Private Equity Health Care Acquisitions – December 2022

January 9, 2023

In light of the growing investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, the Private Equity Stakeholder Project is tracking private equity-backed healthcare acquisitions. Below is a list of private equity healthcare buyouts, growth investments, and add-on acquisitions completed or announced during December 2022. We will continue to track acquisitions on a monthly basis.

See November 2022 acquisitions here.

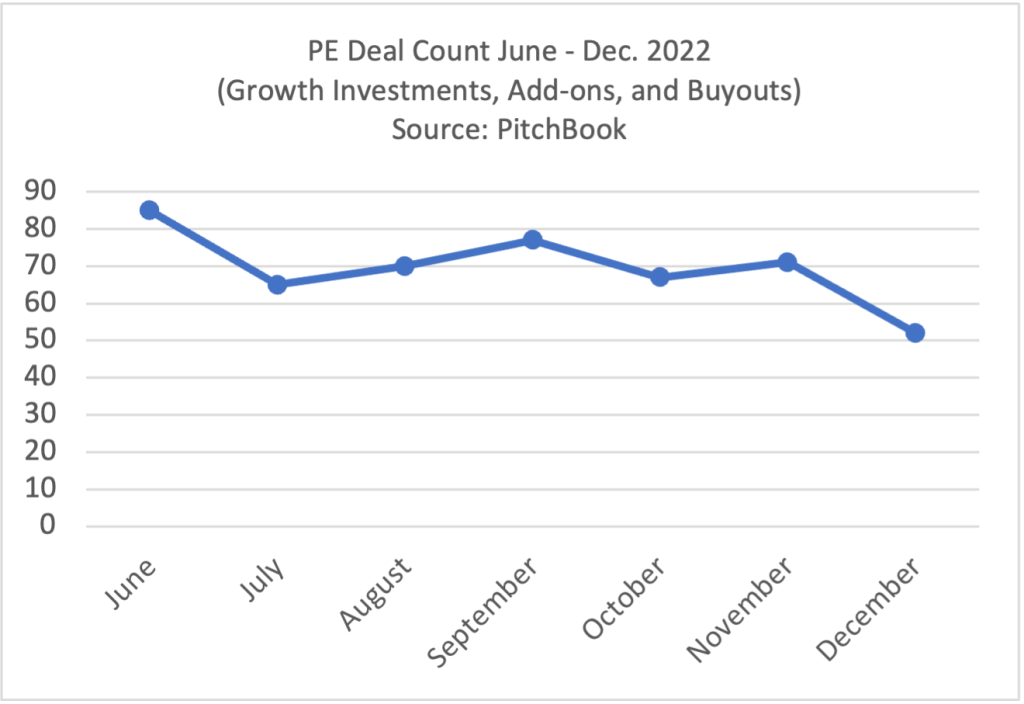

December was a relatively quiet month for private equity in healthcare. Using PitchBook, we tracked only 52 private equity buyouts, add-on acquisitions, and growth/equity investments in the healthcare space across a wide range of subsectors. For comparison, the monthly deal average from June to November was 72.5 deals, with a median of 70.5 (Source: PitchBook).

Private equity closes out the year in healthcare with a focus on medtech

Investments in medtech (e.g. medical supplies, devices, equipment, manufacturing, and related outsourcing solutions) dominated the list of PE deals in December: we counted 2 buyouts, 7 add-on acquisitions, and 2 growth investments involving 22 different investors—approximately 20% of the deals tracked this month. Six of these deals involved manufacturing companies, such as ones that produce durable medical equipment (e.g. wheelchairs) and medical supplies (e.g. drug tests). See the list below for the relevant medtech companies from December and their PE investors.

Medtech Deals – December 2022 (Source: PitchBook)

| Companies | Company Type | Secondary Type | Specialty | PE Firm(s) | Deal Type | Add-on Platform (if applicable) |

| Fusion Biotec | Medtech | design and engineering | medical devices | Accelmed, Lauxera Capital Partners, Summit Partners, Veranex | Add-on | Veranex |

| GHC Imaging | Medtech | medical equipment | radiology | Cane Investment Partners | Add-on | All-Stat Portable |

| Jacinto Medical Corporation | Medtech | medical equipment | radiology; fluoroscopy | Chicago Pacific Founders, CRG, Leavitt Equity Partners, Synergistic Capital Partners | Add-on | MyCare Medical Group |

| Jaco | Medtech | medical equipment manufactuing | Audax Group, Blackstone Secured Lending Fund BDC (NYS: BXSL), Linden Capital Partners | Add-on | GCX Mounting Solutions | |

| Orbit Medical | Medtech | medical equipment manufactuing | durable medical equipment | Harbert Credit Solutions, Northcreek Mezzanine, Orix Private Equity Solutions, Seven Hills Capital | Add-on | Reliable Medical Supply |

| RAM Scientific | Medtech | medical supply manufacturing | Incline Equity Partners | Add-on | ASP Global | |

| Saorsa | Medtech | medical devices | Apposite Capital | Add-on | Emblation | |

| AVS Bio | Medtech | vaccine manufacturing | Arlington Capital Partners | Buyout/LBO | ||

| Premier Biotech | Medtech | medical supply manufacturing | drug screening | Align Capital Partners | Buyout/LBO | |

| Apex Biologix | Medtech | medical equipment manufactuing | Three Bridges Private Capital | PE Growth/Expansion | ||

| World Micro Components | Medtech | electronic parts distributor | Main Street Capital BDC (NYS: MAIN) | PE Growth/Expansion |

In an October 2022 article, Capstone Partners explains that “private equity firms remain bullish” in the medical device outsourcing sector, partly due to an aging population and increased burden of chronic disease that drives demand for medical devices.[1] Capstone Partners points out in a separate June 2022 report that an additional factor that has attracted private equity to the medtech sector is the increase in issues beginning in 2020 that “have exposed weakness in supply chains, creating significant demand for outsourced players with multiple manufacturing operations and a lack of reliance on one supplier or geography.”.[2]

December sees two PE investments in the medical marijuana space

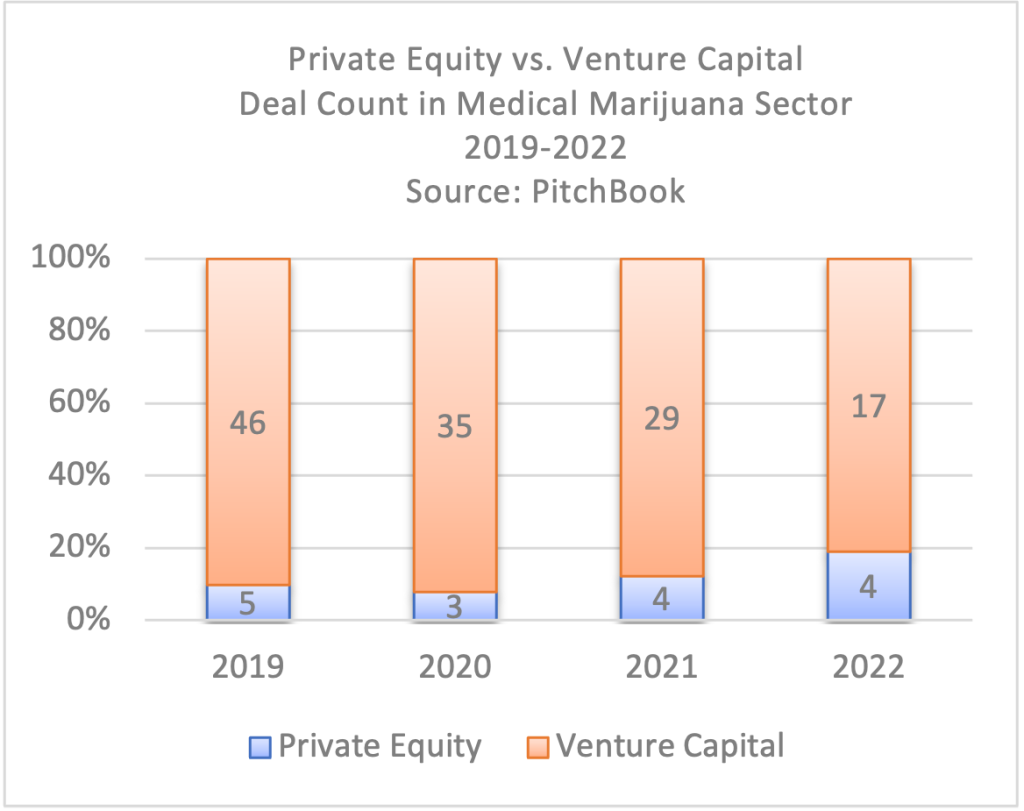

While private equity activity in the cannabis space has been largely overshadowed by venture capital,[3] December saw two notable private equity investments in cannabis-related companies.

Tilia Holdings and Warburg Pincus sponsored Certified Laboratory’s add-on acquisition of Kaycha Labs, a hemp and CBD laboratory testing business.[4] As more states enact regulations around recreational and medical marijuana via the legalization process, testing and laboratory services, like Kaycha Labs, may be an attractive investment choice for private equity. Ancillary businesses not directly involved in the cultivation, distribution, or retail of marijuana have historically offered investment opportunities within the cannabis industry less exposed to the risks associated with a substance that is still considered illicit at the federal level. These risks led to a “cash-starved” and depreciated cannabis market, according to Middle Market Growth in 2020.[5] However, with legalization in 33 states for medical use, a growing number of states permitting recreational use, and perhaps even federal legalization on the way, it is likely that more private equity companies will invest more in the sector and move from ancillary businesses to more direct investments in cannabis—the plant touching side, in industry-speak.[6]

The other big medical marijuana PE deal in December was RIV Capital’s finalized acquisition of Etain Health, a New York-based cannabis cultivation, manufacturer, and retail company, announced on December 15.[7] This $247 million deal, first announced in March 2022, will facilitate RIV’s access to New York’s cannabis market, which Reuters says “is poised to surpass California as the largest legal weed market.”[8] Reuters reported in March 2022 that a $150 million investment RIV received from Scott’s Miracle-Gro would be used to help finance a portion of the deal.[9]

This $247 million deal, first announced in March 2022, will facilitate RIV’s access to New York’s cannabis market, which Reuters says “is poised to surpass California as the largest legal weed market.”[8] Reuters reported in March 2022 that a $150 million investment RIV received from Scott’s Miracle-Gro would be used to help finance a portion of the deal.[9]

While the overall number of traditional private equity deals in the medical marijuana space has remained relatively stable in the past 4 years, the number of venture capital investments has decreased by 63% over the same period.[10] Meanwhile, the median private equity deal value for medical marijuana related companies has increased from $20 million in 2019 to $247 million in 2022, according to PitchBook.[11] Capstone Partners is forecasting a surge in M&A activity in the cannabis sector, more broadly, over the next few years as the industry matures and legalization of recreational and medicinal marijuana use expands.[12]

December Buyouts (8 in total)

| Company | Company Type | Secondary Type | Specialty | PE Firm(s) | |

| ABA Connect | Disability services | applied behavioral analysis | autism | MBF Healthcare Partners | |

| Fortified Health Security | Health IT | cybersecurity | Health Velocity Capital, Nordic Consulting Group,* Silversmith Capital Partners | ||

| ADVI | Healthcare administration | consulting | Sheridan Capital Partners | ||

| Universal Marine Medical Supply International | Healthcare services | marine (cruise and commerical) healthcare | Z Capital Group | ||

| AVS Bio | Medtech | vaccine manufacturing | Arlington Capital Partners | ||

| Premier Biotech | Medtech | medical supply manufacturing | drug screening | Align Capital Partners | |

| Etain Health | Wellness | medical marijuana producer and supplier | cannabis | RIV Capital (CNQ: RIV) | |

| VOS (Clinics/Outpatient Services) | Wellness | mobile application | mindfulness | Soulmates Ventures | |

*Nordic Consulting group is a company owned by Accrete Health Partners.[13]

December Add-On Acquisitions (34 in total)

| Company | Company Type | Secondary Type | Specialty | PE Firm(s) | Add-on Platform |

| MBA Wellness Center | Behavioral health | Substance abuse treatment | opioid addiction | Golub Capital BDC (NAS: GBDC), Linden Capital Partners | Pinnacle Treatment Centers |

| Nashville Recovery | Behavioral health | Substance abuse treatment | opioid addiction | BPEA Private Equity, Webster Equity Partners | BayMark Health Services |

| Brightech International | Contract research organization | Health IT | clinical trial support | Arlington Capital Partners, Everest Clinical Research | Everest Clinical Research |

| Meridian Clinical Research | Contract research organization | clinical trials | GHO Capital | Velocity Clinical Research | |

| Suncoast Research Group | Contract research organization | clinical trials | Barton Technology Ventures, New MainStream Capital | Flourish Research | |

| Complion | Health IT | Document management | clinical trial compliance | LLR Partners | RealTime Software Solutions |

| Swellbox | Health IT | Medical records | Cigna Ventures, Flex Capital, Johnson & Johnson Innovation – JJDC, Mubadala Investment Company, Sixth Street Partners, The Goldman Sachs Group (NYS: GS), Transformation Capital | Datavant | |

| Advanced Claims Review Specialists | Healthcare administration | Medical finance services | MBF Healthcare Partners | Carisk Partners | |

| JP RMP | Healthcare administration | Medical finance services | Practice management | NexPhase Capital | Meduit |

| Springboard Healthcare | Healthcare administration | Consulting | Cornell Capital, Trilantic North America | Ingenovis Health | |

| Versalus Health | Healthcare administration | Revenue cycle management | Cannae Holdings (NYS: CNNE), Sanaka Group, The Carlyle Group (NAS: CG), TripleTree | CorroHealth | |

| 1st Care Home Health Services | Home healthcare | elderly/disability support | Revelstoke Capital Partners | The Care Team | |

| Care Perfections Health Services | Home healthcare | elderly/disability support | Searchlight Capital Partners | Care Advantage | |

| Lighthouse Healthcare | Home healthcare | elderly support | Searchlight Capital Partners | Care Advantage | |

| Kaycha Labs (Hemp and CBD Laboratory Testing Business) | Laboratory services | cannabis | Tilia Holdings, Warburg Pincus | Certified Laboratories | |

| Fusion Biotec | Medtech | Design and engineering | medical devices | Accelmed, Lauxera Capital Partners, Summit Partners, Veranex(Thomas Daulton) | Veranex |

| GHC Imaging | Medtech | Medical equipment | radiology | Cane Investment Partners | All-Stat Portable |

| Jacinto Medical Corporation | Medtech | Medical equipment | radiology; fluoroscopy | Chicago Pacific Founders, CRG, Leavitt Equity Partners, Synergistic Capital Partners | MyCare Medical Group |

| Jaco | Medtech | Medical equipment manufactuing | Audax Group, Blackstone Secured Lending Fund BDC (NYS: BXSL), Linden Capital Partners | GCX Mounting Solutions | |

| Orbit Medical | Medtech | Medical equipment manufactuing | durable medical equipment | Harbert Credit Solutions, Northcreek Mezzanine, Orix Private Equity Solutions, Seven Hills Capital | Reliable Medical Supply |

| RAM Scientific | Medtech | Medical supply manufacturing | Incline Equity Partners | ASP Global | |

| Saorsa | Medtech | Medical devices | Apposite Capital | Emblation | |

| AlphaGroup Medical Communications | Medical communications | Maranon Capital, The Riverside Company | Red Nucleus Solutions | ||

| Luke & Associates | Medical staffing | military healthcare | M33 Growth | Dependable Health Services | |

| Reproductive Endocrinology Associates of Charlotte | Outpatient care | fertility treatment | Nordic Capital | CARE Fertility Group | |

| Chesen Laser Eye Center | Outpatient care | Eye Care | opthalmology | Gryphon Investors | Vision Innovation Partners |

| CNY Diagnostic Imaging Associates | Outpatient care | medical imaging | Sunny River Management | Rezolut Medical Imaging | |

| Dental Associates of North Alabama | Outpatient care | Dental Care | general | Silver Oak Services Partners | Smile Partners USA |

| Las Vegas Smile Center | Outpatient care | Dental Care | general & cosmetic | New Mountain Capital | Western Dental & Orthodontics |

| Ophthalmic Physicians | Outpatient care | Eye Care | opthalmology | Ridgemont Equity Partners, Yukon Partners | Sunvera Group |

| Premier Orthopaedic and Sports Medicine Associates of Southern New Jersey | Outpatient care | orthopedics | Stone Point Capital | American Orthopedic Partners | |

| Sahara Dental (Las Vegas) | Outpatient care | general & cosmetic | New Mountain Capital | Western Dental & Orthodontics | |

| The Orthodontic Group | Outpatient care | orthodontistry | Leon Capital Group, TSG Consumer | Specialty Dental Brands | |

| DailyEndorphin | Wellness | Web-based wellness platform | Archetype Growth | Wellable |

December PE Growth/Expansion Investments (10 in total)

| Company | Company Type | Secondary Type | Specialty | PE Firm(s) |

| Lokavant | Health IT | clinical trials support | Edison Partners(Gregg Michaelson), Roivant Sciences (NAS: ROIV)(Alex Gasner) | |

| Apex Biologix | Medtech | medical equipment manufacturing | Three Bridges Private Capital | |

| World Micro Components | Medtech | electronic parts distributor | Main Street Capital BDC (NYS: MAIN) | |

| ClearHealth Strategies | Healthcare administration | medical finance services | Pleasant Bay Capital Partners | |

| PMB | Healthcare Real Estate | Cypress Ascendant | ||

| Medical Specialists of the Palm Beaches | Outpatient care | Ascend Partners | ||

| Aerami Therapeutics | Pharmaceuticals | Development | Undisclosed | |

| Pharmaceutics International | Pharmaceuticals | Research | Undisclosed | |

| Twin Orbit | Pharmaceuticals | Research | Tidewater Capital Services | |

| MedicoRx Specialty | Pharmacy | Specialty pharmacy | home infusions | Hildred Capital Partners |

[1] Capstone Partners. “Medical Device Outsourcing M&A Market Remains Healthy Despite Economic Headwinds,” October 13, 2022. https://www.capstonepartners.com/insights/article-medical-device-outsourcing-ma-market-remains-healthy-despite-economic-headwinds/.

[2] Pg. 8; Capstone Partners. “M&A Market Remains Robust As Private Equity Builds and Enhances Sector Portfolios: Medical Device Outsourcing Sector Update,” June 2022. https://www.capstonepartners.com/wp-content/uploads/2022/06/Capstone-Partners-Medical-Device-Outsourcing-MA-Coverage-Report-June-2022.pdf.

[3] This assertion is based on data gleaned from an advanced search in PitchBook that quantified venture capital vs. private equity deals in the cannabis space over the last four years.

[4] Certified Group. “Certified Group Announces Investment in Kaycha Labs Knoxville, TN Hemp and CBD Testing Laboratory,” December 19, 2022. https://www.prnewswire.com/news-releases/certified-group-announces-investment-in-kaycha-labs-knoxville-tn-hemp-and-cbd-testing-laboratory-301705302.html.

[5] Mulligan, Kathryn. “Pot Stirs up Private Equity Interest.” Middle Market Growth (blog), April 20, 2020. https://middlemarketgrowth.org/the-round-pot-stirs-up-private-equity-interest/.

[6] Mulligan, Kathryn. “Pot Stirs up Private Equity Interest.” Middle Market Growth (blog), April 20, 2020. https://middlemarketgrowth.org/the-round-pot-stirs-up-private-equity-interest/.

[7] RIV Capital Inc. “RIV Capital Completes Final Closing of Previously Announced Etain Transaction,” December 15, 2022. https://www.prnewswire.com/news-releases/riv-capital-completes-final-closing-of-previously-announced-etain-transaction-301704695.html; Krishna, Rithika. “RIV Capital to Buy Etain Health as It Bets on New York Becoming Pot Hub | Reuters,” March 30, 2022. https://www.reuters.com/legal/transactional/riv-capital-buy-etain-health-it-bets-new-york-becoming-pot-hub-2022-03-30/.

[8] Krishna, Rithika. “RIV Capital to Buy Etain Health as It Bets on New York Becoming Pot Hub | Reuters,” March 30, 2022. https://www.reuters.com/legal/transactional/riv-capital-buy-etain-health-it-bets-new-york-becoming-pot-hub-2022-03-30/.

[9] Krishna, Rithika. “RIV Capital to Buy Etain Health as It Bets on New York Becoming Pot Hub | Reuters,” March 30, 2022. https://www.reuters.com/legal/transactional/riv-capital-buy-etain-health-it-bets-new-york-becoming-pot-hub-2022-03-30/.

[10] Based on data gleaned from an advanced search in PitchBook that quantified venture capital vs. private equity deals over the last four years.

[11] Note that PitchBook has incomplete data on deal values for private companies, so these numbers may vary.

[12] Capstone Partners. “Nascent State Markets Drive Growth for Traditional and Ancillary Businesses: Cannabis Sector Update,” August 2022. https://www.capstonepartners.com/wp-content/uploads/2022/08/Capstone-Partners-Cannabis-MA-Coverage-Report_August-2022.pdf.

[13] “Accrete Health Partners Acquires Nordic Consulting Partners,” June 1, 2022. https://www.nordicglobal.com/about/news/accrete-health-partners-acquires-nordic-consulting-partners.