New Climate Risks Scorecard Outlines Clear Demands of the Private Equity Industry

October 4, 2022

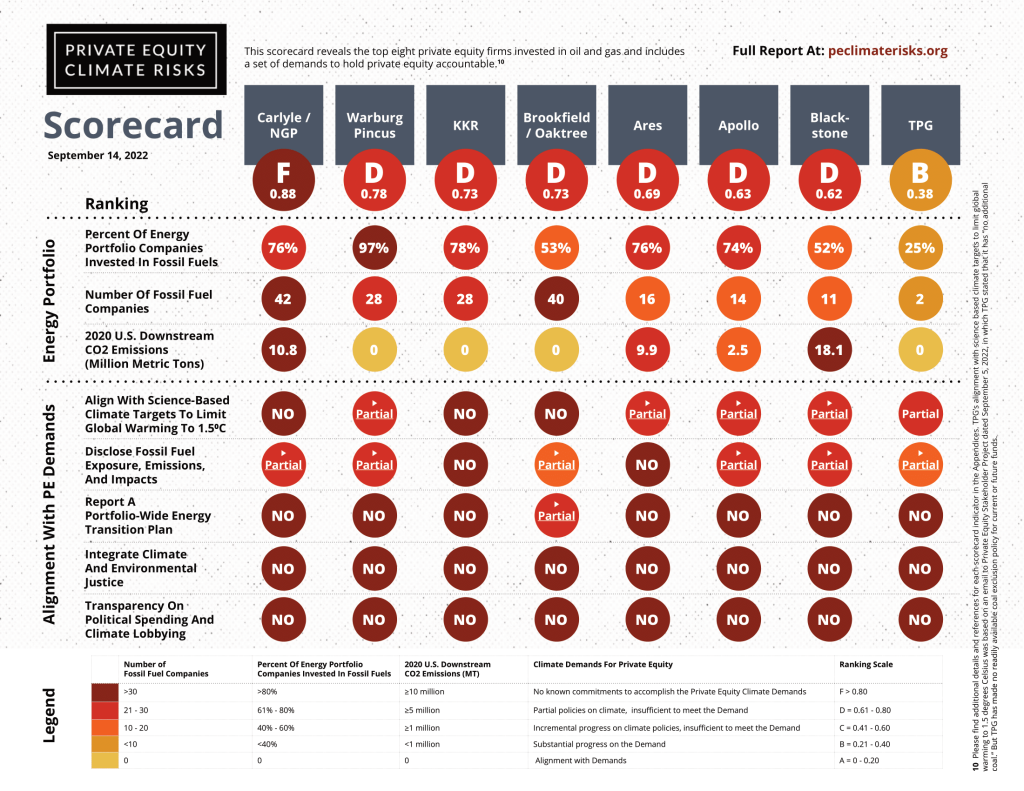

PESP and Americans for Financial Reform Education Fund (AFREF) released the Private Equity Climate Risks Scorecard which provides first-of-its-kind research and analysis of eight private equity firms with some of the largest energy portfolios in the world and a combined $3.6 trillion in assets under management. The analysis and resulting scores are based on four indicators that provide a measure of the firms’ energy holdings, percent of their energy portfolio in fossil fuels, downstream carbon dioxide emissions, and alignment with a set of endorsed Climate Demands.

The Carlyle Group and its subsidiary NGP Energy Partners rank last with an “F” grade, due to their surpassingly dirty portfolio of fossil fuel holdings and weak climate policies. Following Carlyle are Warburg Pincus, KKR, Brookfield and its subsidiary Oaktree, Ares, Apollo, Blackstone, and TPG.

The report also outlines five Climate Demands to assess the firms’ commitment to a just energy transition and grades their progress on their commitments:

- Alignment with science-based climate targets to limit global warming to 1.5 degrees Celsius;

- Disclosure of fossil fuel exposure, emissions, and impacts;

- Reporting of a portfolio-wide energy transition plan;

- Integration of climate and environmental justice;

- Providing transparency on political spending and climate lobbying

The Private Equity Climate Scorecard demonstrates that all eight private equity buyout firms’ investments are exposed to fossil fuels in their energy portfolios, placing their investors and the public at risk. As private equity continues to operate and expand fossil fuel capacity and infrastructure, the underlying assets are highly leveraged – leading to increased risks of bankruptcy, stranded assets, and financial contagion, often with the state bearing the costs of environmental cleanup as well as poor investment returns.

The billions of dollars private equity firms have invested to drill, frack, transport, store, and refine fossil fuels, stand in contrast to what climate scientists and international policymakers have called for to align our trajectory to the 1.5 degrees Celsius warming scenario.

Limiting global temperature rise to 1.5 degrees Celsius above pre-industrial levels can help stabilize long-term impacts from climate change. According to the United Nations Intergovernmental Panel on Climate Change (IPCC):

“…temperature rise to date has already resulted in profound alterations to human and natural systems, including increases in droughts, floods, and some other types of extreme weather; sea level rise; and biodiversity loss – these changes are causing unprecedented risks to vulnerable persons and populations”

The IPCC has made clear that the 1.5 degrees Celsius warming threshold is on track to be breached in the early 2030s, making the next eight years crucial for emissions reductions.

In May 2021, the International Energy Agency announced that a cessation of new oil, gas and coal investments was needed for alignment with a 1.5 degrees Celsius warming scenario. Without a regulatory standard for disclosing climate commitments, it is unclear what is being done by private equity asset managers to realize commitments to mitigate climate risks, transition energy holdings and implement transition plans. More clarity is essential around the investment funds that private equity asset managers have tied up in fossil fuel companies. These PE firms are the fiduciaries of billions of dollars of public sector workers’ retirement savings, and these public pension funds continue to be exposed to significant financial risks because of private equity’s existing portfolio of polluting assets.

Society cannot afford to let private markets continue to pollute under the shroud of darkness. The institutional investors whose retirement capital is at risk, the communities harmed by fossil fuel extraction and impacted by climate change, workers and the public deserve transparency and a rapid transition away from dirty energy from the private equity industry. The policymakers and regulators who govern financial markets, as well as private equity’s investors, must require comprehensive disclosures and transition plans.

Since the release of the scorecard, it has been featured in multiple media outlets including The Guardian, Bloomberg, and CBS. Actor and activist Mark Ruffalo also joined the scorecard buzz by retweeting The Guardian’s coverage of our report:

Eleven organizations endorsed the scorecard and demands: Action Center on Race and the Economy, Climate Finance Action, Food & Water Watch, Friends of the Earth, Greenpeace, Little Sis, Natural Resources Defense Council, Public Citizen, Sierra Club, Stand.earth, and The Sunrise Project.

Scorecard endorsing organization, National Resources Defense Council (NRDC), analyzed the scorecard in a blog post, and European finance watchdog Reclaim Finance also posted an assessment of private equity’s role in climate change.

A briefing on the scorecard is available on our YouTube page—featuring PESP, AFREF, Stand.earth, and ACRE. You can also visit the scorecard at PEClimateRisks.org to download the report and sign up for more research updates.