Sequoia Capital, Technology Crossover Ventures – Think Finance, Elevate Credit

December 11, 2017

From report “Private equity piles into payday lending and other subprime consumer lending”

(Written jointly by Private Equity Stakeholder Project and Americans for Financial Reform)

In recent years, a number of tech-enabled, venture capital-funded startups have sought to “disrupt” the consumer finance industry, utilizing the vast pools of data now available about consumers combined with tools such as machine learning to improve credit decisions and shorten underwriting timelines. While such tools could be used to lower the cost of credit for consumers and make subprime consumer lending more sustainable for borrowers, some consumer-focused financial technology startups have instead utilized the same tactics as payday lenders, charging triple digit APRs along with high fees that are rolled into the cost of the loan and encourage costly refinancing.

Venture capital firms Sequoia Capital and Technology Crossover Ventures have funded two online lending firms with shared origins, Think Finance and Elevate Credit.

John Rosenberg, General Partner at Technology Crossover Ventures, serves as Lead Director on Elevate’s board and served as a director on Think Finance’s board from 2009 to 2014.[i] Michael Goguen, formerly a partner at Sequoia Capital, previously served on Elevate’s board[ii] and on the board of directors of Think Finance from 2006 to 2014.[iii]

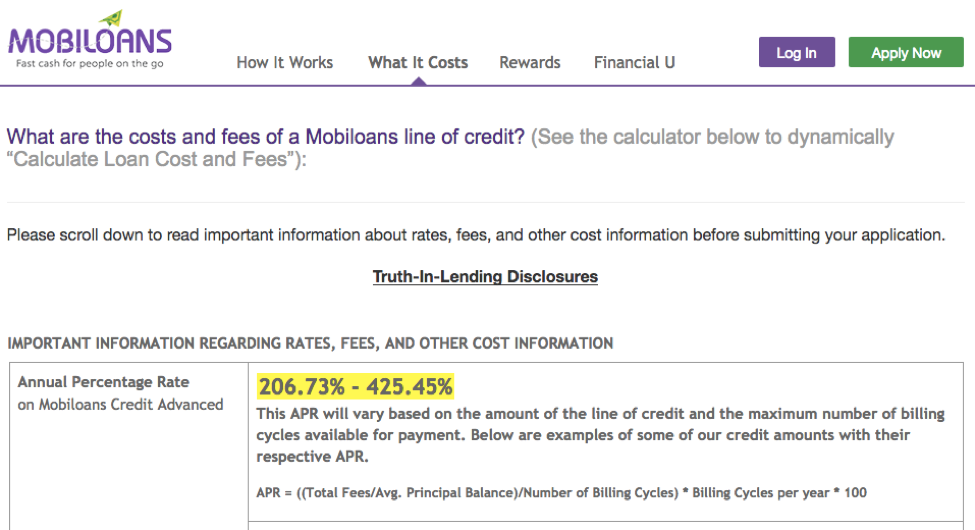

Think Finance was founded in 2001 as Payday One, one of the first online payday lenders.[iv] In 2005, venture capital firms Sequoia Capital, Technology Crossover Ventures, and Startup Capital Ventures invested in the firm.[v]. Think Finance provides “an end-to-end, professionally managed online lending program” including marketing, loan servicing, compliance and risk management.[vi] Think Finance enabled online lenders that have used Native American tribal ownership to circumvent state usury laws (e.g. Mobiloans, Great Plains Lending).[vii] “We think this is a big growth market and will be here for a long time,” then- CEO of Think Finance Ken Rees said of tribal lending in a 2012 interview with Bloomberg Businessweek.

Rees said Think Finance had abandoned doing direct lending itself because “byzantine state laws” made it unprofitable. Native American tribes, he said, “don’t have to look to each state’s lending laws.”[viii]

In recent years, Think Finance and Ken Rees have drawn a series lawsuits related to Think Finance’s conduct, including multiple suits alleging violation of the Racketeer Influenced and Corrupt Organizations (RICO) Act and similar state statutes.[ix]

One of the suits, Gingras v. Rosette, in addition to naming Think Finance and Ken Rees as defendants, also names Sequoia Capital and Technology Crossover Ventures.[x]

In 2014 the Pennsylvania Attorney General filed suit against Think Finance, Rees, and affiliates alleging they had utilized “rent-a-bank” and “rent-a-tribe” schemes to illegally circumvent Pennsylvania usury laws. In early 2016 a federal judge denied Think Finance’s motion for summary judgement, meaning case is proceeding to trial.[xi]

In addition to mounting lawsuits, Think Finance has also drawn regulatory scrutiny. In June 2012 and in February 2016 Think Finance received Civil Investigative Demands from the Consumer Financial Protection Bureau to determine whether Think Finance engaged in unlawful acts or practices relating to the advertising, marketing, provision, or collection of small-dollar loan products.[xii]

In early 2014, perhaps concerned that mounting legal and/or regulatory issues would stall an initial public offering (IPO), Think Finance spun out its direct lending division into a separate company, Elevate Credit. Ken Rees, who led Think Finance and has been named in multiple lawsuits related to the firm, serves as Elevate Credit’s CEO. Elevate went public through an IPO in April 2017 after a last minute withdrawal of the IPO the previous year. Following the IPO, Sequoia Capital Affiliates owned 18.7% of Elevate Credit and remained the largest investor in the company. Affiliates of Technology Crossover Ventures owned 15.2% of the company.[xiii]

As of March 2017, some Elevate Credit customers paid interest rates as high as 365%, though new loans had maximum APR of 299%.[xiv]

While Elevate has not relied on the tribal lender relationships that Think Finance did, it has relied on the relationship with Republic Bank, which is federally chartered, to get around state usury laws. As of the end of March 2017, Elevate Credit’s Elastic line of credit, which is issued by Republic Bank, had an average effective APR of approximately 96%.[xv] This is significantly higher than limits imposed by usury laws on loans of this size in many states.[xvi]

Indeed, earlier this year Elevate reported to investors:

“If we were re-characterized as a “true lender” with respect to Elastic, or Rise in Ohio or Texas, loans could be deemed to be void and unenforceable in some states, the right to collect finance charges could be affected, and we could be subject to fines and penalties from state and federal regulatory agencies as well as claims by borrowers, including class actions by private plaintiffs.”[xvii]

[i]http://investors.elevate.com/corporate-governance, Sept 16, 2017.

[ii]Elevate Credit Final Prospectus, Apr 7, 2017.

[iii]Elevate Credit Form S-1, Nov 9, 2015.

[iv]“Focusing in: Financial firm spinoff elevates profits,” Fort Worth Business Press, Apr 10, 2015.

[v]“Think Finance Receives Funding From Sequoia Capital And Startup Capital Ventures,” www.privco.com, accessed Aug 8, 2017.

[vi]https://www.thinkfinance.com/about/who-we-are, accessed Sept 12, 2017.

[vii]https://www.thinkfinance.com/clients, accessed Sept 12, 2017. “Behind 700% Loans, Profits Flow Through Red Rock to Wall Street, Bloomberg, Nov 24, 2014.

[viii]“Payday Lenders and Indians Evading Laws Draws Scrutiny,” Bloomberg Businessweek, Jun 4, 2012.

[ix] For example, see Gingras v. Rosette, 15-cv-101, US District Court for the District of Vermont and Commonwealth of Pennsylvania v. Think Finance et al., 14-cv-7139, US District Court for the Eastern District of Pennsylvania.

[x]Opinion and Order RE: Cross motion for jurisdictional discovery and motions to dismiss and compel arbitration, Gingras v. Rosette, 15-cv-101, US District Court for the District of Vermont

[xi]Memorandum, Commonwealth of Pennsylvania v. Think Finance et al., 14-cv-7139, US District Court for the Eastern District of Pennsylvania, Jan 14, 2016

[xii]Elevate Credit Final Prospectus, Apr 7, 2017.

[xiii]Elevate Credit Final Prospectus, Apr 7, 2017.

[xiv]Elevate Credit Final Prospectus, Apr 7, 2017.

[xv]Elevate Credit Form 10-Q, May 18, 2017.

[xvi]“Installment Loans: Will states protect borrowers from a new wave of predatory lending,” National Consumer Law Center, Jul 2015.