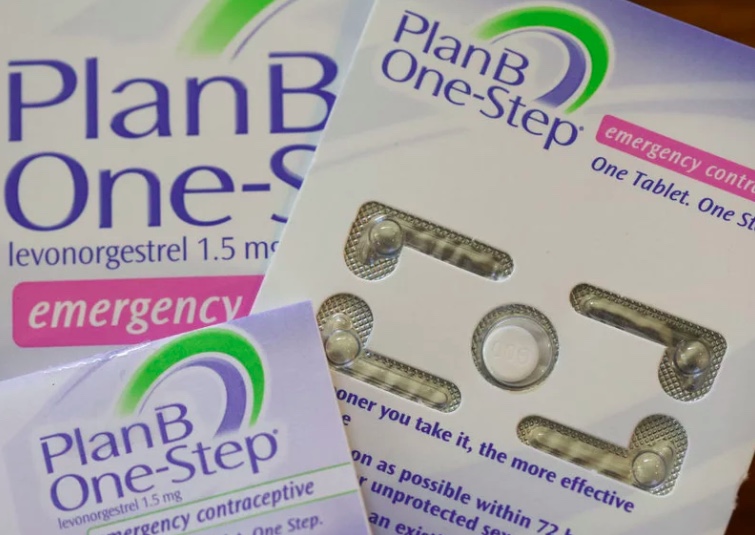

KHN Series: PATIENTS FOR PROFIT: HOW PRIVATE EQUITY HIJACKED HEALTH CARE: Misinformation Clouds America’s Most Popular Emergency Contraception

July 25, 2022

Private equity firms Kelso & Co. and Juggernaut Capital Partners acquired Plan B in 2017, when “the campaign to end federal abortion rights, cresting after decades of legal challenges, would have made the purchase of the nation’s most popular emergency contraception a tantalizing option,” KHN writes.

KHN, June 7, 2022: Misinformation Clouds America’s Most Popular Emergency Contraception

PESP Healthcare director Eileen O’Grady told KHN, “With customers buying up Plan B, this could be very good for their investors regardless of their level of comfort profiting off of Plan B.”

Center for Economic and Policy Research co-director Eileen Appelbaum observed, “Private equity senses a possibility wherever vulnerable people are involved.”

KHN reports that while industry experts say the $45 average price tag for Plan B can be maintained because of its market dominance, the Supreme Court decision on Roe v Wade permitting states to criminalize abortion and certain contraceptives may mean that Kelso and Juggernaut’s investment could be imperiled.

According to KHN, one of the biggest investors in two Kelso funds invested in Foundation Consumer Products, which sells Plan B, is the Teachers’ Retirement System of Louisiana. Louisiana is one of at least 13 states with trigger laws that would ban abortion if Roe v Wade falls. Other investors from anti-abortion states include the University of Houston System endowment and the Houston Police Officers’ Pension System.