NGP emissions grow under Carlyle ownership

August 23, 2023

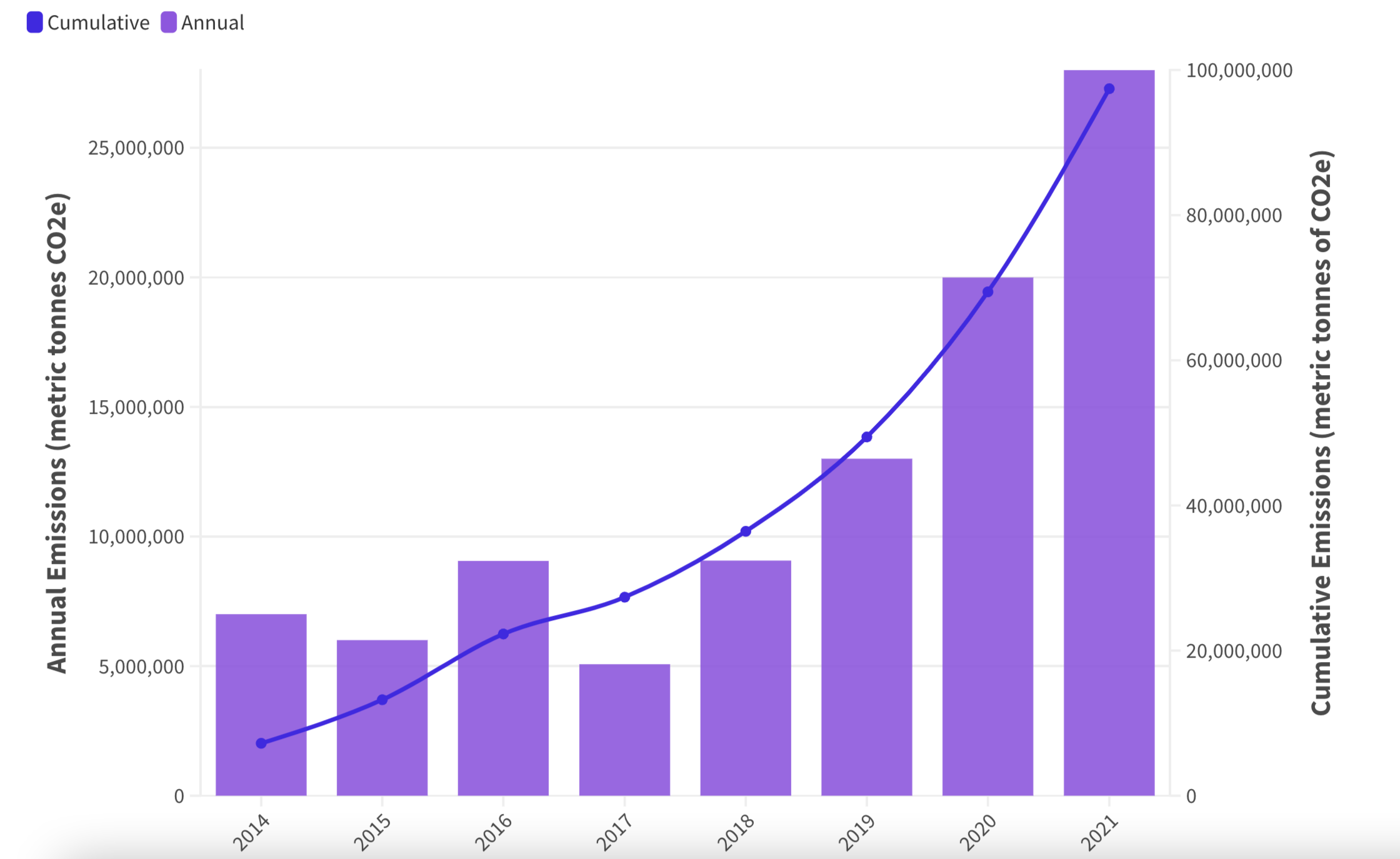

NGP Energy Capital Management (NGP or also called “Natural Gas Partners”) claims to be at the forefront of transitioning to a low-carbon economy, through “partner[ing] with first-in-class entrepreneurs building oil and gas companies that are improving their emissions intensity of energy production while maximizing returns to investors”.[1] NGP lists 23 fossil fuel companies on their website, most of which are conventional exploration and production companies.[2] The private equity firm is headquartered in Dallas, Texas pursuing mostly upstream and oil and gas assets in the western United States since 1988.[3] Since 2012, private equity giant The Carlyle Group (Carlyle) has held a majority stake in NGP according to SEC filings.[4] Recent filings show that around half of Carlyle’s profits in 2022 came from NGP revenue.[5] Based on an emissions analysis from a dataset consisting of a quarter of NGP’s portfolio from 2014-2021, the firm released at least an estimated total of 97 million metric tons of carbon dioxide equivalent.[6] NGP’s emissions account for over a third of Carlyle’s combined upstream and midstream estimated emissions for that period, see Figure 1[7] – suggesting that NGP’s entire upstream portfolio emission impact is likely much larger.

Figure 1. NGP Upstream and Midstream Emissions (metric tonnes CO2e)

Ceres and Clean Air Task Force’s 2023 Benchmarking Methane and Other GHG Emissions report measured and ranked greenhouse gas (GHG) intensities of the top 100 oil and gas producers. Three of NGP’s portfolio companies ranked in the top 25 for overall GHG intensity – Tap Rock Resources (16), Blackbeard Operating (17), and Permian Resources (25).[8] GHG intensity is a metric to measure GHG emissions released during energy production.[9] NGP’s portfolio companies had a larger GHG intensity than oil and gas heavyweights ExxonMobil, ConocoPhilips, Occidental and Chevron, per the report’s analysis. Blackbeard and Tap Rock even beat out one of the nation’s largest non-public producers Hilcorp Energy, which ranked 20th in the analysis. Hilcorp’s business model includes “bringing new life to legacy assets that are often decades old”, which includes a track record of violations, spills, and reputation in Alaska “as a risk-taking vulture compelled to squeeze every last drop from oil fields that have seen better days” according to Bloomberg reporting.

Tap Rock Resources, one of the aforementioned high GHG intensity portfolio companies, was created in 2016 by NGP. Since 2017, according to data from the New Mexico Oil Conservation Division, Tap Rock has reported nearly 4,800 incidents, primarily gas flaring incidents. Over 600 of these incidents were considered “major,” meaning unauthorized releases sufficiently large to endanger human health, threaten water sources, or result in a fire.[11] The EPA also issued informal notices at Tap Rock sites, including the Pliny facility in Eddy County, near Carlsbad, which was deemed a high-priority violation of the Clean Air Act, and remained out of compliance over a two-year period between 2020 and 2022.[12] Tap Rock Resources was funded through NGP Natural Resources Fund XI and XII,[13] Notably, NGP is now fundraising a oil and gas fund that is the successor to the one which funded Tap Rock called NGP Natural Resources XIII, as well as another fossil fuel fund, NGP Royalty Partners II. The Natural Resources XII fund raised $4.3 billion dollars in 2019 while the new Natural Resources XIII is seeking to raise only around half as much, $2.5 billion.[14]

NGP fundraising efforts come in the midst of declines in private markets fundraising globally,[15] and for energy funds in particular. Bloomberg reported that “some energy-focused buyout firms are dialing back their fundraising ambitions as institutional investors shy away from fossil fuels.”[16]Bloomberg listed NGP as one of the firms “in the market with new funds that are smaller than their last pools of capital, as pension funds, university endowments, insurance companies and other investors retreat from the space.”[17] Trade publication New Private Markets reported that oil and gas funds face challenges in liquidity, regulatory policy, and demand uncertainty.[18] Despite such headwinds, in a June 2023 presentation to the Boston Retirement System, NGP claimed “we are in one of the most favorable energy investment environments in decades”.[19]

In 2022, NGP joined 681 asset owners who are signatories of the United Nations Principles for Responsible Investment (UNPRI).[20] The firm recently closed NGP Energy Transition IV fund at $700 million, approximately 28% the size of their current $2.5 billion fundraising goal for its oil and gas Natural Resources XIII.[21] Of the 20 energy transition portfolio companies listed on NGP’s website, only one is a utility-scale energy producer, Nuscale, which develops small nuclear module reactors.[22] Other companies specialize in data analytics, software, finance, EV charging, and carbon capture and offsets.

Strikingly, NGP, its fossil-fuel-laden portfolio, and its relationship to parent company Carlyle have been the subject of media intrigue over the last year. A story by the Guardian spoke of the effects NGP’s fossil fuel companies had on local communities. The piece reported, “Fossil fuel power plants affiliated with Carlyle or NGP are overwhelmingly located in communities with proportionately higher numbers of residents of color and low-income families than the state average.” An investigation by the AP in 2022 called NGP’s fossil fuel emissions and the associated profits being passed to Carlyle into question—contrary to Carlyle’s published emissions declarations. In the story, Dr. Sean Field, Centre for Energy Ethics at University of St. Andrews in Scotland, said, “They are telling one story to investors and doing something else that gets results.” In all, NGP must do more to realize the environmental consequences of its energy portfolio and the local communities that bear those consequences directly.

[1] https://ngpenergy.com/esg/

[2]https://ngpenergy.com/portfolio/#natural-resources Accessed Aug. 27, 2023

[3]https://ngpenergy.com/portfolio/; https://www.psers.pa.gov/About/Board/Resolutions/Documents/2018/res37.pdf

[4] https://6000718.fs1.hubspotusercontent-na1.net/hubfs/6000718/PE%20Climate%20Risks/PECR_Report_Carlyles-Hidden-Climate-Impact_April2023.pdf

[5] Ibid

[6] This analysis is based on data from the Private Equity Climate Risks project, which studies the role of the private equity industry in the climate crisis. The analysis of a dataset of private equity ownership of fossil fuel companies and assets is developed jointly by researchers from Americans for Financial Reform Education Fund, Global Energy Monitor, and Private Equity Stakeholder Project. The upstream emissions were calculated by partners at Carbon Tracker Initiative using Rystad Energy data, using emissions factors that are broadly in line with the IPCC’s Default Emissions Factors. Data for approximately 24% of NGP’s upstream portfolio was available from Rystad Energy. Fugitive methane emissions from upstream gas extraction points in the US were also calculated using data from Global Energy Monitor’s Gas Index report. Fugitive emissions for midstream assets were calculated utilizing the 2019 Refinement to the 2006 IPCC Guidelines for National Greenhouse Gas Inventories. Volume 2: Energy. Chapter 4: Fugitive Emissions. Additional midstream emissions factors outside of the IPCC table were used when necessary, including those for coal and biomass terminals/storage and cryogenic gas facilities. For cryo gas facilities, the emissions factor used was calculated in 2012 by Ken Chow at energy consultancy Muse, Stancil & Co. See additional source information related to private equity ownership of fossil fuel companies and methodology here: https://6000718.fs1.hubspotusercontent-na1.net/hubfs/6000718/PE%20Climate%20Risks/PECR_Report_Carlyles-Hidden-Climate-Impact_April2023.pdf

[7] Ibid

[8] https://www.ceres.org/sites/default/files/reports/2023-05/OilandGas_BenchmarkingReport_2023.pdf

[9] https://www.oecd.org/innovation/green/toolkit/o4greenhousegasintensity.htm

[10] https://www.bloomberg.com/graphics/2021-tracking-carbon-emissions-BP-hilcorp/#xj4y7vzkg

[11] New Mexico Energy, Minerals and Natural Resources Department. Oil Conservation Division. Incident Search database. Accessed March 23, 2023.

[12] New Mexico State Records Center and Archives. New Mexico Administrative Code. 19.15.29 NMAC. Accessed March 23, 2023.

[13] Civitas Resources Inc.. US Securities and Exchange Commission. Schedule 13G. Washington, DC. At p. 19. Accessed August 16, 2023.https://www.sec.gov/Archives/edgar/data/1691879/000119312523211435/d475672dsc13g.htm

[14]https://www.wsj.com/articles/ngp-is-more-than-halfway-toward-750-million-target-for-energy-transition-fund-11654513201#:~:text=NGP%20XII%20closed%20in%202019,by%20WSJ%20Pro%20Private%20Equity.

https://www.buyoutsinsider.com/ngp-bets-on-dramatic-capital-scarcity-in-energy-as-it-raises-2-5bn-fund-xiii/

[15] https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review

[16] https://www.bloomberg.com/news/articles/2023-07-13/energy-buyout-firms-curb-fundraising-goals-seek-workarounds#xj4y7vzkg

[17] Ibid

[18] https://www.newprivatemarkets.com/in-brief-verus-warns-lp-off-oil-and-gas-as-transition-gathers-steam/

[19] https://www.buyoutsinsider.com/ngp-bets-on-dramatic-capital-scarcity-in-energy-as-it-raises-2-5bn-fund-xiii/

[20]https://www.mckinsey.com/~/media/mckinsey/industries/private%20equity%20and%20principal%20investors/our%20insights/mckinseys%20private%20markets%20annual%20review/2023/mckinsey-global-private-markets-review-2023.pdf https://www.unpri.org/signatory-directory/ngp-energy-capital-management-llc/10685.article

[21] https://www.buyoutsinsider.com/ngp-bets-on-dramatic-capital-scarcity-in-energy-as-it-raises-2-5bn-fund-xiii/

[22] https://ngpenergy.com/portfolio/#energy-transition