The fallacy behind the CIM Group’s “commitment” to ESG

August 14, 2023

Environmental, Social and Governance (ESG), is a framework that prioritizes the consideration of the ethical impacts of investments, company leadership decisions, and even environmental waste in regards to how an organization or company functions. Though there are currently no standardized rules for what ESG looks like in practice, companies using an ESG framework often consider factors such as waste pollution and climate change caused by their construction or manufacturing, board diversity; and the racial makeup of communities they choose to engage with or invest in as metrics for assessing their impact. While some say that ESG encourages companies to engage in socially responsible behavior, others argue that ESG is simply a marketing gimmick used by corporations to obscure the negative impacts of their decisions on stakeholders.

Given their treatment of tenants at the Southern Towers apartment complex in Alexandria, Virginia, one may wonder if the private equity firm, the CIM Group, is one of the corporations simply using ESG as a public relations strategy rather than an actual tool to improve the lives of those the company interacts with. On its surface, CIM’s 2022 ESG report paints the picture of a company that values community and sustainable business practices. They include a list of their commitments to changing and improving their business practices alongside local and national nonprofit organizations. However, a deeper dive into their ESG commitments uncovers multiple and significant discrepancies.

In a section titled “The Tenant Experience,” the 2022 ESG Report states:

“We believe that proactively communicating with our tenants is the most effective way to improve tenant satisfaction and retention, improve building performance, cultivate customer service-oriented teams, and foster positive tenant relations.”

Yet at Southern Towers, tenant satisfaction and proactive communication from CIM is far from being achieved. When approached by tenants about existing maintenance issues, CIM Group has repeatedly deflected blame to tenants and previous management. For many of the African immigrants who live at Southern Towers, maintenance requests are often ignored, poorly resolved, or are marked as “completed” on the property’s online maintenance system when problems remain unaddressed.

Another section titled “Health and Safety Initiatives” states that “The COVID-19 pandemic highlighted the responsibility of building owners and operators to facilitate healthy and safe work-live environments.”

Yet when tenants complained to CIM about prevalent mold issues in the buildings, CIM’s most recent response has been to simply paint over the mold instead of proper remediation.

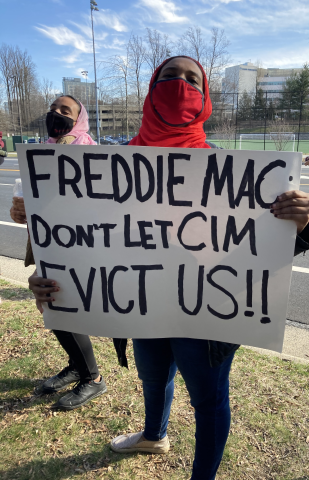

In 2020, CIM purchased Southern Towers using money from a variety of pension fund investors, along with $346.7 million in financing from Freddie Mac. Since CIM’s acquisition of Southern Towers, blue-collar tenants have dealt with predatory actions resulting in their displacement, such as filed evictions during the eviction moratorium, rent hikes, deficient eviction notices, mold infestations and other unresolved maintenance issues. Working with African Communities Together – a nonprofit dedicated to empowering and advocating for African immigrants in the U.S.- Southern Towers tenants have engaged in community organizing to fight back against CIM. Their organizing has resulted in a visit from the Federal Finance Housing Agency (FHFA) Director, Sandra Thompson, along with a public letter from Senators Mark Warner and Tim Kaine about CIM’s treatment of tenants.

A recent CIM-sponsored article in Infrastructure Investor includes statements such as “our investing by its nature has a DEI component,” and “the themes we are investing in are consistent with what we are seeing stakeholders in our communities looking for.” The article shows a complete disconnect between how CIM markets itself to potential investors and the real-world interactions the firm has with its residential tenants. While the CIM website boasts partnerships with nonprofits such as Habitat for Humanity, the firm is actively invested in the displacement of Southern Towers tenants and in the case of Los Angeles neighborhood West Adams, entire neighborhoods.

When making decisions regarding investments, institutional investors cannot assume that every private equity firm claiming a commitment to ESG is engaging in ethical business practices. Collaborating with nonprofits like Habitat for Humanity does not undo the actual harm that CIM causes for Southern Towers tenants and other marginalized communities across the country. The situation at Southern Towers should be a wake-up call for investors and incentivize them to understand the ramifications of their investment decisions when proper due diligence has not been exercised. In order to truly understand the impacts of their investments, institutions should not rely on the company to provide examples, but rather, should prioritize speaking directly with impacted communities who are able to give a more accurate depiction of a company’s ESG commitments.