PE-backed LNG project marred with setbacks and community opposition

PE-backed Saguaro Energía LNG Facility Project marred with legal setbacks and escalating cross-border community opposition

November 21, 2024

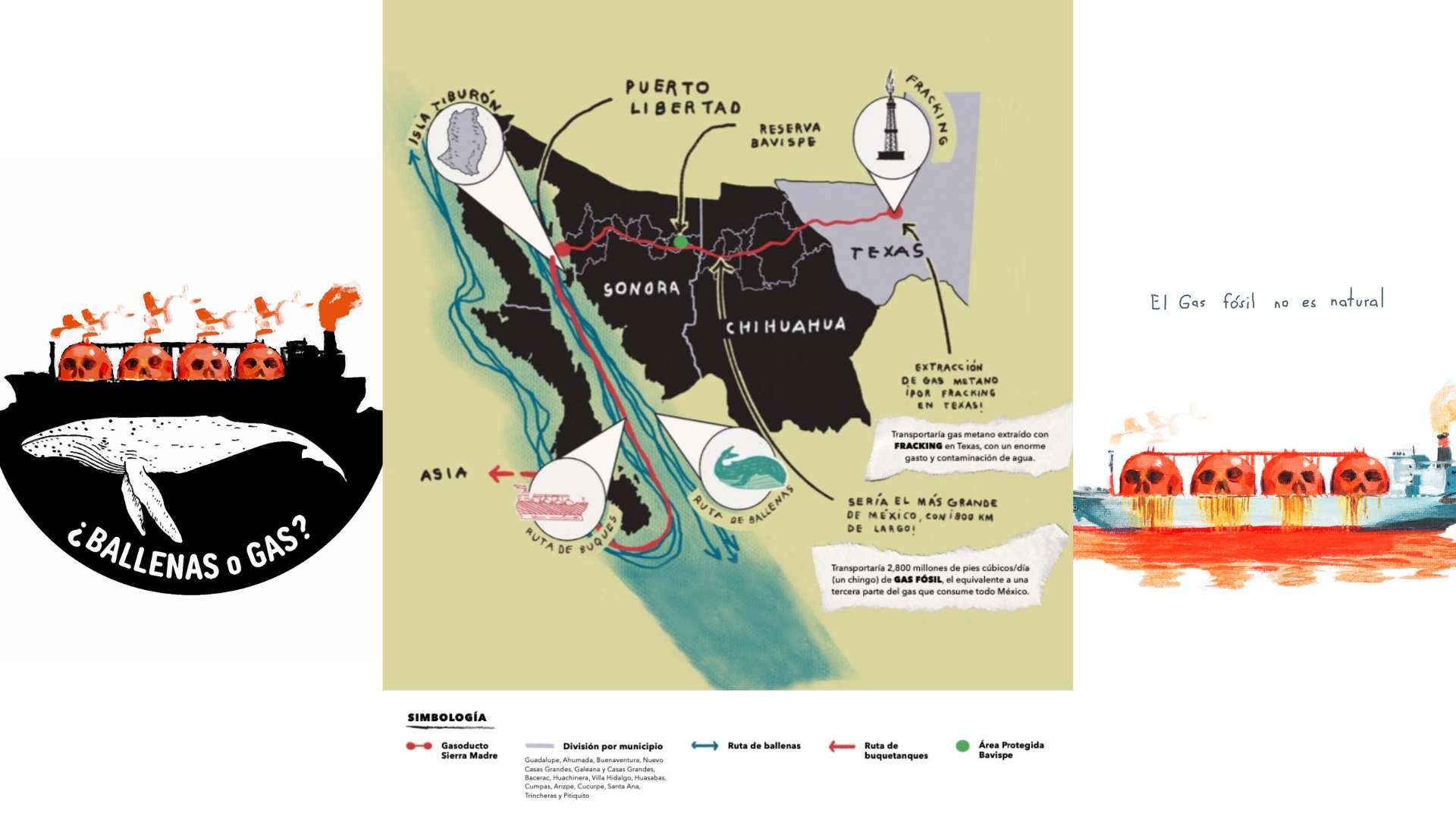

Quantum Energy Partners-backed Saguaro Energía, a massive gas liquefaction and export terminal project under development in Mexico that includes a cross-border pipeline to transport fracked gas from West Texas to the terminal, is marred with legal setbacks and escalating opposition from U.S. and Mexican community and environmental groups.

Saguaro Energía is being developed by Texas-based company Mexico Pacific, a portfolio company of Texas-based private equity firm Quantum Energy. Mexico Pacific’s anchor project is a 15 mtpa LNG export facility in Puerto Libertad, Sonora, Mexico. The company recently reaffirmed its support for the project and its connector pipeline and stated it has invested 30 billion dollars in the project. Mexico Pacific claims the project supports the global energy transition by importing fracked gas from the “lower Co2” Permian Basin gas market via a cross-border pipeline, utilizing newer technologies, and shorter shipping distances to the market–its market being Asia.

Despite these sustainability claims, once fully operational, the Saguaro LNG terminal will emit an estimated 5.7 million metric tons of CO2 equivalent annually[1], equivalent to the emissions of 15 natural gas-fired power plants.[2] While LNG is marketed as a more sustainable bridge fuel by industry groups and companies, it is methane gas, which is eighty times more potent atmospheric warmer than CO2 when measured over 20 years, and may be far worse than coal.

Mexico Pacific confirmed it has closed long-term LNG sales and purchase agreements (SPAs) with China’s Guangzhou Development Group, Shell, ExxonMobil LNG Asia Pacific, Zhejiang Energy, ConocoPhillips, and Woodside. Most recently, the company closed a long-term LNG SPA with Korea’s largest energy trading company, POSCO International. Mexico Pacific has three liquefaction trains commercially contracted, key permits in place, and states the project is positioned for a positive final investment decision (FID). The company has claimed FID was imminent but this project is in the Pre-FID phase. The cross-border gas pipeline also needs to be approved by U.S. regulators and built before the project can be operational.

By building the LNG terminal in Mexico instead of in the United States, developers such as Mexico Pacific are able to avoid the U.S. FERC authorization process for massive liquefaction facilities since it is outside FERC’s jurisdiction. The plan to take fossil gas drilled in the Permian Basin and condense then export it from facilities in western Mexico allows the LNG to reach Asian countries faster bypassing the Panama Canal. This process also exports the environmental harms caused by the facility to frontline communities in Mexico.

Community Opposition and Legal Setbacks

In an effort to halt a planned liquefied natural gas (LNG) infrastructure build-out in the Gulf of California, 30+ Mexico-based community and environmental groups as part of the “¿Ballenas o Gas?” campaign issued a letter to the Mexican government in opposition to the proposed Quantum Energy backed Saguaro LNG export project.

“The gas megaproject directly threatens whales and biodiversity in Mexican waters of the Gulf of California. The Saguaro LNG export project would transform the Aquarium of the World, the Gulf of California, into a sacrifice zone for the fossil fuel industry. The Gulf of California is the permanent and transiting home of 85% of Mexico’s marine mammals; the Saguaro project means the displacement and/or death of whales from these waters.

The fossil gas planned to be transported through Mexican soil is expected to aggravate the climate crisis, which is already having devastating effects on Mexican communities. The Mexican government must look after the interests and well-being of the Mexican population and its natural resources, and not the economic interests of foreign companies. The undersigned organizations reject the proposed Saguaro liquefied natural gas (LNG) export project.”[3]

Photo credit: Conexiones Climáticas

The organization also has a petition to the President-elect of Mexico, Claudia Sheinbaum, her government team, and her counterparts in the United States, President Joe Biden, and responsible regulatory agencies demanding the project be halted.

Around 40 Mexican scientists, photographers, and educators associated with the National Geographic Society released a public statement on the Saguaro LNG project, which stated that the project “is one of the most serious and direct threats that we identify at this time for biodiversity in our country.”

Photo credit: Conexiones Climáticas

The cross-border Saguaro Connector pipeline that would export fossil gas from West Texas to the proposed Saguaro LNG terminal in Mexico has also faced community opposition. The U.S. portion of the pipeline route would pass within one mile of Van Horn, a small West Texas town where residents have expressed concern over the project. In interviews with the Texas Tribune, community members worried about their land being taken via eminent domain for construction, whether their community has the capacity to respond to leaks or explosions by the gas pipeline, and questioned why their town should be sacrificed for infrastructure built only to export gas overseas.

The Sierra Club and Public Citizen filed a recent lawsuit against the Federal Energy Regulatory Commission (FERC) questioning the regulatory agency’s approval of ONEOK’s Saguaro Connector Pipeline. The advocacy groups allege that the law requires a more thorough review process than FERC undertook before green-lighting the project, and claimed FERC limited its review to only 1,000 feet of the pipeline rather than the required review of the entire 157 miles of the U.S. portion of the pipeline. Tyson Slocum, Public Citizen’s Energy Program Director stated: “FERC understood this but arbitrarily limited its environmental analysis to only .12% of the pipeline’s entire length. With this lawsuit, we seek to ensure that FERC cannot turn a blind eye to all of the environmental harms caused by the Saguaro project.”

Energy Specialist PE Firm Quantum Energy Financially Backs Saguaro LNG Terminal alongside an Expanding Fossil Fuel Portfolio

Quantum Energy Partners invested with Mexico Pacific 2021 and is the principal equity owner of the company.

Quantum Energy Partners is a part of Quantum Capital Group, with $21 billion in commitments under stewardship and an investment strategy that “seeks to generate the best risk-adjusted returns across the Sustainable Energy Ecosystem.” Despite its claims of sustainability, Quantum has been spending billions acquiring fossil fuel assets in the last year alone. In August, Quantum purchased Cogentrix, one of the largest portfolios of gas power plants, from The Carlyle Group for $3 billion. Later in the same month Quantum also acquired Western Colorado drilling operator, Caerus Oil & Gas, for $1.8 billion from another private equity firm, Oaktree Capital Management.

Quantum is one of the worst climate offenders on the 2024 Private Equity Climate Risks Scorecard, earning a D.

As of July 2024, Quantum had 95 percent of its energy portfolio invested in fossil fuel assets. The vast majority of the firms’ 20 energy companies were upstream oil and gas drilling operations, three midstream companies (which includes Mexico Pacific), and only one company that focuses on producing solar and wind energy. Quantum’s upstream operations and LNG terminals are responsible for an estimated 152 million metric tons of CO2e emissions annually–equivalent to the emissions of 36 million gas cars driven in a year.[4]

U.S. Retirees’ Pensions are Tied Up in Quantum’s Risky and Harmful Fossil Fuel Expansion

U.S. public pension funds have committed at least 1.2 billion dollars in investment capital to Quantum Energy Partners 2017 and 2023 funds.[5]

Oregon Public Employees Retirement System and Tennessee Consolidated Retirement System have committed the most to Quantum Energy, $240 million and $220million respectively. The next largest investors in Quantum Energy with over $100 million each are the Teacher Retirement System of Texas[6] and the Florida State Board of Administration pension funds. The financial commitments from these public pension funds enable Quantum’s fossil fuel expansion and are driving the development of the Saguaro Energía LNG Facility Project.

In addition to the environmental and community risks associated with LNG projects like Saguaro, the future of the LNG industry is fraught with uncertainty, which poses a financial risk to institutional investors. The development of LNG facilities is incompatible with pathways to limit global temperature increase to 1.5 degrees Celsius and recent studies expect global equity returns to decline by 50% by 2060 if financial funds do not align with Paris Agreement goals. Additionally, while the Energy Information Administration (EIA) analyzed North America is on track to at least double LNG export capacity by 2028, the International Energy (IEA) forecasted that demand for gas, oil, and coal will all peak before 2030, and has noted that demand for gas growth has slowed considerably, leading to concerns about a “glut of LNG.”

Today, any fossil fuel investments ultimately introduce financial, legal, and climate risk for institutional investors. Private equity firms are putting global communities at risk, as well as the retirement funds of everyday Americans like the firefighters and teachers exposed in Quantum’s fossil fuel investments.

**This blog includes an analysis of a dataset of private equity ownership of fossil fuel companies and assets developed jointly by researchers from Americans for Financial Reform Education Fund, Global Energy Monitor, and Private Equity Stakeholder Project.

Resources

[1] Emissions calculations were based on an average of five emissions factors of the LNG liquefaction process from the 2020 NRDC study on lifecycle emissions of LNG, “Sailing to Nowhere: Liquefied Natural Gas is Not an Effective Climate Strategy”. Other emissions considerations that can be associated with LNG but were not included in this analysis include upstream extraction, pipeline transport, tanker transport, regasification, and ultimate end uses.

[2]https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator#results

[3] Original text translated via Google Translate

[4]https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator#results

[5] To compile financial commitments to these funds by public pension funds, the author of this blog used information from Pitchbook, pension fund investor reports, press releases, news stories and other sources.

[6] Pitchbook.