Private equity takeover of Walgreens could mean risks to patients, workers

December 11, 2024

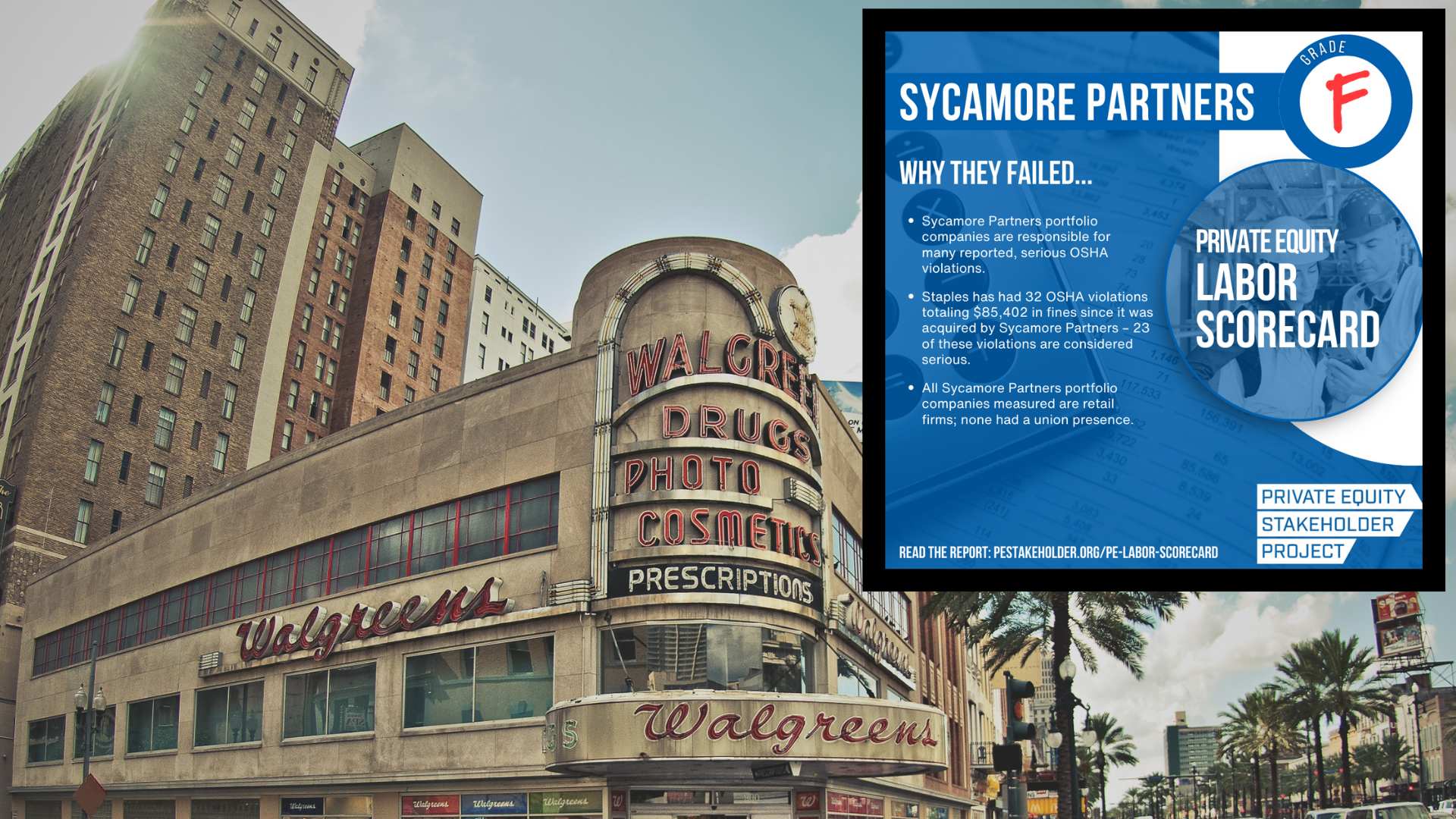

Potential Walgreens buyer Sycamore Partners has history of bankruptcies and workplace violations

This week, a potential acquisition of national pharmacy company Walgreens by private equity firm Sycamore Partners was first reported by the Wall Street Journal.

The nonprofit watchdog Private Equity Stakeholder Project (PESP) released the following statement on the possible private equity takeover of Walgreens:

“Private equity has invested over $1 trillion in the U.S. healthcare sector over the last decade, and touches virtually every corner of the industry. This is despite the fact that private equity investment in healthcare companies carries substantial risk to patients, workers, and investors.

“The typical private equity investment playbook may lead to behavior that jeopardizes patient care and increases bankruptcy risk. In fact, we found that private equity firms played a role in 65% of the largest U.S. corporate bankruptcies during the first six months of this year.

“Sycamore Partners, in particular, has demonstrated problems at the portfolio companies it has owned. Under Sycamore Partners’ ownership, multiple companies, including Belk and Nine West, have filed for bankruptcy. In addition, Sycamore Partners-owned companies have been fined for a number of health and safety, wage and hour, and environmental violations.”

On the 2023 PESP Private Equity Labor Scorecard, Sycamore Partners received a failing grade of 51.73%. Sycamore Partners portfolio companies are responsible for many reported, serious OSHA violations—those in which workplace hazards could cause serious physical harm or death. Staples has had 32 OSHA violations totaling $85,402 in fines since it was acquired by Sycamore Partners—23 of these violations are considered serious. All Sycamore Partners portfolio companies measured are retail firms; none had a union presence.