JLL Partners – ACE Cash Express

December 11, 2017

From report “Private equity piles into payday lending and other subprime consumer lending”

(Written jointly by Private Equity Stakeholder Project and Americans for Financial Reform)

Private equity firm JLL Partners of New York took payday lender ACE Cash Express private in 2006.[i]

Frank Rodriguez of JLL joined the ACE Cash Express’ board of directors.[ii] Rodriguez currently serves as Managing Director at JLL Partners and is a member of JLL’s Management Committee.[iii]

ACE Cash Express has over 1,000 locations in 23 states.[iv] ACE Cash offers payday loans, auto title loans, longer-term installment loans, prepaid debit cards, and other services online and through its branch network.[v] In 2014, the Dallas Morning News reported that ACE Cash Express had an annual transaction volume of $14 billion and saw 40 million customer visits over the prior year.[vi]

ACE charges as much 661% interest (APR) on a fourteen-day loan.[vii] Ace, like many payday lenders, has also begun migrating to long-term payday loans with advertised rates exceeding 200% APR.[viii]

Payday lenders themselves have a long history of pushing the limits or outright ignoring consumer protection laws. ACE, in particular, has run afoul of state and federal regulators multiple times since JLL Partners took control.

In 2008, the California Commissioner of Business Oversight conducted a regulatory examination of ACE which found purported violations including that ACE collected excessive amounts from customers and conducted unlicensed payday loan transactions over the internet and at a branch office. In 2010, ACE entered into a settlement agreement and stipulation to a Desist and Refrain Order that issued approximately 2,512 citations against ACE and ordered it to pay $118,400 in penalties.[ix]

In 2014, ACE agreed to pay $10 million to settle federal allegations by the Consumer Financial Protection Bureau (CFPB) that it used false threats of lawsuits and other illegal tactics to pressure customers with overdue loans to borrow more to pay them off.[x]

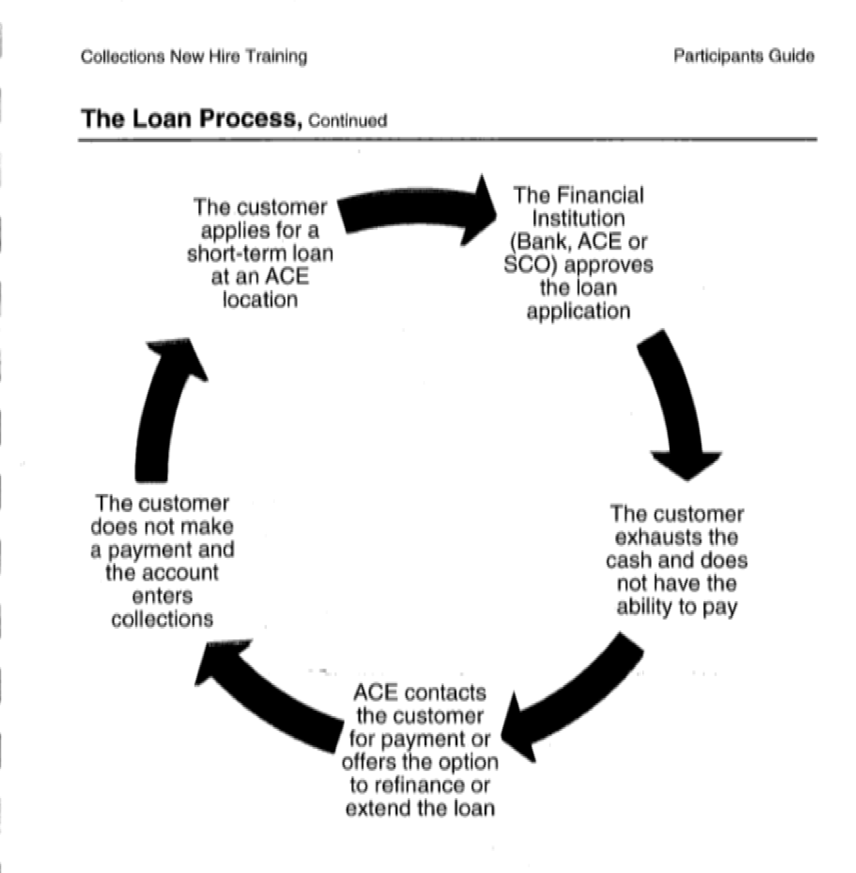

The CFPB alleged that ACE’s tactics trapped consumers in a cycle of debt: ”ACE structures its payday loans to be repaid in roughly two weeks, but its

borrowers frequently roll over, renew, refinance, or otherwise extend their loans beyond the original repayment term. These borrowers typically incur additional interest and fees when they roll over, renew, or refinance their loans.

“ACE used false threats, intimidation, and harassing calls to bully payday borrowers into a cycle of debt,” said CFPB Director Richard Cordray. “This culture of coercion drained millions of dollars from cash-strapped consumers who had few options to fight back.”[xi]

In 2015, the California Commissioner of Business Oversight sought to suspend ACE’s license to sell payday loans in California over a series of alleged lending violations and violation of the 2010 consent order ACE had signed with the state.[xii] ACE ultimately settled for a fine and continues to operate in California.[xiii]

In 2016, State of Washington Department of Financial Institutions (DFI) examiners found that ACE had made more than 700 prohibited payday loans to more than 360 Washington borrowers, collecting more than $48,000 in loan and default fees. ACE Cash Express entered into a consent order with the Washington DFI and agreed to pay a fine.[xiv] ACE appears to have ceased making loans directly in Washington, instead now serving as a lead generator for online lender, Enova (dba CashNetUSA).[xv]

In 2015, The New Jersey State Investment Council, which invests pension funds on behalf of the state, tasked its director with exploring an exit of the state pension system’s commitment to a JLL Partners fund that owns payday lender ACE Cash Express. New Jersey law prohibits payday lenders from operating within the state.[xvi]

Endnotes:

[i]“Management buys out Ace Cash Express for $420M,” Marketwatch, Jun 7, 2006.

[ii] ACE Cash Express restated articles of incorporation, Oct 5, 2006.

[iii]https://www.jllpartners.com/transaction-team, accessed Sept 15, 2017.

[iv]www.acecashexpress.com, accessed Aug 3, 2017.

[v]https://www.acecashexpress.com/, accessed Sept 12, 2017.

[vi]“’Appalling’ predatory lending practices cost Ace Cash Express $10M in settlement with feds,” Dallas Morning News, Jul 10, 2014.

[vii]ACE TX CSO Payday Installment Fee Schedule, accessed Aug 16, 2017.

[viii]ACE Cash Express installment loan rate schedule for California, accessed Sept 22, 2017.

[ix]Accusation in support of notice of intent to issue order suspending California Deferred Deposit Transaction License, Mar 24, 2015.

[x]“ACE Cash Express to pay $10 million over ‘cycle of debt’ allegations,” LA Times, Jul 10, 2014.

[xi]“CFPB Takes Action Against ACE Cash Express for Pushing Payday Borrowers Into Cycle of Debt,” Media Release, Jul 10, 2014.

[xii]Accusation in support of notice of intent to issue order suspending California Deferred Deposit Transaction License, Mar 24, 2015.

[xiii]Settlement Agreement, Oct 5, 2015.

[xiv]Consent Order, State of Washington Department of Financial Institutions, Feb 12, 2016.

[xv]www.acecashexpress.com/about-ace, accessed Aug 8, 2017. https://www.acecashexpress.com/services, accessed Sept 22, 2017.

[xvi]“Buyouts Snapshot: NJ explores exit of JLL fund with stake in payday lender,” www.pehub.com, May 29, 2015.