PE’s failed autism bets harm workers and consumers

July 28, 2023

In recent years autism services companies have been a particularly trendy target for private equity acquisitions, but sweeping closures and a large-scale bankruptcy at PE-owned autism services chains over the last month suggest that PE’s aggressive descent on the industry may not be panning out how investors hoped.

However, headwinds faced by the industry still have not deterred investors from continuing to gobble up and consolidate autism providers. Two cases discussed below, Invo Healthcare (Golden Gate Capital) and Center for Autism and Related Disorders (Blackstone Group).

Invo Healthcare Closures – Golden Gate Capital

Autism services provider Invo Healthcare has notified multiple state agencies in that it will be shutting down its home and community-based autism services companies across the country. The move will mean shuttering at least 23 offices and laying off nearly 1,000 workers.[i]

The closures and layoffs span six states, including:

- Colorado: 3 locations closing, 240 workers laid off.[ii]

- Florida: 11 locations closing, 290 workers laid off.[iii]

- Illinois: 7 locations closing, 282 workers laid off.[iv]

- Michigan: 1 location closing, 116 workers laid off.[v]

- Pennsylvania: 2 locations closing, 94 workers laid off.[vi]

- California: 3 locations, undisclosed number of layoffs (as of July 7, 2023).[vii]

Private equity firm Golden Gate Capital has owned Invo since 2019, when it acquired the company from fellow PE firm the Jordan Company.[viii]

Invo is reportedly in talks to sell the shuttered locations. The two buyers that have so far been disclosed are also owned by PE firms: BlueSprig (owned by KKR[ix]) and The Autism Therapy Group (owned by Centennial Investment Group[x]).[xi]

CARD Bankruptcy – Blackstone

Center for Autism and Related Disorders (CARD), owned by private equity giant Blackstone, filed for Chapter 11 bankruptcy in June.[xii]

CARD calls itself “the world’s largest and most experienced autism treatment provider…”[xiii] At the time of its bankruptcy, CARD reported having 130 centers across 13 states, with approximately 2,500 employees serving over 3,500 patients.[xiv]

Blackstone’s 2018 buyout of CARD was the largest ever buyout in the in the autism services industry, for a reported $600 million.[xv] Blackstone’s goal was to grow CARD to up to 4 times its 2018 size.[xvi] That plan did not come to fruition.

In the months and years leading up to the bankruptcy filing, CARD has been quietly closing down locations around the country. In the years following Blackstone’s acquisition, CARD closed 50 provider locations.[xvii] And just since January 2022, CARD has shuttered another 92 locations.[xviii]

According to legal filings, CARD attributes its financial woes to a combination of headwinds triggered by the COVID-19 pandemic, wage inflation, a shortage of qualified clinicians, unprofitable payor contracts, and burdensome lease obligations and other corporate overhead costs. [xix]

CARD has agreed to sell itself back to its founder, Doreen Granpeesheh, for $25 million. Granpeesheh has retained a minority stake in the company since Blackstone’s acquisition and remained on the board until mid-2022.[xx]

According to a Forbes investigation, Granpeesheh left CARD’s board “saying that she disagreed with issues ranging from cuts in training and certification programs, which started in 2020, to how revenue was being spent and bonuses for senior executives.”[xxi]

Granpeesheh’s concerns about changes at the company post-buyout echo concerns raised by former CARD employees.

A new report by the Center for Economic and Policy Research (CEPR), “Pocketing Money Meant for Kids: Private Equity in Autism Services,” analyzes the recent wave of private equity buyouts in autism and delves into CARD as a case study. Drawing on interviews with a range of treatment providers, including CARD employees, the CEPR report sheds light on what was happening at CARD under Blackstone’s ownership.

According to CEPR, soon after acquiring CARD Blackstone began making substantial cuts to the company’s training requirements, including shifting away from in-person to online training and cutting the weeks of new hire orientation in half. CARD’s high standards began to deteriorate, and poor working conditions exacerbated staff turnover.[xxii] Patient to clinician ratios rose from 10-12 patients per staff member to up to 25.[xxiii]

Former managers at CARD alleged that the company was managing resources poorly “by making decisions that added costs at the top and cut resources and capabilities at the bottom.” One former manager said that “The top management team more than doubled in size, and the newly hired managers had no prior experience in autism services.” [xxiv]

CARD staff also argued that the new management attempted to raise revenues by prioritizing younger children who needed more intensive, i.e. more profitable, services. A former employee told the CEPR researchers:

“They would literally terminate patients in our programs who required lower hours and replace them with those requiring at least 30-40…. And they started targeting younger children more because then they [CARD] are guaranteed at least four years of income. Children come in at two-years-old, and at six-years old, they are often pushed into a school environment…. Then they [CARD executives] started saying they were no longer taking adult clients [who require fewer hours per week]. They said that they didn’t feel our centers were appropriate for them; our staff was not specialized in adult services…. But before Blackstone, we did have a whole group of people who were specialized in adult services… Blackstone cut the scope of practices for BCBAs.”[xxv]

CARD’s closures have been hard felt by clients and their families. Many were given less than six weeks to find alternative providers, and wait lists at other providers had up to year long wait lists.[xxvi]

CARD says that it does not anticipate any more closures through the bankruptcy process. The acquisition by Granpeesheh “supports a seamless transition of all patients and each of the approximately 130 treatment centers and preserves the majority, if not all, of [CARD’s] workforce,” according to CARD’s bankruptcy filings.[xxvii]

Blackstone’s exit and sale to Granpeesheh holds promise for CARD’s ability to recover, though the PE firm’s legacy will likely follow CARD in the coming years. Together, CARD’s bankruptcy and Invo Healthcare’s recent closures paint a grim picture of PE’s future in the autism services industry.

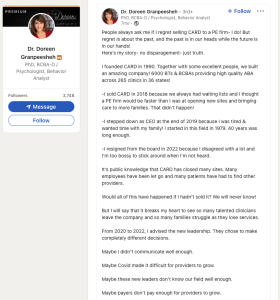

A 2022 LinkedIn post by Dr. Granpeesheh aptly captures the fears and frustrations of clinicians, patients, and advocates:

“People always ask me if I regret selling CARD to a PE firm- I do! … I resigned from the Board in 2022 because I disagreed with a lot …. It’s public knowledge that CARD has closed many sites. Many employees have been let go and many patients have had to find other providers… it breaks my heart to see so many talented clinicians leave the company and so many families struggle as they lose services.”[xxviii]

See Dr. Granpeesheh’s full LinkedIn post here.

For more on private equity investment in behavioral health, see our reports:

- “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth” (February 2022)

- “Understaffed, Unlicensed, and Untrained: Behavioral Health Under Private Equity (September 2020)

[i] Chris Larson, “Invo Healthcare Exiting Home- and Center-Based ABA, Transitioning Business Assets to Other Operators,” Behavioral Health Business, June 12, 2023. https://bhbusiness.com/2023/06/22/pe-backed-invo-healthcare-closes-autism-home-support-services-abandons-home-and-center-aba/.

[ii] Larson, “Invo Healthcare Exiting Home- and Center-Based ABA, Transitioning Business Assets to Other Operators.” ; WARN Tracker, https://www.warntracker.com/?company=autism-home-support-services. Accessed July 18, 2023.

[iii] Henry Queen, “Tampa company to lay off hundreds, affecting special needs services across Florida,” Tampa Bay Business Journal, June 23, 2023. https://www.bizjournals.com/tampabay/news/2023/06/23/progressus-therapy-tampa-layoffs.html#:~:text=Progressus%20Therapy%2C%20a%20Tampa%20company,%2C%20Tallahassee%2C%20Tampa%20and%20Yulee..

[iv] Katherine Davis, “PE-backed owner closes autism care company, laying off hundreds nationwide,” Crain’s Chicago Business, June 23, 2023. https://www.chicagobusiness.com/health-care/pe-backed-owner-closes-autism-care-organization-laying-hundreds

[v] Davis, “PE-backed owner closes autism care company, laying off hundreds nationwide.”

[vi]https://www.inquirer.com/health/invo-healthcare-aba2day-layoffs-delaware-county-autism-20230627.html

[vii] Larson, “Invo Healthcare Exiting Home- and Center-Based ABA, Transitioning Business Assets to Other Operators.”

[viii] “Golden Gate Capital Acquires Invo Holdings,” Business Wire press release, September 25, 2019. https://www.businesswire.com/news/home/20190925005465/en/Golden-Gate-Capital-Acquires-Invo-Holdings

[ix] “KKR Forms Blue Sprig Pediatrics to Address Unmet Clinical Needs of Children Diagnosed with Autism,” KKR, January 9, 2018. https://www.businesswire.com/news/home/20180109005598/en/KKR-Forms-Blue-Sprig-Pediatrics-to-Address-Unmet-Clinical-Needs-of-Children-Diagnosed-with-Autism.

[x] Centennial Investment Group website, https://centennialinvestmentpartners.com/. Accessed July 7, 2023.

[xi] Larson, “Invo Healthcare Exiting Home- and Center-Based ABA, Transitioning Business Assets to Other Operators.”

[xii] Soma Biswas, “Blackstone-Owned Autism Treatment Provider Files for Bankruptcy,” Wall Street Journal, June 12, 2023. https://www.wsj.com/articles/blackstone-owned-autism-treatment-provider-files-for-bankruptcy-fcaf010a.

[xiii] CARD LinkedIn profile. https://www.linkedin.com/company/the-center-for-autism-and-related-disorders-inc–card-/. Accessed July 11, 2023.

[xiv] “Disclosure Statement For The Joint Chapter 11 Plan Of Center For Autism And Related Disorders, LLC And Its Debtor Affiliates,” Chapter 11, Case No. 23-90709 (DRJ). Filed June 12, 2023. https://cases.stretto.com/public/X244/12205/PLEADINGS/1220506122380000000028.pdf pg. 31.

[xv] Sarah Pringle, “Blackstone Walks Away with the Win for Autism-Treatment Company CARD,” PE Hub, April 13, 2018. https://webcache.googleusercontent.com/search?q=cache:LH1mPoWV8_gJ:https://www.pehub.com/blackstone-walks-away-win-autism-treatment-company-card/&cd=10&hl=en&ct=clnk&gl=us.

[xvi] Rosemary Batt, Eileen Appelbaum, Quynh Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services,” Center for Economic and Policy Research, June 21, 2023. https://cepr.net/wp-content/uploads/2023/06/2023-06-Private-Equity-in-Autism-Services.pdf pg. 45.

[xvii] Phoebe Liu, “This Psychologist Got Rich Selling Her Chain Of Autism Treatment Centers. Now She’s Trying To Buy It Back.” Forbes, July 5, 2023. https://www.forbes.com/sites/phoebeliu/2023/07/04/doreen-granpeesheh-psychologist-got-rich-autism-treatment-centers/?sh=500dd2c72d1d

[xviii] “Disclosure Statement For The Joint Chapter 11 Plan Of Center For Autism And Related Disorders, LLC And Its Debtor Affiliates,” Chapter 11, Case No. 23-90709 (DRJ). Pg. 45.

[xix] “Disclosure Statement For The Joint Chapter 11 Plan Of Center For Autism And Related Disorders, LLC And Its Debtor Affiliates,” Chapter 11, Case No. 23-90709 (DRJ). Pg.. 10.

[xx] Biswas, “Blackstone-Owned Autism Treatment Provider Files for Bankruptcy.”

[xxi] Phoebe Liu, “This Psychologist Got Rich Selling Her Chain Of Autism Treatment Centers. Now She’s Trying To Buy It Back.” Forbes, July 5, 2023. https://www.forbes.com/sites/phoebeliu/2023/07/04/doreen-granpeesheh-psychologist-got-rich-autism-treatment-centers/?sh=500dd2c72d1d

[xxii] Batt, Appelbaum, and Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Pg. 45.

[xxiii] Batt, Appelbaum, and Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Pg. 47.

[xxiv] Batt, Appelbaum, and Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Pg. 45-46.

[xxv] Batt, Appelbaum, and Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Pg. 46.

[xxvi] Batt, Appelbaum, and Nguyen, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Pg. 46.

[xxvii] “Disclosure Statement For The Joint Chapter 11 Plan Of Center For Autism And Related Disorders, LLC And Its Debtor Affiliates,” Chapter 11, Case No. 23-90709 (DRJ). Pg. 11.

[xxviii] Doreen Granpeesheh Linkedin profile post, accessed July 10, 2023. https://www.linkedin.com/in/dr-doreen-granpeesheh-b245b0161/recent-activity/all/