatory landscape around surprise billing began to shift, and as the pandemic disrupted operations as usual for both the emergency physician staffing arm of Envision’s business, as well as their ambulatory surgery center staffing and management business.

Envision’s business model has historically relied on the inelastic demand of emergency medical care coupled with a strategy of out-of-network billing to charge much higher than average rates to patients via surprise bills.[8]

KKR acquired the company even though it was facing scrutiny over its use of surprise billing. In 2017, researchers at Yale University had published findings that demonstrated that when Envision entered into a new contract with a hospital, it would “immediately exit networks, bill as out-of-network providers, and seek to collect their charges (which they also [raised] by 96 percent relative to the charges billed by the prior physician charges).”[9] Shortly after the research was published, the New York Times covered the findings,[10] drawing national attention to Envision’s role in the issue of surprise medical billing.

The concerning findings were also cited by Senator Claire McCaskill (D-MO). In September 2017, Senator McCaskill initiated an inquiry into Envision’s business practices, requesting information from the company’s CEO.[11] These developments did not deter KKR from acquiring Envision: in June 2018, KKR announced the pending acquisition. [12]

When legislative efforts ramped up in 2019 to regulate surprise billing, [13] Envision lobbied extensively (spending millions of dollars via a dark money campaign alongside Blackstone-owned TeamHealth) to prevent federal regulations that would limit the practice,[14] but these efforts ultimately failed when the No Surprises Act became law in December 2020[15] and went into effect in January 2022.[16]

Paul Keglevic’s (Chief Transformation Officer) statements in support of Envision’s Chapter 11 petition blame the “flawed” implementation of the No Surprises Act, rather than the act itself, as one of the factors contributing to the bankruptcy, writing: “Envision supported the patient protections in the No Surprises Act” and that “While the legislative policy behind the No Surprises Act is sound, the regulatory implementation of the No Surprises Act has been highly flawed, ultimately shifting the power dynamic in payment disputes too far in favor of insurance companies.”[17]

In the same disclosure statement, Keglevic cites COVID-19 as a major challenge facing the company, while taking the opportunity to boast of Envision’s importance in providing care during this critical time: “Envision’s emergency medicine clinicians and anesthesiologists experienced sharp, overwhelming, and localized surges of COVID-19 patients early in the pandemic—at the height of the pandemic, Envision’s clinicians treated approximately 1 in 10 COVID-19 patients.”[18]

Yet, a damning investigative report from ProPublica published in April 2020 cited how Envision cut “pay and benefits for emergency room doctors and other medical workers” at the beginning of the pandemic, while continuing to spend millions on a dark money campaign against surprise billing legislation.[19] Axios also reported in April 2020 that Envision had received CARES Act money, likely to the tune of $100 million.[20]

By June 2021, Envision had received at least $270 million in CARES Act funds.[21] This tidbit of information was not shared in the “COVID-19” section of Keglevic’s declaration.

In March 2022, researchers Eileen Appelbaum and Rosemary Batt declared that Envision Healthcare had “hit the skids,” arguing that Envision would have to pivot back to a surprise billing strategy, “if it was to meet its debt obligations.”[22] Yet, this was not a possibility given that the No Surprises Act had gone into effect a few months earlier.[23]

Appelbaum and Batt predicted that KKR would adopt a familiar private equity strategy to protect Envision’s more valuable assets as it headed toward a potential bankruptcy, explaining:

“Drawing on lessons from other PE-owned companies facing financial distress —like Nine West, J. Crew, and Sears—KKR will likely emerge unscathed by dividing Envision into two companies, one with the valuable assets and the second with the remaining assets…. KKR may divide Envision’s assets, with ‘Bad Envision’ holding the least profitable assets and the debt, while ‘Good Envision’ gets to make a clean start and raise new debt to pay off creditors holding the debt of Bad Envision, at significantly less than 100 cents on the dollar.”[24]

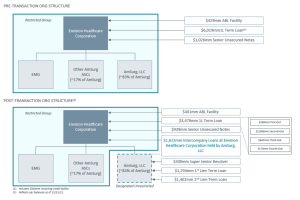

Envision’s bankruptcy was the culmination of credit downgrades and distressed debt exchanges beginning in 2020, in which KKR and Envision, with the help of high-powered law firms, nimbly shielded their most valuable assets from some of their original creditors,[25] as predicted by Appelbaum and Batt.[26] Figure 1, taken straight from Envision’s bankruptcy documents, shows how the profitable AMSURG was cordoned off from the rest of Envision.

As part of the Chapter 11 restructuring, Envision plans to sell its remaining ambulatory surgical centers to AMSURG for $300 million and a waiver of intercompany loans between the two.[27] Envision has reportedly been working with Goldman Sachs since January 2023 to find a buyer for the AMSURG business, as well.[28]

Figure 1: Envision’s org structure before and after its “2022 liability management transactions.”[29]

On September 21, 2022, Moody’s Investor Service downgraded Envision Healthcare to its lowest corporate credit rating. In its rating report, Moody’s explained:

“With respect to governance, Envision Healthcare has an aggressive financial strategy characterized by high financial leverage, shareholder-friendly policies, and the pursuit of acquisitive growth. This is largely due to its private equity ownership by KKR since its leveraged buyout in 2018. Lastly, the company executed a distressed exchange in April 2020, April 2022 and again in July 2022.”[30]

Leading up to its bankruptcy filing, Envision missed a March 31, 2023 reporting deadline for its quarterly financials,[31] and then missed a $40 million interest payment in April.[32]

Envision’s worforce is already being impacted. In March, Envision announced it would lay off 167 New York employees, and it announced another layoff of 162 workers in Pennsylvania in May.[33] Most of Envision’s $7 billion in debt has been trading below 10 cents on the dollar in recent weeks.[34]

Medical debt is one of the leading causes of bankruptcy in the United States,[35] and surprise medical billing has likely contributed to this issue.[36] Envision Healthcare’s extractive business model of surprise billing that can saddle medical debt onto patients has come full circle as Envision enters bankruptcy itself, saddled with debt by its private equity owner and amidst the regulatory challenges posed by the No Surprises Act.

Yet, unlike the ordinary Americans who may end up in life-changing bankruptcies because of their medical debt, and the workers who are already being laid off at Envision, Envision’s private equity investors will likely be just fine.[37] Ahead of the bankruptcy filing, WSJ reported that the KKR fund that owns Envision had already written off the investment, and “still had a net annualized return of 19%, according to people familiar with the matter.”[38]

All in all, Envision’s narrative[39] for why it needed to file for bankruptcy skirts around the elephant in the room – the billions of dollars in debt that KKR saddled onto the company in one of the largest leveraged buyouts since the financial crisis. Without its unwieldy debt obligations, it is possible Envision could have successfully reacted to the changing tides stemming from shifting market conditions and the No Surprises Act. Despite its “sound” physician services business and the $1.2 billion in revenue generated by AMSURG in 2022,[40] it needed to file for Chapter 11 because it was suffocating under billions in debt.

As Americans struggle to afford healthcare and even delay needed care in order to avoid expensive bills, our healthcare and political system allows investors to recklessly saddle healthcare companies with debt and run them into the ground without consequence. Envision’s saga—from surprise billing, to its leveraged buyout, to its layoffs of doctors at the start of the pandemic, to its credit downgrades and now its bankruptcy—is a chilling indictment of the U.S. healthcare system and the opportunities it cultivates for private equity investors to loot companies and profit at the expense of workers and affordable patient care.

[1]Reuters. “KKR-Backed Envision Healthcare Files for Bankruptcy | Reuters.” May 15, 2023. https://www.reuters.com/markets/deals/kkr-backed-envision-healthcare-files-bankruptcy-2023-05-15/.

[2] See pgs. 2,3, and 4; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[3] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[4] Stinnet, Joel. “Envision Healthcare Completes $9.9 Billion Sale to KKR.” Nashville Business Journal. Accessed October 13, 2022. https://www.bizjournals.com/nashville/news/2018/10/11/completion-of-9-9b-deal-leaves-nashville-with-one.html.

[5] Brooke, David, and David Weinman. “Envision US$5.45bn TLB Sinks as US Healthcare Debate Rages.” Reuters, August 28, 2019. https://www.reuters.com/article/envision-us545bn-tlb-sinks-as-us-healthc-idCNL2N25O14W.

[6] Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[7] Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[8] Cooper, Zack, Fiona Scott Morton, and Nathan Shekita. “Surprise! Out-of-Network Billing for Emergency Care in the United States.” Cambridge, MA: National Bureau of Economic Research, July 2017. https://doi.org/10.3386/w23623.

[9] Pg. 4, Cooper, et al.

[10] Creswell, Julie, Reed Abelson, and Margot Sanger-Katz. “The Company Behind Many Surprise Emergency Room Bills.” The New York Times, July 24, 2017, sec. The Upshot. https://www.nytimes.com/2017/07/24/upshot/the-company-behind-many-surprise-emergency-room-bills.html.

[11] U.S. Senate Committee on Homeland Security & Governmental Affairs. “Rising Emergency Room Costs in Missouri Is Focus of McCaskill Inquiry,” September 25, 2017. https://www.hsgac.senate.gov/media/minority-media/rising-emergency-room-costs-in-missouri-is-focus-of-mccaskill-inquiry.

[12] Merced, Michael J. de la. “K.K.R. Said to Be Near Deal to Acquire Envision Healthcare.” The New York Times, June 11, 2018, sec. Business. https://www.nytimes.com/2018/06/10/business/dealbook/kkr-envision-healthcare-deal.html.

[13] Pallone, Frank. “H.R.3630 – 116th Congress (2019-2020): No Surprises Act.” Legislation, July 11, 2019. 2019/2020. https://www.congress.gov/bill/116th-congress/house-bill/3630.

[14] Arnsdorf, Isaac. “Medical Staffing Companies Cut Doctors’ Pay While Spending Millions on Political Ads.” ProPublica, April 20, 2020. https://www.propublica.org/article/medical-staffing-companies-cut-doctors-pay-while-spending-millions-on-political-ads

[15] American Medical Association. “Implementation of the No Surprises Act.” Accessed October 26, 2022. https://www.ama-assn.org/delivering-care/patient-support-advocacy/implementation-no-surprises-act.

[16] CMS.gov. “Surprise Billing & Protecting Consumers.” CMS.gov, January 14, 2022. https://www.cms.gov/nosurprises/Ending-Surprise-Medical-Bills.

[17] Pg.3; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[18] Pg.2; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[19] Arnsdorf, Isaac. “Medical Staffing Companies Cut Doctors’ Pay While Spending Millions on Political Ads.” ProPublica, April 20, 2020. https://www.propublica.org/article/medical-staffing-companies-cut-doctors-pay-while-spending-millions-on-political-ads.

[20] Herman, Bob. “Health Care Bailout Fund Reaches $175 Billion.” Axios, April 22, 2020. https://www.axios.com/2020/04/22/health-care-bailout-fund-coronavirus-175-billion.

[21] Moody’s Investor Service. “Moody’s Affirms Envision Healthcare’s CFR at Caa2; Outlook Changed to Stable.” Moodys.com, October 18, 2021. http://www.moodys.com:18000/research/Moodys-affirms-Envision-Healthcares-CFR-at-Caa2-outlook-changed-to–PR_456377.

[22] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[23] CMS.gov. “Surprise Billing & Protecting Consumers.” CMS.gov, January 14, 2022. https://www.cms.gov/nosurprises/Ending-Surprise-Medical-Bills.

[24] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[25] Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[26] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/.

[27] Pg.10; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[28] Pg.10; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[29] Pg. 8; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.

[30] Moody’s Investor Service. “Moody’s Downgrades Envision Healthcare Corporation to C, Outlook Stable.” Moodys.com, September 21, 2022. http://www.moodys.com:18000/research/Moodys-downgrades-Envision-Healthcare-Corporation-to-C-outlook-stable–PR_469479.

[31] Gottfried, Miriam, and Alexander Saeedy. “WSJ News Exclusive | KKR-Backed Envision Healthcare Plans Chapter 11 Bankruptcy Filing.” Wall Street Journal, May 9, 2023, sec. Markets. https://www.wsj.com/articles/kkr-backed-envision-healthcare-plans-chapter-11-bankruptcy-filing-2fff4382.

[32] Shi, Madeline. “KKR’s Equity at Risk in Envision Healthcare Debt Restructuring Talks | PitchBook,” April 20, 2023. https://pitchbook.com/news/articles/KKR-Envision-Healthcare-PE-debt-equity.

[33] Condon, Alan. “Envision Plans Layoffs in New York, Pennsylvania.” Becker’s Hospital Review, May 11, 2023. https://www.beckershospitalreview.com/finance/envision-plans-layoffs-in-new-york-pennsylvania.html.

[34] Gottfried, Miriam, and Alexander Saeedy. “WSJ News Exclusive | KKR-Backed Envision Healthcare Plans Chapter 11 Bankruptcy Filing.” Wall Street Journal, May 9, 2023, sec. Markets. https://www.wsj.com/articles/kkr-backed-envision-healthcare-plans-chapter-11-bankruptcy-filing-2fff4382.

[37] Appelbaum, Eileen, and Rosemary Batt. “Envision Healthcare Hits the Skids.” The American Prospect, March 14, 2022. https://prospect.org/api/content/dee32e40-a176-11ec-bb52-12f1225286c6/; Ronalds-Hannon, Eliza, and Davide Scigliuzzo. “The Debt Deal That Shows How Ugly Things Are Getting for Lenders.” Bloomberg.Com, October 5, 2022. https://www.bloomberg.com/news/articles/2022-10-05/kkr-s-envision-deal-shows-how-ugly-creditor-battles-are-getting.

[38] Gottfried, Miriam, and Alexander Saeedy. “WSJ News Exclusive | KKR-Backed Envision Healthcare Plans Chapter 11 Bankruptcy Filing.” Wall Street Journal, May 9, 2023, sec. Markets. https://www.wsj.com/articles/kkr-backed-envision-healthcare-plans-chapter-11-bankruptcy-filing-2fff4382.

[39] as represented in Keglevic’s declaration supporting the Chapter 11 petition.

[40] Pg. 12; “Declaration of Paul Keglevic, Chief Restructuring Officer of Envision Healthcare Corporation, In Support of the Debtor’s’ Chapter 11 Petitions.” United States Bankruptcy Court for the Southern District of Texas Houston Division, May 15, 2023. https://www.courtlistener.com/docket/67385012/2/envision-healthcare-corporation/.