Victory Park Capital – LoanMart, Think Finance, Elevate Credit, LendUp, Personify Financial, Avant

December 11, 2017

From report “Private equity piles into payday lending and other subprime consumer lending”

(Written jointly by Private Equity Stakeholder Project and Americans for Financial Reform)

Chicago-based private equity firm Victory Park Capital, which features former US Senator Joe Lieberman and former Chicago Mayor Richard Daley on its Advisory Board, has provided funding for several online lenders, some of which have utilized tribal lending or “rent-a-bank” schemes to circumvent state payday lending and usury laws and/or paid large fines related to state and federal regulatory complaints.[i]

Think Finance– Victory Park Capital has funded Think Finance since as early as 2010.[ii]

As of September 2016, Victory Park Capital had invested almost $350 million with Think Finance. Specifically, Victory Park appears to have invested in GPL Servicing (GPLS), a Cayman Islands-based entity that acquired loans from Plain Green, a tribal lender owned by the Chippewa Cree Tribe.[iii] In 2012, Bloomberg Businessweek, citing an unnamed source, reported that Victory Park Capital funded the Plain Green loans by taking a 99 percent participation in them once they were made by the tribe.[iv]

Victory Park Capital and affiliates were recently named as defendants in the Pennsylvania Attorney General’s RICO lawsuit against Think Finance and Ken Rees.

In an April 2017 memo, the Pennsylvania AG’s office alleged that “discovery has revealed, as the proposed [Second Amended Complaint] alleges, that Victory Park was no mere investor; it was actually involved in the development and operation of Think Finance’s ‘tribal’ lending structure.”[v]

Elevate Credit– Victory Park Capital has also played a key role in funding Elevate Credit, which spun off from Think Finance in 2014, including providing capital to acquire loans issued through Elevate’s “rent-a-bank” relationship with Republic Bank.. Elevate has relied on the relationship with Republic Bank, which federally chartered, to get around state usury laws. As of the end of March 2017, Elevate Credit’s Elastic line of credit, which is issued by Republic Bank, had an average effective APR of approximately 96%.[vi] This is significantly higher than limits imposed by usury laws on loans of this size in many states.[vii]

As of May 2017, Victory Park Capital had provided a $250 million credit line to Elastic SPV, a Cayman Islands-based entity which purchases loan participations in the Elastic line of credit product originated by Republic Bank & Trust Company.[viii]

LoanMart– In March 2016, Victory Park Capital provided a $100 million credit facility to Wheels Financial Group dba LoanMart, a California-based auto title lender. At that time, LoanMart did business in twenty states and reported being the largest auto title lender in California.[ix]

Auto title lenders like LoanMart require borrowers to put up the title to their car as security for the loan and place liens on borrowers’ vehicles. In some places, LoanMart charges interest rates of more that 200%.[x]

In February 2017, LoanMart agreed to pay the California Department of Business Oversight $450,000 to settle a complaint that the firm had violated the California Finance Lender Law by using unapproved names, engaging in blind advertisements, filing a false report with the Commissioner, compensating unlicensed persons for soliciting or accepting applications for loans, conducting unlicensed brokering from its Illinois branch, and failing to maintain proper books and records.

This was not the first time LoanMart had caught the attention of California regulators. In 2013 the California Department of Business Oversight alleged the company had engaged in false and misleading advertising, leading the department to issue a Desist and Refrain Order.[xi]

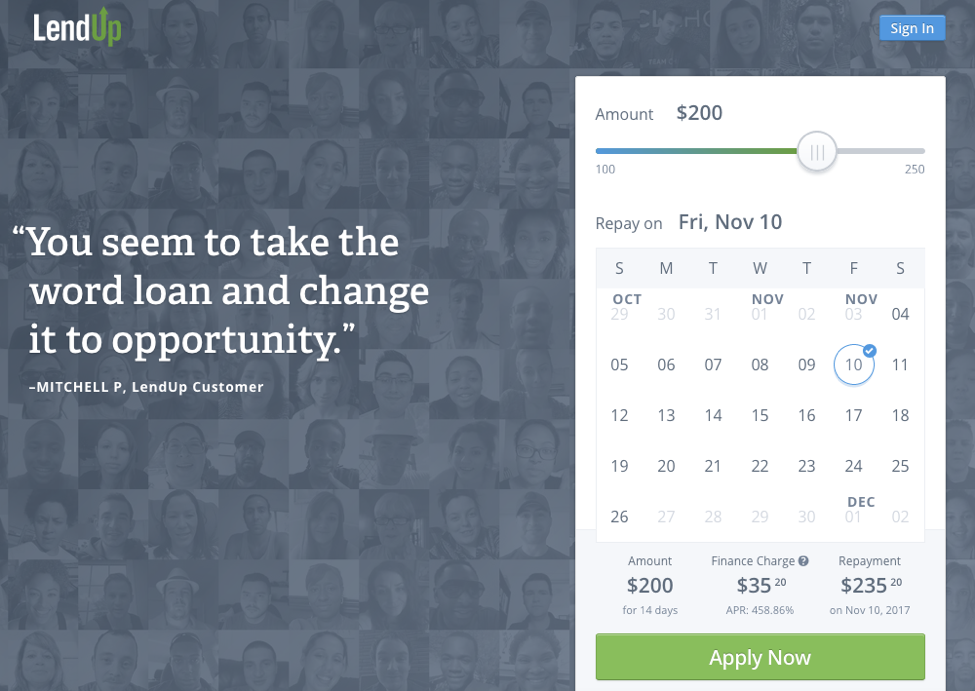

LendUp – In April 2014, Victory Park Capital provided a $50 million credit facility to Flurish Inc. dba LendUp, an online payday lender.[xii] Earlier this year, Bankrate.com reported that the APR on a 14-day, $100 loan from LendUp ranges from 235.42% to 625.71% depending on the state in which the borrower resides.[xiii]

In September 2016, LendUp agreed to pay $6.3 million in refunds and penalties to settle allegations by the California Department of Business Oversight and the federal Consumer Financial Protection Bureau (CFPB) that LendUp charged illegal fees, miscalculated interest rates and failed to report information to credit bureaus despite promising to do so.[xiv]

“LendUp pitched itself as a consumer-friendly, tech-savvy alternative to traditional payday loans, but it did not pay enough attention to the consumer financial laws,” CFPB Director Richard Cordray said in a statement announcing the enforcement action.[xv]

Despite the CFPB and the California Department of Business Oversight complaints, in March 2017 Victory Park Capital gave LendUp an additional $100 million credit facility.[xvi]

[i]VPC Specialty Lending Strategy presentation, Dec 2016.

[ii] “Think Finance Gets $90 Million Credit Line But Mum On IPO,” PE Hub, Sept 22, 2010.

[iii]VPC Specialty Lending Strategy presentation, Dec 2016.; Term sheet for Think Finance-Chippewa Cree Transaction, Mar 11, 2011.

[iv]“Payday Lenders and Indians Evading Laws Draws Scrutiny,” Bloomberg Businessweek, Jun 4, 2012.

[v] Memorandum in support of Commonwealth of Pennyslvania’s motion for leave to file second amended complaint, Commonwealth of Pennsylvania v. Think Finance et al., 14-cv-7139, US District Court for the Eastern District of Pennsylvania, Apr 7, 2017.

[vi]Elevate Credit Form 10-Q, May 18, 2017.

[vii]“Installment Loans: Will states protect borrowers from a new wave of predatory lending,” National Consumer Law Center, Jul 2015.

[viii]“Elevate Announces Expanded Elastic Funding Capacity,” Media Release, May 2, 2017.

[ix]“Victory Park Capital Provides $100 Million Credit Facility to Wheels Financial Group to Support Company Growth,” Media Release, Mar 15, 2016.

[x]https://www.800loanmart.com/legal-missouri-disclosures, https://www.800loanmart.com/legal-utah-disclosures, accessed Sept 22, 2017.

[xi]CA LoanMart Desist and Refrain Order, Jul 11, 2013.

[xii]“LendUp Raises $50 Million To Disrupt Payday Lending,” TechCrunch, Apr 28, 2014.

[xiii]“LendUp personal loans: 2017 comprehensive review,” Bankrate.com, May 2, 2017.

[xiv]“Google-backed LendUp fined by regulators over payday lending practices,” LA Times, Sept 27, 2016.

[xv]“Google-backed LendUp fined by regulators over payday lending practices,” LA Times, Sept 27, 2016.

[xvi]“Victory Park Provides $100MM LendUp Facility,” ABF Journal, Mar 3, 2017.