Private equity firms now rank among the largest owners of US subsidized affordable housing properties

August 2, 2022

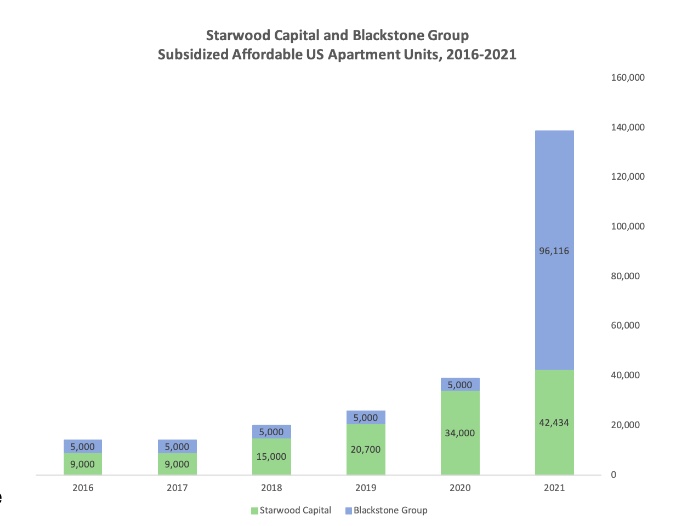

In the last few years, private equity firms including The Blackstone Group and Starwood Capital have become some of the largest owners of subsidized affordable housing in the United States, acquiring apartment properties with more than 138,000 units backed by the Low-Income Housing Tax Credit and other federal housing programs meant to create affordable housing.

Neither private equity firm has created affordable housing. Both Blackstone and Starwood Capital accumulated their portfolios by acquiring interests in existing subsidized affordable properties, raising concern about whether they will maintain the properties as affordable when current subsidies lapse.

Blackstone is by far the largest owner of rental housing in the US, with more than 300,000 units as of July 2022.[i] Starwood Capital is the second largest owner of rental housing in the US, with more than 115,000 units.[ii]

Blackstone now owns more than 95,000 subsidized affordable units, making it one of the largest owners of affordable rental housing in the United States.[iii] Starwood Capital owns more than 43,000 subsidized affordable units, making it one of the top five owners of subsidized affordable housing in the US.[iv]

These private equity firms have only recently begun acquiring large numbers of subsidized affordable apartments. Blackstone in late 2021 purchased a portfolio of more than 80,000 units concentrated in California, Colorado, Texas and Virginia that are backed by Low-Income Housing Tax Credits (LIHTC).[v] Starwood Capital has accumulated its affordable properties over the last several years, beginning in 2016 and acquiring several thousand units per year.[vi]

Both companies’ track records suggest reasons to be concerned about them maintaining affordability at the properties and working to support residents. For example, in 2018 Blackstone spent more than $5 million to help defeat a California ballot measure that would have enabled California cities to limit rent increases.[vii] In July 2020, The Washington Post reported that Starwood Capital “repeatedly pursued the eviction of residents in its apartment buildings after the [Covid] eviction ban was put in place.”[viii]

Robert Rozen, who helped design the low-income housing tax credit program when he was an adviser to Democratic Senator George Mitchell in the 1980s, last year told the Financial Times, “Private equity has discovered this sector of the housing market. And they are attempting to earn big profits by taking money out of affordable housing in ways that were not contemplated by Congress.”[ix]

Investment strategy focused on rent increases

Both private equity firms have highlighted potential rent increases at the properties as a key driver of profits.

Blackstone, which owns most of the affordable properties through its Blackstone Real Estate Income Trust (BREIT) non-traded real estate investment trust, noted in a June 2022 prospectus of its residential and industrial real estate holdings, “Our portfolio’s rents in these high conviction sectors remain below current market rents and have short duration leases, enabling BREIT to increase revenue as leases expire.”[x]

Blackstone noted in a June marketing presentation that its BREIT investment fund had generated a 30.8% profit over the past year.[xi]

Starwood Capital’s publicly traded Starwood Property Trust, through which the private equity firm owns 15,000 affordable units in Florida, reported in a May 2022 investor presentation that “The performance of our Florida affordable housing portfolio continues to vastly exceed our expectations.” Starwood reported that it would be raising rents by 9.1% over the next several months.[xii]

Starwood Capital chairman Barry Sternlicht noted, “And because it can only go up, rents can only go up and not down, the asset category has become a very, very exciting unlevered yields for offshore investors” and reported that Starwood Capital had sold a portion of its Florida affordable housing portfolio to “offshore sovereign wealth funds.”[xiii]

Litigation to prevent nonprofit sponsors from re-acquiring properties

Blackstone has drawn scrutiny for pursuing litigation to prevent nonprofit sponsors of LIHTC-backed affordable housing from reacquiring properties after the 15-year tax credit has ended.[xiv]

The LIHTC program includes a Right of First Refusal provision for nonprofit general partners that facilitates their taking ownership of a development at a minimum price after fifteen years when the investor has completed claiming the tax credits for which they invested. A 2021 fact sheet by the National Housing Trust noted:

“Recently, sources of outside capital have acquired the control of investor partnerships in Housing Credit properties and begun systematically challenging general partners’ project-transfer rights, disrupting the normal investor exit process in hopes of generating windfall returns.

This has led to a growing number of troubling legal disputes and litigation that both drains the general partner’s resources and threatens the long-term affordability of valuable affordable homes.”[xv]

While Blackstone has moved to settle some of the Right of First Refusal litigation after taking ownership, it brushed aside a recent appellate court ruling that favored a nonprofit sponsor, saying it had “no impact on the economics of the deal or how we engage with our partners.”[xvi]

The growing role of private equity firms in acquiring subsidized affordable properties raises concerns about whether hundreds of thousands of units will remain affordable for the long term.

[i] Including 150,000 units managed by LivCor and 246,000 units in the portfolio of Blackstone Real Estate Income Trust. https://careers-livcor.icims.com/jobs/4094/job, accessed July 16, 2022 and https://www.breit.com/portfolio/ accessed July 16, 2022.

[ii] NMHC 50 Largest Apartment Owners, 2022. https://www.nmhc.org/research-insight/the-nmhc-50/top-50-lists/2022-top-owners-list/

[iii] Based on 79,658-unit ACE Affordable Housing Portfolio, 11,157-unit Florida Affordable Housing Portfolio, 5,000 affordable units at Stuyvesant Town-Peter Cooper Village. BREIT Property Book as of Mar 31, 2022. https://www.breit.com/breit-property-book/, “How Much Affordable Housing Did the City Really Preserve?,” New York City Independent Budget Office, Jan 2018. https://www.ibo.nyc.ny.us/iboreports/the-stuyvesant-town-peter-cooper-village-deal-how-much-affordable-housing-did-the-city-really-preserve-january-2018.html

[iv] “Top 50 Affordable Housing Owners of 2021,” Affordable Housing Finance, June 2, 2022. https://www.housingfinance.com/management-operations/top-50-affordable-housing-owners-of-2021_o

[v] 79,658-unit ACE Affordable Housing Portfolio. BREIT Property Book as of Mar 31, 2022. https://www.breit.com/breit-property-book/,

[vi]https://www.multifamilyexecutive.com/business-finance/starwood-reit-acquires-two-affordable-housing-portfolios_o, https://www.starwoodcapital.com/wp-content/uploads/2020/07/Starwood-Capital-Group-Acquires-Multifamily-Affordable-Housing-Portfolio….pdf, https://www.housingfinance.com/management-operations/starwood-buys-florida-affordable-housing-portfolio_o

[vii] “Blackstone Spends Huge to Kill California Rent Control,” The American Prospect, Oct 23, 2018. https://prospect.org/power/blackstone-spends-huge-kill-california-rent-control/

[viii] “Evictions are likely to skyrocket this summer as jobs remain scarce. Black renters will be hard hit.” The Washington Post, Jul 6, 2020. https://www.washingtonpost.com/business/2020/07/06/eviction-moratoriums-starwood/

[ix] “Why Blackstone made a $5bn bet on housing low-income Americans,” Financial Times, Aug 26, 2021. https://www.ft.com/content/3a60c15a-da53-45be-b246-a3f1288d5034

[x] BREIT Prospectus, June 16, 2022. https://www.breit.com/prospectus

[xi] BREIT marketing presentation, June 2022. https://www.breit.com/marketing-presentation/

[xii] Starwood Property Trust, Inc. (STWD) CEO Barry Sternlicht on Q1 2022 Results – Earnings Call Transcript, May 4, 2022. https://seekingalpha.com/article/4506825-starwood-property-trust-inc-stwd-ceo-barry-sternlicht-on-q1-2022-results-earnings-call

[xiii] Starwood Property Trust, Inc. (STWD) CEO Barry Sternlicht on Q1 2022 Results – Earnings Call Transcript, May 4, 2022. https://seekingalpha.com/article/4506825-starwood-property-trust-inc-stwd-ceo-barry-sternlicht-on-q1-2022-results-earnings-call

[xiv] “Blackstone dealt legal setback after $5bn low-income housing deal,” Financial Times, Jun 29, 2022. https://www.ft.com/content/605cc60e-c294-4ef6-b72f-3d873205f3cf

[xv] “Right of First Refusal,” National Housing Trust, 2021. https://www.ncsha.org/wp-content/uploads/ROFR-Factsheet.pdf

[xvi] “Blackstone dealt legal setback after $5bn low-income housing deal,” Financial Times, Jun 29, 2022.