With High Debt, Dozens of Private Equity-Backed Oil & Gas Companies File for Bankruptcy

October 8, 2020

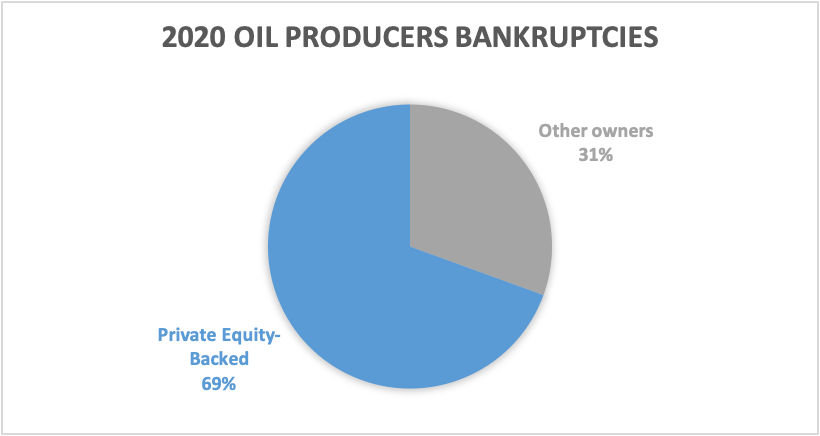

Oil company bankruptcies are on the rise, on track in the first nine months of 2020 to hit the highest number since the 2016 price downturn. However, compared to 2016, this year’s bankrupt companies are carrying substantially more debt. Through August, nearly 70 percent of the oil and gas producers that filed for bankruptcy were backed by private equity firms, or 25 of the 36 filings, according to filings tracked by Haynes and Boone.

Source: Haynes and Boone Energy Bankruptcy Reports and Surveys

Private equity has cultivated a reputation for taking advantage of market distress. As the oil and gas sector struggles under price fluctuations and depressed demand, will private equity chase deals, as in past cycles?

After oil prices dropped in 2014-2016, private equity poured capital into oil and gas companies. The current trend of mounting bankruptcies in the sector underscores the investment risks. Private equity firms often acquire portfolio companies through the heavy use of leverage. But with decreasing revenues, oil and gas companies are failing to meet their debt obligations.

Industry forecasting indicates ongoing weakening in oil and gas consumption. For example, BP reported in September that demand for oil may have peaked last year and may never recover after the coronavirus pandemic. French energy giant Total echoed the pessimism, saying last month that growing global energy demand will support growth in renewables rather than fossil fuels.

Bankruptcies Underscore Risk

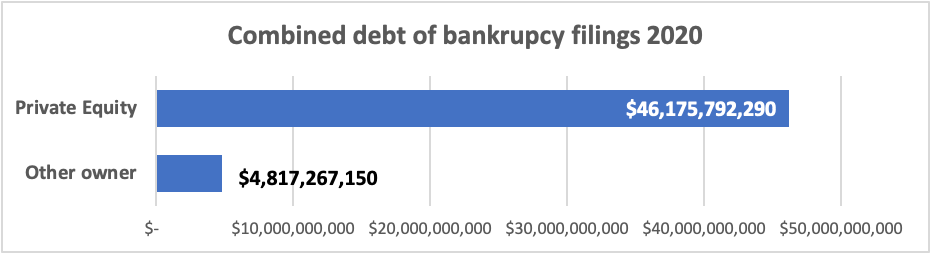

The combined debt of the 36 companies that filed for bankruptcy through August, according to Haynes and Boone, was around $51 billion. Private equity-backed oil producers constitute over 90 percent of that debt, owing a combined $46 billion.

Source: Haynes and Boone Energy Bankruptcy Reports and Surveys

Notably, the average debt held by bankrupt private equity-backed oil and gas producers was $1.85 billion, more than four times that of their non-private equity-backed peers.

| Average Debt Load | |

| Private Equity-Backed | $ 1,847,031,692 |

| Other Owners | $ 437,933,377 |

Source: Haynes and Boone Energy Bankruptcy Reports and Surveys

Private equity’s model of loading debt obligations onto portfolio companies limits those companies’ ability to adapt to new market conditions. Luckey McDowell, a partner in the law firm Shearman & Sterling told PE News in June, “Portfolio companies that were more levered are going to have a harder time servicing that debt. Private equity groups are not immune from liquidity challenges.”

For instance, earlier this year, Ultra Petroleum — backed by Fir Tree Capital, a private equity firm – filed for Chapter 11 bankruptcy for the second time in four years. Ultra’s operational problems, however, began before the pandemic. During its 2019 third quarter earning call, Ultra executives stated that it had suspended drilling operations for the remainder of 2019 and into 2020.

“Given the backdrop of the [low natural gas] pricing environment, we simply were not in a position to invest capital at the rates of return needed to organically generate net free cash flow, and we determined that it made more sense for the business as a whole to focus on free cash flow generation and the use of this cash to repay debt,” CEO Bradley Johnson said Nov. 7, 2019. Two quarters later, the company filed for bankruptcy in May 2020.

Another example involves Hi-Crush, a leading Texas provider of fracking shale sand, which is backed by private equity firm Avista Capital Partners. On July 7, 2020, Hi-Crush’s board of directors granted nearly $3 million in bonuses to four executives. Five days later, the company declared bankruptcy. Aside from low fuel demand, Michael Boyd, an investment advisor with Energy Income Authority, told Reuters, “the firm’s downfall stems also from poor oversight by directors who prioritized the interests of executives over shareholders, a common problem in the U.S. shale sector.”

Hi-Crush’s questionable investment decisions are exemplified by a 2017 land acquisition, according to an analysis of comparable sales by Reuters. Hi-Crush paid $275 million for 1,226 acres in west Texas. In the same period, Reuters found that larger properties in the region were selling for substantially less. The seller had acquired the same parcel two months prior for $12 million, meaning Hi-Crush paid a premium of 20 times the previous acquisition price.

Private equity investments in energy face challenges

Private equity investments in energy face new challenges. As publicly traded energy companies have faced pressure, they’ve shied away from new oil patch acquisitions, which in part has complicated exit pathways for private equity-backed oil firms. Private equity firms sold an average of $10.4 billion in oil and gas assets a year in the 2017-2019 period, 64% less than the $28.5 billion they sold in 2016, PE News reported.

“The private equity industry mistook a structural change, that is a collapse in buyer demand, for being cyclical and tied to oil prices,” Calgary-based Waterous Energy’s CEO and managing partner Adam Waterous told PE News.

In July 2020, Warburg Pincus told investors it will not make any deals tied to fossil fuels in its next flagship fund. Earlier in the year, Warburg Pincus suspended fundraising for its second energy fund.

“I think you are going to see the energy private equity world shrink — their next funds are going to be smaller as institutional investors are abandoning the energy sector,” Pickering Energy Partners LP founder Dan Pickering told S&P Global in an interview.

The table below shows some of the private equity-backed oil and gas companies that have filed bankruptcy, with debt loads exceeding $100 million including secured and unsecured debt, as tracked by Haynes and Boone.

| Filing Date | Debtor | Private Equity Owners | Total Secured & Unsecured Debt |

| 6/28/20 | CHESAPEAKE ENERGY CORPORATION | Citadel Advisors, Carlyle (exited its 9% stake in May) | $11,800,000,000 |

| 7/15/20 | CALIFORNIA RESOURCES CORPORATION | Ares Management | $6,285,823,505 |

| 5/14/20 | ULTRA PETROLEUM CORP | Fir Tree Capital Management, Disciplined Growth Investors Inc | $5,532,056,552 |

| 5/22/20 | UNIT CORPORATION | Partners Group, OPTrust | $4,808,182,228 |

| 8/16/20 | CHAPARRAL ENERGY, INC. | Bayou City Energy | $3,542,888,635 |

| 6/14/20 | EXTRACTION OIL & GAS, INC. | Yorktown Partners, Luminus Management | $2,522,573,161 |

| 7/30/20 | DENBURY RESOURCES INC. | GoldenTree Asset Management, Fidelity | $2,500,000,000 |

| 8/3/20 | FIELDWOOD ENERGY INC. | Riverstone Energy, Canada Pension Plan Investments, ACE & Company | $1,959,200,000 |

| 6/25/20 | SABLE PERMIAN RESOURCES, LLC | Energy and Minerals Group, OnyxPoint Global Management, Pantheon International | $1,434,296,685 |

| 5/15/20 | GAVILAN RESOURCES, LLC | Blackstone, Mesquite Energy | $1,120,804,265 |

| 7/16/20 | BRUIN E&P PARTNERS, LLC | ArcLight Capital Partners | $1,077,000,000 |

| 1/27/20 | SOUTHLAND ROYALTY COMPANY LLC | EnCap Investments, MorningStar Partners | $625,047,200 |

| 3/23/20 | SHERIDAN HOLDING COMPANY I, LLC | Warburg Pincus | $618,485,147 |

| 6/28/20 | LILIS ENERGY, INC. | Varde Partners | $579,876,334 |

| 6/17/20 | CHISHOLM OIL AND GAS OPERATING, LLC | Ares Management, Apollo Global | $560,003,485 |

| 5/31/20 | TEMPLAR ENERGY LLC | Bain Capital, Ares Management, Paulson & Co Inc. | $465,700,000 |

| 7/26/20 | ROSEHILL RESOURCES INC. | EIG Global Energy Partners | $362,700,000 |