Blackstone’s Description of ESG Practices Leaves Out Key Information on its Fossil Fuel Investments

November 11, 2020

Filling in the Gaps on Blackstone’s energy investments

Key Points

– Private equity firm The Blackstone Group recently released a brochure describing its environmental, social, and governance (ESG) program that left out information about the firm’s extensive fossil fuel holdings.

– While Blackstone notes that oil “exploration and production make up less that 3% of the fair market value of Blackstone’s entire portfolio,” it does not describe Blackstone’s larger portfolio of energy investments that includes midstream and power generation assets as well.

– Blackstone’s reporting of fair market value understates the impact of its investments since many of its energy investments are now worth less than what Blackstone invested. For example, Blackstone has seen at least two energy companies it owns, Gavilan Resources and Energy Alloys, go bankrupt in recent months.

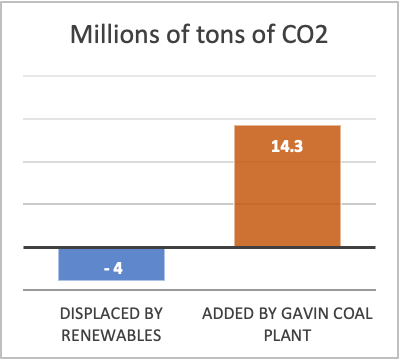

– While Blackstone touts the CO2 emissions that its renewable energy investments displace, the firm’s Gavin coal plant emitted 14.3 million tons of CO2 in 2019, more than 3.5 times the emissions projected to be displaced by all of Blackstone’s renewable investments (4 million tons).

– It is unclear how Blackstone applies environmental, social and governance (ESG) factors in energy investments, particularly fossil fuels, since Blackstone has proceeded with investments in energy assets with substantial environmental violations and/or community opposition such as the Rover Pipeline, Eagleclaw (Permian Highway Pipeline), and Tallgrass Energy (Plaquemines Terminal).

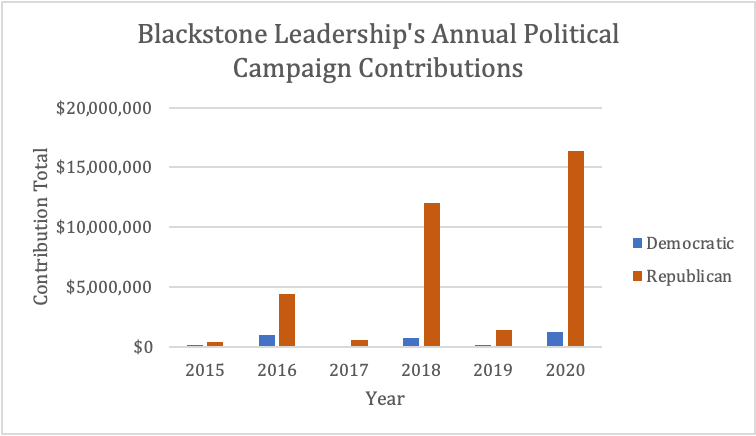

– Blackstone has not committed to disclose how its political spending aligns with the Paris Accord, and in the last several years 90% of its executives’ political contributions supported President Donald Trump and Republican candidates as the Trump administration has dismantled numerous environmental regulations.

Our August 2020 report: Blackstone Drills Deeper as Investors Shift Away from Fossil Fuels

Blackstone’s Energy Portfolio

The world’s largest alternative asset manager, The Blackstone Group, recently released a brochure describing its environmental, social, and governance (ESG) program, with some limited references to the company’s energy investments. However, the brochure leaves out information about Blackstone’s extensive fossil fuel holdings and the climate impacts of those investments.

Blackstone’s ESG brochure said it will continue to invest “across the energy landscape,” including some renewables. In fact, Blackstone’s energy investments include nearly two dozen fossil fuel companies compared to just a handful of renewable firms.

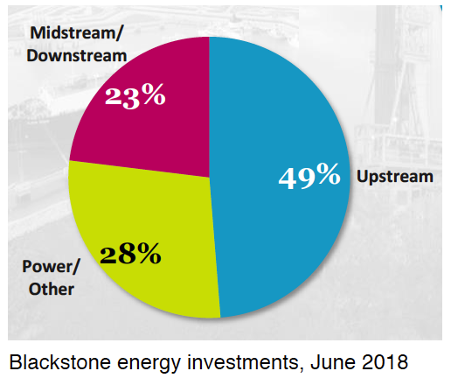

In the ESG brochure, Blackstone reports that oil “exploration and production make up less that 3% of the fair market value of Blackstone’s entire portfolio.” However, that is an incomplete picture, as upstream assets in oil exploration and production represent only a portion of Blackstone’s larger portfolio of energy investments which also includes midstream assets like pipelines or power generation.

Based on Blackstone’s $568 billion in assets under management as of July 2020, that 3% still amounts to billions of dollars invested in oil exploration and production.

In its first quarter 2020 report, Blackstone noted that overall energy represents 7% of its investment portfolio on an aggregate basis.

In addition, fair market value does not adequately measure the climate impacts of investments that Blackstone substantially marked down in value. For example, Blackstone has seen at least two energy companies it owns, Gavilan Resources and Energy Alloys, go bankrupt in recent months. As of the end of September, energy investments held by Blackstone’s Energy Partners I (2011) fund were worth 10% less than what the firm had invested. Investments in its Blackstone’s Energy Partners II (2015) fund were valued at a 20% discount.[1]

As of June 2018, Blackstone reported that its energy portfolio was 49% in upstream, 23% in Midstream/Downstream and 28% in power generation, which includes some renewables but also coal-fired power plants.[2]

Blackstone has said that in the last couple of years, it has focused more on midstream assets like oil and gas pipelines. As of June 30, 2020, Blackstone reported owning $14.7 billion in publicly traded oil and gas (mostly midstream) investments.

Blackstone also continues to own oil exploration and production companies, and has recently made new investments in oil exploration. For example, in July Reuters reported that Blackstone signed a preliminary deal to raise its stake in a drilling project in the Gulf of Mexico.

Blackstone’s coal plant’s emissions are 3.5 times greater than those displaced by renewable investments

Blackstone’s ESG brochure said that “4 million tons of CO2 (are) projected to be displaced annually through renewable energy assets developed and built under Blackstone’s ownership, the equivalent of taking ~864k passenger cars off the road.”

However, Blackstone also owns the General JM Gavin coal plant in Ohio, acquired with Arclight in 2017. The EPA listed the Gavin plant as the 6th largest coal polluter in the US in 2019.

The Gavin plant emitted 14.3 million tons of CO2 in 2019,[3] the equivalent of 3.1 million passenger vehicles driving for a year.[4] In other words, the Gavin plant emitted 3.5 times the CO2 that all of Blackstone’s renewable investments are projected to displace. Since Blackstone and Arclight acquired the plant, the emissions from Gavin add up to more than 45 million tons of CO2.

These figures do not account for the climate impacts of Blackstone’s other fossil fuel investments, such as offshore drilling or gas pipelines.

Renewable Energy Investments

Blackstone’s ESG brochure claims the company has “committed over $7 billion to renewable energy investments.” But in other communications Blackstone confirmed that the $7 billion figure represents enterprise value, meaning the number does not indicate how much was Blackstone’s equity investment as compared to debt.

Moreover, the brochure does not provide an equivalent figure for investments in fossil fuels or energy as a whole, so it is difficult to assess what portion of Blackstone’s overall energy investments were to renewable energy versus fossil fuels. However, a review of Blackstone’s energy portfolio shows the vast majority of its energy portfolio companies are fossil fuel related.[5]

Furthermore, it is unclear what analysis Blackstone used to evaluate the climate impacts and risks of its fossil fuel assets.

In Blackstone’s real estate portfolio, the company has sought to “reduce energy consumption with operational efficiency improvements,” according to the ESG brochure, and has set targets on a subset of real estate assets to cut energy usage. But in fossil fuel investments, while a strategy for operational efficiency may be desirable, it does not address the more significant climate impacts. For example, emissions generated directly through operations (such as methane) as well as throughout the value chain (Scope 1, 2 and 3 emissions).

Blackstone’s Consideration of Environmental, Social and Governance (ESG) factors

It is unclear how Blackstone applies environmental, social and governance (ESG) factors in energy investments, particularly fossil fuels.

Blackstone’s ESG brochure noted that it conducts due diligence “to assess any risks related to environmental issues, labor and employment practices, governance policies, and cybersecurity” and collects information on environmental litigation or audits.

But Blackstone has proceeded with investments in energy assets with an active roster of environmental violations and/or community opposition such as the Rover Pipeline, Eagleclaw (Permian Highway Pipeline), and Tallgrass Energy (Plaquemines Terminal).

In an August conversation, Blackstone officials mentioned their use of sector specific ESG questionnaires but declined to make the energy sector document public. It is unclear how Blackstone’s ESG policy is applied by energy investment teams to evaluate deals that have pre-existing problems, nor is it clear what steps asset management teams take to mitigate existing or emerging problems related to community opposition, litigation and citations or penalties by environmental regulators.

Of equal importance, it is unclear how Blackstone tracks or accounts for the short- and long-term carbon impact of its fossil fuel investments.

Political Spending

Although voters opted for a change in administration, Blackstone’s political contributions have largely gone in the opposite direction, overwhelmingly to President Donald Trump and Republican Senate candidates and PACs. Blackstone executives contributed millions in political donations, particularly CEO and Chairman Stephen Schwarzman.

Schwarzman alone gave nearly $20 million to Republican PACs, including nearly $5 million to Trump-affiliated PACS even as President Trump has gutted environmental regulations to the benefit of the oil & gas industry (including Blackstone’s own portfolio companies).

Blackstone has responded that its executives have a range of political views and their contributions are bipartisan. However, Federal Election Commission (FEC) contribution data show that over 90% of Blackstone executives’ political giving has been to Republicans, and Mr. Schwarzman has vastly outspent his colleagues.

| Party | Percent | Contributions |

| Republican | 91.4% | $35,081,800 |

| Democratic | 8.5% | $3,288,775 |

Over the course of Trump’s presidency, Blackstone executives increased their contributions to Republicans, contributing the most in 2020 at over $16 million.

Further, Mr. Schwarzman’s closeness with the Trump administration has meant he has played a role in federal energy policy in ways that have overlapped with some of Blackstone’s investments.

For example:

- In early 2017 Mr. Schwarzman addressed Canadian officials on behalf of the Trump Administration regarding the approval of pipeline projects, including the Keystone XL pipeline owned by TC Energy (previously called Transcanada Corp).

- In March 2017, the Trump administration granted a permit to the Keystone XL pipeline.

- In August 2017, Blackstone acquired Harvest Fund Advisors, which invests in publicly traded pipeline companies.

- Between Sept 30 and Dec 31, 2018, Harvest Fund Advisors acquired a $45 million stake in Transcanada Corp.[6]

- In March 2019, President Trump issued a new permit for Transcanada’s Keystone XL pipeline.

- As of June 30, 2020 Blackstone had amassed a more than $600 million stake in TC Energy and a related company (TC Pipelines LP).[7]

Shareholders at a number of companies, like Chevron, have adopted resolutions calling for disclosure of lobbying and political spending and whether it aligns with the Paris Accords and the 1.5 degree scenario.

When asked if Blackstone would commit to similarly disclose how its, its portfolio companies’, and its executives’ political spending aligns with the Paris Climate Accords and the 1.5 degree scenario, Blackstone responded that the question is not relevant since contributions are made by individual executives.

Our August 2020 report: Blackstone Drills Deeper as Investors Shift Away from Fossil Fuels

[1] Blackstone Group Form 10-Q, 3Q20.

[2] Blackstone Group presentation, June 2020.

[3] According to US EPA Air Markets Program Data https://ampd.epa.gov/ampd/

[4] www.epa.gov/energy/greenhouse-gas-equivalencies-calculator

[5] 80% of Blackstone’s energy portfolio consists of fossil fuel companies while 20% are in renewables (Counting companies that don’t directly or exclusively produce renewable energy like an energy transmission company, a middle eastern firm focused on both renewables and fossil fuels, and a financing firm for residential solar).