Kroger-Albertsons merger, $4 billion dividend will line private equity pockets at the expense of consumers

January 20, 2023

Private equity firm Cerberus Capital management is providing the world with yet another example of how the past year’s record inflation has been largely caused by corporate greed and excessive profits.

On January 17, the Washington State Supreme Court refused to review a case halting the $4 billion debt-funded dividend that Cerberus and other private equity owners are collecting from grocery store chain Albertsons ahead of its proposed merger with Kroger.

In October 2022, grocery giant Kroger announced plans to buy competitor Albertsons for $24.6 billion. Shortly after, Albertsons announced a $4 billion dividend payout to investors, $1 billion of which would go to one private equity firm, Cerberus Capital Management.

This is a controversial financial tactic called a dividend recapitalization, where a private equity firm borrows money against a company it owns to pay itself cash dividends. The proposed dividend would deplete much of Albertsons’ currently available cash, funded with $2.5 billion in cash and $1.5 billion in debt.

The dividend payout was temporarily halted by a Washington judge until a hearing on January 17, after Attorney General Bob Ferguson sued to delay the payout until regulators make a decision on whether or not to approve the merger. In a statement Tuesday, Albertsons said it would “immediately begin the process of paying” the $4 billion dividend.

The companies that will profit from the merger and from the dividend will do so on the backs of consumers that are already burdened with record cost of living increases.

While grocery stores see increased profits, food prices skyrocketed by 11.2% from September 2021 to September 2022. Many factors, from supply chain issues to war in Ukraine, have driven record inflation in the past year, but this $4 billion money grab makes clear that grocery giants are choosing to increase prices to make huge profits.

Cerberus, the private equity company that controls the Alberton’s board that approved the $4 Billion payout, has a history of controversy, including a military contractor that trained those involved in the murder of Jamal Khashoggi; a $9M settlement after accusations of defrauding the federal government; housing scandals involving evictions during COVID-era moratoriums, housing code violations, and gentrification; as well as deep ties to multiple Republican administrations.

Despite its controversial investments, Cerberus has historically been notoriously media shy. In 2007, Cerberus CEO Stephen Feinberg famously said, “We try to hide religiously. If anyone at Cerberus has his picture in the paper and a picture of his apartment, we will do more than fire that person. We will kill him. The jail sentence will be worth it.”

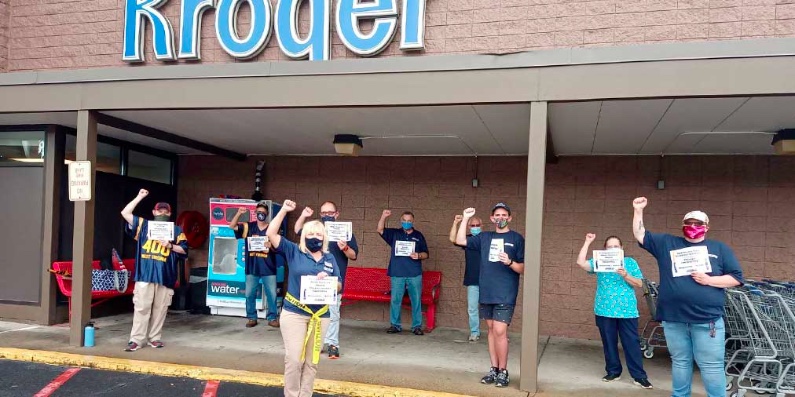

The dividend has been widely criticized because Cerberus may be profiting at the expense of consumers. UFCW Local 770, which represents grocery workers at Albertsons stores, said that the dividend will “devalue the company at a time when consumers are facing crushing inflation.” In a statement, UFCW Local 3000 shared “we are disappointed to see a ruling that favors a small number of ultra-wealthy shareholders over the many thousands of essential workers and millions of Americans who will be left to suffer the consequences of the outright financial looting of Albertsons.”

Senators Klobuchar, Blumenthal, and Booker wrote to Lina Khan, chair of the Federal Trade Commission, expressing concern regarding the merger and the effects it could have on food prices. Bob Ferguson, the Washington State Attorney General who filed the suit that halted the dividend cited concerns regarding the potential for food prices to rise and the effect on unionized workers.

Cerberus-owned Albertson’s has used inflation as an excuse to raise prices and drastically increase profits, while taking a huge payout with this dividend instead of lowering prices for its customers. Albertsons’ cash has nearly doubled to $3.4 billion since February 2021 as consumers have faced an 18% increase in food prices over the same period.

While Cerberus and other Albertsons investors line their pockets, consumers will see store closures and limited competition that may further drive up food prices. Halting the dividend payout is a necessary step in ensuring consumers are not hurt by this merger.