Private Equity Health Care Acquisitions – May 2022

June 15, 2022

In light of the growing investor interest in healthcare and therisks associated with private equity ownership of healthcare companies, the Private Equity Stakeholder Project will be tracking private equity-backed healthcare acquisitions. Below is a list of private equity healthcare buyouts and add-on acquisitions completed or announced during May 2022. We will continue to track acquisitions on a monthly basis.

See April 2022 acquisitions here.

Waud Capital-owned GI Alliance (GIA) has acquired two gastroenterology practices in May, marking further inroads by private equity firms into the digestive health industry.

Last month GIA partnered with Digestive Health Specialists, the largest independent practice in Missouri, with 19 gastroenterologists and nine advanced practice providers in five locations.[1] GIA also partnered with Houston-based Gastroenterology Consultants, which has nine physicians and six advanced practice providers in six Texas locations.[2]

Since Waud acquired GIA in 2018[3] it has become the biggest private-equity-owned gastroenterology platform in the US, [4] growing from having 159 affiliated gastroenterologists to over 670 operating in Texas, Arkansas, Arizona, Colorado, Florida, Illinois, Indiana, Kansas, Louisiana, Mississippi, Missouri, Oklahoma, Utah, and Washington.[5]

The company is still growing rapidly; in December 2021 alone it acquired six other gastroenterology practices in Arizona, Mississippi, Louisiana, Washington, Illinois, and Colorado.[6]

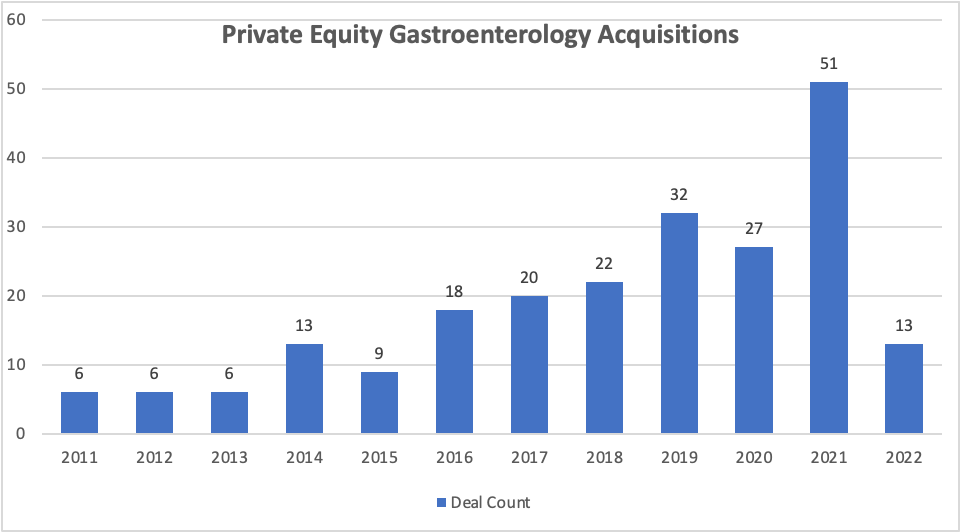

Waud’s expansion of GIA is reflective of private equity’s growing interest in the broader digestive health market. According to a 2021 report by Physician Growth Partners, nearly 10% of the 14,000 gastroenterologists in the United States were partners or employed by a private-equity-owned company.[7]

Several forces appear to be driving investor interest in gastroenterology. An aging population means more people are getting colonoscopies to screen for colorectal cancer, and for patients age 65 and older these screenings are covered entirely by Medicare. In 2021 the CDC lowered the recommended age for colorectal cancer screening from age 50 to 45, [8] in part due to increasing incidence of early-onset colorectal cancer in younger adults.[9]

Read: Kaiser Health News, “Betting on ‘Golden Age’ of Colonoscopies, Private Equity Invests in Gastro Docs”

These factors have increased demand for gastroenterology services, aggravating a shortage of gastroenterology providers. The Health Resources and Services Administration (HRSA) estimates that by 2025, the US will face a shortage of more than 1,600 gastroenterologists nationwide.[10]

Finally, the gastroenterology industry has historically been fragmented, creating opportunities for private equity firms to use platform companies to buy up and consolidate providers, as Waud Capital has done over the four years since it acquired GIA.[11]

Private equity ownership of physicians’ practices has garnered scrutiny for appearing to increase the rate of surprise medical billing, whereby providers charge insured patients out-of-network rates for services patients believed to be in-network.[12] A 2020 study published in the Annals of Internal Medicine found that nearly 1 in 8 patients receive out-of-network bills for routine screening colonoscopies where both the endoscopists and hospital facilities were in-network.[13]

Colonoscopies can result in surprise medical bills for a few reasons. The Affordable Care Act made screening colonoscopies free of charge to patients without cost sharing, but if precancerous polyps are discovered and removed during a procedure then the procedure is retroactively reclassified as a diagnostic colonoscopy, which is not required to be covered. In other words, patients are essentially punished with higher bills if their colonoscopy reveals that they are at risk for developing cancer.[14]

Additionally, while the colonoscopies may be covered by insurance, related services like anesthesia used in the procedures or pathology services used conduct biopsies may be out-of-network. This increases the likelihood that a patient will receive a surprise medical bill.[15]

May 2022 Buyouts

| Company | Type | PE Firm(s) |

| IntriCon | Medical devices | Altaris Capital Partners |

| Open Health Group | Healthcare marketing | Astorg |

| Allentown | Medical supplies | Aterian Investment Partners |

| Alvogen Group | Pharmaceuticals | Aztiq Pharma Partners and Innobic |

| Lombart Instrument | Medical devices | Cornell Capital |

| Howard Chudler & Associates | Behavioral health | Enhanced Healthcare Partners |

| TherapeuticsMD | Pharmaceuticals | EW Healthcare Partners |

| JoyBridge Kids | Behavioral health | Frontline Healthcare Partners |

| PathGroup | Pathology | GTCR |

| Sanderling Renal Services | Dialysis | Pharos Capital Group |

| Ellie Mental Health | Behavioral health | Princeton Equity Group |

| IPM Medical Group | Physicians group | Silver Oak Services Partners |

May 2022 Add-On Acquisitions

| Company | Type | PE Firm(s) | Add-on Platform |

| PatientPal | Health tech, revenue cycle management1 | A&M Capital, FS KKR Capital BDC, KKR Private Credit | Med-Metrix |

| Medi-Corp | Revenue Cycle Management | Aquiline Capital Partners | National Medical Billing Services |

| Orchid Medical | Claims management | Ardian, Caisse de dépôt et placement du Québec, MVP Capital Partners, Onex, Stone Point Capital, The Carlyle Group | Sedgwick Claims Management Services |

| Psychological Assessment and Intervention Services | Behavioral health | Atar Capital | Pathways Healthcare |

| The Allied Group | Medical supplies | Atlantic Street Capital | Lab Logistics |

| Hospice of the Carolina Foothills | Hospice | Audax Group, Churchill Asset Management, H.I.G. Capital, Ridgemont Equity Partners | Agape Care Group |

| Premier Orthopaedics | Orthopaedics | Audax Group, Frazier Healthcare Partners, Mitchell Family Office and Linden Capital Partners | HOPco |

| Bluemark | Health tech | Barings, Francisco Partners | Office Ally |

| United Medical Providers | Medical supplies | Beecken Petty O’Keefe & Company | Home Care Delivered |

| Dynamic Healthcare Systems | Health tech, revenue cycle management1 | Boston Millennia Partners, Oak HC/FT, Upfront Ventures | Reveleer |

| Okemos Infusion Center | Infusion services | Boyne Capital Partners | Infusion Associates Management |

| Aergo Solutions | Revenue Cycle Management | Cannae Holdings, Sanaka Group, The Carlyle Group, TripleTree | CorroHealth |

| Consolidated Medical | Medical supplies | Capital Southwest BDC, Osceola Capital Management | Central Medical Supply |

| Helping Hands Medical Supply | Medical supplies | Capital Southwest BDC, Osceola Capital Management | Central Medical Supply |

| PPD Homecare | Medical devices | Capital Southwest BDC, Osceola Capital Management | Central Medical Supply |

| Karner Psychological Associates | Behavioral health | Centra Capital | CM Counsel |

| Edge Biomedical | Medical supplies | Emigrant Capital, Gauge Capital, The HiGro Group | Equipment Management Service and Repair |

| Center for Sleep and Nasal Sinus Disorders | Sleep disorder services | Excellere Partners | ADVENT |

| SmartCare Medical Group | Urgent care | FFL Partners, Madsen Capital Group | WellStreet Urgent Care |

| SportsMED Orthopedic Surgery and Spine Center | Orthopedics | FFL Partners, Thurston Group | Mississippi Sports Medicine and Orthopaedic Center |

| H.M. Systems | Pediatric therapy services | Five Arrows Capital Partners, Florac, Leonard Green & Partners | The Stepping Stones Group |

| Lasky Skin Center | Dermatology | Gemini Investors, Hildred Capital Partners | DermCare Management |

| BODYWORKS | Rehabilitation services | Grant Avenue Capital | H2 Health |

| Kinetix Advanced Physical Therapy | Physical therapy | Gryphon Investors | Physical Rehabilitation Network |

| Jvion | Health tech | Healthcare Growth Partners, Primus Capital | Lightbeam Health Solutions |

| EKG Life Science Solutions | Laboratory services | Imperial Capital Group | Infinity Laboratories |

| Coastal Behavior Consulting | Behavioral health | Leavitt Equity Partners, Waud Capital Partners | Ivy Rehab |

| Dr. Aristides Martinez Internal Medicine Health Center | Hospitals/clinics | MBF Healthcare Partners | Palm Medical Centers |

| Mid-Atlantic Dental Partners | Dental | New Mountain Capital | Western Dental Services |

| Cardiac Services Mobile | Medical devices | O2 Investment Partners | Modulardevices |

| Hometown Medical Supplies (San Jose) | Medical devices | Orix Private Equity Solutions, Seven Hills Capital | Reliable Medical Supply |

| Momentum Healthware | Health tech | Partners Group | Civica |

| Meadows Dental Group (Lone Tree)) | Dental | Rallyday Partners | Espire Dental |

| Arizona Emergency Medicine Specialists | Emergency medical services | Regal Healthcare Capital Partners, Varsity Healthcare Partners | Emergency Care Partners |

| Werner Orthodontics | Dental | Rock Mountain Capital | Spark Dental Management |

| Cornerstone Healthcare Group | Behavioral health | ScionHealth | Apollo Global Management |

| NCGS | CRO | Sequoia Capital, TPG | Novotech CRO |

| Nanoview Biosciences | Medical devices | The Carlyle Group | Unchained Labs |

| Somerset Family Physical Therapy | Physical therapy | Thomas H. Lee Partners | Professional Physical Therapy |

| Digestive Health Specialists (Tupelo) | Gastroenterology | Waud Capital Partners | GI Alliance |

| Gastroenterology Consulting | Gastroenterology | Waud Capital Partners | GI Alliance |

[1]https://www.beckersasc.com/gastroenterology-and-endoscopy/gi-alliance-acquisition-spree-2-deals-in-1-week.html

[2]https://www.beckersasc.com/gastroenterology-and-endoscopy/gi-alliance-acquisition-spree-2-deals-in-1-week.html

[3]https://tddctx.com/texas-digestive-disease-consultants-partners-waud-capital-forms-gi-alliance/

[4]https://www.beckersasc.com/gastroenterology-and-endoscopy/the-rise-of-gi-alliance.html

[5]https://www.prnewswire.com/news-releases/provident-healthcare-partners-advises-gastroenterology-consultants-in-its-partnership-with-gi-alliance-301544549.html

[6] Pitchbook, accessed June 2022.

[7]https://physiciangrowthpartners.com/gastroenterology-private-equity/#:~:text=While%20private%20equity’s%20presence%20in,a%20private%20equity%20backed%20platform.

[8]https://blogs.cdc.gov/cancer/2021/06/08/45-is-the-new-50-for-colorectal-cancer-screening/

[9]https://www.nejm.org/doi/full/10.1056/NEJMra2200869#:~:text=In%20the%20United%20States%2C%20the,2015%2C%20a%2063%25%20increase.

[10]https://bhw.hrsa.gov/sites/default/files/bureau-health-workforce/data-research/internal-medicine-subspecialty-report.pdf pg. 5.

[11]https://www.beckersasc.com/asc-transactions-and-valuation-issues/gastroenterology-an-emerging-trend-in-private-equity-healthcare-transactions.html

[12]https://www.nber.org/system/files/working_papers/w23623/w23623.pdf

[13]https://ihpi.umich.edu/news/many-colonoscopy-patients-could-get-surprise-bills-new-study-finds

[14]https://khn.org/news/article/surprise-medical-bill-colonoscopy-screening-versus-diagnosis/

[15]https://ihpi.umich.edu/news/many-colonoscopy-patients-could-get-surprise-bills-new-study-finds