Carlyle Group fundraising drops by half as head of private equity, other executives depart

May 4, 2023

Private equity firm The Carlyle Group reported earlier this week that its fundraising declined by 48% over the last twelve months through March 2023.[1] Carlyle reported raising $27.6 billion during the twelve months ending March 31, 2023[2], down from nearly $53 billion the year prior.[3]

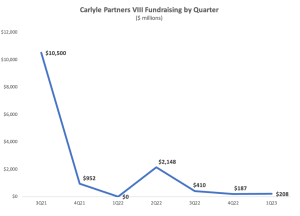

Carlyle’s flagship buyout fund, Carlyle Partners VIII, in particular has struggled. After raising $10.5 billion during its first quarter in market (third quarter 2021), the fund has raised less than half of that ($3.9 billion) over the last six quarters combined.[4] Carlyle Partners VIII raised just $208 million during the first quarter of 2023 and $395 million over the past six months.[5]

If Carlyle keeps fundraising at that rate ($208 million per quarter), it will take the firm 15 more years to reach Carlyle Partners VIII’s $27 billion target.[6]

(Source: Carlyle Group earnings releases, 3Q21-1Q23)

Carlyle private equity head, other executives leave firm

The decline in fundraising corresponds to a period when Carlyle has seen dozens of longtime staff depart – from Managing Directors to its CEO Kewsong Lee to, most recently, the Chief Investment Officer of Carlyle’s private equity funds.

Since 2019, dozens of Carlyle executives and employees with a combined total of more than 550 years’ experience at Carlyle and almost a thousand years of investment/ finance experience have left the firm. That exodus of expertise may leave investors wondering about the quality of investment decisions at Carlyle.

Peter Clare, Carlyle’s longtime Chief Investment Officer of its private equity funds, chairman of Carlyle’s Americas division and a member of the company’s board of directors, stepped down from the firm on April 30 after more than thirty years.[7]

Clare helped build Carlyle’s Asia buyout business and launch the firm’s first distressed-debt investments before being appointed co-head of the US buyout division in 2011, Bloomberg reported.[8]

Clare’s exit comes as Carlyle Partners VIII fundraising has stalled and after Carlyle recently launched fundraising for Carlyle Asia Partners VI, seeking as much as $10 billion for the fund.[9] Meanwhile, Carlyle is preparing to launch fundraising for its Carlyle Europe Partners VI buyout fund, seeking 7.5 billion euros ($8.5 billion).[10]

Oil and gas fund helps prop up Carlyle fundraising

Carlyle reported that NGP Natural Resources XIII, an oil and gas-focused fund managed by Carlyle subsidiary NGP Energy Capital that is seeking to raise $2.5 billion[11], was one of the drivers of its fundraising in the first quarter of 2023.[12] Carlyle and NGP are also raising NGP Royalty Partners II, another oil and gas fund.[13]

Carlyle Group subsidiary NGP has continued to make new oil & gas investments, including Wing Resources VII (April 2023)[14], Elk Range Royalties (April 2023)[15], and Mesa Minerals III (Nov 2022).[16]

Carlyle staff departures, 2019-2023

| Name | Position | Departure | Years at Carlyle | Years Investment/ Finance Experience (at Carlyle exit) | Source |

| Peter Clare | CIO Private Equity | Apr-23 | 31 | 31 | https://www.ft.com/content/c3972a50-d3ac-4669-8ca4-e78ac014d567 |

| Ryan Selwood | Chief Development Officer | Feb-23 | 1 | 22 | https://www.bloomberg.com/news/articles/2023-02-14/carlyle-s-chief-development-officer-ryan-selwood-departs-firm |

| Todd Triller | Managing Director | Jan-23 | 6 | 34 | https://www.linkedin.com/in/todd-triller-46115543/ |

| Brooke Coburn | Deputy Chief Investment Officer, Real Assets | Dec-22 | 26 | 30 | https://www.linkedin.com/in/brooke-coburn1993 |

| Rahul Mukim | Director | Dec-22 | 6 | 16 | https://in.linkedin.com/in/rahul-mukim-9b56367?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Avik Dey | Co-Head of Energy | Nov-22 | 0.5 | 18 | https://www.bnnbloomberg.ca/carlyle-energy-co-head-avik-dey-who-joined-this-summer-to-exit-firm-1.1847947 |

| Patrick Doyle | Executive Partner | Nov-22 | 3 | 21 | https://www.linkedin.com/in/patrick-doyle-81381a7/ |

| Kewsong Lee | CEO | Aug-22 | 9 | 33 | https://www.nytimes.com/2022/08/29/business/carlyle-group-kewsong-lee.html |

| Jay Sammons | Global head of consumer, media and retail | Aug-22 | 16 | 18 | https://www.bloomberg.com/news/articles/2022-08-08/carlyle-s-head-of-consumer-media-retail-sammons-leaves-firm#xj4y7vzkg |

| Nathan Urquhart | Global head of investor relations | Aug-22 | 3 | 14 | https://www.pionline.com/alternatives/carlyle-executives-mike-gozycki-nathan-urquhart-latest-leave-alternatives-manager |

| Ashley Evans | Partner in Carlyle’s technology, media and telecommunications group | Jul-22 | 16 | 19 | https://www.bloomberg.com/news/articles/2022-08-08/francisco-partners-hires-carlyle-s-ashley-evans-as-a-partner |

| Mike Gozycki | Managing Director | Jul-22 | 15 | 15 | https://www.pionline.com/alternatives/carlyle-executives-mike-gozycki-nathan-urquhart-latest-leave-alternatives-manager |

| Norma Kuntz | Chief Operating Officer and Chief Financial Officer of Global Private Equity | Jun-22 | 11 | 24 | https://www.linkedin.com/in/norma-kuntz-023b4a1b |

| David Bluff | Managing Director, Head of buyout team in Australia and New Zealand | Jun-22 | 14 | 21 | https://www.afr.com/street-talk/carlyle-country-head-david-bluff-announces-retirement-20220602-p5aqhc |

| Ian Jackson | Managing Director/Partner | Jun-22 | 13 | 26 | https://uk.linkedin.com/in/ian-jackson-4454a820b?original_referer=https%3A%2F%2Fwww.google.com%2F |

| George Westerkamp | Managing Director, Alpinvest | Jun-22 | 21 | 31 | https://nl.linkedin.com/in/george-westerkamp-86894410 |

| James Shillito | Principal, Healthcare | Jun-22 | 7 | 22 | https://www.linkedin.com/in/james-shillito-b54a124 |

| Cam Dyer | Managing Director, Partner, Co-head of Global TMT Sector | Jan-22 | 20 | 24 | https://www.linkedin.com/in/cam-dyer-163066138 |

| Michael Johnson | Head of Investor Relations for Carlyle Global Credit | Jan-22 | 1 | 19 | https://www.linkedin.com/in/t-michael-johnson-a80b88b |

| Nancy Palleschi | Managing Director and Head of Global Conferences and Events | Dec-21 | 21 | 21 | https://www.linkedin.com/in/nancy-palleschi-a617144 |

| Fernando Borges | Managing Director | Aug-21 | 14 | 26 | https://br.linkedin.com/in/fernando-borges-09560654?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Adam Palmer | Managing Director | Jun-21 | 25 | 27 | https://www.linkedin.com/in/adam-palmer-9a22877 |

| Cherine Aboulzelof | Managing Director, Head of Europe, Metropolitan Real Estate | Apr-21 | 4 | 28 | https://uk.linkedin.com/in/cherine-saddi-aboulzelof-83714234 |

| Erik Thyssen | Managing Partner, Alpinvest | Apr-21 | 20 | 20 | https://nl.linkedin.com/in/erik-thyssen-1a804118?original_referer=https%3A%2F%2Fwww.google.com%2F |

| David Tung | Managing Director, Asia fundraising | Mar-21 | 21 | 36 | https://www.privateequityinternational.com/carlyle-fundraising-rainmaker-retires-after-two-decades-with-firm/ |

| Shary Moalemzadeh | Co-Head of Illiquid Credit Strategies and Co-Head of Carlyle Strategic Partners | Feb-21 | 17 | 30 | https://www.bloomberg.com/press-releases/2021-02-08/blackstone-hires-shary-moalemzadeh-as-a-senior-managing-director-for-blackstone-tactical-opportunities |

| Adam Glucksman | Managing Director | Jan-21 | 10 | 17 | https://www.linkedin.com/in/adam-glucksman-89194a34?original_referer=https%3A%2F%2Fwww.google.com%2F |

| William Allen | Managing Director | Jan-21 | 12 | 16 | https://www.linkedin.com/in/william-allen-41a512215?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Glenn Youngkin | Co-CEO | Sep-20 | 25 | 28 | https://www.carlyle.com/media-room/news-release-archive/youngkin-lee-2020-ceo |

| Will Darman | Managing Director | Sep-20 | 12 | 16 | https://www.linkedin.com/in/willdarman |

| Eric Kump | Managing Director | Jul-20 | 10 | 28 | https://uk.linkedin.com/in/eric-kump-a7ba291a |

| John Kim | Jun-20 | 3 | 6 | https://www.linkedin.com/in/johnkim1593 | |

| Idris Mohammed | Managing Director | Jun-20 | 3 | https://www.crunchbase.com/person/idris-mohammed | |

| Andrew Marino | Managing Director and co-Head of Global Infrastructure Investing | May-20 | 16 | 20 | https://www.linkedin.com/in/andrew-marino-79550415 |

| Rodney Cohen | Managing Director and Co-Head of The Carlyle Group’s Carlyle Equity Opportunity Funds | Mar-20 | 10 | 25 | https://www.prnewswire.com/news-releases/black-diamond-capital-management-announces-key-addition-to-leadership-team-with-appointment-of-rodney-cohen-as-head-of-private-equity-301024767.html |

| Charlotte Lawrence | Jan-20 | 10 | 15 | https://uk.linkedin.com/in/charlotte-lawrence-6b705a22?original_referer=https%3A%2F%2Fwww.google.com%2F | |

| Jonathan Cosgrave | Managing Director and Co-head of Carlyle’s Ireland Fund | Dec-19 | 5 | 18 | https://ie.linkedin.com/in/jonathan-cosgrave-b0b697a9 |

| Peter Garvey | Managing Director and Co-head of Carlyle’s Ireland Fund | Dec-19 | 5 | 20 | https://www.carlyle.com/media-room/news-release-archive/carlyle-group-appoints-peter-garvey-and-jonathan-cosgrave-directors |

| Drew Olian | Vice President | Oct-19 | 5 | 9 | https://www.linkedin.com/in/drewolian?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Ward Young | Principal | Sep-19 | 13 | 14 | https://www.linkedin.com/in/wardyoung1?original_referer=https%3A%2F%2Fwww.google.com%2F |

| David Scharf | Operating Advisor | Sep-19 | 7 | 14 | https://www.linkedin.com/in/david-scharf-28bab27?original_referer=https%3A%2F%2Fwww.google.com%2F |

| David Albert | Managing Director, Energy Credit | Jul-19 | 9 | 25 | https://www.linkedin.com/in/david-albert-5611b425?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Vincenzo Narciso | Managing Director | Jun-19 | 5 | 15 | https://uk.linkedin.com/in/vincenzo-narciso-23a15b |

| Juan Carlos Felix | Managing Director | May-19 | 11 | 18 | https://br.linkedin.com/in/juan-carlos-felix-7b0534b?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Zeina Bain | Managing Director | Mar-19 | 18 | 18 | https://uk.linkedin.com/in/zeina-bain-3470056?original_referer=https%3A%2F%2Fwww.google.com%2F |

| Elliot Wagner | Managing Director | Feb-19 | 18 | 20 | https://www.linkedin.com/in/elliot-wagner-6b8a5513 |

| David Stonehill | Managing Director | Feb-19 | 9 | 19 | https://www.linkedin.com/in/david-stonehill-a6427381 |

[1] “Carlyle Reports First Quarter 2023 Financial Results,” May 4, 2023. https://ir.carlyle.com/static-files/33631e38-672c-43ba-8a92-6a659203ce59

[2] “Carlyle Reports First Quarter 2023 Financial Results,” May 4, 2023. https://ir.carlyle.com/static-files/33631e38-672c-43ba-8a92-6a659203ce59

[3] “Carlyle Reports First Quarter 2022 Financial Results,” Apr 28, 2022. https://ir.carlyle.com/static-files/c5f3b6a8-6ca6-4b62-8112-1a0cbb4f205c

[4] Carlyle 3Q21,1Q23 earnings releases.

[5] Carlyle 3Q21,4Q22, 1Q23 earnings releases.

[6] “Carlyle Pushes for Industry’s Largest Buyout Fund at $27 Billion,” Bloomberg, Jul 21, 2021. https://www.bloomberg.com/news/articles/2021-07-22/carlyle-pushes-for-industry-s-largest-buyout-fund-at-27-billion

[7] “Carlyle’s Pete Clare to Exit After Being Passed Over for CEO,” Bloomberg, Feb 27, 2023. https://www.bloomberg.com/news/articles/2023-02-27/carlyle-s-pete-clare-to-depart-after-being-passed-over-for-ceo

[8] “Carlyle’s Pete Clare to Exit After Being Passed Over for CEO,” Bloomberg, Feb 27, 2023. https://www.bloomberg.com/news/articles/2023-02-27/carlyle-s-pete-clare-to-depart-after-being-passed-over-for-ceo

[9] “Carlyle to return next year with latest Asia mega-fund,” Private Equity International, Nov 15, 2021. https://www.privateequityinternational.com/carlyle-to-return-next-year-with-latest-asia-mega-fund/ “US pension commits up to $65m to Carlyle, IDG Capital’s new funds,” Deal Street Asia, May 23, 2022. https://www.dealstreetasia.com/stories/us-pension-carlyle-idg-capital-293524

[10] “Carlyle Prepares to Raise Its Biggest-Ever European Buyout Fund,” Bloomberg, Jan 19, 2022. https://www.bloomberg.com/news/articles/2022-01-20/carlyle-prepares-to-raise-its-biggest-ever-european-buyout-fund

[11] NGP Natural Resources XIII Form D, Feb 14, 2023. https://www.sec.gov/Archives/edgar/data/1962951/000196556723000002/xslFormDX01/primary_doc.xml

[12] “Carlyle Reports First Quarter 2023 Financial Results,” May 4, 2023. https://ir.carlyle.com/static-files/33631e38-672c-43ba-8a92-6a659203ce59

[13] “NGP and Crestline funds backed by Alaska,” Private Debt Investor, Dec 8, 2022. https://www.privatedebtinvestor.com/ngp-crestline-funds-backed-by-alaska/

[14] “NGP and Wing Resources Announce Formation of Wing Resources VII, LLC,” Media release, Apr 20, 2023. https://www.businesswire.com/news/home/20230420005277/en/NGP-and-Wing-Resources-Announce-Formation-of-Wing-Resources-VII-LLC

[15] “Foley Serves as Legal Counsel to Elk Range in Acquisition of Mineral and Royalty Interests in the Eagle Ford Basin,” Foley & Lardner LLP, Apr 27, 2023. https://www.foley.com/en/insights/news/2023/04/foley-legal-counsel-elk-range-acquisition-mineral

[16] “Mesa Minerals Partners III Raises $150 Million of Aggregate Equity Commitments from NGP,” NGP, Nov 7, 2022. https://ngpenergy.com/news/mesa-minerals-partners-iii-raises-150-million-of-aggregate-equity-commitments-from-ngp/