Petco’s IPO: All Bark and No Bite?

January 12, 2021

The private equity-owned retailer’s market share has shrunk and staffing cuts mean employees are stretched

Private equity-owned pet supply retailer Petco is seeking to raise $744 million this week through an initial public offering (IPO).[1]

In recent months, US pet supply retailers have faced widely different fortunes. On November 4, a day before Petco announced it had filed confidentially for the IPO, competitor Pet Valu (also private equity-owned) announced that it was winding down operations and closing all of its 358 stores and warehouses across the U.S. Meanwhile, online retailer Chewy has seen its sales grow by 46% during the pandemic.

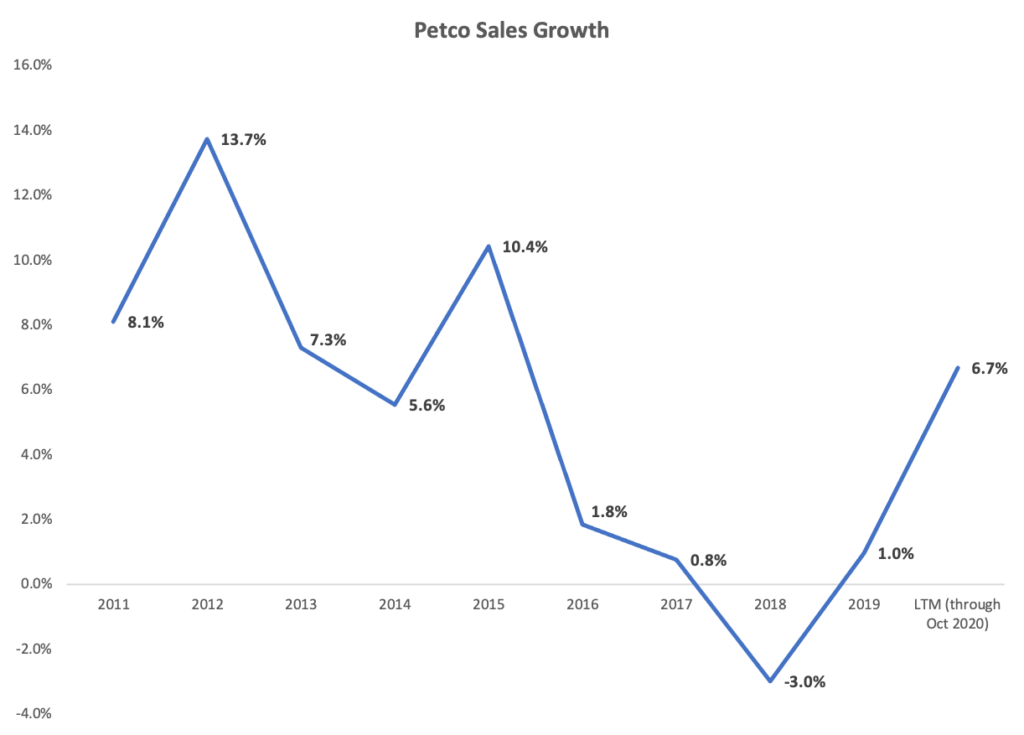

Petco’s recent performance under private equity ownership has been lackluster, with its sales growth significantly trailing industry growth in four of the past five years. Petco’s market share has shrunk as competition from fast growing online competitors has increased – and stands to increase further as more consumers have shifted to buying online during the COVID-19 pandemic.

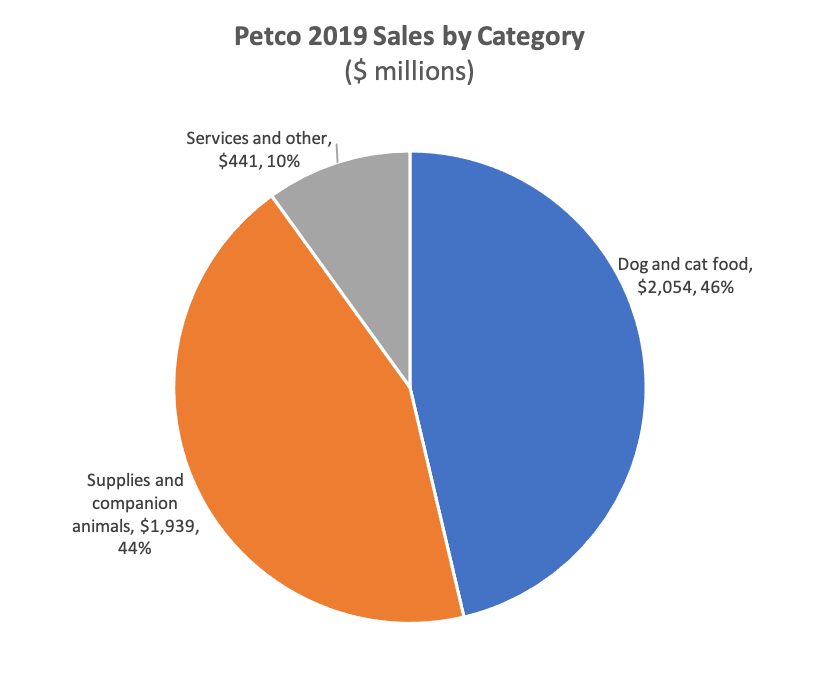

Petco has sought to differentiate itself by growing the variety of services it offers (e.g. grooming, training, veterinary clinics, etc.), but those still make up a small part (~10%) of its overall business.

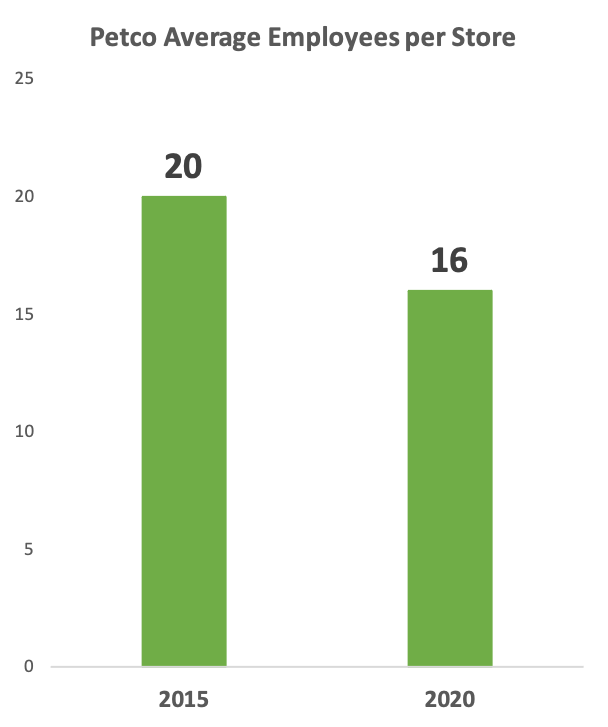

In addition, the Petco employees that staff its stores, interact with customers, and provide those services are stretched thin. Petco has cut thousands of staff in recent years even as it has expanded its store count and service offerings. This has been especially clear during the COVID-19 pandemic, as Petco has laid off employees even as its sales have increased.

Key points:

- Petco’s sales growth has stagnated in recent years, growing by an average of 1.4% annually since private equity firm CVC Capital Partners and the Canada Pension Plan Investment Board (CPPIB) acquired the company in 2015, significantly lagging growth in the US pet care industry more broadly.

- Petco’s online sales in particular have lagged competitors like Chewy, meaning it has missed out on an opportunity during the COVID-19 pandemic.

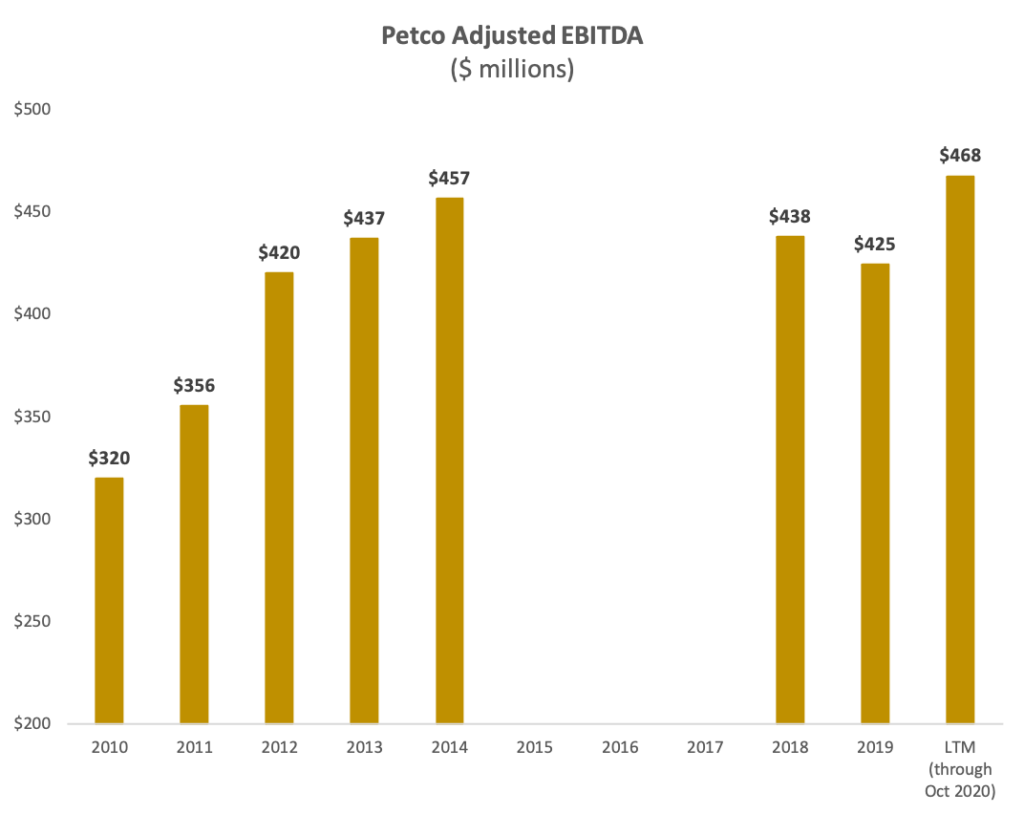

- Petco’s adjusted EBITDA has grown by less than 0.4% on an annualized basis since 2015.

- Services accounted for just 9% of Petco’s overall sales between February and October 2020 and 10% last year, meaning the company faces significant risk from online competitors.

- CVC Capital and CPPIB, the same ownership group that has overseen years of sluggish revenue and EBITDA growth at Petco, will remain in control of the company post-IPO.

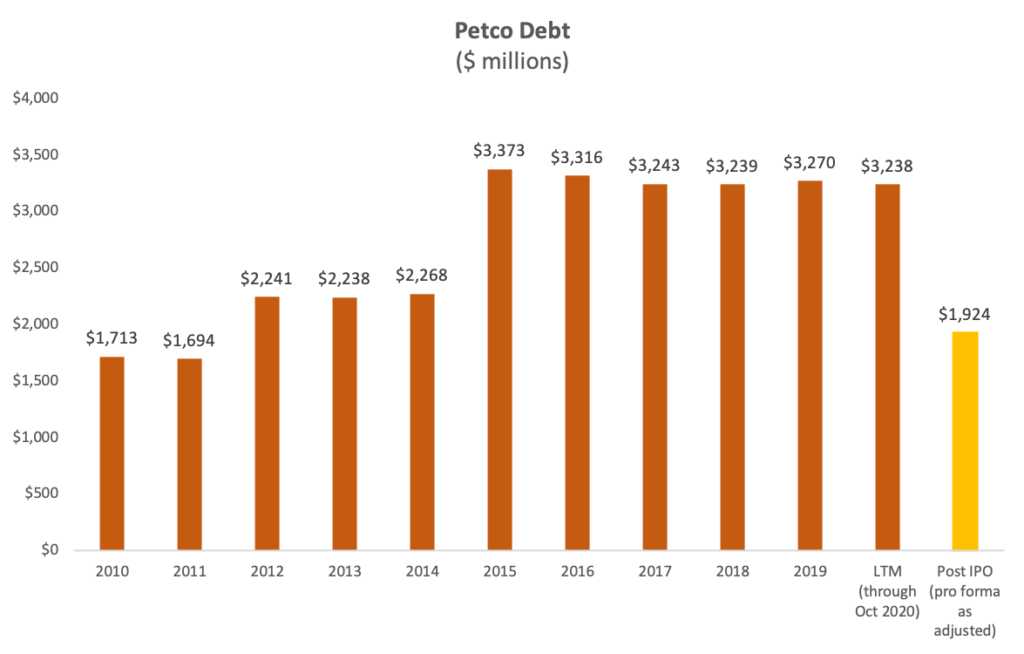

- Multiple private equity buyouts have left Petco with a mountain of debt: Petco’s Net Debt-to-Adjusted EBITDA ratio over the last twelve months was around 6.5x, or 8.9x if operating lease liabilities are included.

- While Petco has called itself a “category defining brand,” since 2017 the company has written down the value of its goodwill and intangibles such as brands by around $910 million.

- While Petco has sought to distinguish itself by emphasizing its variety of service offerings, the employees that provide those services are stretched thin: since 2015, Petco has added 59 additional stores but cut nearly 5,000 employees.

Petco’s sales growth has stagnated in recent years

After years of rapid sales growth between 2011 and 2015, Petco’s sales have stagnated in recent years as the company has faced aggressive competition from online competitors like Chewy and Amazon.

While Petco did see a significant increase in sales during the COVID-19 pandemic (February through November 2020), the company’s sales growth had stagnated during the prior four years (2016-2019) under its current ownership by private equity firm CVC Capital and others.[2]

While US pet care industry sales have grown by an average of 5% annually over the last several years, Petco’s sales have only grown by an average of 1.4% annually under CVC Capital’s ownership.[3]

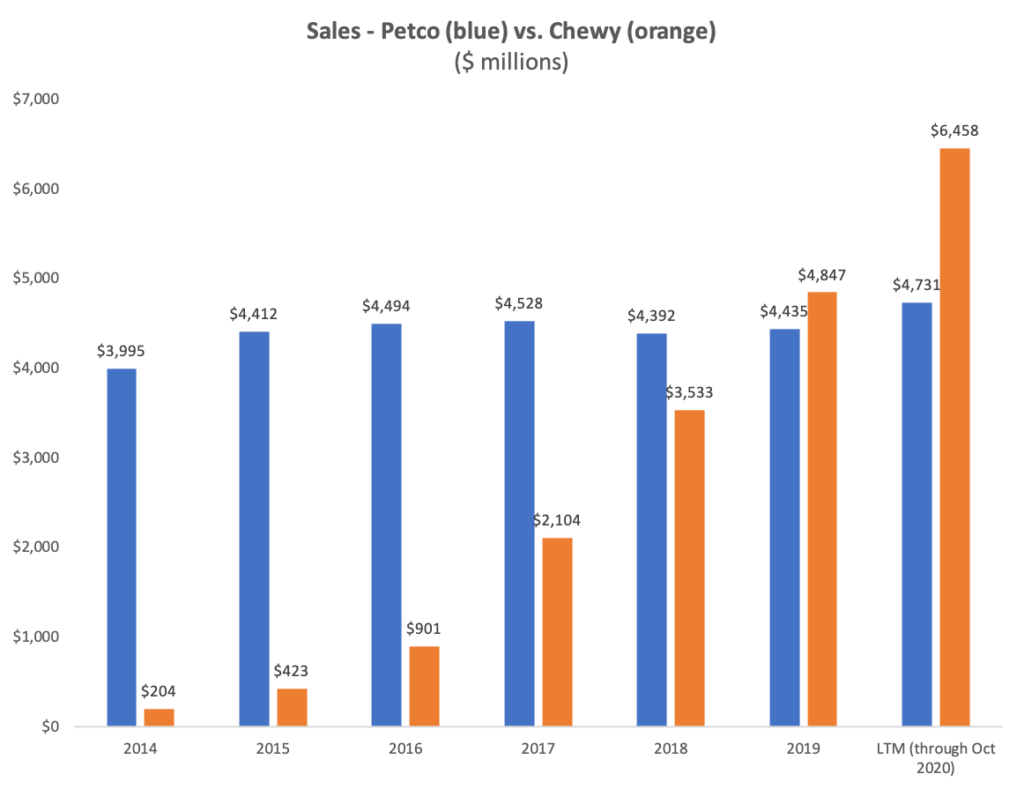

Instead, Petco has watched faster growing competitors like Chewy pass it by. Since 2015, Chewy’s sales have grown by an average of 72% annually.[4] In 2014, Chewy had $203 million in sales.[5] By 2019, Chewy generated $4.8 billion in sales, surpassing Petco ($4.4 billion).[6]

While Petco has seen its sales grow by 9% during the first three quarters of 2020 versus the same period last year, from $3.3 billion to $3.6 billion, Chewy’s sales grew by 46% over the same period, from $3.5 billion to $5.1 billion.[7]

Petco’s online sales in particular have lagged competitors like Chewy, meaning it has missed out on an opportunity during the COVID-19 pandemic, and may continue to miss out as customers shift more of their purchases online.

Petco generated around $476 million in ecommerce and digital sales between February and October 2020, less than one tenth of the online sales Chewy saw over the same period.[9] Chewy spent almost three times as much on advertising and marketing ($363 million) as Petco did ($124 million) during that period.[10]

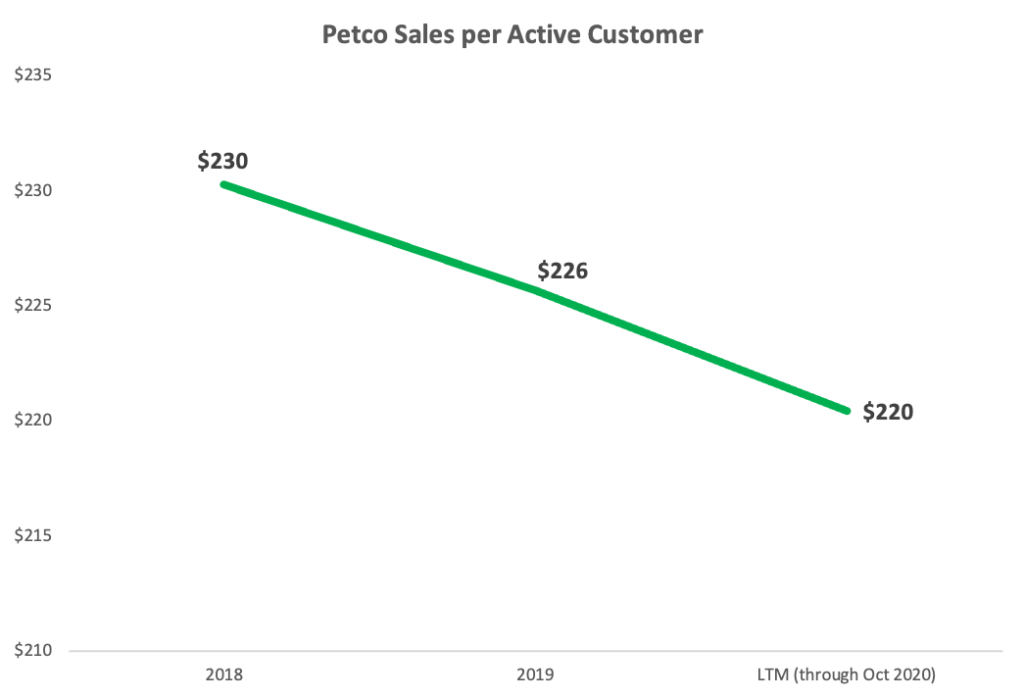

Petco’s net sales per active customer have declined in recent years. Petco has touted its 21 million active customers, but the company has seen its net sales per active customer decline from $230 in 2018 to $220 over the twelve months ending October 2020.[11] By comparison, Chewy saw its net sales per active customer increase from $334 in 2018 to $363 over the twelve months ending October 2020.[12]

Petco’s earnings before interest, taxes, depreciation and amortization (EBITDA) and Adjusted EBITDA growth has been similarly lackluster. In the twelve months through October 2020, Petco reported $355 million in EBITDA and $467 million in Adjusted EBITDA.[13] In 2014, prior to the CVC Capital buyout, the company had generated $411 million in EBITDA and $456 million in adjusted EBITDA, suggesting Petco’s Adjusted EBITDA has grown by less than 0.4% on an annualized basis since the CVC Capital buyout. The company’s unadjusted EBITDA declined by 2.4% annually over the same period.[14]

Petco’s Adjusted EBITDA margin has also declined from 11.4% in 2014 to 9.9% over the twelve months ended October 2020.[15]

CVC Capital and CPPIB will remain in control of Petco post-IPO

Since January 2016, Petco has been controlled by private equity firm CVC Capital Partners and the Canada Pension Plan Investment Board (CPPIB).[16]

Following the IPO, CVC Capital Partners and CPPIB will remain in control, holding 81% of voting power.[17]

Petco will remain a controlled company after its IPO, will not have a majority of independent directors and its Compensation Committee, and its Nominating and Governance Committee will not consist entirely of independent directors.

CVC Capital Partners and CPPIB hold a majority of seats on Petco’s board.[2][18]

In other words, the same ownership group that has overseen years of sluggish revenue and EBITDA growth at Petco will remain in control following the company’s IPO.

Petco still mostly sells products, meaning it faces significant risk from online competitors

In its prospectus, Petco has sought to emphasize its varied pet service offerings (e.g. grooming, training, veterinary services) as a way to distinguish itself from online competitors like Chewy, Amazon and retailers like Walmart and Target. But services accounted for just 9% of Petco’s overall sales between February and October 2020. Services accounted for 10% of Petco’s overall sales during the company’s 2019 fiscal year.[19]

The vast majority of Petco’s sales come from sales of dog and cat food (~46%) and sales of pet supplies and companion animals (~44%), much of which faces direct and increasing competition.[20]

Further, Petco has reported that services are less profitable than its sales of pet food and supplies, meaning even if the company succeeds in shifting its sales mix toward services to distinguish itself from online retailers, it may sacrifice profitability of the process.[21]

Multiple private equity buyouts have left Petco with a mountain of debt

While Petco has not generated significant sales and EBITDA growth in recent years, multiple private equity buyouts have left the company with $3.23 billion in debt.[22]

Petco’s Net Debt to Adjusted EBITDA ratio over the last twelve months is around 6.5x, or 8.9x if operating lease liabilities are included.[23]

Petco has not significantly reduced its debt since the company was acquired by CVC Capital and other investors in a leveraged buyout in 2015, though the company does plan to use IPO proceeds to reduce its debt.

In April 2020, rating agency Moody’s downgraded Petco’s corporate credit rating from B3 to Caa1 and the rating on its term loan from B2 to B3. Moody’s recently changed Petco’s outlook to positive, citing company’s operating performance during the pandemic. Still, the agency maintained the same lower credit ratings, adding:

“The competitive landscape is getting tougher as consumers are increasingly shopping online at companies like Chewy (owned by PetSmart) and Amazon and the mass channel which includes supermarkets, Walmart, and Target continues to price aggressively.”[24]

Moody’s, October 2020

Petco faces a January 2023 maturity on its $2.4 billion term loan.[25]

Petco has substantially written down the value of its goodwill and brands in recent years

While Petco has pitched itself as a “category-defining brand with long-term customer relationships built on trust,” the company’s recent write-downs suggest the brand and customer relationships are not what they once were.[26]

Since 2017, Petco has written down the value of the company’s goodwill and intangibles such as brands by around $910 million.[27] The company has written down the value of its goodwill by 27%, or $807 million, citing “a combination of market conditions, increased competition from online competitors, and decreased financial performance.”[28]

While Petco has emphasized multiple product and service offerings, its employees are stretched thin

It its prospectus, Petco has attempted to rebrand itself as a “pet health and wellness company” offering not just products but also a variety of services including veterinary clinics, grooming, and training to distinguish itself from online competitors like Chewy and Amazon. Petco has emphasized the role of its employees in this transformation, noting:

“Across our platform, we have a team of over 23,000 highly trained pet care experts who love animals and are passionate about sharing their expertise with pet parents. Through our people—such as digital experts, sales and engagement partners, groomers, trainers, companion animal experts, and veterinarians—we are able to build and maintain long-term, high-touch relationships with pet parents.”[29]

Yet while Petco has expanded the services it offers, its employees are increasingly stretched thin, with fewer employees in its stores than a few years ago. In mid 2015, prior to its acquisition by the CVC Capital-led ownership group, Petco had a total of 1,409 stores and 27,800 employees, or around 20 employees per store.[30]

Since then, Petco has added 59 additional stores but cut nearly 5,000 employees, meaning its average employees per store has dropped by one fifth to around 16. [31]

In September 2020, hundreds of Petco employees signed on to a letter to Petco owner CVC Capital in which they asked the firm to provide protective equipment, hazard pay, and other protections to frontline Petco workers, reporting:

“The vast majority of us are working in stores that lack basic safety precautions, like adequate masks and gloves, and have drastically cut hours, while the rest of us are navigating the unemployment process due to the mass furloughs and layoffs in the midst of a global health crisis and recession.”[32]

Given Petco’s growing reliance on employees to provide the variety of services it offers to distinguish its brand from competitors, it is surprising that the company has cut back on staffing and laid off workers even as it saw a 9% jump in sales during the COVID-19 pandemic. [33]

[1]Pet Acquisition LLC form S-1/A, Jan 6, 2021. “WOOF! Pet care retailer Petco sets terms for $744 million IPO,” Renaissance Capital, Jan 6, 2021.

[2]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.4.

[3]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.3,p.63.

[4]Chewy form 10-Q, Dec 8, 2020. Chewy form 10-K, Apr 2, 2020.Chewy form 424B4, Jun 17, 2019.

[5]Chewy form 424B4, Jun 17, 2019, p.58.

[6]Chewy form 10-K, Apr 2, 2020. p.49. Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.63.

[7]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.63. Chewy form 10-Q, Dec 8, 2020, p.3.

[8]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.26.

[9]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.77. Chewy form 10-Q, Dec 8, 2020, p.3.

[10]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.F-14. Chewy form 10-Q, Dec 8, 2020, p.3.

[11]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.63, p.65.

[12]Chewy form 10-Q, Dec 8, 2020, p.16, Chewy form 424B4, Jun 17, 2019, p.18.

[13]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.20.

[14]Petco Holdings Inc form S-1/A, Oct 20, 2015. p.17.

[15]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.20. Petco Holdings Inc form S-1/A, Oct 20, 2015. p17.

[16]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.13.

[17]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.13.

[18]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.114-115.

[19]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.F-19.

[20]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.F-19.

[21]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.72.

[22]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.65.

[23]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.65.

[24] ‘Moody’s announces completion of a periodic review of ratings of Petco Animal Supplies, Inc.,” Moody’s, Apr 29, 2020.“Moody’s changes Petco’s outlook to positive; affirms Caa1 CFR,” Moody’s, Oct 8, 2020.

[25]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.82.

[26]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.94.

[27]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.63.

[28]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.79, p.F-27.

[29]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.5.

[30]Petco Holdings Inc form S-1/A, Oct 20, 2015. p.86.

[31]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.5, p.20.

[32]Petco workers letter to CVC Partners, Aug 31, 2020.

[33]Pet Acquisition LLC form S-1/A, Jan 6, 2021, p.4.