Secretive private equity investments emit more carbon emissions than aviation industry

Workers’ retirement savings are unwittingly financing a billion tons a year of climate pollution, says new Private Equity Climate Risks Scorecard, calling on private equity firms to retire their coal, oil and gas assets

October 2, 2024

A little-examined part of the economy continues to invest vast sums of workers’ retirement savings in fossil fuels, causing more global warming pollution annually than all the airplanes in the world, according to a new scorecard out today.

The 2024 Private Equity Climate Risks Scorecard studied 21 private equity firms that manage $6 trillion worth of companies, and found that two-thirds of the energy companies in their portfolios are invested in fossil fuels, using hundreds of millions of dollars from pension funds.

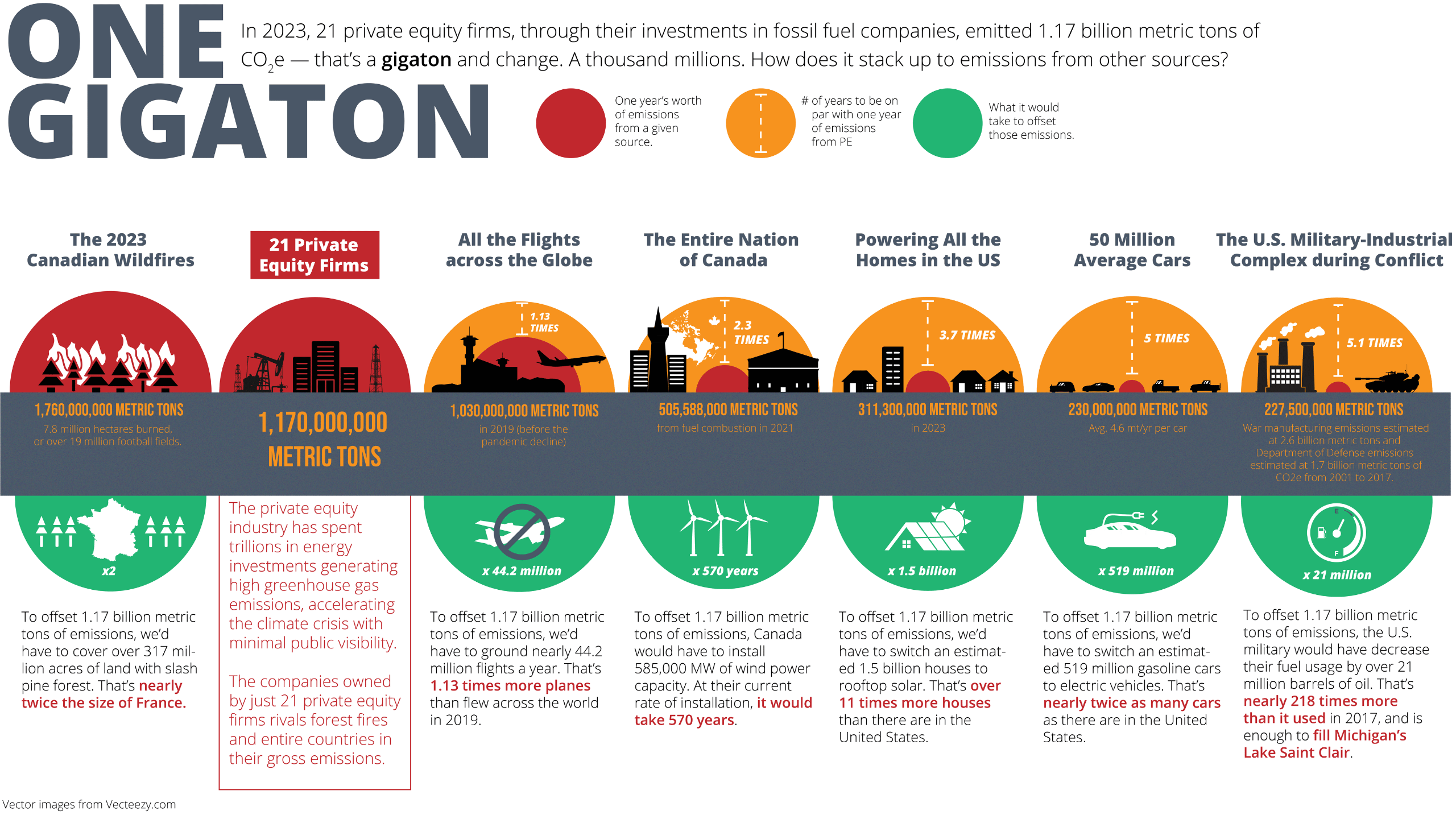

The Scorecard finds that these fossil fuel assets are responsible for 1.17 billion metric tons CO2 equivalent of emissions a year in upstream oil and gas, liquefied natural gas (LNG) terminals, and coal-fired power plants. That gigaton level of emissions is over three times as much as from the energy used to power all the homes in America. It exceeds the global aviation industry, and is on the scale of the Canadian wildfires of 2023.

The Scorecard’s sponsoring organizations point to examples of private equity firms trying to “greenwash” or deny their involvement, and demand they meet five standards for climate action instead.

Researchers for the Americans for Financial Reform Education Fund, Global Energy Monitor, and the Private Equity Stakeholder Project prepared the Scorecard. Its findings are endorsed by 22 organizations including The Carrizo Comecrudo Tribe, Citizens Caring For the Future, Climate Organizing Hub, Divest Oregon, Divest Washington, Earthworks, Food & Water Watch, Friends of the Earth US, Green America, Greenpeace USA, LittleSis, Minnesota Divestment Coalition, Public Citizen, Rainforest Action Network, Sierra Club, Solutions For Our Climate, South Texas Environmental Justice Network, STAND.earth, Strong Economy For All, The Sunrise Project, Urgewald, and Western Environmental Law Center.

The 2024 Private Equity Climate Risks Scorecard compares the impact of private equity firms’ emissions to the 2023 Canadian wildfires and the global aviation industry. Graphic: PECR

Private equity firms are investment funds that pool money from institutional investors — a principal source of which are the pension funds of middle-class working retirees such as public employees like firefighters and teachers. They buy out companies, often strip them of safe worker staffing levels and valuable assets, even sell the land the company operates on, to hike up returns. They frequently proceed to sell the stripped-down version of these companies in a short period such as three to five years.

Such private equity firms are largely unregulated, making it difficult for the public and investors to access clear and comparable data on their investments. Based on laborious research into data that the firms are not required to disclose, the new Scorecard offers a window into an opaque and largely unregulated industry and its already enormous fossil fuel footprint.

“Private equity firms and their executives are making billions by investing public employees’ retirement money into planet-destroying fossil fuel assets,” said Amanda Mendoza, Senior Climate Research and Campaign Coordinator of the Private Equity Stakeholder Project. “These billion-dollar companies make their profits while largely avoiding liability for the damages their fossil fuel investing causes frontline communities. At the end of the day, the price we pay for private equity’s greed is our health and livelihoods, for ourselves and generations to come.”

EIG Global Energy Partners of Washington, D.C., which controls $23.5 billion in assets, got the worst grade, an F, with 82% of its energy portfolio made up of fossil fuel companies and an estimated 271.8 million tons of emissions that contribute to climate change.

Blackstone, the world’s largest private equity firm with $1 trillion under management, has 85% of its energy portfolio companies invested in fossil fuels. The Scorecard singles out Blackstone for being a major investor in the Gavin coal plant in Ohio — “also known as the deadliest coal plant in the U.S.,” Mendoza said. Once thriving, the entire surrounding small town was acquired and bulldozed to enable the coal plant to keep operating.

Private equity giant Kohlberg Kravis Roberts & Co. (KKR) holds investments in 188 fossil fuel assets across 21 countries among $553 billion in assets, including major Liquid Natural Gas holdings. Still, in its self-published sustainability disclosures, KKR reported only 14,342 metric tons of greenhouse gas emissions — when the real climate impact of its entire portfolio is estimated at 6,500 times higher than that, researchers found in April 2024. In just the three fossil fuel asset classes the Scorecard examines, KKR is responsible for 64.3 million tons of emissions.

“A shadowy group of private equity firms secretly finance a gigaton of emissions a year,” said Oscar Valdés Viera of Americans for Financial Reform Education Fund. “Private equity firms buy up oil fields, pipelines, and gas terminals while the rest of us breathe toxic air, face catastrophic fires and floods, and try to plan for an uncertain future.”

The 2024 Scorecard’s researchers and 22 endorsing organizations demand that the private equity firms adopt five important climate standards. They urge that the sources of the capital — such as public pension funds and other institutional investors — add their voices in support:

- Align with science-based climate targets to limit global warming to 1.5⁰c

- Disclose fossil fuel exposure, emissions and impacts

- Report a portfolio-wide energy transition plan

- Integrate climate and environmental justice

- Provide transparency on political spending and climate lobbying

The Scorecard provides details on each of these demands (see p. 30), on which of the private equity firms have made progress, and in what areas.

“While companies like banks and oil majors face pressure over their climate risks and fossil fuel emissions, private equity firms continue to dodge the spotlight, pouring billions into fossil fuels and pushing us further from a sustainable future,” said Alex Hurley of Global Energy Monitor.

“These firms may operate in the shadows, but the public has a right to know how private equity’s debt-fueled extraction of both resources and wealth threatens our climate, communities, and financial stability,” Hurley said. “We call on private equity firms to adopt climate standards that apply to their Scope 3 investments, and retire any fossil fuel assets in their portfolios in short order.”

The 2024 Private Equity Climate Risks Scorecard report was researched, written, and edited by researchers at these organizations, which form the Private Equity Climate Risks research team (PECR) that produced the Scorecard:

Americans for Financial Reform Education Fund is a nonprofit, nonpartisan coalition of more than 200 civil rights, community-based, consumer, labor, small business, investor, faith-based, civic groups, and individual experts. It was founded in the wake of the 2008 financial crisis and its mission is to fight to eliminate inequity and systemic racism in the financial system in service of a just and sustainable economy. @realbankreform

Global Energy Monitor develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape, creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Users of GEM’s data and reports include the International Energy Agency, United Nations Environment Programme, the World Bank, and the Bloomberg Global Coal Countdown. @GlobalEnergyMon

Private Equity Stakeholder Project is a nonprofit organization with a mission to identify, engage, and connect stakeholders affected by private equity with the goal of engaging investors and empowering communities, working families, and others impacted by private equity investments. @PEstakeholder