New data reveals extent of PE ownership of rural hospitals

February 26, 2023

In a January 2023 report, “Private Equity Descends on Rural Healthcare,” Private Equity Stakeholder Project released previously unreported data on private equity ownership of rural hospitals.

PESP counted at least 130 rural hospitals that are currently owned by private equity firms.

Rural hospitals are closing at a dangerous rate. Since 2010, 140 rural hospitals have shuttered. Nineteen of those closures occurred in 2020 as the COVID-19 pandemic stretched already-thin staffs and hospital operating margins to their limits.[1] According to a November 2022 study from the Center for Healthcare Quality and Payment Reform, 631 rural hospitals — or about 30 percent of all rural hospitals — are at risk of closing in the immediate or near future. Most of the hospitals at immediate risk for closure are in isolated rural communities, where a closure means that communities served by those hospitals will have to travel long distances for essential care.[2]

Even with substantial financial assistance received during the pandemic, six rural hospitals closed in 2021 and 2022. Three of those were private-equity-owned: Missouri hospitals Callaway Community Hospital and Audrain Community Hospital, which were owned by Nueterra Capital,[3] and Arizona’s Santa Cruz Valley Regional Hospital, which was owned by Lateral Investment Management.[4]

The rural hospitals currently owned by private equity are largely dominated by a handful of firms. Apollo Global Management, through its two hospital systems LifePoint Health and ScionHealth,[5] owns 71 rural hospitals. GoldenTree Asset Management and Davidson Kempner own 17 rural hospitals through Quorum Health, which the firms bought after it filed for bankruptcy in 2020.[6] Equity Group Investments, through its hospital system Ardent Health Services,[7] has 15 rural hospitals.

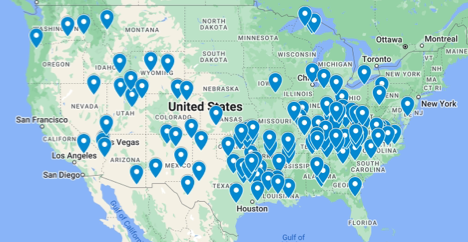

Geographic Spread

PESP found that that the South generally has the highest concentration of private equity-owned rural hospitals. Texas has the most private-equity-owned hospitals, with 17 facilities. Kentucky and North Carolina follow with 12 private-equity-owned facilities.

Click here for an interactive map.

This is consistent with previous research on PE-owned hospital concentration; a 2020 study published in the Annals of Internal Medicine found that on average, private equity-owned hospitals in the US are more likely to be in low-income, rural areas in the South, and have lower patient experience scores and fewer full-time equivalent employees per occupied bed to non-acquired hospitals.[8]

| State | # PE-owned rural hospitals |

| TX | 17 |

| KY | 12 |

| NC | 12 |

| OK | 9 |

| TN | 8 |

| LA | 7 |

| AL | 5 |

| NM | 5 |

CMS Payment Designations

Of the 130 identified PE-owned hospitals, 85 – or 65% – of the facilities benefit from CMS rural payment designations that allow them to access a variety of favorable reimbursement rates. These designations include sole community hospital (SCH), Medicare-dependent hospital (MDH), rural referral center (RRC), and critical access hospital (CAH).

| Payment Model | # of PE-owned hospitals |

| Critical Access Hospital | 20 |

| Medicare Dependent Hospital | 14 |

| Rural Referral Center | 17 |

| Sole Community Hospital | 24 |

| Sole Community Hospital/Rural Referral Center | 10 |

| Total | 85 |

Rural hospitals and providers may be attractive to investors in part because these designations have major implications for how much hospitals receive from government payers (e.g. Medicare, Medicaid) for services.

For example, Medicare pays CAHs for the same services as other acute care hospitals, but payments are based on each CAH’s costs and the share of those costs that are allocated to Medicare patients. Cost based reimbursement provides significant financial advantage to CAHs by allowing them to get paid at 101% of costs on all of their hospital Medicare business.[9] Similarly, SCHs are paid on the higher of the Inpatient Prospective Payment System (IPPS) rate or a base year federal rate, and MDHs are reimbursed by the Outpatient Prospective Payment System (OPPS) and have a special payment for inpatient services.[10]

QHR Healthcare, a hospital management company owned by private equity firm Grant Avenue Capital, advertises how it helped Jennie Stuart Health, a nonprofit hospital in Hopkinsville, Kentucky, increase its revenue by $4.4 million over three years after helping it secure a rural health designation as well as a Medicare Sole Community Hospital Designation.[11]

For more on private equity’s incursion into rural healthcare, see the full report: Private Equity Descends on Rural Healthcare (January 2023)

[1] “Rural Hospital Closures,” UNC Sheps Center for Rural Health (blog), accessed September 15, 2022, https://www.shepscenter.unc.edu/programs-projects/rural-health/rural-hospital-closures/.

[2] “Rural Hospitals at Risk of Closing” (Center for Healthcare Quality and Payment Reform, November 3, 2022), https://ruralhospitals.chqpr.org/downloads/Rural_Hospitals_at_Risk_of_Closing.pdf.

[3] Sarah Jane Tribble, “Buy and Bust: When Private Equity Comes for Rural Hospitals,” Kaiser Health News, June 15, 2022, https://khn.org/news/article/private-equity-rural-hospitals-closure-missouri-noble-health/.

[4] Machelor, “Employees of Closed Green Valley Hospital Left without Pay, Seek Answers | Local News | Tucson.Com,” Arizona Daily Star, August 9, 2022, https://tucson.com/news/local/employees-of-closed-green-valley-hospital-left-without-pay-seek-answers/article_c25cb346-0f98-11ed-a61a-9f8160732bfc.html.

[5] Kacik, Alex. “LifePoint Health and Kindred Healthcare Close Deal, Form New Company.” Modern Healthcare, December 22, 2021. https://www.modernhealthcare.com/mergers-acquisitions/lifepoint-health-and-kindred-healthcare-close-deal-form-new-company.

[6] Case M.9845 – DAVIDSON KEMPNER CAPITAL MANAGEMENT / GOLDEN TREE ASSET MANAGEMENT / QUORUM HEALTH CORPORATION, No. 32020M9845 (European Commission, Directorate-General for Competition May 28, 2020). https://ec.europa.eu/competition/mergers/cases/decisions/m9845_112_3.pdf

[7] S&P Global Intelligence. “Ardent Health Partners Completes $797M Term Loan Repricing; Terms,” February 25, 2021. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/ardent-health-partners-completes-797m-term-loan-repricing-terms-62820062; https://www.egizell.com/wp-content/uploads/2021/07/Ardent-financial-restructuring-and-growth-platform-healthcare.pdf

[8] Joseph Bruch, Dan Zeltzer, and Zirui Song, “Characteristics of Private Equity–Owned Hospitals in 2018,” Annals of Internal Medicine 174, no. 2 (February 16, 2021): 277–79, https://doi.org/10.7326/M20-1361.

[9] “Critical Access Hospital Finance 101.” National Rural Health Resource Center, February 2015. https://www.ruralcenter.org/sites/default/files/CAH%20Replacement%20Manual.pdf. Pg 10.

[10] Rural Health Information Hub. “Rural Healthcare Payment and Reimbursement Overview.” Accessed November 18, 2022. https://www.ruralhealthinfo.org/topics/healthcare-payment.

[11] “QHR Health Client Success Story: Jennie Stuart Health,” QHR Health, November 5, 2021, https://qhr.com/resources/qhr-health-client-success-story-jennie-stuart-health/.