Private equity healthcare bankruptcies show no signs of slowing

August 1, 2024

Key Points

- During the first half of 2024, nine private equity-owned healthcare companies have filed for bankruptcy, comprising 23% of all large US healthcare bankruptcies so far this year.

- Some other private equity-owned healthcare companies have also defaulted on their debt but avoiding bankruptcy court through distressed debt exchanges. At least six major healthcare companies have completed distressed exchanges this year.

- Many more private equity-owned healthcare companies are highly leveraged and considered at high risk for bankruptcy, including multiple companies that have taken on debt to finance payouts to their private equity owners.

Private equity firms, which characteristically use excessive debt and aggressive financial strategies, are key drivers in a recent wave of healthcare bankruptcies in the US, threatening the stability of essential healthcare services across the country.

In our April report, PESP found that at least 17 (21%) of the 80 large healthcare companies that filed for bankruptcy last year were owned by private equity firms.

This trend has continued in 2024. In the first six months of this year, PESP has tracked at least nine bankruptcies by companies that were private equity-owned, which accounts for 23% of all healthcare bankruptcies filed this year.

On top of that, there have been at least six more defaults by PE-owned healthcare companies (where the companies managed to restructure their debt outside of bankruptcy court).

The rise in healthcare bankruptcies, and bankruptcies by private equity-owned healthcare companies in particular, stems from a few factors. Private equity firms routinely use much higher levels of debt than other companies, often the result of leveraged buyouts and aggressive debt-funded growth strategies.

Some private equity firms even add additional debt to their portfolio companies to fund shareholder payouts, known as “dividend recapitalizations.” Just last month, private equity-owned medical debt collector Ensemble RCM took out an over $800 million loan to finance a payout to its private equity owners.[1]

Private equity’s aggressive use of debt leaves companies more vulnerable to changing market conditions, including high interest rates and rising labor costs.

Private Equity Bankruptcy Trend Has Continued in 2024

Of the 40 large healthcare companies that have filed for bankruptcy so far this year (January-June 2024), nine companies are or were recently backed by private equity, accounting for 23% of the total filings.[2]

Private equity owns or recently owned companies that accounted for three of the four largest healthcare bankruptcies of the year so far, where the companies’ total liabilities exceeded $1 billion: Consulate Health Care, Steward Health Care, and Cano Health.[13]

Not included in that list is Careismatic Brands, a medical scrubs manufacturer owned by Partners Group that also had a >$1 billion bankruptcy,[14] but is classified within the consumer discretionary market rather than healthcare.[15]

LaVie Care Centers/Consulate Health Care – Formation Capital

One of the largest healthcare bankruptcies this year was nursing home chain LaVie Care Centers (aka Consulate Health Care), which filed for Chapter 11 protection in June.[16] LaVie/Consulate operates 43 nursing homes in five states: Mississippi, North Carolina, Pennsylvania, Virginia, and Florida. It has 3,700 long-term residents and 3,600 employees.[17]

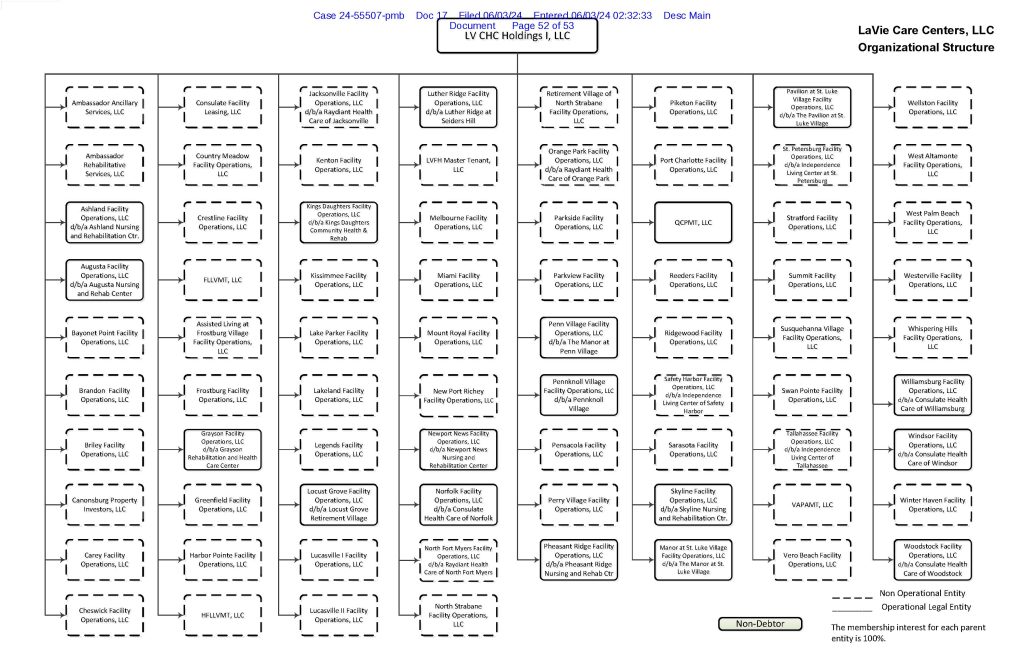

LaVie/Consulate is owned by private equity firm Formation Capital[18] through a complex web of dozens of related shell companies.[19]

Formation has been scrutinized for structuring LaVie/Consulate and its nursing homes in a way that makes the facilities appear “cash strapped” so it can continue to receive federal funding despite quality concerns. According to a 2019 article from the Naples Daily News, “While individual nursing home LLCs are essentially empty shells, they pay rent, management and rehabilitation service fees to Consulate or Formation Capital-affiliated companies.” [20]

One of eight interlocking organizational structure charts provided in LaVie Care Centers’ bankruptcy filing.

In its bankruptcy filings, LaVie blamed the impacts of the COVID-19 pandemic, wage inflation, and staffing requirements as having “caused the Debtors to suffer a nearly 25% reduction in their total workforce in 2021 and they were forced to substantially increase their reliance on staffing agencies to staff their facilities.”[21]

That list of causes notably does not include mention of the prior bankruptcy filing by LaVie/Consulate entities that were facing substantial litigation liabilities.

In March 2021, six nursing homes affiliated with Consulate Healthcare filed for bankruptcy following a $258 million False Claims Act fraud settlement.[22] The whistleblower suit alleged that nursing homes managed by Consulate upcoded services and provided patients with unnecessary and sometimes harmful therapies to increase Medicare billing, as well as denied treatment to patients on Medicaid.[23] Those facilities had been sued by 137 plaintiffs in the six years prior with allegations ranging from negligence to wrongful death to Medicare fraud.[24]

According to a 2022 investigation by STAT News,

“lawyers for Consulate affiliates leveraged the threat of bankruptcy in seeking to lower settlements, and that the companies’ actions fit a larger pattern. Before bankruptcy, the company used a convoluted corporate structure that stymied litigation, including dividing up ownership of its nursing homes and keeping paltry liability insurance.”[25]

In its 2021 bankruptcy filing, Consulate said that it was unable to pay the $258 million fraud judgement. In December of that year, a bankruptcy order was approved to reduce the judgement to $4.5 million.[26]

Charter Healthcare – Pharos Capital Group

Charter Healthcare, a provider of hospice, home health, complex care management and palliative care services, filed for Chapter 7 bankruptcy in January. As of February 2023, the company served nearly 13,000 patients in at least eight states.[27]

Charter was owned by private equity firm Pharos Capital Group, which first acquired the company in 2018.[28]

At the time of the bankruptcy, Charter was facing a False Claims Act lawsuit alleging Medicare and Medicaid fraud and whistleblower retaliation.[29] On January 11, 2024, Charter filed its answer to the complaint with a demand for a jury trial.[30] Two weeks later, on January 26, it filed for bankruptcy protection.[31]

The bankruptcy filing prompted a stay in the fraud lawsuit, which delays any progress in the case moving to trial.[32]

Steward Health Care – Cerberus Capital Management

Steward Healthcare, a hospital chain formerly owned by Cerberus Capital Management, filed for Chapter 11 bankruptcy in May 2024.[33] The system reported over $9 billion in liabilities in its bankruptcy filing, which included almost $1 billion owed to vendors and medical suppliers and $6.6 billion in long-term lease obligations to its hospital landlord, Medical Properties Trust.[34] Steward’s bankruptcy is one of the largest hospital bankruptcies in decades.[35]

Read about Steward’s bankruptcy in our July 2024 report: The Pillaging of Steward Health Care.

More Companies Quietly Defaulting Through Distressed Debt Exchanges

In addition to bankruptcies, private equity-owned healthcare companies have been quietly defaulting but avoiding legal bankruptcy proceedings by executing “distressed exchanges.” A distressed exchange is a transaction whereby a company offers creditors assets worth less than their original bonds or loans. These deals are essentially bankruptcy stopgaps that allow companies to restructure out of bankruptcy court. Some analysts, including Moody’s Investors Service, consider distressed exchanges to be defaults.[36]

At least six major private equity-owned healthcare companies completed distressed exchanges in recent months.[37]

| Healthcare Company | PE Firm | Type | PDR |

| Drive DeVilbiss Healthcare | Clayton, Dubilier & Rice[38] | DME | Caa2-PD |

| Global Medical Response | KKR[39] | Emergency medical transport | Caa2-PD |

| EyeCare Partners | Partners Group[40] | Eye care | Caa3-PD |

| Sonrava Health (fka Western Dental) | New Mountain Capital[41] | Dental care | Caa2-PD |

| Sound Physicians | Summit Partners, Optum Health[42] | Physician staffing | Ca-PD |

| AccentCare | Advent International[43] | Home health, hospice | Caa3-PD |

Four of the six companies[44] that completed distressed exchanges now have a probability of default ratings (PDR) at Caa-PD, which Moody’s characterizes as “speculative of poor standing, subject to very high default risk, and may be in default on some but not all of their long-term debt obligations.”[45] This indicates that although these companies have managed to defer bankruptcy through the debt exchanges, they are not yet out of the woods.

Drive DeVilbiss Healthcare – Clayton, Dubilier & Rice

Among the list of companies that defaulted through a distressed exchange is Drive DeVilbiss Healthcare, one of the largest providers of durable medical equipment (DME), such as wheelchairs and other mobility equipment used by people with disabilities and chronic health conditions. Drive DeVilbiss Healthcare’s current owner, private equity firm Clayton Dubilier & Rice, acquired the company in 2016.[46]

Private equity firms have been key drivers of consolidation within the DME industry in recent years, particularly among motorized wheelchair providers. In our 2023 report, PESP found that cost-cutting at major private equity-owned DME companies has been linked to slow repair times and other outcomes that have harmed wheelchair users.[47]

AccentCare – Advent International

AccentCare, one of the largest for-profit home healthcare providers, also completed a distressed debt exchange in early 2024. In its March 2024 rating of AccentCare, Moody’s noted that “AccentCare’s financial leverage will remain very high over the next 12 to 18 months increasing the probability of default.”[48]

AccentCare is owned by private equity firm Advent International, which acquired in 2019 from Oak Hill Capital Partners, another private equity firm. Under Advent International’s ownership, AccentCare has made at least 18 new acquisitions and entered 21 new states. As of January 2022, it had over 30,000 employees at more than 260 locations.[49]

Distressed Companies With Histories of Debt-Funded Dividend Payouts

Many other private equity-owned healthcare companies are so highly leveraged that they are at significant risk of default or bankruptcy, including multiple companies that have taken on new debt in recent years to finance large payouts to their private equity owners.

Notably, private equity-owned medical debt collector Ensemble Health Partners announced in June that it is taking on over $800 million in new debt to finance a shareholder dividend. In evaluating the new loan, rating agency Moody’s wrote:

“Moody’s views Ensemble’s debt funded dividend as aggressive given the size and associated increase in debt that weakens the company’s credit metrics. Moody’s anticipates a financial policy that includes the potential for debt funded acquisitions and shareholder dividends given the company’s history under ownership by private equity and its largest customer, Bon Secours Mercy Health.”[50]

Ensemble previously paid out an $805 million debt-funded dividend to its owners in 2021.[51]

Ensemble is a revenue cycle management company (RCM) company owned by Warburg Pincus and Berkshire Partners, with minority investments from Golden Gate Capital and Bon Secours Mercy Health.[52] It has a B2-PD probability of default rating (“considered speculative and are subject to high default risk”[53]).[54]

In addition to Ensemble, the following distressed companies executed debt-funded dividend payouts in recent years:

- Duly Health (Ares Management): The operating company for multi-specialty physician group Duly Health (aka Midwest Physician Admin Svcs, LLC) has a Caa1-PD rating (“subject to very high default risk, and may be in default on some but not all of their long-term debt obligations”[55]). It is owned by Ares Management.[56] PESP has previously pointed out that that Duly collected an over $200 million debt-funded dividend in early 2021,[57] not long after it collected nearly $80 million in CARES Act aid.[58] Last year, Duly reportedly initiated multiple rounds of layoffs and compensation reductions, and eliminated its palliative medicine services.[59]

- Medical Solutions (Centerbridge Partners, CDPQ): Healthcare staffing company Medical Solutions, owned by Centerbridge Partners and Caisse de dépôt et placement du Québec (CDPQ),[60] was downgraded to B3-PD in March due to its high level of debt following a series of dividend recapitalizations. In 2022 and 2023 it paid out $200 million and $350 million in debt-funded dividends, respectively.[61]

- Sevita (Centerbridge Partners, Vistria Group, Madison Dearborn): Sevita is one of the largest providers of community-based and in-home care services for people with intellectual and developmental disabilities (I/DD). It is owned by Centerbridge Partners, Vistria Group, and Madison Dearborn Partners.[62] The company has a Caa1-PD rating due in part to “very aggressive financial policies” (though Moody’s reports having a positive outlook on the rating with the expectation that the aggressive financial policies will stop).[63] In a 2022 report, PESP documented how Sevita’s (aka Mentor Network) private equity owners, collected almost half a billion dollars in debt-funded dividends from the company in the first two years of their ownership, even as the company faced numerous allegations of widespread abuse, neglect, and deaths at its foster care and residential programs.[64]

Resources

[1] “Moody’s Ratings affirms Ensemble RCM, LLC’s B2 senior secured debt rating following debt funded dividend, outlook is stable,” Moody’s Investors Service, June 18, 2024. https://www.moodys.com/research/Moodys-Ratings-affirms-Ensemble-RCM-LLCs-B2-senior-secured-debt-Rating-Action–PR_491978

[2] See S&P Global Intelligence monthly bankruptcy reports for 2024: January, February, March, April, May, June. S&P’s list of bankruptcies includes 40 total healthcare bankruptcies for January-June 2024. Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Private equity ownership was determined through a combination of news searches, credit rating agency reports, and data provider Pitchbook. Specific sourcing for PE ownership is provided in footnotes to the table below.

[3] See Eye Care Leaders Portfolio Holdings bankruptcy filings, Bankruptcy Court of Northern District of Texas, Dallas Division. Case No. 24-80001 (MVL): “Declaration of Sophia Turrell, Chief Executive Officer, in Support of Chapter 11 Petitions and First Day Motions.” https://cases.stretto.com/public/X310/12632/PLEADINGS/1263201182480000000200.pdf pg. 5; “Application Of The Official Committee Of Unsecured Creditors Of Eye Care Leaders Portfolio Holdings, Llc, Et Al., For Entry Of An Order Authorizing The Employment And Retention Of Kilpatrick Townsend & Stockton Llp As Its Attorneys Effective As Of February 13, 2024,” https://cases.stretto.com/public/X310/12632/PLEADINGS/1263203072480000000104.pdf pg. 17.

[4] Andrew Donlan, “Home Health Provider Charter Healthcare Files For Bankruptcy,” Home Health Care News, April 2, 2024. https://homehealthcarenews.com/2024/04/home-health-provider-charter-healthcare-files-for-bankruptcy/

[5] Pharos Capital Group, “Pharos Capital’s Charter Health Care Group Acquires Generations Hospice Care,” PR Newswire, August 11, 2021. https://www.prnewswire.com/news-releases/pharos-capitals-charter-health-care-group-acquires-generations-hospice-care-301352786.html

[6] “INTANDEM CAPITAL PARTNERS PORTFOLIO COMPANY, CANO HEALTH, WILL BEGIN TRADING TOMORROW ON THE NEW YORK STOCK EXCHANGE “NYSE”,” June 3, 2021. https://intandemcapital.com/news-and-videos/intandem-capital-partners-portfolio-company-cano-health-will-begin-trading-tomorrow-on-the-new-york-stock-exchange-nyse/

[7] Prime Plastic Surgery & Med Spa, “PRIME PLASTIC SURGERY ENTERS STRATEGIC FINANCING PARTNERSHIP WITH WHITE OAK; CLOSES ITS SIXTH AND SEVENTH ACQUISITIONS,” PR Newswire, July 21, 2022. https://www.prnewswire.com/news-releases/prime-plastic-surgery-enters-strategic-financing-partnership-with-white-oak-closes-its-sixth-and-seventh-acquisitions-301590941.html

[8] Madeline Ashley, “Massachusetts lawmakers say Cerberus got $800M profit from Steward exit,” Becker’s, April 3, 2024. https://www.beckershospitalreview.com/finance/massachusetts-lawmakers-say-cerberus-got-800m-profit-from-steward-exit.html

[9] Healthpoint Capital, “HealthpointCapital Invests in ProSomnus Sleep Technologies and Completes Sale of MicroDental Laboratories,” PR Newswire, October 26, 2016. https://www.prnewswire.com/news-releases/healthpointcapital-invests-in-prosomnus-sleep-technologies-and-completes-sale-of-microdental-laboratories-300351926.html ; SEC Form 13-D for Prosomnus, Inc filed by HealthPoint Capital Partners LP. December 6, 2022. https://investors.prosomnus.com/static-files/8402ea6b-cee1-49ea-8f6f-3170691ee9ac

[10] Altair Health website, https://altairhealth.com/ans/. Accessed July 24, 2024.

[11] Lorient Capital, https://lorientcap.com/partnerships/. Accessed July 23, 2024. ; PitchBook profile for Altair Health, https://my.pitchbook.com/profile/268600-42/company/deals#deal-265480-66T/sellers.

[12] Apax Partners press release, “Funds advised by Apax Partners to acquire remaining minority stake in Vyaire Medical from BD,” March 19, 2018. https://www.apax.com/news-views/funds-advised-by-apax-partners-to-acquire-remaining-minority-stake-in-vyaire-medical-from-bd/ ; Apax Partners website, https://www.apax.com/partnerships/vyaire-medical/. Accessed July 17, 2024.

[13] S&P Global Intelligence monthly bankruptcy reports for 2024 include a running tally of the largest bankruptcies (with liabilities greater than $1 billion). As of June 2024, the largest healthcare companies with >1 $billion were Consulate Health Care (Formation Capital), Steward Health Care (Cerberus Capital), Cano Health (InTandem Partners), and Invitae Corp. Invitae Corp is the only company that does not have a history of PE ownership.

[14] Becky Yerak, “Private-Equity-Owned Medical Apparel Seller Careismatic Files for Bankruptcy,” Wall Street Journal, January 23, 2024. https://www.wsj.com/articles/private-equity-owned-medical-apparel-seller-careismatic-files-for-bankruptcy-357e17e7

[15] Annie Sabater, Sean Longoria, “US corporate bankruptcies in June reach highest monthly level since early 2020,” S&P Global Intelligence, July 8, 2024. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-corporate-bankruptcies-in-june-reach-highest-monthly-level-since-early-2020-82297569

[16] Dietrich Knauth, “US nursing home operator LaVie files for bankruptcy to downsize, shed debts,” Reuters, June 3, 2024. https://www.reuters.com/legal/litigation/us-nursing-home-operator-lavie-files-bankruptcy-downsize-shed-debts-2024-06-03/

[17]https://www.kccllc.net/lavie/document/2455507240603000000000003 pg. 3-4, 10-11.

[18] The bankruptcy petition for LaVie Care Centers names FC Investors XXI, LLC as LaVie’s parent company. FC Investors XXI is also named as an owner in CMS records of many of LaVie’s facilities (and Consulate’s). FC Investors XXI’s SEC Form D filing lists its principal place of business as an address associated with Formation Capital’s corporate headquarters.

[19] Chapter 11 Bankruptcy for LaVie Care Centers. Case No. 24-55507 (PMB). DECLARATION OF M. BENJAMIN JONES IN SUPPORT OF CHAPTER 11 PETITIONS AND FIRST DAY PLEADINGS. https://veritaglobal.net/lavie/document/2455507240603000000000003. Page 19: “As reflected in the organizational chart attached hereto as Exhibit A, LaVie is a wholly-owned subsidiary of Debtor LV Operations II, LLC, which is a wholly-owned subsidiary of LV Operations I, LLC (‘LVO I’). Debtor LVO I, LLC is a wholly-owned subsidiary of nonDebtor LaVie HoldCo, LLC, whose ultimate parent is non-Debtor FC Investors XXI, LLC (‘FCXXI’).” See also LaVie Care Centers, LLC Organizational Structure charts, pages 46-53.

[20] Ryan Mills and Melanie Payne, “Neglected: Florida’s largest nursing home owner represents trend toward corporate control,” Naples Daily News, January 24, 2019. https://www.naplesnews.com/story/news/special-reports/2018/05/31/floridas-largest-nursing-home-owner-part-growing-national-trend/581511002/

[21]https://www.kccllc.net/lavie/document/2455507240603000000000003 pg. 4-5.

[22] Danielle Brown, “Six nursing home entities file for bankruptcy following $258M FCA ruling,” McKnights Long-Term Care News, March 4, 2021. https://www.mcknights.com/news/six-nursing-home-affiliates-file-for-bankruptcy-following-258m-fca-ruling/

[23] Ryan Mills, “Consulate Health Care, Florida’s largest nursing home company, faces quarter-billion-dollar fraud judgment,” Naples Daily News, July 2, 2020. https://www.naplesnews.com/story/news/local/florida/2020/07/02/consulate-health-care-florida-fraud-reinstated-judgment-255-million/3278365001/

[24] Jared Whitlock, “Nursing home chain’s tangled corporate structure and bankruptcy threats stymied litigation,” STAT News, August 5, 2022. https://www.statnews.com/2022/08/05/consulate-health-care-litigation-tangled-corporate-structure-bankruptcy/

[25] Jared Whitlock, “Nursing home chain’s tangled corporate structure and bankruptcy threats stymied litigation,” STAT News, August 5, 2022. https://www.statnews.com/2022/08/05/consulate-health-care-litigation-tangled-corporate-structure-bankruptcy/

[26] Jared Whitlock, “Nursing home chain’s tangled corporate structure and bankruptcy threats stymied litigation,” STAT News, August 5, 2022. https://www.statnews.com/2022/08/05/consulate-health-care-litigation-tangled-corporate-structure-bankruptcy/

[27] Jim Parker, “Hospice, Home Health Provider Charter Healthcare Files for Chapter 7 Bankruptcy,” Hospice News, April 2, 2024. https://hospicenews.com/2024/04/02/hospice-home-health-provider-charter-healthcare-files-for-chapter-7-bankruptcy/

[28] Pharos Capital Group press release, “Pharos Capital Recapitalizes Post-Acute Care Provider Charter Health Care Group,” October 30, 2018. https://pharosfunds.com/2018-10-30-Pharos-Capital-Recapitalizes-Charter-Health-Care-Group.php

[29] Panowicz V. Charter Health Holdings, Inc. Et Al, US District Court for the District of Nebraska. COMPLAINT AND JURY DEMAND. 8:23cv483. Filed October 31, 2023. https://advance.lexis.com/r/documentprovider/g2x8k/attachment/data?attachmentid=urn:contentItem:69HM-JFN3-RV3R-80H6-00000-00&attachmenttype=PDF&attachmentname=Click%20to%20view%20PDF%20document&origination=BlobStore&sequencenumber=1&ishotdoc=false&docTitle=Panowicz%20V.%20Charter%20Health%20Holdings%2C%20Inc.%20Et%20Al&pdmfid=1519360&#page=

[30] Panowicz V. Charter Health Holdings, Inc. Et Al, US District Court for the District of Nebraska. DEFENDANTS’ ANSWER TO PLAINTIFF’S COMPLAINT. 8:23cv483. Filed January 11, 2024. https://advance.lexis.com/r/documentprovider/g2x8k/attachment/data?attachmentid=urn:contentItem:6B6W-7HN3-RXBD-P3X8-00000-00&attachmenttype=PDF&attachmentname=Click%20to%20view%20PDF%20document&origination=BlobStore&sequencenumber=1&ishotdoc=false&docTitle=Panowicz%20V.%20Charter%20Health%20Holdings%2C%20Inc.%20Et%20Al&pdmfid=1519360&#page=

[31] 1:24bk10090, Charter Health Care Group, LLC. US Bankruptcy Court Docket United States Bankruptcy Court, Delaware. Filed January 26, 2024. https://advance.lexis.com/document/?pdmfid=1519360&crid=29c7f92d-f3b3-4700-bcee-b08e8dd0339f&pddocfullpath=%2Fshared%2Fdocument%2Fdockets%2Furn%3AcontentItem%3A69P9-NPM3-RS8V-F3BD-00000-00&pdcontentcomponentid=343392&pdteaserkey=sr5&pditab=allpods&ecomp=hc-yk&earg=sr5&prid=8864fa40-8bef-41dc-82b6-4981b9ea4491

[32] Panowicz V. Charter Health Holdings, Inc. Et Al, US District Court for the District of Nebraska. Order filed April 26, 2024. https://advance.lexis.com/document/?pdmfid=1519360&crid=5c88fd7d-4deb-4245-bb10-e71f74292cf9&pddocfullpath=%2Fshared%2Fdocument%2Fbriefs-pleadings-motions%2Furn%3AcontentItem%3A6BWS-7893-S26X-C12T-00000-00&pdcontentcomponentid=109120&pdteaserkey=sr0&pditab=allpods&ecomp=hc-yk&earg=sr0&prid=32b9be3f-b475-4636-88c9-a03114faf38b

[33] E. Harrison, L. Creamer, and P. McCluskey, “Steward Health Care Seeks Bankruptcy Protections,” WBUR, May 6, 2024, wbur.org/news/2024/05/06/steward-bankruptcy-massachusetts-for-profit-hospitals-debt.

[34] M. Ashley, “Steward Plans Sale of All Hospitals, Reports $9B in Debt,” Becker’s Hospital Review, May 7, 2024, beckershospitalreview.com/finance/steward-plans-sale-of-all-hospitals-reports-9b-in-debt.html.

[35] S. Vogel, “Steward Health Care Files for Chapter 11 Bankruptcy,” Healthcare Dive, May 6, 2024, healthcaredive.com/news/steward-health-care-files-chapter-11-bankruptcy/714050.

[36] Rating Symbols and Definitions, Moody’s Investors Service, January 2011. https://www.moodysanalytics.com/-/media/products/Moodys-Rating-Symbols-and-Definitions.pdf pg. 38.

[37] Distressed exchanges reported by Moody’s Investors Service. See here for each rating action: Drive DeVilbiss Healthcare, Global Medical Response, EyeCare Partners, Sonrava Health (fka Western Dental), Sound Physicians, AccentCare. Sourcing for private equity ownership is included in the table below.

[38] Clayton, Dubilier & Rice‘s website, https://www.cdr-inc.com/investments#portfolio. Accessed July 17, 2024. ; Drive Healthcare, “Clayton, Dubilier & Rice Makes Significant Investment in Drive DeVilbiss Healthcare in Partnership with Existing Management,” January 3, 2017. https://www.drivemedical.com/news-article/clayton-dubilier-rice-makes-significant-investment-in-drive-devilbiss-healthcare-in-partnership-with-existing-management

[39] Eliza Ronalds-Hannon and Jeannine Amodeo, “KKR Plans Debt Overhaul at Medical Transport Provider GMR,” Bloomberg, April 17, 2024. https://www.bloomberg.com/news/articles/2024-04-17/kkr-plans-debt-overhaul-at-medical-transport-provider-gmr

[40] Elisângela Mendonça, “Partners Group buys US-based EyeCare Partners for $2.2bn,” PE News, December 17, 2019. https://www.penews.com/articles/partners-group-buys-us-based-eyecare-partners-for-2-2bn-20191217

[41] “New Mountain’s Western Dental Returns to Auction Block,” PEHub, November 26, 2019. https://www.pehub.com/new-mountains-western-dental-returns-to-auction-block/

[42] Beth Jones Sanborn, “OptumHealth and Summit Partners to acquire staffing firm Sound Inpatient Physician Holdings for $2.2 billion,” Healthcare Finance, June 7, 2018. https://www.healthcarefinancenews.com/news/optumhealth-and-summit-partners-acquire-staffing-firm-sound-inpatient-physician-holdings-22

[43] Advent International, “Advent International Acquires AccentCare,” press release, May 16, 2019. https://www.adventinternational.com/advent-international-acquires-accentcare/

[44] The two companies that do not are Global Medical Response and Sound Physicians. Global Medical Response’s default rating was upgraded to B3 in response to the exchange. Sound Physicians default rating remained at a Ca-PD.

[45] Rating Symbols and Definitions, Moody’s Investors Service, November 9, 2023. https://ratings.moodys.com/api/rmc-documents/53954 pg. 14. According to Moody’s, the numbers appended to the rating indicate how the company ranks within the generic rating category (i.e., Caa1 ranks higher and is thus less risky than Caa2).

[46] Nathan Williams, “CD&R Acquires $800m Drive DeVilbiss,” Private Equity International, September 1, 2016, https://www.privateequityinternational.com/cdr-acquires-800m-drive-devilbiss/.

[47] Eileen O’Grady, “Private Equity In Durable Medical Equipment,” Private Equity Stakeholder Project and National Disability Rights Netqork, November 2023. https://pestakeholder.org/reports/private-equity-in-durable-medical-equipment/

[48] “Moody’s downgrades Pluto Acquisition’s (AccentCare) PDR to D-PD, CFR to Caa3, outlook is stable,” Moody’s Investors’ Service, March 1, 2024. https://www.moodys.com/research/Moodys-downgrades-Pluto-Acquisitions-AccentCare-PDR-to-D-PD-CFR-to-Rating-Action–PR_485885

[49] Jim Parker, “AccentCare Unifies Seven Brands Under Single Identity,” Hospice News, January 3, 2022. https://hospicenews.com/2022/01/03/accentcare-unifies-seven-brands-under-single-identity/

[50] “Moody’s Ratings affirms Ensemble RCM, LLC’s B2 senior secured debt rating following debt funded dividend, outlook is stable,” Moody’s Investors Service, June 18, 2024. https://www.moodys.com/research/Moodys-Ratings-affirms-Ensemble-RCM-LLCs-B2-senior-secured-debt-Rating-Action–PR_491978

[51] “Moody’s says Ensemble RCM’s upsized loan is credit-negative development,” Moody’s Investors Service, February 10, 2021. https://www.moodys.com/research/Moodys-says-Ensemble-RCMs-upsized-loan-is-credit-negative-development-Announcement–PR_440443

[52] Ensemble Health Partners, “Berkshire Partners and Warburg Pincus to partner for an investment in Ensemble Health Partners,” Global Newswire, March 28, 2022. https://www.globenewswire.com/news-release/2022/03/28/2411025/0/en/Berkshire-Partners-and-Warburg-Pincus-to-partner-for-an-investment-in-Ensemble-Health-Partners.html

[53] Rating Symbols and Definitions, Moody’s Investors Service, November 9, 2023. https://ratings.moodys.com/api/rmc-documents/53954 pg. 14.

[54] “Moody’s Ratings affirms Ensemble RCM, LLC’s B2 senior secured debt rating following debt funded dividend, outlook is stable,” Moody’s Investors Service, June 18, 2024. https://www.moodys.com/research/Moodys-Ratings-affirms-Ensemble-RCM-LLCs-B2-senior-secured-debt-Rating-Action–PR_491978

[55] Rating Symbols and Definitions, Moody’s Investors Service, November 9, 2023. https://ratings.moodys.com/api/rmc-documents/53954 pg. 14.

[56] “Moody’s Ratings downgrades Midwest Physician Admin Svcs, LLC’s (Duly’s) CFR to Caa1, outlook stable,” Moody’s Investors Service, April 16, 2024. https://www.moodys.com/research/Moodys-Ratings-downgrades-Midwest-Physician-Admin-Svcs-LLCs-Dulys-CFR-Rating-Action–PR_488544

[57] “Moody’s affirms Midwest Physician Admin Svcs’ B2 CFR; outlook stable,” Moody’s Investors Service. February 2021. https://www.moodys.com/research/Moodys-affirms-Midwest-Physician-Admin-Svcs-B2-CFR-outlook-stable-Rating-Action–PR_441161

[58]https://pestakeholder.org/news/private-equity-firms-reaped-billions-of-dollars-in-debt-funded-dividends-from-healthcare-companies-in-2021/

[59] Katherine Davis, “Layoffs and other cutbacks follow executive shakeup at debt-heavy doc group,” Crain’s, September 28, 2023. https://www.chicagobusiness.com/health-care/duly-health-physicians-group-layoffs-cutbacks

[60] CDPQ press release, “Medical Solutions to be Acquired by Centerbridge Partners and CDPQ,” August 30, 2021. https://www.cdpq.com/en/news/pressreleases/medical-solutions-acquired-centerbridge-partners-cdpq

[61] “Moody’s downgrades Medical Solutions’ CFR to B3; outlook stable,” Moody’s Investors Service, Mach 19, 2024. https://www.moodys.com/research/Moodys-downgrades-Medical-Solutions-CFR-to-B3-outlook-stable-Rating-Action–PR_487289

[62] Chris Larson, “Madison Dearborn to Buy 25% of Sevita at Roughly $3B Valuation,” Behavioral Health Business, January 20, 2022. https://bhbusiness.com/2022/01/20/madison-dearborn-to-buy-25-of-sevita-at-roughly-3b-valuation/

[63] “Moody’s revises National MENTOR’s (Sevita) outlook to positive, affirms Caa1 CFR,” Moody’s Investors Service, March 28, 2024. https://www.moodys.com/research/Moodys-revises-National-MENTORs-Sevita-outlook-to-positive-affirms-Caa1-Rating-Action–PR_487879

[64] Eileen O’Grady, “The Kids Are Not Alright: How Private Equity Profits Off of Behavioral Health Services for Vulnerable and At-Risk Youth,” Private Equity Stakeholder Project, February 2022. https://pestakeholder.org/wp-content/uploads/2022/02/PESP_Youth_BH_Report_2022.pdf