Unimpressive performance compounds investor concerns over Ariel’s anti-union policies

April 11, 2025

See September 2025 update here

Ariel Investments’ private equity arm is the majority owner of Sorenson Communications, a language services provider for Deaf and hard-of-hearing communities. American Sign Language (ASL) interpreters at Sorenson are organizing a union with the Office and Professional Employees International Union (OPEIU) to improve insufficient wages and working conditions and improve a vital service to the Deaf community. Ariel and Sorenson have refused to meet with the interpreters’ union, instead stating that they are “working to remain free of third-party representation.” This anti-union position contradicts Ariel’s reputation for progressive thinking and positive impact investments that both support diversity and minority owned businesses.

While all Ariel clients should be concerned with the reputational risks involved with Ariel’s anti-union approach at Sorenson, issues regarding Ariel’s performance have surfaced in recent years that are bringing additional negative attention to the firm. Ariel’s mutual funds, which are marketed to both institutional investors and retail investors, have suffered from significant performance issues, according to a PESP review. These include senior staff turnover and poor performance relative to their peers and the broader stock market.

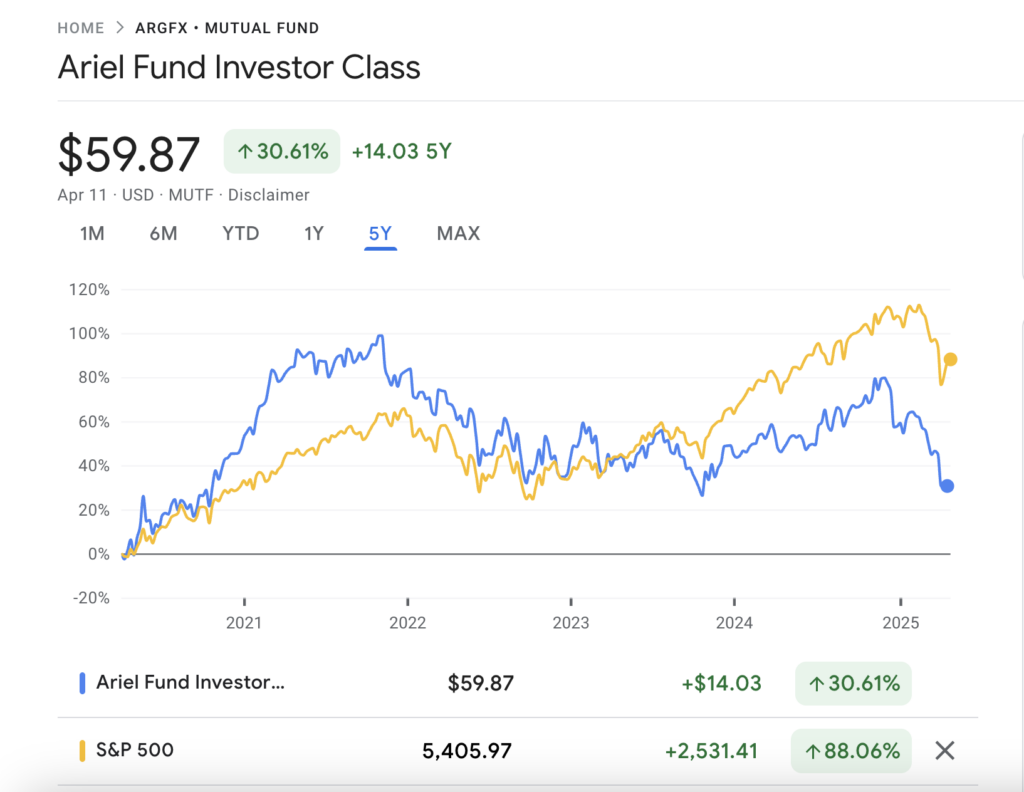

Ariel’s largest fund by assets according to Morningstar, ARGFX, has underperformed the S&P 500 for each year going back to 2022. In 2023 and 2024, that underperformance was dramatic, with the S&P 500 returning over 25 percent and the Russell 3000 returning 23.8 percent in 2024, while ARGFX returned 11.8 percent. In 2023, ARGFX returned 15.81 percent, while the Russell 3000 returned 25.96 percent and the S&P 500 returned 26.29 percent. In 2022, the underperformance was less dramatic but still significant, with ARGFX returning -18.81 percent while the S&P 500 returned -18.11 percent.[1]

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| ARGFX | 10.02 | 30.36 | -18.81 | 15.81 | 11.79 |

| S&P 500 | 18.4 | 28.71 | -18.11 | 26.29 | 25.02 |

| Russell 3000 | 20.89 | 25.66 | -19.21 | 25.96 | 23.81 |

For the ten years ending March 31, 2025, ARGFX returned 6.04 percent annually, while the average fund in their category returned 6.53 annually, and the Morningstar US Small Brd Val Ext TR USD index which Morningstar uses as ARGFX’s index to compare to returned 6.63 percent. During that same time period, the S&P 500 returned 10.7 percent annually. [2]

Google Finance comparison of ARGFX to Russell 200 and Russell 3000.

Google Finance comparison of ARGFX to S&P 500.

Pension Fund Problems[3]

Some public pension funds’ reports have noted Ariel’s underperformance relative to the standard S&P 500 and Russell 3000 stock indexes for US stocks and the MSCI index for foreign stocks, with some placing Ariel on a watchlist. One major public pension fund terminated[4] its Ariel investment altogether in 2023, without citing their justification.

- The Chicago Transit Authority’s pension fund, for which Ariel manages $66 million,[5]reports that over the 10 years ending September 30, 2024, Ariel has returned 8.4 percent,[6] while the Russell 3000, the fund’s benchmark for the entirety of its US equity portfolio, returned 12.8 percent over the same time period.[7] The fund marginally outperformed its specific benchmark, the Russell 2000 Value Index during that time period, which returned 8.2 percent annually, but also underperformed the benchmark that the fund uses for small cap stocks, the Russell 2000 index, which returned 8.8 percent annually over that time period.[8]

- The Chicago Metropolitan Water Reclamation District’s pension fund, which had $87 million[9] invested with Ariel as of September 30, 2024, reported as of December 31, 2024 that their investments in Ariel had returned4 percent over the three year period, ending December 31, 2024.[10] By contrast, the S&P 500 returned 8.9 percent annually[11] over the same time period, and the Russell 3000 returned 8.01 percent.[12] Ariel also trailed the Russell 2500 Value Index (which the MWRD uses as its benchmark) during that time, which returned 3.8 percent.

- The Chicago Teachers’ Pension Fund has $80 million invested with Ariel in a foreign stocks strategy. For the 7 years ending on September 30, 2024, the strategy has returned 3.49 percent, while the MSCI index of foreign stocks has returned 6 percent.[13] Ariel has been on a watch list for CTPF since 2020 for “performance reasons/personnel turnover.”

- The Chicago Municipal Employees Association Benefit Fund has $125 million invested with Ariel.[14] For the 10 years ending on February 28, 2025, Ariel has returned 8.1 percent.[15] The Russell 3000 returned 12.4 percent, and the S&P 500 returned 13 percent.[16] The fund’s “US Equity Policy Benchmark” that the fund uses for its whole US equity portfolio, which includes Ariel, returned 9.7 percent.[17] Ariel did slightly outperform its benchmark selected by the fund, the Russell 2500 Value Index which returned 7.5 percent.[18]

- The Minnesota State Board of Investment (MSBI) has $390 million invested with Ariel in a foreign stocks strategy. For the three years ending June 30, 2024, Ariel returned 7 percent[19] while the MSCI index of global stocks returned 6.86 percent.[20] Ariel’s benchmark for MSBI also outperformed Ariel over the same time period, returning 5.4 percent.[21] The MSBI stated in their August 14, 2024 report that “Value manager Ariel… also lagged the benchmark, hurt by poor security selection in the U.S. and a large overweight to French stocks.”[22] MSBI reports paying $1.86 million in fees to Ariel in 2024.[23]

- The Dallas Employees’ Retirement Fund has $90 million invested with Ariel. For the past 5 years ending June 30, 2024, their Ariel strategy in foreign stocks has returned 7.56 percent annualized, while the MSCI AC World Index has returned 10.76 percent.[24]

The investment research firm Morningstar is critical of Ariel’s offerings. None of Ariel’s mutual funds rated by Morningstar receive above a “Neutral” rating, and two of them have a “Negative” rating.[25] Morningstar gives Ariel as a whole an “Average” rating, noting that “in August 2023, Ariel’s CIO of global equities and portfolio manager Rupal Bhansali left the firm, which was a significant loss given she ran 40% of the firm’s assets as of June 2023. Ariel quickly reassigned the fund to Henri Mallari-D’Auria, but his most recent experience has been focused on emerging markets and he joined the firm only in April 2023.”[26] D’auria will be supported by the younger brother of Bhansali.[27]

For Ariel’s largest fund, ARGFX, Morningstar concluded in January 2025 that “Based on our assessment of the fund’s People, Process, and Parent Pillars in the context of these expenses, we don’t think this share class will be able to deliver positive alpha relative to the category benchmark index.”[28]

The middling performance of Ariel’s funds, which manage billions of dollars for public pension funds, represents a significant lost opportunity for these pension funds at a great cost in fees and opportunity costs. The combination of questions around labor issues, reputational risks, and poor performance should make investors take a deep look at the funds they have entrusted to Ariel.

[1]Data extracted from Morningstar Ariel Funds Profile. Accessed April 3, 2025. https://www.morningstar.com/asset-management-companies/ariel-investments-BN00000JKQ/funds

[2]Morningstar ARGFX Profile — Quarter Ending March 31, 2025. https://www.morningstar.com/funds/xnas/argfx/performance

[3] This data is based on the longest time period available that the fund invested with Ariel after “since inception” data, which is more difficult to make accurate comparisons. For each fund, we’ve taken the most recent quarter for which information is available as of April 1, 2025.

[4] New York State Common Retirement Fund, Monthly Transaction Report, September 2023, page 1

[5] Chicago Transit Authority Employees Retirement Plan, Quarterly Report, Executive Summary, September 30, 2024, page 3 of pdf

[6] Ibid, page 8 of pdf

[7] Ibid, page 7 of pdf

[8] Ibid, page 8 of pdf

[9] Metropolitan Water Reclamation District Retirement Fund-Total Fund Composite, Quarter Ending in September 20, 2024, page 1 of pdf

[10] Metropolitan Water Reclamation District Retirement Fund-Total Fund Composite, Annualized Performance (Net of Fees), page 2 of pdf

[11] Quarterly Performance Report Vermont Pension Investment Commission December 31, 2024, page 19 of pdf

[12] Ibid

[13] Callan, CTPF Executive Summary, September 30, 2024, page 16

[14] Municipal Employees’ of Chicago Annuity and Benefit Fund, Monthly Update, February 28, 2025, page 23

[15] Ibid, page 10

[16] Ibid, page 10

[17] Ibid, page 10

[18] Ibid, page 10

[19] Minnesota State Board of Investment, Comprehensive Performance Report, June 30, 2024, page 222 in pdf

[20] Quarterly Investment Performance Analysis Vermont Pension Investment Commission Period Ended: June 30, 2024, page 20

[21] Minnesota State Board of Investment, Comprehensive Performance Report, June 30, 2024, page 222 in pdf

[22] Ibid, page 76 of pdf

[23] Minnesota State board of Investment, 2024 Annual Report, page 180

[24] Wilshire Quarterly Market Review, June 30, 2024, presented at Dallas ERF September 2024 board meeting, page 53 of pdf

[25] See Morningstar’s Ariel page, accessed April 11, 2025.

[26] Ibid

[27] Callan, CTPF Executive Summary, September 30, 2024, page 5

[28] Morningstar profile of ARGFX