Private Equity Healthcare Acquisitions – July 2024

August 22, 2024

In light of continued investor interest in healthcare and the risks associated with private equity ownership of healthcare companies, the Private Equity Stakeholder Project is tracking private equity-backed healthcare acquisitions. Below is a list of private equity healthcare buyouts, growth investments, and add-on acquisitions completed or announced during July 2024. We will continue to track acquisitions on a monthly basis.

See June 2024 acquisitions here.

Click here to jump to acquisitions tracking table.

Pharma Services

Private equity firms made at least nine investments in the pharma services sector.[1] Pharma services include contract and outsourced services for the pharmaceuticals industry throughout the drug development and commercialization process, including drug discovery, development, clinical trials, and marketing.[2]

Recent acquisitions include:

- Ampersand Capital Partners-owned MedPharm acquired Tergus Pharma, a contract development and manufacturing organization (CDMO).[3]

- Vistria Group acquired Ora, a contract research organization (CRO) focused on ophthalmic drugs.[4]

- Inflexion’s Rosemont Pharmaceuticals[5] acquired Sabal Therapeutics, distributor of prescription, liquid medicines.[6]

- Avista Capital Partners and Hamilton Lane acquired Cosette Pharmaceuticals, a specialty pharmaceutical company.[7]

- VSS Partners’ Exima Clinical Research acquired Tidewater Clinical Research.[8]

Pharma services has seen rapid growth in recent years; according to a June 2024 PitchBook report, “over the past two years, pharma services has become the hottest area of PE healthcare investing.”[9]

Investors are attracted to the sector for several reasons: 1. The growth of the overall global market driven by tailwinds in the pharmaceuticals and biotech markets, 2. The complexity of the growing specialty drugs market which has incentivized pharmaceutical companies to turn to specialized outsourced services to reduce costs, 3. The highly fragmented pharma services ecosystem, providing opportunities for consolidation, and 4. Broader macro tailwinds in the healthcare sector, such as an aging population and higher incidence of chronic diseases.[10]

Dental Care

Private equity firms have also continued to make inroads in the dental care market.

Zenyth Partners-owned Smilist Dental acquired Simply Beautiful Smiles, which operates 23 dental clinics in the mid-Atlantic,[11] as well as Boston-based Hirshberg Wozny Dental Care.[12]

Quad-C Management’s Specialized Dental Partners[13] (formerly US Endodontic Partners)[14] acquired McMurtrey Endodontics in Colorado,[15] continuing an acquisition spree – the platform has made 16 new add-on acquisitions in the first six months of 2024 alone.[16]

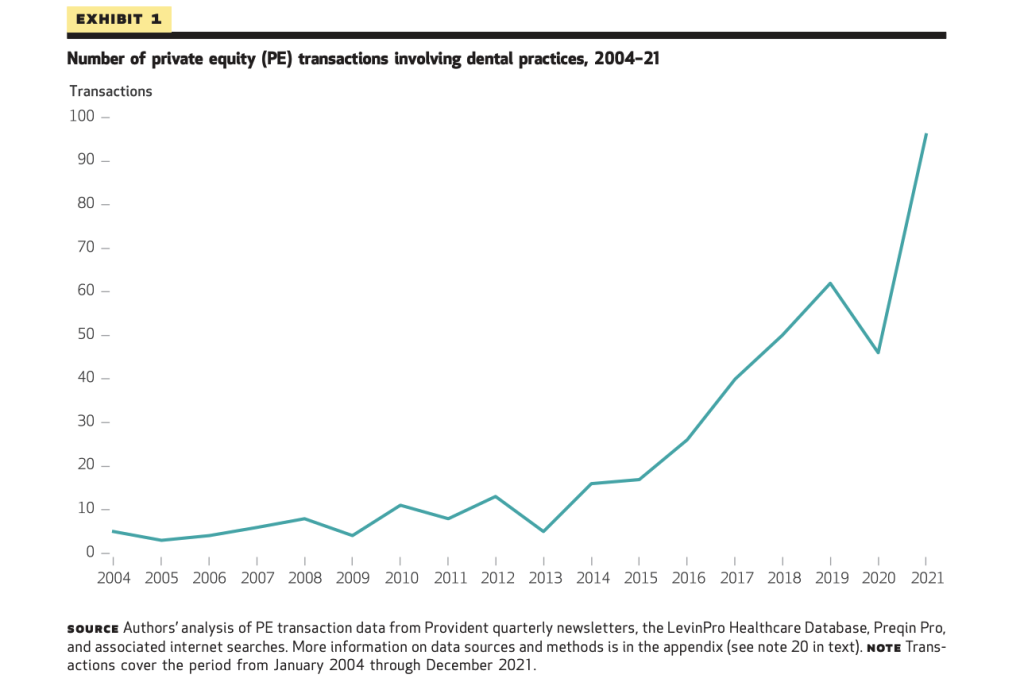

The dental deals, particularly in endodontics, reflect recent trends in private equity dealmaking. A new study published in Health Affairs has found that private equity affiliation with dental practices nearly doubled for the period 2015-2021, from 6.6% in 2015 to 12.8% in 2021. The study found the highest growth among dental specialties such as endodontists and oral surgeons, which more than doubled during the period.[17]

According to the study’s authors, “One possible reason for PE interest in dental specialist practices may be the high prices that specialists can earn for procedures such as root canals and implants, as opposed to routine exams from general practice dentists. PE firms may believe that they can get a higher return on investment from acquiring specialist practices.”[18

Private equity-affiliated practices had a higher rate of Medicaid participation. The researchers note that while this could expand access to dental care in poorer communities, “there are concerns that PE could implement strategies to increase the volume of unnecessary dental services for Medicaid enrollees.”[19]

Source: Health Affairs, 2024.

Behavioral Health

The behavioral health sector also saw increased investment from private equity firms, continuing a trend of private equity buyouts of behavioral health and intellectual and developmental disabilities (I/DD) providers.

A new study published in Health Affairs Scholar found that private equity buyouts of behavioral health providers increased substantially from 2010 to 2021 in both the frequency of acquisitions and the number of facilities they involved, and accounted for around 60% of all behavioral health acquisition activity. Additionally, add-on deals tended to focus on geographic proximity; 25% of acquired facilities were located within 20 miles of one another and 50% occurred within 80 miles. Such consolidation raises questions for how concentrated market power by private equity-owned providers may impact prices, access, and quality.[20]

July’s deals include the acquisitions of Community Concepts Inc. and Community Visions, LLC, by Beacon Specialized Living, which is owned by private equity firm Vistria Group. The company provides residential and day support programs for people with intellectual and developmental disabilities (I/DD) and mental health needs.[21] Vistria has owned Beacon Specialized Living since it acquired it from another private equity firm, Pharos Capital Group, in 2022.[22]

Vistria has a checkered track record with behavioral health and I/DD providers; together with Centerbridge Partners it owns Sevita, a provider of I/DD and foster care services with a history of making large debt-funded dividend payouts to its owners despite widespread allegations of harmful and negligent conditions.[23]

In addition, Beacon Behavioral Hospital (unrelated to Beacon Specialized Living), owned by Latticework Capital Management,[24] acquired Hauser Clinic & Associates. Hauser provides mental health services throughout the Houston area.[25] According to PitchBook, Beacon Behavioral Hospital has acquired nine other behavioral health providers in 2024.[26]

And Behavioral Framework, owned by Renovus Capital Partners,[27] acquired North Carolina-based Behavior Consultation & Psychological Services (BCPS) in July.[28]

July Acquisitions Table

Resources

[1] The “pharma services” sector is broadly defined, and includes a variety of outsourcing/contracting companies across the biopharmaceuticals sector. For the purposes of this analysis, we have categorized the following July acquisitions within pharma services: Cosette Pharmaceuticals, NGM Biopharmaceuticals, Valinor Pharma, Ora, Brightseed, CluePoints, Tidewater Clinical Research, Tergus Pharma, and Sabal Therapeutics.

[2] Houlihan Lokey Pharma Services, Spring 2024. https://cdn.hl.com/pdf/2024/2024-spring-pharma-services-sector-spotlight.pdf

[3] “MedPharm, Ltd. and Tergus Pharma Merger Forms Topical and Transepithelial CDMO Leader,” MedPharm, July 8, 2024. https://www.medpharm.com/medpharm-tergus-merger/

[4] “Ora Announces Strategic Investment from The Vistria Group to Propel Global Growth, Enhance Customer Experience in Ophthalmic Research,” July 19, 2024. https://www.businesswire.com/news/home/20240719985823/en/Ora-Announces-Strategic-Investment-from-The-Vistria-Group-to-Propel-Global-Growth-Enhance-Customer-Experience-in-Ophthalmic-Research

[5] “Rosemont Pharmaceuticals unveils plans to expand in the USA,” Rosemont, January 2024. https://www.rosemontpharma.com/plans-to-expand-in-the-usa/

[6] “Rosemont enhances its ability to develop products for global market with acquisition of Sabal Therapeutics and its affiliates Metacel Pharmaceuticals, Palmetto Pharmaceuticals, Athena Bioscience and Sarras Health,” Rosemont, July 2024. https://www.rosemontpharma.com/rosemont-acquires-sabal-therapeutics/

[7] “Cosette Pharmaceuticals Transaction,” Hamilton Lane, July 17, 2024. https://www.hamiltonlane.com/en-us/news/avista-capital-partners-cosette-pharma

[8] “Eximia Research Network Expands into Virginia with Integration of Tidewater Clinical Research,” PR Newswire, July 31, 2024. https://www.prnewswire.com/news-releases/eximia-research-network-expands-into-virginia-with-integration-of-tidewater-clinical-research-302210547.html

[9] Pitchbook Launch Report: Pharma Services. Q1 2024. https://files.pitchbook.com/website/files/pdf/Q1_2024_Launch_Report_Pharma_Services.pdf#page=1

Pg. 1.

[10] Houlihan Lokey Pharma Services, Spring 2024. https://cdn.hl.com/pdf/2024/2024-spring-pharma-services-sector-spotlight.pdf Pg. 2.

[11] “The Smilist Affiliates with Simply Beautiful Smiles Offices and Expands to Maryland,” PR Newswire, July 9. https://www.prnewswire.com/news-releases/the-smilist-affiliates-with-simply-beautiful-smiles-offices-and-expands-to-maryland-302191193.html

[12] “Freedom Dental Partners leads Hirshberg Wozny Dental Care to New Affiliation with The Smilist,” Freedom Dental Partners, July 30, 2024. https://freedomdentalpartners.com/2024/07/freedom-dental-partners-leads-hirshberg-wozny-dental-care-to-new-affiliation-with-the-smilist/

[13] “Quad-C | Private Equity Partner | Portfolio.” Accessed August 9, 2024. https://www.quadcmanagement.com/portfolio-info/specialized-dental.

[14] Partners, Specialized Dental. “US Endo Partners Changes Name to Specialized Dental Partners,” August 31, 2023. https://www.prnewswire.com/news-releases/us-endo-partners-changes-name-to-specialized-dental-partners-301915352.html.

[15] “Specialized Dental Partners Welcomes New Partner,” Healthcare Deal Flow, July 2, 2024. https://healthcaredealflow.com/specialized-dental-partners-welcomes-new-partner-3/

[16] Pitchbook profile for Specialized Dental Partners, https://my.pitchbook.com/profile/435555-28/company/profile#investments. Accessed August 7, 2024.

[17] Kamyar Nasseh, Anthony T. LoSasso, and Marko Vujicic, “Percentage Of Dentists And Dental Practices Affiliated With Private Equity Nearly Doubled, 2015–21,” Health Affairs. Vol. 43, No. 8: (2024): 1082–1089. https://doi.org/10.1377/hlthaff.2023.00574. Pg. 1084.

[18] Nasseh et al. Pg. 1086.

[19] Nasseh et al. Pg. 1087.

[20] Ben Thornburg, Emma B McGinty, Julia Eddelbuettel, Alene Kennedy-Hendricks, Robert T Braun, Matthew D Eisenberg, Acquisitions of behavioral health treatment facilities from 2010 to 2021, Health Affairs Scholar, Volume 2, Issue 7, July 2024, qxae080, https://doi.org/10.1093/haschl/qxae080.

[21] The Braff Group, “COMMUNITY CONCEPTS INC. AND COMMUNITY VISIONS ACQUIRED BY BEACON SPECIALIZED LIVING,” PR Newswire, July 17, 2024. https://www.prnewswire.com/news-releases/community-concepts-inc-and-community-visions-acquired-by-beacon-specialized-living-302198043.html

[22] Chris Larson, “Vistria Group Reportedly Set to Buy SMI Provider Beacon Specialized Services for $300M,” Behavioral Health Business, March 3, 2022. https://bhbusiness.com/2022/03/03/vistria-group-reportedly-set-to-buy-smi-provider-beacon-specialized-services-for-300m/

[23] Eileen O’Grady, “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth,” PESP, February 2022. https://pestakeholder.org/reports/the-kids-are-not-alright-how-private-equity-profits-off-of-behavioral-health-services-for-vulnerable-and-at-risk-youth/. Pgs. 10-12.

[24] “Latticework Capital Management Announces Investment in Beacon Behavioral Hospital, a Leading Provider of Mental Health Treatment Programs,” Businesswire, January 12, 2021. https://www.businesswire.com/news/home/20210112005312/en/Latticework-Capital-Management-Announces-Investment-in-Beacon-Behavioral-Hospital-a-Leading-Provider-of-Mental-Health-Treatment-Programs

[25] “Beacon Behavioral Partners Strengthens Presence in Texas through New Partnership with Hauser Clinic & Associates,” Beacon Behavioral Partners, July 23, 2024. https://beaconbhpartners.com/2024/07/24/beacon-behavioral-partners-strengthens-presence-in-texas-with-acquisition-of-hauser-clinic-associates/

[26] PitchBook, https://my.pitchbook.com/profile/346776-04/company/profile#investments. Accessed August 7, 2024.

[27] “Renovus Capital Partners Announces Investment In Behavioral Framework,” PR Newswire, January 3, 2024. https://www.prnewswire.com/news-releases/renovus-capital-partners-announces-investment-in-behavioral-framework-302022535.html

[28] “Behavioral Framework Acquires Behavior Consultation & Psychological Services (BCPS),” Renovis Capital, July 24, 2024. https://renovuscapital.com/behavioral-framework-acquires-behavior-consultation-psychological-services-bcps/