Researchers launch update to database of top private equity energy portfolios

June 12, 2024

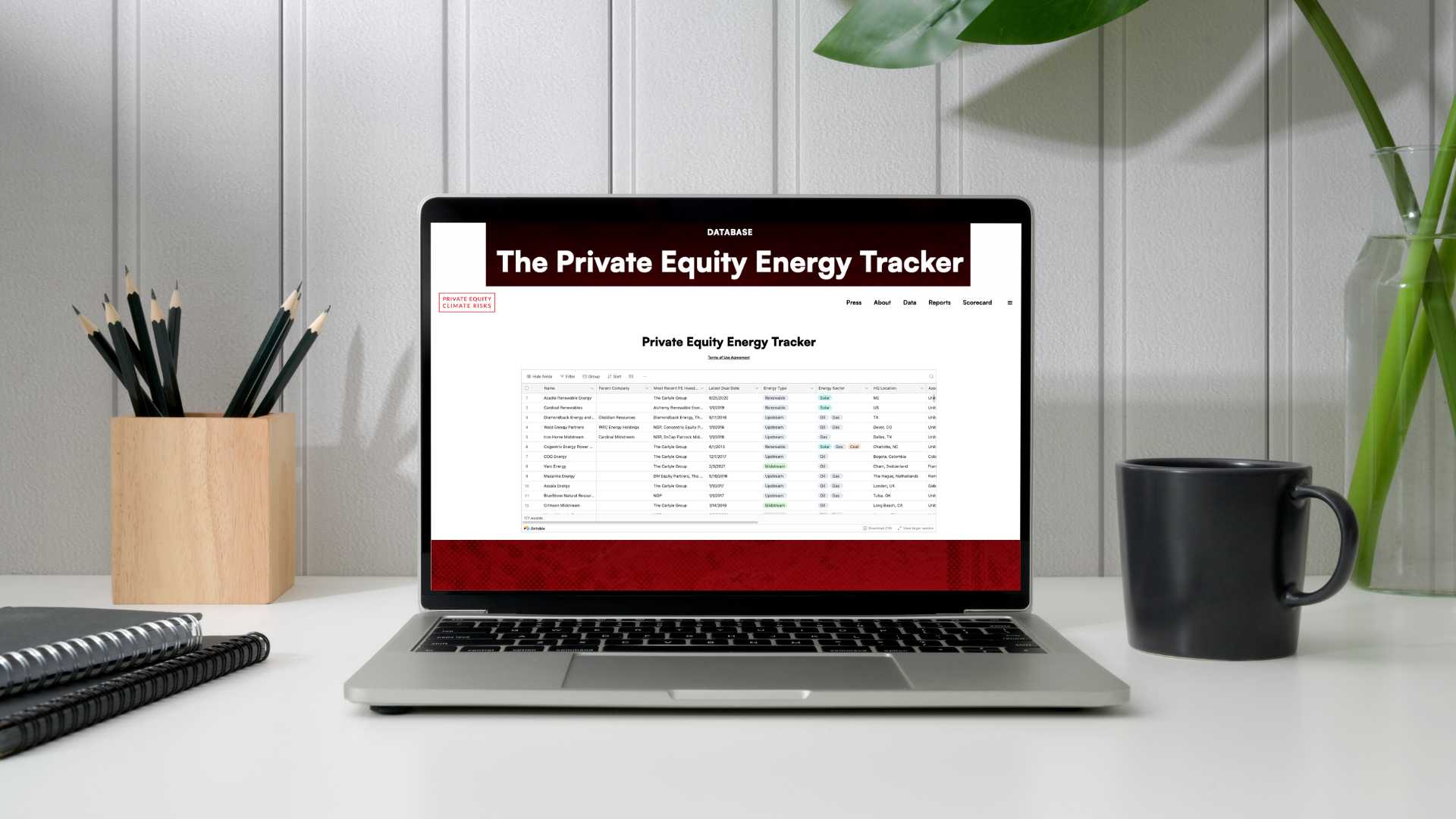

The first-ever Private Equity Energy Tracker was just updated by the Private Equity Climate Risks data consortium project. First released in February of 2024, the Energy Tracker showcases a list of the energy holdings of 21 of the largest private equity firms globally, compiling their energy deals in one, easy-to-access portal/database.

The private equity industry has been quietly expanding into the energy sector for decades, while fighting efforts to allow investors and the public from accessing the true scope of their ownership and influence. The Private Equity Energy Trackerwill allow investors, climate campaigners, community members, journalists, and academics to investigate the role the private equity industry is playing in the continued production and distribution of fossil fuels.

“The Private Equity Energy Tracker finally does what private equity firms refuse to do themselves: disclose their energy portfolios to the public,” said Amanda Mendoza, senior campaign and research coordinator at the Private Equity Stakeholder Project (PESP). “Private equity firms consistently limit disclosure of the extent of their energy portfolios to their investors and to the public. We hope that pension funds and other investors finally have the tools to realize the frightening risks their capital faces when exposed to these private equity-owned fossil fuel companies. These top private equity firms intentionally want their fossil fuel investments to remain shrouded in secrecy, but with the new Energy Tracker, the hidden risks of PE’s dirty investments are showcased for the world to see.”

As of May 2024, these private equity firms were invested in at least 272 companies in the fossil fuel industry out of 404 energy companies overall. The PE Energy Tracker shows that some of the most polluting fossil fuel projects in North America are owned and operated by the firms. This includes the Gen. James Gavin Power Plant in Ohio, one of the largest and top-emitting coal-fired power plants in the United States, and the Colonial Pipeline, the United States’ largest refined products pipeline.

“We knew that private equity has been secretly expanding into the global energy sector, but this data has been truly eye-opening,” said Dustin Duong, research associate at Americans for Financial Reform Education Fund (AFREF). “It punctures their claim that they understand the urgency of the energy transition and the need to pivot to investments that can help solve the climate crisis. Until they stop supporting polluting industries, their claim of protecting communities, especially communities of color and low-income neighborhoods, will always ring hollow.”

Besides the United States, these firms have sizable investments in at least 40 different countries spanning both developed markets such as Canada and the United Kingdom as well as emerging economies including India and Brazil.

“The Private Equity Energy Tracker will allow deeper investigation into the ownership of these energy companies and their assets,” said Alyssa Moore, researcher at Global Energy Monitor (GEM). “Curious about the energy holdings of a specific private equity firm, or the ownership of a particular energy company? This database can be a place to start.”

The Private Equity Climate Risksproject is a collaborative effort investigating private equity’s impact on the climate crisis by Americans for Financial Reform Education Fund, Global Energy Monitor, and the Private Equity Stakeholder Project.